The best no KYC crypto exchanges allow you to trade anonymously. This means no personal information or ID verification documents.

Not all no KYC exchanges are safe, so read on to discover the top providers. In addition to security and trust, I rank anonymous exchanges for fees, supported coins, and trading tools.

List of the 10 Best No KYC Crypto Exchanges

Consider one of the no KYC crypto exchanges listed below when trading anonymously:

- Margex – The overall best crypto exchange without KYC requirements

- MEXC – Trade over 2,000 crypto tokens at just 0.01% per slide

- BingX – Great option for day traders with short selling and 150x leverage

- Best Wallet – Top decentralized exchange and wallet on a user-friendly app

- Changelly – Withdraw up to 1 BTC daily without ID verification checks

- CoinEx – KYC-free accounts with 24-hour cash-out limits of 10,000 USDT

- Jupiter – Access brand-new Solana meme coins before they blow up

- LocalCoinSwap – P2P trading platform supporting local payment methods

- Gate.io – Over 1,700 markets and 100,000 USDT daily withdrawal limits

- OKX DEX – Trade over 70 blockchain networks with a DEX aggregator

Reviewing the Top Non KYC Exchanges for 2024

KYC requirements are just one aspect to consider when selecting an exchange. Crypto traders should also assess safety and security, tradable pairs, commissions, and other important metrics.

I’ll now take a much closer look at the no identification crypto exchanges listed above.

1. Margex – The Overall Best Cryptocurrency Exchange Without KYC Requirements

I’m opting for Margex as the best crypto exchange without KYC requirements. Margex operates in more than 150 countries and is used by over 500,000 traders. It not only offers a safe and private means to trade crypto but is also cost-effective. Market takers pay just 0.06% in trading commissions. That’s just $0.60 for every $1,000 traded.

What’s more, Margex is a great option for trading crypto with leverage. You’ll get 100x leverage on major cryptocurrencies like Bitcoin, Ethereum, and BNB. Margex offers up to 50x on other popular coins, such as Bitcoin Cash, Polygon, Cosmos, and Polkadot. This means you can trade with considerably more than you have in your Margex account.

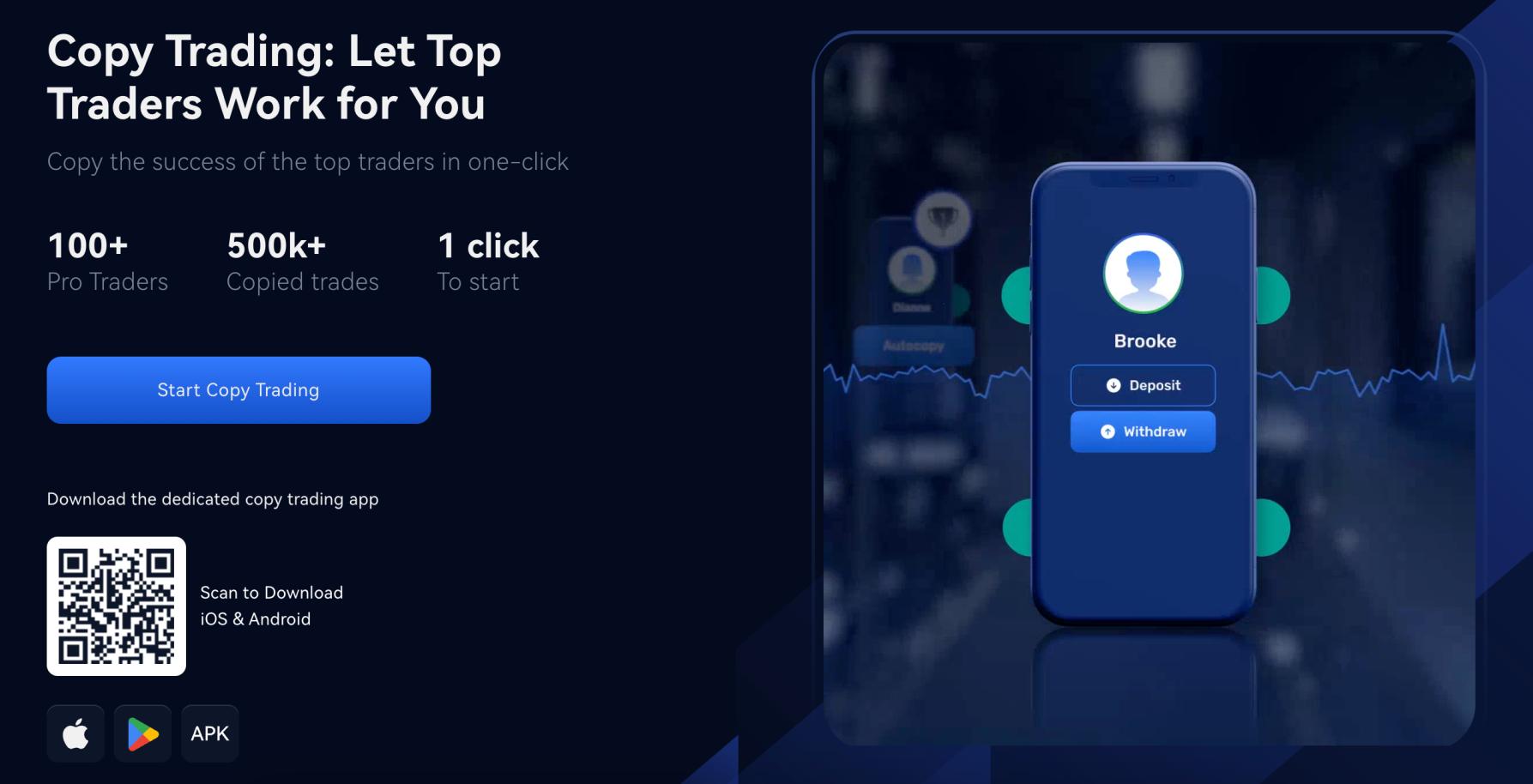

I also like that Margex offers perpetual futures. This enables traders to go long or short on all supported markets. Margex also offers copy trading tools. This is a passive investment feature that enables you to copy experienced crypto traders. However, Margex has smaller trading volumes than other no KYC crypto exchanges. What’s more, it doesn’t accept US clients.

