ICOs are a great way to buy into a new project before it blows up. If you’re searching for the best crypto ICOs to invest in, read on. I explore 9 promising ICO campaigns that offer significant upside potential.

Read on to discover the top initial coin offerings from multiple niches, including meme coins, VR gaming, sustainable transportation, and mining solutions.

- New multichain meme token with over $13 million raised in its presale - ends soon.

- As a PoS token users can stake their holdings and earn passive rewards - currently over 80% APY.

- Wormhole and Portal Bridge technology gives holders access to other blockchains for cheaper fees and faster transactions.

ETH

ETH USDT

USDT BNB

BNB- +1 more

- Fun play on South Park with viral potential amid Solana meme coin craze

- Looks to capitalize on expected Summer meme coin frenzy

- Rumors that it's from same team as SLERF which saw big gains earlier this year

SOL

SOL

- Brand-new meme ERC20 token integrating two hot niches AI and crypto meme culture

- Degens can buy and stake $WAI to earn passive rewards in excess of 1,000% p/a

- WienerAI's presale is currently trending having raised over $700k

ETH

ETH USDT

USDT Bank Card

Bank Card- +1 more

- The world's top GameFi token hosted on the Solana blochain

- Coming from an established crypto casino with over 50k players, $DICE offers new utility to this popular casino

- $2.25M available via airdrops for casino players

SOL

SOL ETH

ETH BNB

BNB

- Exciting new Learn-to-Earn ecosystem expected to 100x ahead of Bitcoin halving event.

- Token holders gain exclusive access to trading webinars, courses and more.

- Buy and stake $99BTC tokens to earn passive rewards.

BNB

BNB ETH

ETH Bank Card

Bank Card- +1 more

- One of a kind AR & VR crypto ecosystem

- 5.21B total supply and 15M marketcap at listing

- Exciting gaming experiences with token rewards exceeding standard staking

ETH

ETH BNB

BNB USDT

USDT- +1 more

- Previous version witnessed 100x pump in 2023

- Massive community of Spongers including +30k followers on social media

- Early investors can buy and stake $SPONGEV2 tokens for 163% p/a rewards

ETH

ETH USDT

USDT Bank Card

Bank Card

- Massively-hyped solana meme coin with unprecedented airdrops

- Buy and stake $SMOG tokens for 42% APY rewards

- Complete tasks, quests, and challenges to earn rewards

ETH

ETH USDT

USDT Bank Card

Bank Card

- Driving a sustainable transportation revolution with green $TUK presale

- Investors can buy and stake $TUK tokens for 85% yearly rewards

- Integrates AI for predictive maintenance of electric vehicles

BNB

BNB USDT

USDT Bank Card

Bank Card

The 9 Best ICOs to Invest in Now

In my view, the 9 best crypto ICOs for 2024 are listed below:

- Dogeverse – The overall best ICO for 2024 with multi-chain compatibility

- WienerAI – Unique AI and dog-themed token with high staking APY.

- Slothana – Trending Solana meme coin due to launch on Doge Day

- 99Bitcoins – Learn2Earn crypto platform offers huge staking yields

- 5th Scape – Invest in the next generation of VR, AR, and blockchain gaming

- eTukTuk – Sustainable transportation meets electric tuk-tuk vehicles

- BlastUp – L2 Ethereum launchpad offers high staking rewards. $5M raised.

- Healix – AI-integrated platform making health and well-being more affordable

- Eosi Finance – Private-round ICO with an immediate upside of 850%

The Top New Crypto ICOs Reviewed

I’ll now review the best ICO cryptocurrency projects listed above. I explore the upside potential, token use cases, ICO details, and other important factors.

