Bitcoin Wallet Guide, Reviews, and Comparison

By: Alexander Reed | Last updated: 3/13/24

Bitcoin wallets are devices or programs that allow you to store, send, and receive Bitcoin. However, in order to choose the best wallet for your needs, there are a lot of factors to take into account. In this post, I’ll cover everything you need to know about wallets and also review the best Bitcoin wallets around.

Don’t Like to Read? Watch Our Video Instead

Bitcoin Wallet Guide Summary

A Bitcoin wallet is a device or program that stores your private keys and allows you to interact with the Bitcoin blockchain (i.e., send and receive Bitcoin). It’s important to differentiate between wallets where you have complete control over your private keys (non-custodial) and those that don’t give you access to your keys (custodial). Bitcoin wallets also comes as Apps, and we’ve covered those under mobile wallets.

Here are my top picks by category:

If you want the complete guide to Bitcoin wallets and different wallet reviews, keep on reading. Here’s what I’m going to cover:

- What is a Bitcoin wallet?

- What is a private key?

- HD wallets

- Types of wallets

- What is the best Bitcoin wallet to use?

- Additional Bitcoin wallet terms

- Backing up your wallet

- Transaction fee handling

- What to watch out for

- Conclusion – My Top Picks

This isn’t the shortest read out there, but it will teach you everything you need to know about wallets, so I suggest bookmarking this page for future reference.

1. What is a Bitcoin wallet?

A Bitcoin wallet is a program for sending and receiving bitcoins. The wallet does this by interacting with Bitcoin’s ledger, known as the blockchain. Bitcoin wallet programs are available for mobile phones, desktops, and even as a standalone piece of hardware (more on that later on).

Generally speaking, Bitcoin wallets are a bit similar to how email works. If you want to send and receive emails, you need some sort of program to do so (e.g., Gmail, Outlook). Like emails, receiving Bitcoin requires a unique personal address. This unique address is called your Bitcoin address, and—just like your email address—you can share it with anyone who wants to send you bitcoins.

Here’s a Bitcoin address example: 1BoatSLRHtKNngkdXEeobR76b53LETtpyT

(Bitcoin addresses always start with a “1”, “3”, or “bc1”)

Once you have your address, what’s missing is your password. With email, you choose your own password, while with Bitcoin, the wallet chooses it randomly for you. This password is called your private key, and—similar to your email password—it should never be shared with anyone.

The private key is best kept offline, meaning you shouldn’t write it in a file on your computer. The best practice is to write it down on a piece of paper or keep it on a flash drive that’s disconnected from the internet.

2. What is a private key?

A private key is a very long string of numbers and letters that acts as the password to your Bitcoin. It’s from this secret combination that your wallet derives the capability to tell the Bitcoin network you want to send your Bitcoin to another destination. The most important thing to remember is this: Whoever knows your private key has control over your bitcoins.

The private key is also used to generate your Bitcoin address. The process would look like this:

- You download a wallet program (Wallet Apps) to your mobile phone or laptop.

- The program (also known as the client) randomly creates a private key.

- A Bitcoin address is created by running some sort of mathematical algorithm on your private key.

Even though the Bitcoin address is generated from the private key, there’s no way to figure out what the private key is just by examining a Bitcoin address. This is a one-way process.

The wallet’s core function is the creation, storage, and use of the private key. In other words, it automates Bitcoin’s complex cryptography and blockchain interactions for you. You could argue that the program itself isn’t that important—the only thing that matters is the private key.

For example, if you have a Bitcoin wallet app on your phone and that phone gets stolen, but you’ve written down your private key on a piece of paper before that happened, you could just download a new Bitcoin wallet to a different phone, import the private key to that new wallet, and regain control of your bitcoins again.

Custodial vs. Non-Custodial wallets

In general, wallets can be categorized as custodial and non-custodial. A non-custodial wallet is any wallet where you are the sole owner of the private key. This means that no one has access to the private key (or seed phrase) other than yourself.

A custodial wallet is kind of like today’s bank accounts. It’s a place to store your Bitcoin, but you don’t actually own it since the company supplying it holds the private keys to those coins. The risks of using a custodial wallet are that the company will freeze your funds, go bankrupt, or commit fraud and steal your coins.

The Bitcoin community has a phrase that says, “Not your keys, not your Bitcoin.” This goes to illustrate the dangers of a custodial wallet. On the other hand, some people prefer not to be in charge of their own funds and, therefore, choose custodial wallets.

