What is Proof of Stake and How to Stake Ethereum

By: Alexander Reed | Last Updated: 2/21/24

What is Staking? Can it help me earn passive income with my cryptocurrency? Is it risky? And what do I need to know before I get started? In this post, I’ll try and answer all of these questions and also show you how you can start to stake Ethereum on your own.

Don’t Like to Read? Watch Our Video Instead

What is Proof of Stake Summary

Proof of Stake (POS) is an alternative consensus mechanism to Proof of Work. It allows users to put their coins at stake instead of committing computing power. The network then randomly chooses users to help forge the next block of transactions.

Through POS a blockchain can continue to be updated in a decentralized manner without the need for powerful computers and waste of electricity.

That’s Proof of Stake in a nutshell. For a more detailed explanation keep reading this post, here’s what I’ll cover:

- Mining and Proof of Work

- Proof of Stake Explained

- Staking Ethereum

- Staking Pools and Other Solutions

- Conclusion

If you’re new to cryptocurrencies let me suggest that you start with our “What is Bitcoin?” and “What is Bitcoin mining?” posts before reading this one to gain a solid foundation for what we’ll be covering here.

1. Mining and Proof of Work

Before we dive into staking let’s take a moment to understand the problem that staking tries to solve. Bitcoin and other decentralized cryptocurrencies hold the promise of sending money digitally without any central authority.

Initially, the solution to managing a blockchain, which is a fancy term for a ledger of balances that isn’t controlled by any one entity, was done through mining. Mining is sort of a competition where powerful computers try to guess the solution to a mathematical question.

Whoever finds the solution first, earns the right to write the next page of transactions, also known as a block, into the ledger.

With mining, the more powerful computer you use, the more guesses it can make in a second, increasing your chances of winning this contest. Thanks to the laws of math and probability, it is highly unlikely that any single person or group will gain a monopoly over updating the ledger, and that’s how decentralization is maintained.

Mining’s technical term is “proof of work” – because by displaying the right solution, miners prove that they’ve put in a lot of work, as there is no other way to get to the solution aside from using computing power to constantly work at trying to guess it.

Proof of work is what is known as a consensus mechanism since its design is to create an agreement as to who gets to update the ledger amongst a group of people who don’t really know each other or have any other basis for working together.

While the proof of work consensus mechanism may be a reliable and secure solution for managing a decentralized ledger, it’s also very resource-intensive. Running all of these supercomputers just for the sake of guessing a number takes up a lot of electricity, among other disadvantages.

2. Proof of Stake Explained

Because of these disadvantages, other alternative consensus mechanisms have been suggested throughout the years. One very popular alternative is proof of stake. This means that instead of committing electricity to run computers and try to win a contest, people will stake actual coins.

But how does this all work?

Well, you basically lock a certain amount of funds on an everyday computer that is connected to the network. Your computer is called a node in technical terms and your locked funds are your stake. Once your stake is in place you take part in the contest of which node will get to forge the next block. You see stakers forge blocks, they don’t mine them.

The winner of this contest is chosen by taking into consideration several factors:

- How much money is being staked?

- How long have the coins been staked for?

- Randomization (so that no single entity will gain a monopoly over forging)

Generally speaking, whoever wins the contest gets to forge the next block of transactions and is rewarded in coins for his contribution to the network.

3. Staking Ethereum

It is important to note that there are many coins that use proof of stake such as Tezos, Cosmos and Cardano, and each coin has different rules as to how it calculates and distributes rewards. In this post we will focus mainly on how Ethereum’s proof of stake model works.

Up until 2020, Ethereum’s blockchain was based purely on proof of work; but in December of 2020 a new blockchain named “Beacon chain” was set up that uses proof of stake.

This beacon chain was run alongside the proof of work chain until September 2022, when the two chains were integrated into a single proof of stake network. This integration was known as “The Merge”.