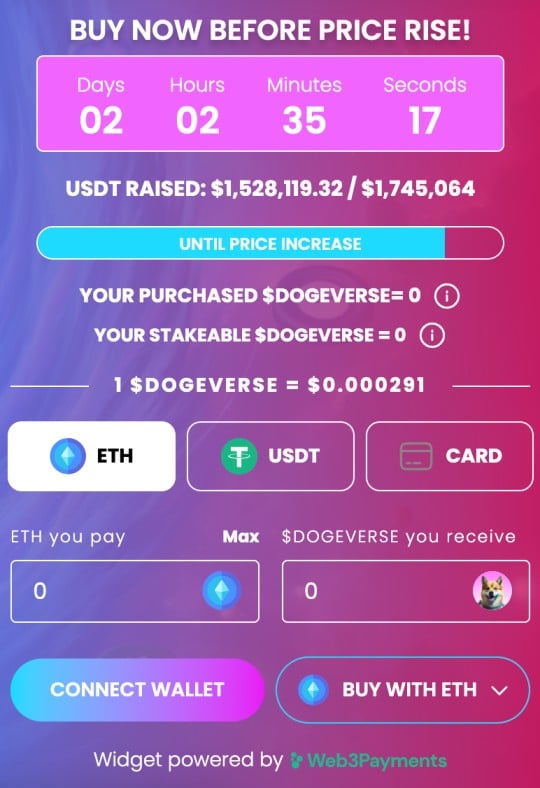

1. Dogeverse – The Overall Best ICO Crypto Investment for 2024 [$1.4 Million Raised so far]

Dogeverse (DOGEVERSE) is my top ICO pick for 2024. This a dog-themed meme coin, which is one of the hottest trends right now. Especially considering the recent success of dogwifhat and Bonk. Unlike these projects, Dogeverse is a multi-chain token. It’s currently compatible with Ethereum, BNB Chain, Polygon, and Avalanche.

It’s also building compatibility with Solana and Base. These are the six most active blockchain networks, so Dogeverse will have exposure to a huge audience. The project’s mascot is Cosmo, a cross-chain Shiba Inu breed with plenty of energy. In terms of tokenomics, the total DOGEVERSE supply is 200 billion tokens.

15% of the supply will be sold to ICO investors at various prices. Put otherwise, the earlier you buy the lower the price. The remaining tokens have been allocated for marketing, exchange applications, liquidity, and staking. The latter offers a sizable APY of 796%. So far, the Dogeverse ICO has raised $1.4 million. The current ICO price is just $0.000291.

| ICO Project | Ticker | Total Supply | Chain | ICO Payment Methods |

| Dogeverse | DOGEVERSE | 200 billion | Ethereum, BNB Chain, Polygon, Avalanche, Solana, Base | ETH, USDT, BNB, MATIC, AVAX, credit cards |

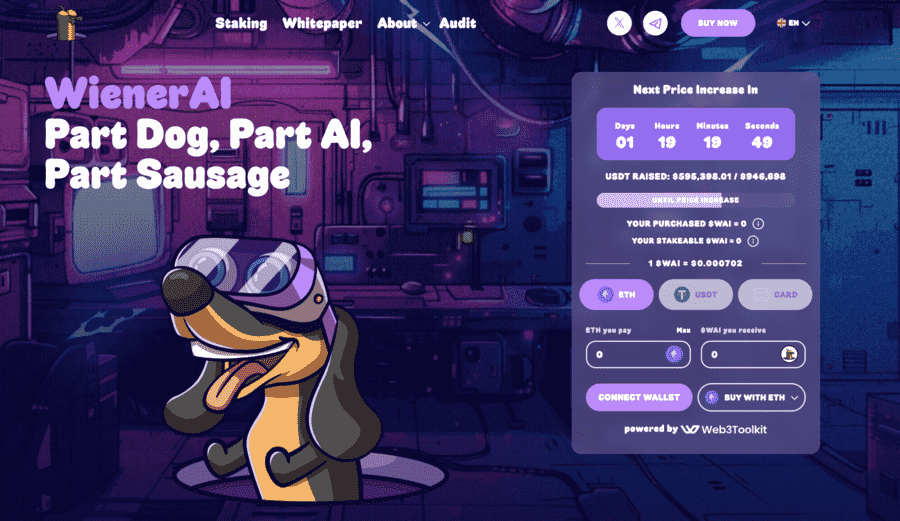

2. WienerAI – Unique AI and Dog-Themed Token With High Staking APY

Next on our list of best crypto ICOs is WienerAI ($WAI). It is a unique meme token that combines a funny dog theme with advanced AI. It’s quickly gaining investor attention since its presale launch.

Early investors can buy the $WAI token for just $0.000702 during this presale. The project raised over $580,000 within a week of its official launch.

The initial investor traction reaffirms market excitement and shows its potential to see huge growth similar to other popular meme coins such as Doge and Pepe.

What makes WienerAI unique is its big plans to use AI, which are highlighted in its roadmap. They aim to make $WAI into an “upgradeable cybernetic canine AI.”

The platform also has a highly rewarding staking program offering over 1,400% APY at press time. Staking often encourages long-term token holding and helps stabilize the price after the ICO.