3. The HD wallet evolution

As Bitcoin wallets evolved, HD wallets (aka hierarchical deterministic wallets) were created. HD wallets generate a phrase known as a seed or mnemonic phrase. This seed is a set of common words that you can memorize instead of the long and confusing private key.

As you can imagine, it’s much easier to write down 12 simple words than a long, confusing string of numbers and letters.

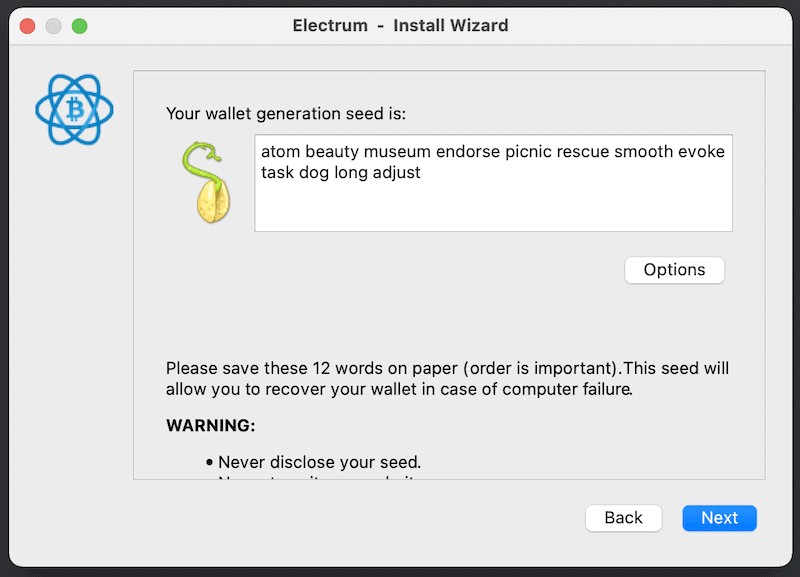

An example of a seed phrase from an Electrum wallet

Additionally, an HD wallet can create many Bitcoin addresses from the same seed, so you don’t have just one Bitcoin address. All the transactions sent to addresses created by the same seed will be part of the same wallet.

4. Types of Wallets

There are two main types of Bitcoin wallets – cold storage and hot wallets.

Cold storage: The secure way to hold Bitcoin

Cold storage (or cold wallets) refers to any type of wallet that is detached from an internet connection and, therefore, cannot be hacked remotely. Some examples of cold storage wallets are hardware wallets, paper wallets, and brain wallets.

All cold storage wallets are non-custodial.

Hardware wallets

Hardware wallets are physical devices that safely store private keys. They usually come in the form of a special flash drive that can connect to your computer in order to interact with them.

Different types of hardware wallets

Hardware wallets are built to protect your private key, even if the device they are connected to is compromised by malware. You can even use them with a public computer you don’t trust. To send your bitcoins to someone using a hardware wallet, you’ll need to have your hardware wallet connected to a computer and use some sort of software or web page that allows control over the wallet.

Hardware wallets offer the optimal mix between security and ease of use. Their only limitations are that you need to have the hardware wallet on you in order to send the coins and that they cost money.

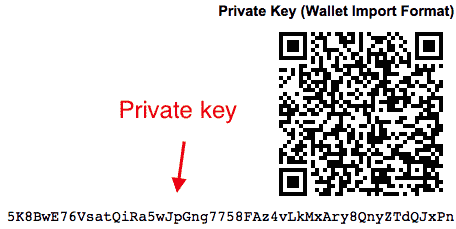

Paper wallets

Paper wallets are just pieces of paper with a private key or seed written on them. When you keep your private key on a piece of paper, only someone who can view that paper can steal your Bitcoin. However, paper wallets are easily destroyed, and it’s advisable to create multiple copies so that if one is lost, your bitcoins can still be retrieved.

An example of a Bitcoin paper wallet

Another thing to consider is that in order to send the Bitcoin you have on a paper wallet, you will have to import the private key into some form of digital Bitcoin wallet.

Hot wallets – The convenient way to store Bitcoin

A hot wallet refers to any form of Bitcoin wallet that is connected in some way to the internet. This can be a wallet that is connected to a web service, a wallet installed on a computer connected to the internet, or even a wallet installed on your mobile phone, assuming you have an active data connection to and from your phone.

Hot wallets, while being the most popular type of wallet, are also the least secure because they allow access to their inner workings through internet connections.

Nowadays, most popular hot wallets are available cross-platform, on both desktop and mobile.