In order to join as a validator for Ethereum, you will need to lock up 32 Ether as collateral, which in turn will earn you staking rewards. There’s no way to lock up more than 32 Ether on a single node, so if you want to increase your reward you can just set up multiple nodes with 32 Ether each.

At present, there is no way to withdraw your staked Ether – this will not be enabled until a network upgrade called “Shanghai” that is scheduled for March 2023.

Now you’re probably asking how much Ether is rewarded?

In Ethereum,each validator that participates in the forging of a block gets a percentage of the newly minted Ether when it’s created. The more validators the network has, the smaller the proportion of the reward will be.

For example, if 1 million ETH is staked, the max annual reward for each staker could reach 18.10%, however if 3 million Ether are staked, that annual reward rate would drop to 10.45%. You can think of the total amount of new Ether awarded as a pie with a fixed size, and the more validators you have that want a piece of that pie – the smaller each slice will be.

To simplify things there are dedicated staking calculators you can use that will try and estimate how much Ether you’ll make when staking a certain amount of ETH in any certain way.

So where do I sign up?

There are a variety of ways to participate in ETH staking. The primary way is setting up your own validator, however this requires technical knowledge, a dedicated computer and 32 Ether – all of which provide barriers that may keep a lot of people from being able to take part.

To make matters even more complicated, if you don’t set up your validator correctly, or if it goes offline or it is harmful to the network in any way, you may be subject to penalties. These penalties may even include ‘slashing’ – a term referring to the destruction of portions of your stake and even removal from the network.