WienerAI has set a supply cap of 69 billion tokens. It offers 30% of these tokens to its ICO buyers at a discounted price before it hits the market.

You can buy $WAI tokens directly from their site using BNB, ETH, or USDT. Just make sure you have enough money to cover all the transaction fees.

You can enter WienerAI’s Telegram channel and follow it on X (Twitter) to keep up with the latest project updates.

| ICO Project | Ticker | Total Supply | Chain | ICO Payment Methods |

| WienerAI | WAI | 69 Billion | Ethereum | ETH, USDT, BNB, Card |

3. Slothana – Trending Solana Meme Coin With Over $10 Million in ICO Funding

Slothana (SLOTH) is also one of the best meme coins for ICO investors. This ICO campaign has taken an unconventional route; investors simply need to transfer SOL to the project’s wallet address. Once the ICO campaign has finished, SLOTH tokens are airdropped to investors. More than $10 million worth of SOL has been raised to date.

This makes Slothana one of the most successful ICOs in 2024. That said, the ICO is ongoing, so you can still buy SLOTH tokens at competitive prices. 1 SOL gets you 10,000 SLOTH, which values the tokens at just $0.0172. Slothana is expected to list on exchanges on Doge Day, which is April 20th, 2024.

Although Slothana is a pre-launch project, it has already amassed a growing community. On the Slothana X page, the project has more than 16,000 followers. This has been achieved in just one month. The main drawback is that Slothana hasn’t published its tokenomics. What’s more, it hasn’t launched a Telegram group.