Desktop wallets

Desktop wallets are hot wallets that store your private key on your computer. As long as your computer is free of malware or any security weaknesses, your Bitcoin is safe. However, we all know that’s not the case for most of us. Today, it’s hard to be 100% protected, and this makes desktop wallets that are connected to the internet a valuable target for hackers.

Mobile wallets & apps

These wallets store your private key on your mobile phone. I actually consider these wallets to be the least secure of all wallets. As phones are frequently lost, broken, or stolen, it’s strongly advised that you enable two-factor authentication, password-protect your wallet, and create a private key backup.

Mobile wallets also comes as apps – programs that store and protect the private keys to your Bitcoin and cryptocurrency wallets on your computer’s hard drive or mobile phone.

Mobile wallets and apps are highly convenient and are designed to provide as much security as possible in an insecure environment. Nonetheless, substantial sums should not be stored on a mobile wallet.

Web wallets

Markets, exchanges, betting sites, and other Bitcoin services frequently require you to deposit funds into their online hot wallets in order to conduct your business. These web wallets are the least secure option for storing bitcoins because the operators own the private key to the bitcoins stored on their site. In other words, they are custodial wallets.

Web wallets are also more vulnerable to hackers since they have many possible loopholes along the way. For example, the website in question, the device you’re using to connect to the website, or the internet connection can be monitored to steal your bitcoins.

On the other hand, web wallets are highly convenient, as they allow you to buy, sell, and send bitcoins at a moment’s notice.

More competent web wallet services will provide two-factor authentication options, such as validating every account login with a text message, to guard against external hackers. Even so, for storing any significant amount of coins, web wallets are not worth the risk. We advise that you avoid the #1 newbie mistake and never keep your bitcoins in a web wallet.

5. What is the Best Bitcoin Wallet to Use?

Different people use different Bitcoin wallets for different purposes. For example, if I need to store a large amount of Bitcoin safely, I will probably use cold storage. If, on the other hand, I just want to pay for a cup of coffee, a hot wallet would be more suitable.

Usually, wallets vary on the scale of security versus convenience, and you need to decide where you want to be on that scale. Some of the questions you should ask yourself include:

- How much Bitcoin will I be storing?

- How frequently will I use the wallet?

- Can I afford to pay for a wallet?

- Will I be storing additional coins other than Bitcoin?

- Do I need to carry the wallet around with me?

- Do I need to share the wallet with someone else?

- How tech-savvy am I?

- How much do I value my privacy?

- Do I trust myself to safeguard my wallet, or do I want to give a third party the task of doing so?

You may want to use more than one wallet. For example, you can use a hardware wallet for large sums of Bitcoin and a mobile wallet with a small balance for daily payments. This way, even if your mobile phone breaks or gets stolen, you’re not risking a lot of money.

How do I get a Bitcoin Wallet?

Desktop and mobile wallets can be downloaded for free from the internet, while hardware wallets can be bought online and will be shipped to your home or office. Web wallets require you to sign up for a specific service.

What is the Best Bitcoin Hardware Wallet?

Ledger

Ledger manufactures cold storage wallets designed for users who want increased security. Their wallets are a physical device that connects to your computer. You can only send Bitcoin from the device once it’s connected. Ledger offers different hardware wallets, such as the Ledger Nano S Plus and the Ledger Nano X (a Bluetooth-connected hardware wallet).

TREZOR

TREZOR is a pioneering hardware wallet company. The combination of world-class security with an intuitive interface and compatibility with other desktop wallets makes it ideal for beginners and experts alike. The company has gained a lot of the Bitcoin community’s respect. TREZOR offers three main models – The TREZOR Safe 3, the TREZOR Model One, and the TREZOR Model T (which has a built-in touch screen).

KeepKey

KeepKey’s hardware wallet has a very sleek and unique design, which makes it probably the best-looking physical Bitcoin wallet out there. The device itself is very intuitive and easy to set up. It also supports a variety of different coins. You can read a full KeepKey review here.

BitBox02

The BitBox02 from Shift Crypto is a nifty alternative to the better-known hardware wallets. It has a one-piece design and is extremely user-friendly. It supports plenty of assets but not quite as many as some other wallets. You can read our full BitBox02 review here.

CoolWallet

CoolWallet looks and feels like a credit card and has one small operation button on it. The device must be held close to your mobile app when sending out coins, adding another layer of security. Even though the concept is pretty cool, the execution is far from complete. Click here to read our full CoolWallet review.