Pros

- The best no KYC exchange for crypto traders

- Offers leverage of up to 100x

- Supports perpetual futures

- Copy trading tools for passive investing

- Trade online or via the Margex app

Cons

- Doesn’t accept US clients

- Lower trading volumes than other platforms

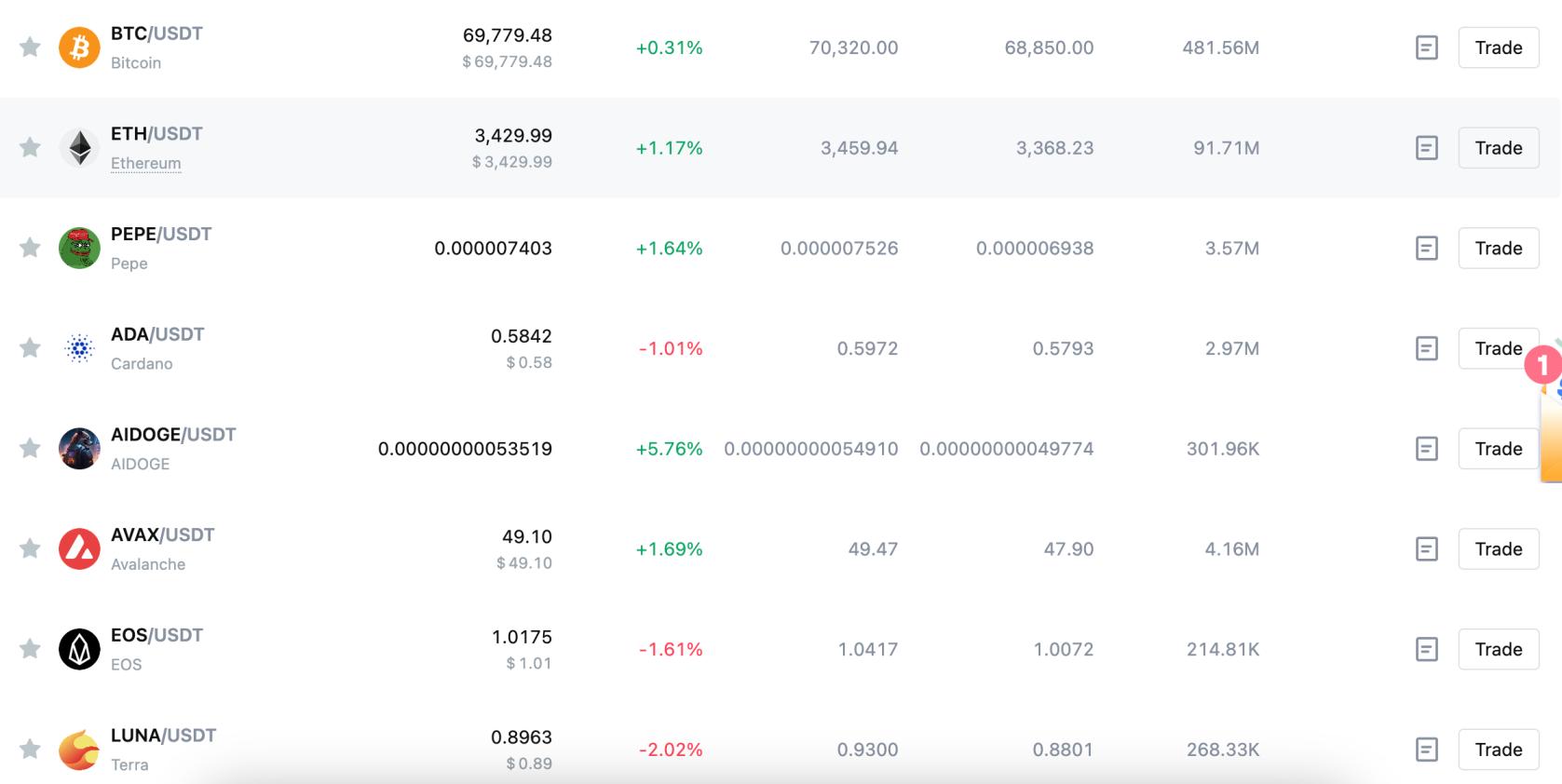

2. MEXC – Trade Over 2,000 Crypto Tokens at Just 0.01% per Slide

MEXC is also a top-rated no KYC crypto exchange. It’s considered a tier-one platform with significant trading volumes and liquidity levels. MEXC is also a safe exchange with proven reserves. I like that MEXC supports more than 2,000 crypto tokens, so you’ll never be short of trading opportunities.

This includes a great range of small, medium, and large-cap markets. Best of all, tokens can be traded at commissions of 0.1%. This means you’re paying just $1 for every $1,000 traded. MEXC not only supports spot trading but also leveraged futures. Major cryptocurrencies can be traded with leverage of up to 200x.

This means you can trade $100,000 worth of Bitcoin with just $500. Futures trading fees are even more competitive at just 0.02%. However, this is based on the total leveraged amount, not the margin. Another drawback is that the user experience might not be suitable for beginners. On the contrary, I found that MEXC is best suited for experienced traders.

Pros

- Open an account with an email address only

- Trade more than 2,000 crypto tokens

- Spot trading fees of 0.1%

- Offers leveraged futures of up to 200x

- Proven reserves that cover customer balances

Cons

- Operates without a reputable license

- The iOS/Android apps are rated below 4/5

3. BingX – Great Option for Day Traders With Short Selling and 150x Leverage

I found that BingX is one of the top no KYC crypto exchanges for day traders. It offers a full suite of tools that enable traders to make smart decisions. This includes high-end charts with TradingView integration. Charts are fully customizable and come packed with technical and economic indicators. Not to mention drawing tools like the Fibonacci retracement.