| ICO Project | Ticker | Total Supply | Chain | ICO Payment Methods |

| Slothana | SLOTH | Not published | Solana | SOL |

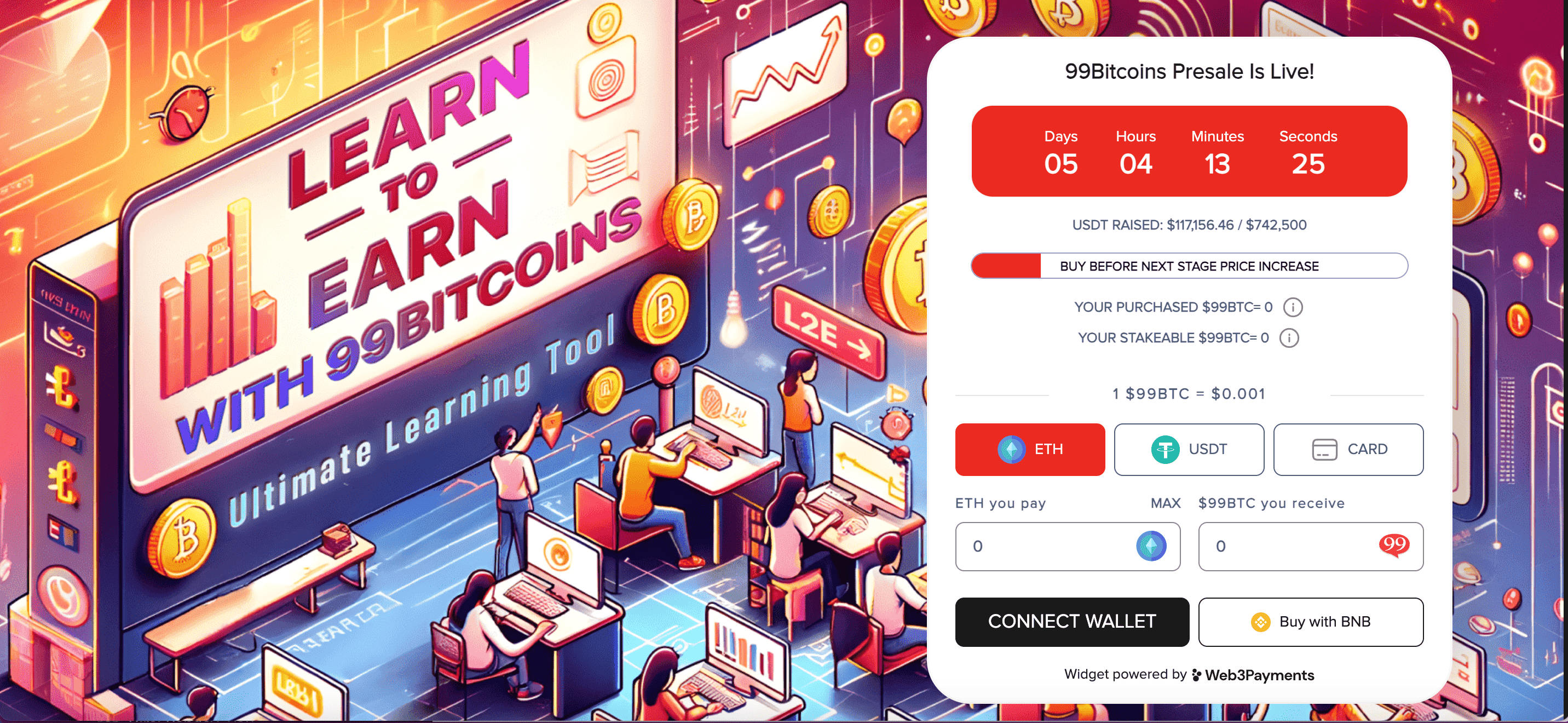

4. 99Bitcoins – New Crypto Offers Token Rewards Through its Learn2Earn Ecosystem

99Bitcoins ($99BTC) is a new learn-to-earn cryptocurrency platform. This platform pushes you to increase your knowledge about the crypto space by offering its native token as a reward.

Recently, the $99BTC token launched its ICO round – which has raised more than $115K in just a few hours. From a total supply of 99 billion tokens, 15% is being allocated through the ICO. Investors are flocking to the ICO due to 99Bitcoins’ multiple use cases.

Firstly, you can earn additional $99BTC tokens by progressing through the learning curriculum, taking quizzes, and completing assessments. Furthermore, token holders get access to a VIP group, where they can gain insights from like-minded individuals. Token holders also get access to expert trading signals on 99Bitcoins.

Finally, this cryptocurrency also offers huge staking rewards through its secure smart contract. At press time, one can generate more than 70,000% in annual yields by staking $99BTC. While 99Bitcoins is built on Ethereum, it will eventually migrate to the Bitcoin blockchain.

Once the migration is complete, it will adopt the BRC-20 token standard. Thus, 99Bitcoins can benefit from Bitcoin’s robust network, which developers use to create DApps and NFTs. Early investors can also stand a chance to win a share of the 99Bitcoins airdrop. Through the airdrop campaign, $99,000 worth of tokens will be distributed among 99 lucky winners.

All these reasons have played a role in 99Bitcoin’s rapid presale launch.

| ICO Project | Ticker | Total Supply | Chain | ICO Payment Methods |

| 99Bitcoins | 99BTC | 99 billion | Ethereum (Will migrate to Bitcoin) | ETH, USDT, BNB, Card |

5. 5th Scape – Invest in the Next Generation of VR and Blockchain Gaming

5th Scape (5SCAPE) is one of the best crypto ICOs with long-term utility. This project has every chance of exploding during the next bull run, considering it is involved in high-growth markets; virtual reality (VR) and augmented reality (AR). Not only that, but 5th Scape bridges the gap between real-world gaming and the blockchain ecosystem.

In a nutshell, 5th Scape has developed VR and AR games that cover multiple genres. This includes racing, cricket, archery, and fighting. Most importantly, its exclusive games require the 5th Scape headset, which is proprietary to the project. This means 5th Scape is a self-sufficient project that will generate long-term revenues.

It also offers an ergonomic chair that takes VR and AR experiences to the next level. The 5th Scape ICO is approaching $5 million in funding. It’s currently in stage four, so 5SCAPE tokens are priced at $0.00285. This will increase by 14% in the next stage. 5SCAPE will be listed on exchanges at $0.01 after the ICO, which is a 250% increase from current prices.

| ICO Project | Ticker | Total Supply | Chain | ICO Payment Methods |

| 5th Scape | 5SCAPE | 5.21 billion | Ethereum | ETH, USDT, BNB, MATIC, credit cards |