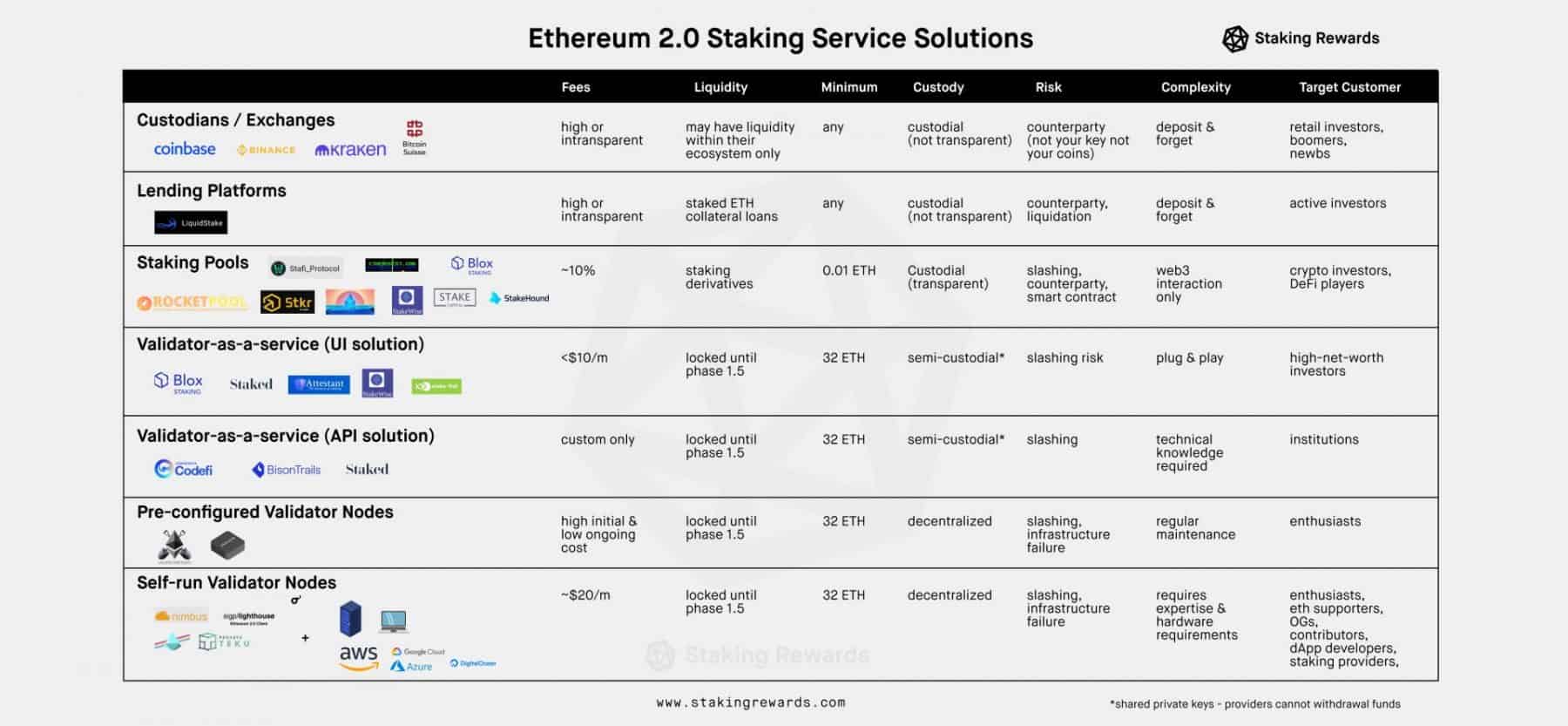

4. Staking Pools and Other Solutions

All of the risks I’ve just mentioned are why some additional staking solutions were created. These alternatives allow for the everyday person to stake ETH and earn staking rewards – without the considerable effort or risk of running your own node.

Exchanges

The easiest way to stake for a non tech savvy person would be to use staking services supplied by exchanges. Certain exchanges allow you to stake your coins through their validators even if you only have a small amount for a fee.

This completely eliminates the hassle of running your own validator but requires you to forfeit control over your coins to the exchange. Some exchanges will also allow you to claim your staking rewards immediately and not wait until Ethereum 2.0 reaches the docking phase.

Staking Pools

Another option is to join a staking pool. Just like mining pools, staking pools are groups of people joined together in order to get a better chance at forging the next block. Staking pools also allow you to deposit less than the minimum staking amount since all of the funds are pooled together.

If you decide to go with a staking pool it’s important to research certain aspects of the pool:

- Reliability of its validators

- Pool fees

- Customer support

- Pool size

- User reviews

- Whether or not you are required to give up your private keys to the pool

Preconfigured validator

Additionally, you can purchase a pre-configured validator. While the initial setup of these validators should be relatively easy you will still be required to keep up the ongoing maintenance which can be a hassle, depending on how tech-savvy you are.

Validator as a Service (Cloud Staking)

These are companies that will allow you to run your own validator on their computers without the need to set it up or maintain it. Since this is your own personal validator, you’ll still be required to deposit 32 ETH and pay a certain fee for this service. The great thing about this option is that it’s relatively easy to set up and you don’t need to give control over your coins to another company.

Source: Staking Rewards

Liquid staking

Liquid staking is an additional feature that can apply to most, if not all of the above staking options. Currently when staking ETH, the coins are “stuck” and unavailable for trading, lending, or other uses within the crypto ecosystem.

Liquid staking issues stakers with tokens that represent a claim on their staked tokens, which can be utilized and exchanged freely. Once staking withdrawals are enabled, these liquid staking tokens will be redeemable for the original staked ETH.

5. Conclusion

Proof of Stake is an exciting new concept that allows everyday users to participate in securing a certain blockchain while earning passive rewards. Since the transition of Ethereum to PoS via “The Merge”, this consensus mechanism has gained massive exposure.

If you want to read more about this topic you can browse this excellent overview by The Ethereum Foundation. And if you have any more questions feel free to leave them in the comment section below.

So, now that I’ve deposited my ETH into the ETH2 Proof-Of-Stake option of choice, does this what benefits become available upon launch of the Ethereum 2.0 network? What I mean is, as a traditional stakeholder in a companies stock would reap the benefit of buying into the stock further but at the reduced priced of that stock when the stockholder first purchased it- Would there be any similar benefit to staking ETH2, any more incentive than just the 6% that is offered now?