BingX also offers short-selling capabilities via perpetual futures. Traders can also apply leverage of up to 150x. This boosts a $100 account balance to $15,000. More than 700 crypto tokens are supported by BingX. This includes some of the best meme coins to buy, such as dogwifhat, Shiba Inu, Dogecoin, and Bonk.

However, this is another no KYC exchange that’s aimed at experienced investors. There is an overwhelming range of tools, features, and markets – which can be intimidating for beginners. Nonetheless, I like that BingX offers competitive trading commissions. Market takers pay just 0.1% per slide.

Pros

- A great option for crypto day traders

- Go long or short on hundreds of markets

- Access leverage of up to 150x

- Buy and sell crypto at just 0.1% per slide

- Offers peer-to-peer funding methods

Cons

- Rated 2.6/5 on Trustpilot

- Reports of long waiting times for live support

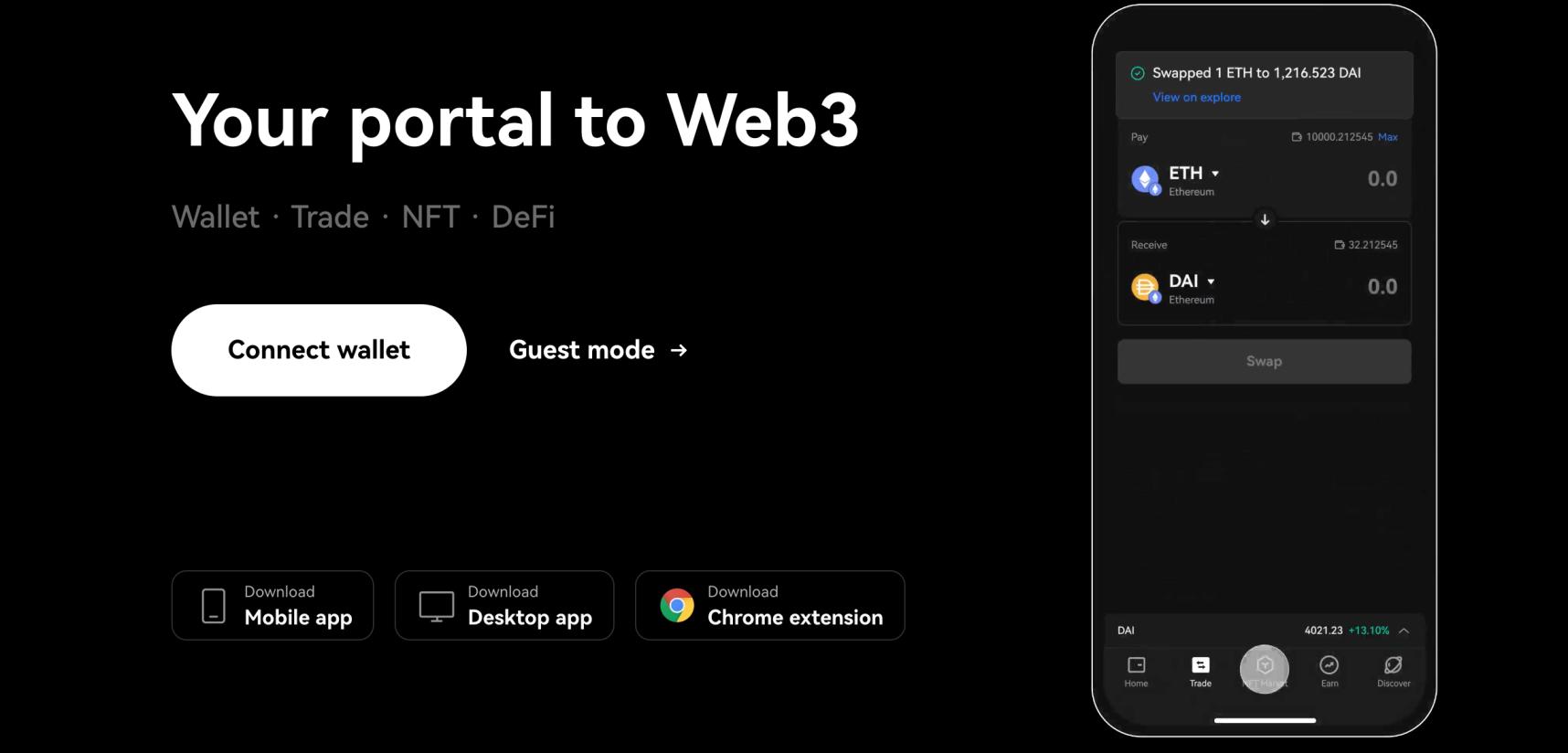

4. Best Wallet – Top Decentralized Exchange and Wallet on a User-Friendly App

Best Wallet is a great option for mobile traders. It has developed a user-friendly app for iOS and Android. Best Wallet is suitable for beginners and experienced traders alike. The app offers two primary products; a decentralized exchange and a wallet. There is no requirement to register an account, so you’ll have complete anonymity.

Best Wallet uses market-leading liquidity pools to offer a smooth and cost-effective trading experience. It supports all ERC-20 and BEP-20 tokens, covering everything from ETH and BNB to USDT and DAI. Traders get the best exchange rate at the time of the swap; Best Wallet doesn’t add a markup to the spread.

Additional networks will be supported in the future, including Bitcoin and Solana. What’s more, some Best Wallet features are still being developed, including token analytics, market insights, and news feeds. Nonetheless, I like that the in-built wallet offers non-custodial storage with two-factor authentication and biometrics.