What is the Best Bitcoin Desktop Wallet?

Exodus

Exodus allows you to store not only Bitcoin but also Ethereum, Binance Coin, Dogecoin, and Solana. It’s unique in its beautiful design and intuitive user interface. You can swap and trade cryptocurrencies within the wallet. Exodus is available for both desktop and mobile and is compatible with Trezor hardware wallets. Here’s my full review of Exodus.

Electrum

My personal favorite. While Electrum can look a bit daunting for beginners, if you put in some extra time, you can quickly get the hang of it. The wallet has a pretty ugly interface but offers a variety of features, including RBF and Segwit support (explained in Chapter 8 – Transaction handling). Here’s my full Electrum review.

Bitcoin Core

Bitcoin Core (also known as Bitcoin QT) is a full node, meaning it’s a wallet that downloads the complete Bitcoin blockchain to your computer. This takes a lot of time (can reach several weeks) but also gives you an array of advanced options that are more suitable for experienced users. If you’re just starting out, I suggest avoiding this wallet.

Armory

Armory is a well-known and trusted open-source brand when it comes to Bitcoin security. The wallet is usually best suited for more advanced users. If you are looking for a wallet that emphasizes safety and security, Armory should make the shortlist as it features a variety of encryption and cold-storage options (including multisig).

What is the Best Bitcoin Mobile Wallet?

Ledger Nano X

The Ledger Nano X is the best hardware wallet by Ledger. The Nano X’s interface is done through the Ledger Live mobile app (via a Bluetooth connection). Ledger’s intuitive design is maintained with this model. This is probably one of the safest ways to store coins on your mobile device since the private key isn’t on the device; it’s on the Nano X itself. You can read my full review of the Nano X here.

Edge Review

Previously known as Airbitz, Edge is an open-source, multi-currency mobile Bitcoin wallet. In addition to its excellent security score, Edge is also known for its beginner-friendly features, such as an easy-to-use interface and ways to buy discounted gift cards.

Zengo review

Zengo offers a highly secure wallet without needing a private key, making the company a pioneer in their field. Zengo does that by securing the private key on their servers and applying advanced cryptography measures. The wallet app is also feature-packed, including a crypto exchange, a trading platform, and even an interest-yielding account. You can read my full Zengo review here.

Coinomi Review

Coinomi is a secure cryptocurrency wallet that offers exchange capabilities within the app. Coinomi considers itself to be security and privacy-focused, emphasizing the fact that no identity linking is possible from within the wallet. You can read my full Coinomi review here.

6. Additional Bitcoin Wallet Terms

Multisig wallets

Multisig stands for multi-signature, a wallet that allows sending bitcoins, only with the approval of enough private keys, out of a set of predefined keys. Let me explain:

To clarify, let’s say that Alice, Bob, and Charlie all want to open a business together and invest some of their Bitcoin, but none of them actually wants only one person to have the private keys to the money. So they each get one key and use a multisig wallet that requires two out of three of those keys. This way, none of them can run away with the money alone, but they also don’t need all three of them to pay expenses.

For example, if Alice wants to run away with the money, she can’t because she only has one key. But if Bob is missing and Alice and Charlie want to pay an expense, they can do it with their two keys.

Multisig doesn’t have to be only two out of three—it can be almost any combination. For example, a couple wants a shared account and decides that they can spend the money only if both of them agree; or a Company’s board of directors allows payments only by vote of a majority.

Multisig is often used for escrow services, in which two parties decide on a transaction that requires two out of three keys. If the seller and buyer don’t agree, a trusted third party will arbitrate and release the funds.

SPV wallets

Some wallets hold a full copy of the blockchain in order to validate each and every transaction. This type of wallet is referred to as a full node. Unlike full nodes, SPV (simplified payment verification) wallets (aka lite or thin wallets) don’t hold a full copy of the blockchain. SPV wallets rely on the full nodes to which they are connected in order to validate transactions.

SPV wallets are faster and consume less disk space than their counterparts. Since the blockchain today is becoming increasingly big, many wallets offer an SPV solution for limited-capacity devices such as mobile phones, tablets, and desktops.

Brain wallets

Brain wallets are just a way to create a private key out of a predetermined text or set of words. So, instead of getting a randomly generated seed or private key, you can decide for yourself on a passphrase and use some basic algorithms to generate a private key from that passphrase.

However, brain wallets have a significant disadvantage by having a higher probability of being hacked. This is because people are usually very predictable in what they use as passwords or supposedly random text, and hackers have a way of knowing that.