Pros

- True privacy on a decentralized exchange

- No account opening requirements

- Supports all ERC-20 and BEP-20 tokens

- Obtains market-leading prices from liquidity providers

- Also offers a non-custodial wallet

Cons

- Yet to support Bitcoin or Solana

- Many features are still being developed

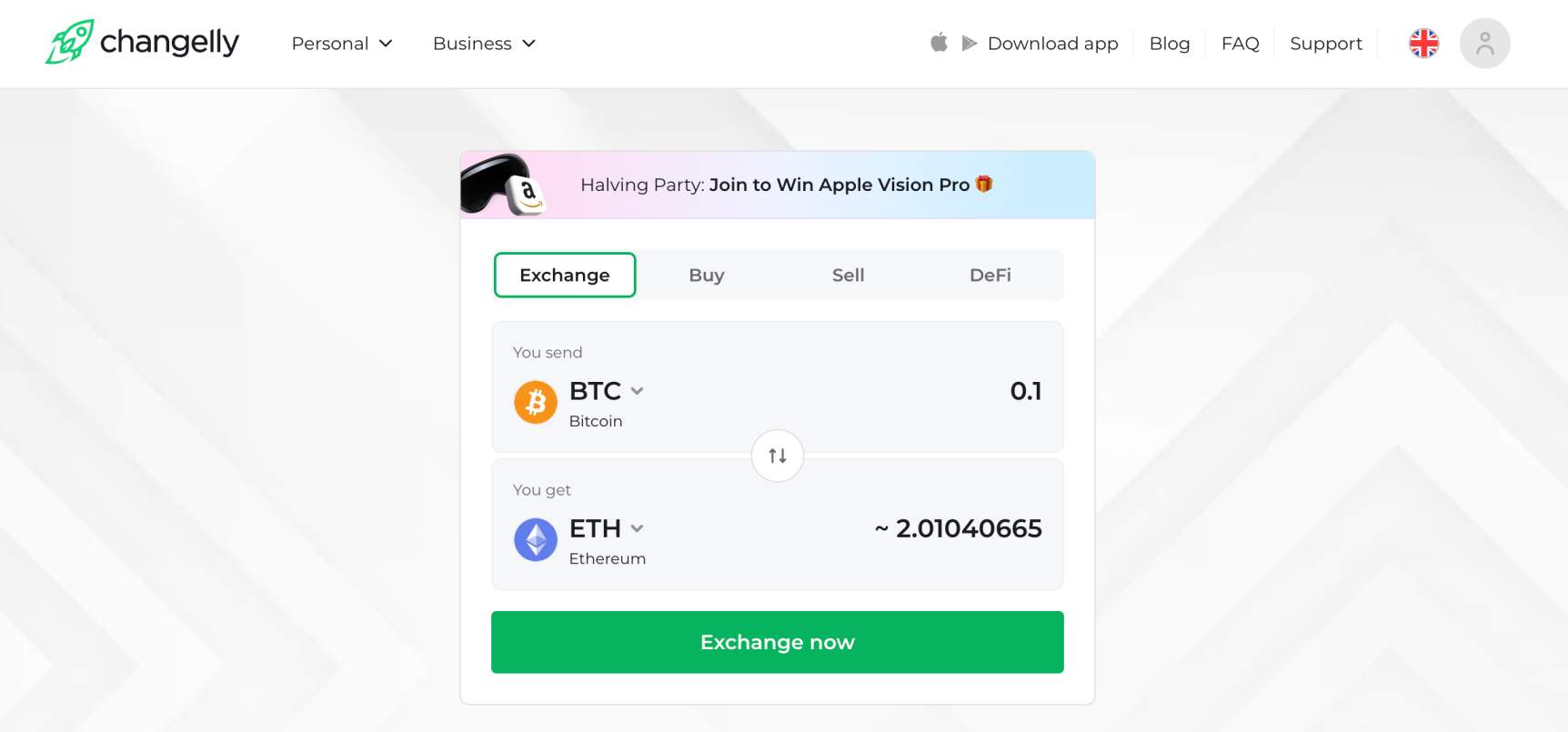

5. Changelly – Withdraw up to 1 BTC Daily Without ID Verification Checks

Changelly is a popular crypto exchange that was launched in 2015. It supports Bitcoin and over 500 altcoins, including Shiba Inu, Solana, Ethereum, Monero, and Cardano. Traders can swap any supported coin instantly. Changelly obtains market prices from over 20 liquidity providers. This ensures traders get the best price possible.

However, Changelly adds a 0.25% markup on swaps, which is more than other providers. Nonetheless, I like that Changelly offers a KYC-free experience. As long as you don’t need to withdraw more than 1 BTC per day, you can buy and sell cryptocurrencies anonymously. These limits should suit the majority of traders.

Changelly is also one of the best no KYC crypto exchanges for beginners. It offers a smooth and simple trading experience on desktop and mobile devices. The latter includes a mobile app for iOS and Android. I also like that Changelly never stores client-owed funds. Cryptocurrencies are sent straight to your stated wallet address after transacting.

Pros

- One of the best options for beginners

- User-friendly experience on desktops and mobiles

- Withdraw up to 1 BTC daily without KYC requirements

- Supports some of the best altcoins

- Established in 2015

Cons

- Adds a 0.25% markup on swaps

- Doesn’t offer a native crypto wallet

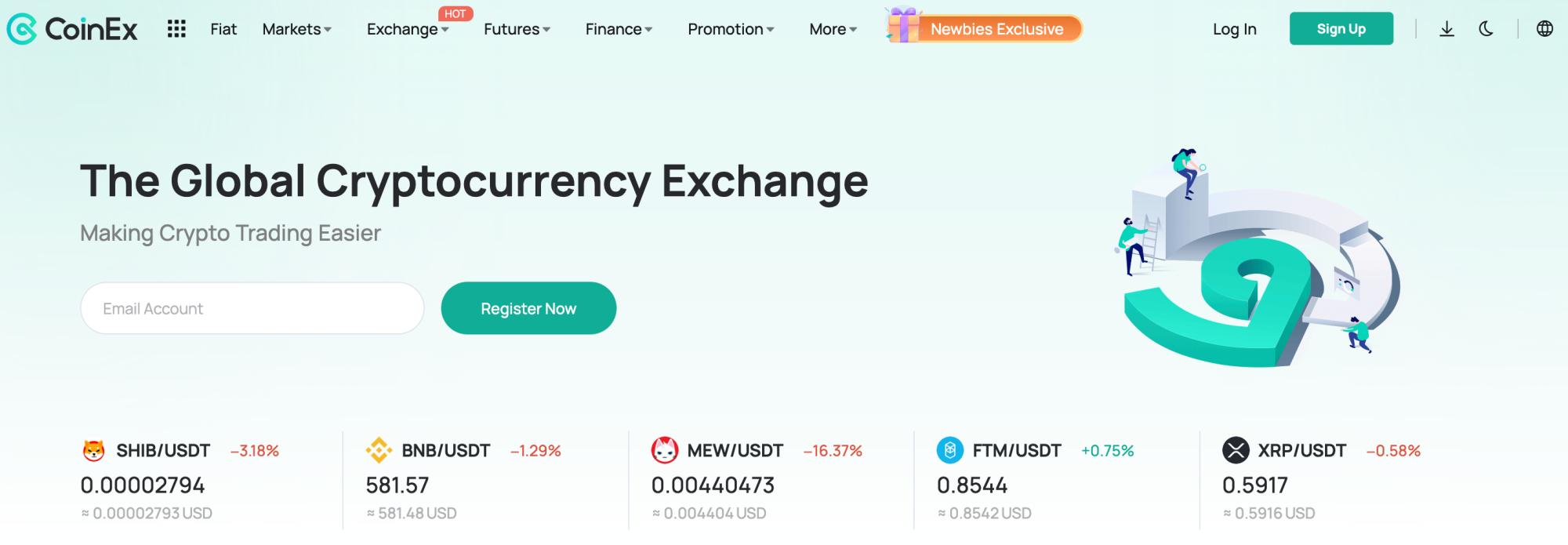

6. CoinEx – KYC-Free Accounts With 24-Hour Cash-Out Limits of 10,000 USDT

CoinEx is another top-rated exchange that offers KYC-free accounts. It enables traders to open an account with an email address only. Thereon, you can withdraw up to 10,000 USDT every 24 hours without ID verification. CoinEx supports a huge range of markets. This covers over 960 coins and 1,400 pairs.

What’s more, CoinEx makes it simple to find trading opportunities. It displays markets based on a range of metrics, such as ‘top searches’, ‘top gainers’, and ‘new coins’. Clicking on a coin reveals real-time market data. CoinEx also supports perpetual futures. This includes linear and inverse contracts, which are aimed at experienced traders.

Other features include smart trading tools, loans, and liquidity provision. The latter offers a 50% share of trading fees when supplying liquidity. That said, I found that fees are slightly more expensive than other no KYC exchanges. For instance, you’ll pay 0.2% per slide on spot trading commissions. Futures are also above the market average, with CoinEx charging 0.05%.