To prove this point, some tests have been done where simple passwords have been used for brain wallets and deposited with funds. The results? The funds have been quickly stolen. Additionally, one Bitcoin user lost four bitcoins from his wallet after using a brain wallet private key generated from a little-known Afrikaans poem.

This proves that even if you think you’ve found an obscure text for a passphrase, you’re still in danger of being hacked.

Bear in mind that some wallets will fulfill more than one criterion. For example, you can have a mobile SPV wallet that also has a multisig feature.

7. Backing up your Bitcoin wallet

Because private keys and seed phrases have complete power over your Bitcoin, they must be kept secret and safe. If you fail to protect your wallet’s private key or seed, the Bitcoin it controls could be irretrievably lost.

A standard Bitcoin wallet (i.e., not an HD wallet) will create a wallet.dat file containing its private key. This file should be backed up by copying it to a safe location, such as an encrypted drive on your computer, an external flash drive, or even a piece of paper that’s hidden away.

An HD wallet, on the other hand, will supply you with a seed phrase with 12–24 words that you should write down in a safe place. One interesting product people often use for backing up their wallets is the Cryptosteel, an indestructible metal plate on which you can put your private key.

8. Transaction fee handling

Each Bitcoin transaction has a transaction fee attached to it. This fee is included in order to incentivize Bitcoin miners to include the transaction in the next block of transactions. The larger the size of your transaction, the higher the fee you’ll need to pay in order to get confirmed in the next block.

Some transactions aren’t as time-sensitive as others. For example, if I’m just moving funds from my desktop wallet to my hardware wallet for safekeeping, I don’t really care if it takes the transaction even two days to get confirmed. That’s why I can allow myself to use a lower fee. However, if I’m sending payment for a service or a product I purchased, I might want to use a higher fee so the transaction is confirmed faster.

Fees also highly depend on the number of transactions waiting to be confirmed. If many people want to confirm their transactions, they will start bidding up the attached fees. Therefore, a fee that was considered high yesterday might be considered low today.

One of the important features to check out in a wallet is fee handling. Here is what you need to find out:

- Does the wallet allow you to choose your own fee, or does it choose it automatically for you?

- Does the wallet support Segwit? An upgrade issued to the Bitcoin protocol, which—among other things—allows you to shrink your transaction file size (hence reducing your required fee).

- Does the wallet support Replace by Fee (RBF)? If your transaction can’t get confirmed because you didn’t pay a high enough fee, you can easily bump the fee via the RBF option. Your wallet will then rebroadcast the transaction with a fee raised to your required level.

9. Watch out! Common ways hackers will try to steal your money

Apps that steal Bitcoin

Hackers will sometimes introduce a new wallet to the Apple App Store (or Google Play) with the intent of stealing user funds. There’s no way to know a wallet isn’t malicious other than by actually reviewing its code, and that’s not a feasible option for most of us.

In order to stay on the safe side, it’s always recommended to only download wallets that are open source (i.e., their code is public) and that have accumulated a strong reputation in the Bitcoin community. Don’t just download an app or wallet because a friend referred you; do your own research, ask around on forums, and read review sites.

The wallets listed on this page have all been around for several years and have gained a good reputation from the Bitcoin community.

Hardware wallet tampering

Hardware wallets should only be bought from the manufacturer or an authorized reseller. Having said that, most reputable hardware wallets have a built-in mechanism that will alert you if your device has been tampered with.

Hardware wallets should come sealed with a holographic sticker showing that the device has never been opened. One thing to keep in mind is that the seed phrase for the hardware wallet should be generated by the device itself and not by the manufacturer. This is done so that only you will know the seed phrase to your device.

Not too long ago, a user reported that he’d received a Ledger wallet with a sheet of paper that already had a 24-word seed phrase on it. Once he uploaded funds to the wallet, they were stolen, as the seller knew his seed phrase.

10. Conclusion – My Top Picks

Now that you’re a Bitcoin wallet expert, you probably understand that there’s no simple answer to the question, “What is the best Bitcoin wallet to use?” But not to leave you empty-handed, here are my personal picks:

- Ledger (Hardware)

- TREZOR (Hardware)

- Exodus (Desktop)

- Electrum (Desktop, not beginner friendly)

- Edge (Mobile)

In the end, the decision is yours based on your needs. If you have any additional comments or questions, or if you’d like to share your experience with a specific wallet, feel free to leave me a comment below.

Thanks

Thanks. It’s educative and inspiring

Thank’s