Pros

- No KYC when withdrawing less than 10,000 USDT per day

- Only an email is needed to get started

- Supports over 900 coins and 1,400 tradable pairs

- Offers spot trading and perpetual futures

- Earn a share of trading fees when supplying liquidity

Cons

- Much lower trading volumes than other exchanges

- Trading fees are above the market average

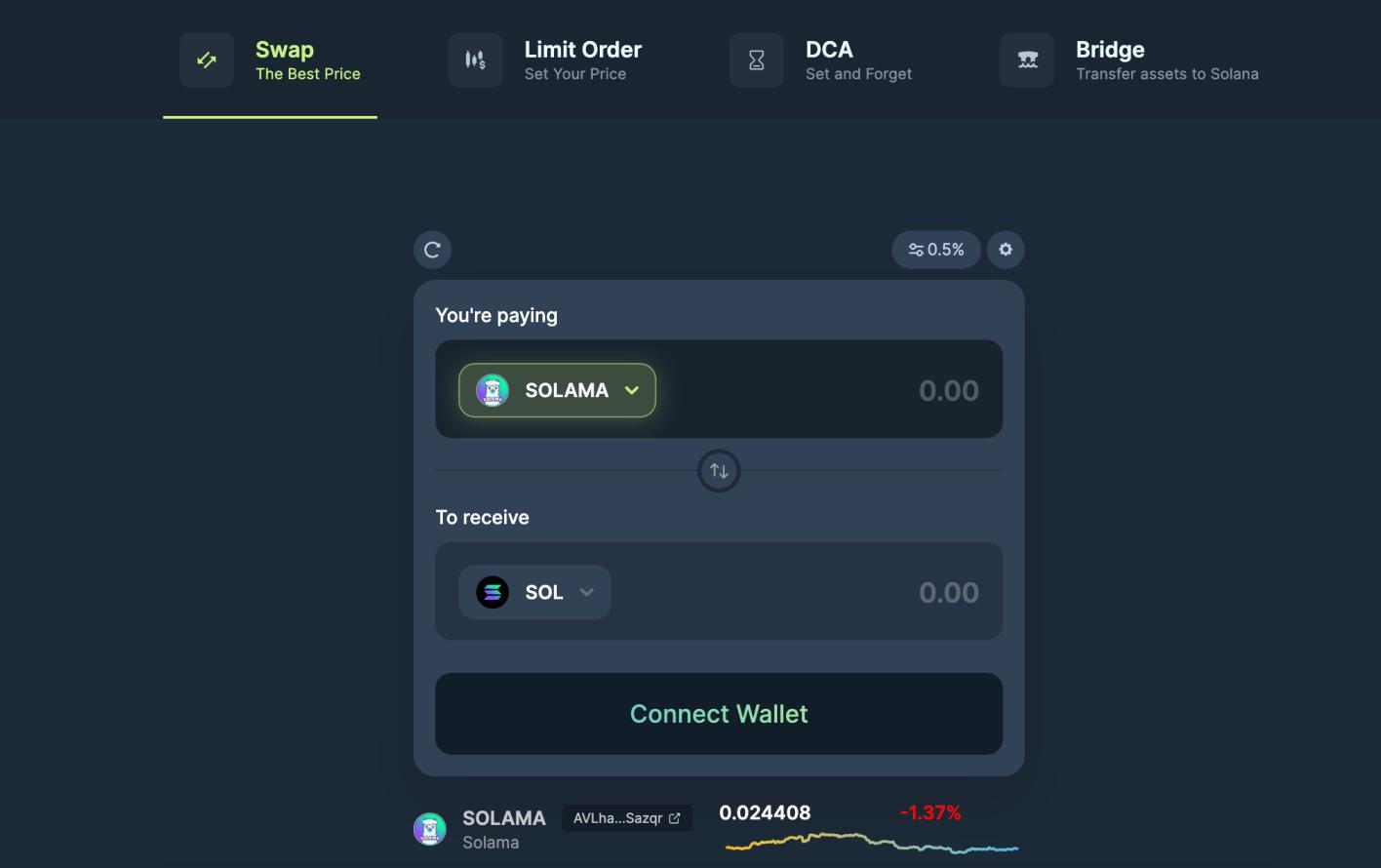

7. Jupiter – Access Brand-New Solana Meme Coins Before They Blow up

Jupiter is the best no KYC crypto exchange for trading Solana meme coins. It offers a safe, private, and reliable trading experience. Simply connect a wallet and swap SOL for your preferred coin. Alternatively, you can create a custom dollar-cost averaging schedule. For instance, you might want to buy $100 worth of a new meme coin every hour.

This ensures you avoid entering the market at peak pricing. Jupiter is also ideal for investing in non-meme coin projects. It supports almost every token on the Solana network. You can paste the project’s unique contract address to make sure you’re trading the right token. I also like that Jupiter offers bridging tools.

This enables investors to buy Solana-based tokens even if they aren’t currently on-chain. Cross-chain compatibility includes Ethereum, BNB Chain, Avalanche, Base, and Polygon. The main drawback of Jupiter is its lack of analysis features. You’ll need to use a traditional exchange if you want high-level charts and indicators.

Pros

- The best option for trading new Solana meme coins

- Simple and user-friendly trading experience

- No account is needed – just connect a wallet

- Offers dollar-cost averaging tools

- Bridge assets from outside of the Solana ecosystem

Cons

- Limited charting and analysis tools

- Doesn’t accept fiat money

8. LocalCoinSwap – Peer-to-Peer Trading Platform Supporting Local Payment Methods

LocalCoinSwap is a peer-to-peer crypto exchange that doesn’t implement KYC requirements. This is because traders buy cryptocurrencies directly from sellers in their home country. Only an email address is needed; you can then choose your preferred coin, investment size, and payment method.

You’ll be dealing with domestic sellers, most accept local bank transfers or e-wallets. Note that exchange rates are set by sellers. I found this averages 3-5% above the spot trading price. LocalCoinSwap clearly displays how much you’re paying when compared to real-time prices. After finding a suitable seller, they’re required to deposit the coins into the escrow wallet.

The buyer then completes the payment, and the seller releases the coins. Any issues go through LocalCoinSwap for added protection. However, I should note that KYC requests are at the seller’s discretion. This is usually displayed before you confirm a new deal. The vast majority of sellers offer Bitcoin, Ethereum, or Tether, so diversification isn’t possible.

Pros

- The best option for peer-to-peer trading

- Buy crypto using local payment methods

- Avoid foreign exchange markups

- Trades are often completed in minutes

- Sellers must deposit coins into the escrow wallet

Cons

- Sellers can choose to request KYC documents

- A very small selection of coins to choose from

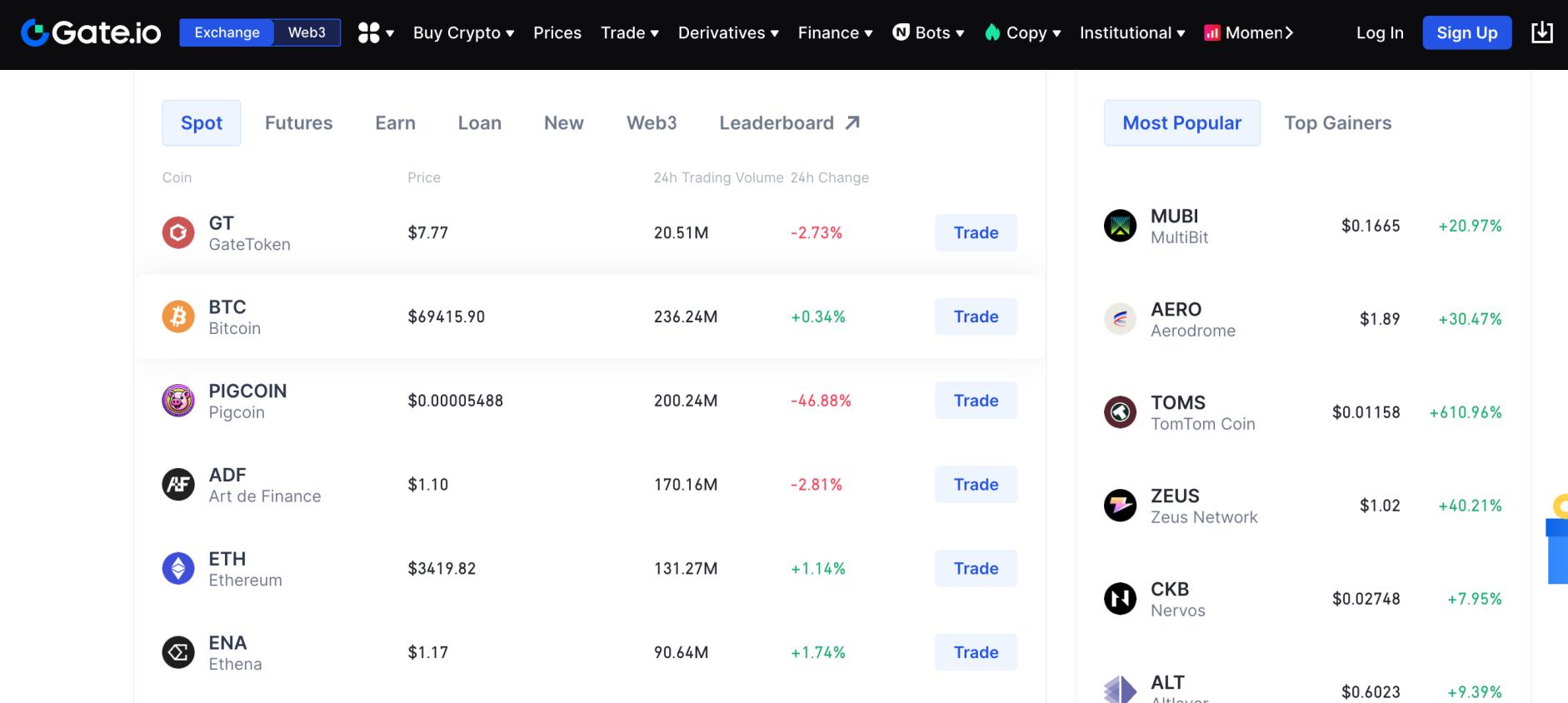

9. Gate.io – Over 1,700 Supported Markets and 100,000 USDT Daily Withdrawal Limits

Gate.io is a top 10 crypto exchange with daily volumes of over $2 billion. It supports more than 1,700 crypto markets, making it a solid option for diversification. This covers some of the best cryptocurrencies to buy, such as Bitcoin, XRP, Solana, Ethereum, Dogecoin, and Cardano. Plenty of new, micro-cap tokens are also available on Gate.io.

The easiest way to buy coins is via the ‘Convert’ tool. This will suit beginners who don’t feel comfortable using an advanced trading dashboard. That said, Gate.io also offers high-level charts, indicators, and in-depth order books. Using the spot trading platform means you’ll pay just 0.1% per slide. This fee reduces as you increase your trading volumes.

Gate.io also offers a sizable derivatives platform. This includes perpetual and delivery futures, not to mention European-style crypto options. In terms of anonymity, KYC-free accounts get 24-hour withdrawal limits of 100,000 USDT. Staying within these limits ensures complete privacy.

Pros

- Withdraw up to 100,000 USDT daily without KYC checks

- Competitive spot trading commissions of 0.1%

- Supports more than 1,700 crypto markets

- Also offers leveraged futures and options

- Attracts huge trading volumes

Cons

- Unregulated in most global markets

- Doesn’t accept US traders

10. OKX DEX – One-Click Trading Across 70 Blockchain Networks With a Pricing Aggregator

OKX offers a decentralized exchange that supports no KYC trading. No account requirements are in place. Traders can connect a wallet and access thousands of tokens from over 70 blockchain networks. This includes Bitcoin, Solana, Optimism, Polygon, BNB Chain, and Ethereum.

OKX has developed a bridge aggregator that connects with over 400 other exchanges. This means you’ll get the most competitive exchange rates when trading. The purchased tokens will be deposited in your connected wallet in seconds. I also like that OKX offers decentralized earning tools.

This will appeal to long-term investors who want to generate passive income from their holdings. Simply search for a token and choose the most suitable tool – such as staking or yield farming. OKX also offers a decentralized wallet. This comes as desktop software and a mobile app.

Pros

- Trade thousands of tokens from over 70 network standards

- Connects with over 400 DEX aggregators

- Get the best price possible when trading tokens

- Offers competitive APYs on staking and yield farming

- Also offers a desktop and mobile wallet

Cons

- Using the main OKX exchange requires KYC

- Slippage adjustments are required on some trades

What are No Identification Crypto Exchanges?

No identification exchanges enable you to trade crypto without traditional Know-Your-Customer (KYC) requirements. This means you’ll benefit from a private and anonymous trading experience. Opening an account typically only requires an email address. Some no KYC crypto exchanges have no account requirements at all.

There are some considerations to make before using a no KYC platform. First, while many exchanges offer a KYC-free experience, limitations often apply. This is usually determined by a 24-hour withdrawal limit. Fortunately, these limits are often very high, meaning very few traders will need to exceed them.

For example, Changelly enables traders to withdraw up to 1 BTC every day without revealing their identity. This amounts to $70,000 daily based on current Bitcoin prices. CoinEx has a similar procedure, although daily withdrawal limits are much smaller at 10,000 USDT. Once again, this is considerably more than most traders will need.

Another important consideration is that no KYC accounts are usually only available on crypto-to-crypto payments. So, if you want to buy Bitcoin with fiat money, KYC will be mandatory. The only possible workaround is to use a peer-to-peer exchange. Even then, some sellers will request KYC documents to ensure they comply with anti-money laundering regulations.

I should also note that some no KYC crypto exchanges are based offshore. This means you won’t have anywhere to turn if things go wrong. It also means that investor protections might not apply; such as minimum capital requirements or proof of reserves. Always do your research before choosing an exchange.

Advantages of Using a No NYC Crypto Exchange

I’ll now cover some of the advantages of trading at a no KYC exchange.

Trade Crypto Anonymously

Some crypto investors simply don’t want to reveal their identity when trading online. This aligns with the Bitcoin ethos of private and anonymous transactions. Ordinarily, KYC processes are intrusive.

- First, investors will be asked for their personal information when opening an account.

- This includes a name, date of birth, and nationality.

- Next, KYC requirements also demand ID verification documents.

- This means a government-issued ID and proof of address.

- Investors then need to wait for the KYC checks to be made, which can take several days.

In contrast, no KYC exchanges do not ask for personal information or verification documents. This ensures that investors can buy and sell crypto in complete privacy.

Fast Sign-Up Process

Getting started with a no KYC crypto exchange takes seconds. For instance, Margex only collects an email address and password when new clients register. A crypto deposit can then be made instantly. Decentralized exchanges like Best Wallet and Jupiter take things to the next level.

No account is required on these platforms. Instead, users connect a private wallet that’s already funded with cryptocurrencies. This enables them to trade tokens without delay. The newly bought tokens will then be deposited in the user’s wallet, which can be disconnected after the trade is completed.

Data Protection

A significant number of crypto exchanges have been hacked in the prior decade. This has resulted in billions of dollars in lost client funds. In some instances, hacks have breached client data, such as government-issued IDs submitted during the KYC process.

With data breaches becoming all too common, many investors are turning to no KYC platforms. In doing so, there is no risk of personal information or ID verification documents getting into the wrong hands. This is because traders are only required to supply an email when signing up.

Faster Withdrawals

Withdrawing tokens from a no KYC exchange is often fast and hassle-free. Users simply need to provide the exchange with their private wallet address. I found that withdrawal requests are often approved near-instantly, so the tokens will be received in minutes.

In comparison, traditional exchanges are unable to approve withdrawals until the KYC process has been completed. Even then, withdrawals can be slow, especially when cashing out larger amounts. This is due to increased regulatory scrutiny on crypto exchanges, and how they handle money laundering risks.

Selecting the Right No KYC Exchange: My Criteria

I’ll now explain how you can choose the right no KYC exchange for your requirements. Some of the metrics I cover include daily limits, security, supported markets, and trading tools.

No KYC Limits

First, you’ll want to check what withdrawal limits are available on KYC-free accounts. As I mentioned earlier, this is often a 24-hour limit. Unless you’re looking to trade huge amounts, you’ll find that most withdrawal limits will be sufficient.

However, if you need to go over the allowed limit, you’ll only have two options. You’d either need to complete KYC or split your withdrawals over multiple days. Just remember that limits can change at any time.

Safety and Security

The best no KYC crypto exchanges offer a safe trading experience. This means the exchange employs institutional-grade security controls. Ensure the majority of client-owned funds are secured in cold wallets. They should require multi-sig access to approve withdrawals. This ensures there isn’t a single point of failure.

- I also prefer exchanges that offer two-factor authentication. This requires a unique code when logging in and withdrawing funds. Many exchanges support 2FA via the Google Authenticator app, which is free and secure.

- Whitelisting is also a great security feature to look for. This requires an extra security step when logging in from a new device or IP address.

Proof of reserves should also be explored. Especially since the FTX bankruptcy revealed the exchange didn’t have enough funds to cover customer balances. Ensure reserves have been audited and verified by a reputable source. It’s also a bonus if your chosen no KYC exchange is licensed.

Supported Coins

Once you’ve assessed limits and safety, you’ll want to check what coins the exchange lists. Consider whether you’re interested in large-cap coins like Bitcoin, or up-and-coming tokens with a small valuation. Some exchanges are better than others when it comes to listing new projects.

Tradable markets should also be assessed. For instance, some crypto exchanges without KYC only support spot trading. While others also offer crypto derivatives, such as perpetual swaps and options. This enables traders to go long or short on crypto, not to mention apply leverage.

Payment Methods

Most exchanges prefer crypto payments, as this won’t trigger any KYC requirements. This means you can easily deposit and withdraw funds anonymously. However, if you’re a first-time buyer who doesn’t own any crypto, things get a bit tricky. This is because fiat money deposits demand ID verification documents.

The only exception here is peer-to-peer exchanges like LocalCoinSwap. You’ll be matched with a seller in your home country, meaning you can pay for your crypto purchase with local payment methods. You can then transfer the crypto to a more comprehensive exchange, such as Margex or MEXC.

Trading Fees

I also prefer no KYC exchanges that offer low trading fees.

- For example, Margex charges commissions of just 0.06%. So, if you bought $100 worth of crypto, you’d pay just $0.06 in commission.

- MEXC is also competitive. Traders pay spot commissions of just 0.1%. Or 0.02% when trading futures.

Other trading fees can apply, such as overnight financing on leveraged positions. Fees also need to be paid when withdrawing crypto to a private wallet. These fees are often minimal, but should still be checked.

Trading Volume and Liquidity

Investors should prioritize no KYC exchanges with high trading volumes. This ensures the platform has sufficient liquidity, especially when trading smaller-cap coins. Increased liquidity means smooth trading conditions, as price movements won’t be as volatile.

What’s more, you won’t lose out on slippage. This happens when there isn’t enough liquidity to cover your order size. The result is you need to accept a less favorable price to trade. I always verify trading volumes on CoinMarketCap, as exchanges are known to over-report.

Trading Tools and Features

I’d also suggest checking what trading tools and features the no KYC exchange offers. For example, Margex and MEXC offer copy trading tools. After you’ve chosen a suitable trader, you can copy their positions automatically. This means you’ll be trading crypto passively.

Intermediate-to-experienced traders should look for analysis tools. For instance, customizable charts and technical indicators. TradingView integration is also handy. Consider whether the exchange offers leverage too. This enables you to access more trading capital than your balance allows.

The Legalities of Crypto Exchanges With No KYC

Crypto exchange regulations are complex – especially when it comes to KYC. The key issue is that many exchanges operate globally. KYC regulations will vary within each supported country. What’s more, exchanges are often located in countries with weak regulation. This enables exchanges to adopt more flexible KYC requirements.

For example, I mentioned that Gate.io offers KYC-free accounts with limitations. However, withdrawal limits are set at 100,000 USDT daily. This will suffice for the vast majority of traders. In addition, KYC-free accounts often only support crypto deposits and withdrawals. If you want to add funds via bank transfer or credit card, then KYC requirements are mandatory.

Conclusion

In summary, demand for no KYC crypto exchanges is on the rise. An increasing number of traders favor anonymity, privacy, and data protection when selecting a provider.

My top pick for KYC-free trading is Margex. Traders benefit from a safe and private experience – only an email address is needed. Spot trading and leveraged futures are supported, with fees amounting to just 0.06% per slide.

FAQs

Which crypto exchange doesn’t have KYC?

Margex and MEXC offer a KYC-free experience, although limits are in place. Other options include BingX, Best Wallet, and Changelly.

Can I use Binance without KYC?

Having been fined over $4 billion for money laundering failures, Binance has stepped up its KYC requirements. That said, most users can still withdraw up to 0.06 BTC per day without completing KYC.

Is Bybit a KYC?

Bybit enables users to withdraw up to 20,000 USDT per day without completing KYC. This is capped at 100,000 USDT per month.