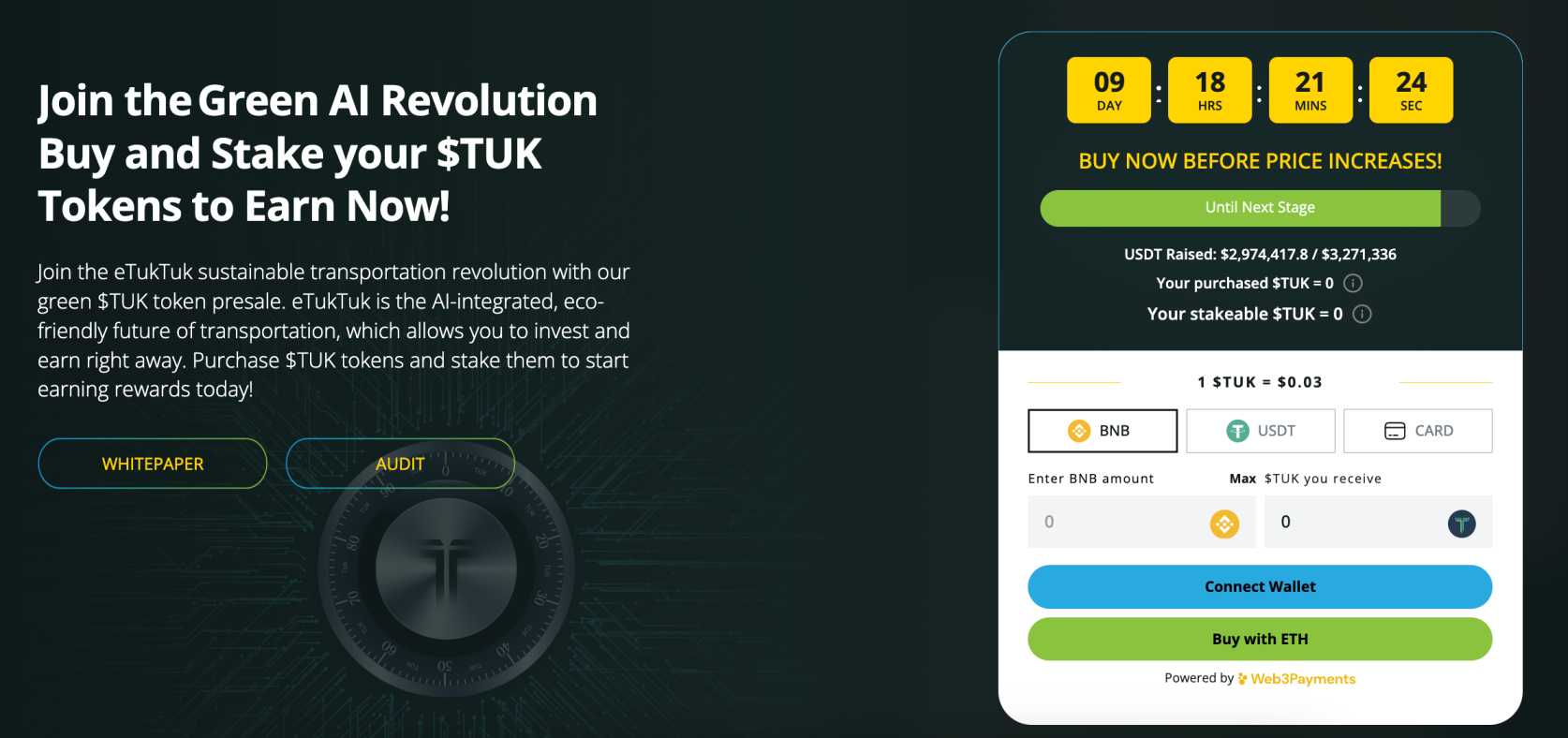

6. eTukTuk – Sustainable Transportation Meets Electric Tuk-Tuk Vehicles

eTukTuk (TUK) is another ICO project that’s operating in a high-growth market. Based in Sri Lanka, eTukTuk is spearheading the electric vehicle revolution on the Asian continent. More specifically, it manufactures electric tuk-tuk vehicles, which are used by millions of drivers in the developing world.

However, in the current landscape, tuk-tuks are fueled by internal combustion engines, which are bad for the environment. Therefore, eTukTuk is creating societal changes. eTukTuk is also revolutionizing day-to-day transportation. Its electric tuk-tuks are built with artificial intelligence dashboards.

Put simply, this will help drivers find the fastest and most efficient routes in real time. This further helps the environment by reducing traffic. eTukTuk’s ICO is going well, with almost $3 million raised. TUK tokens – which operate on the BNB Chain, are being sold for just $0.03. After the ICO, investors can stake their TUK tokens at APYs of 91%.

| ICO Project | Ticker | Total Supply | Chain | ICO Payment Methods |

| eTukTuk | TUK | 2 billion | BNB Chain | ETH, USDT, BNB, credit cards |

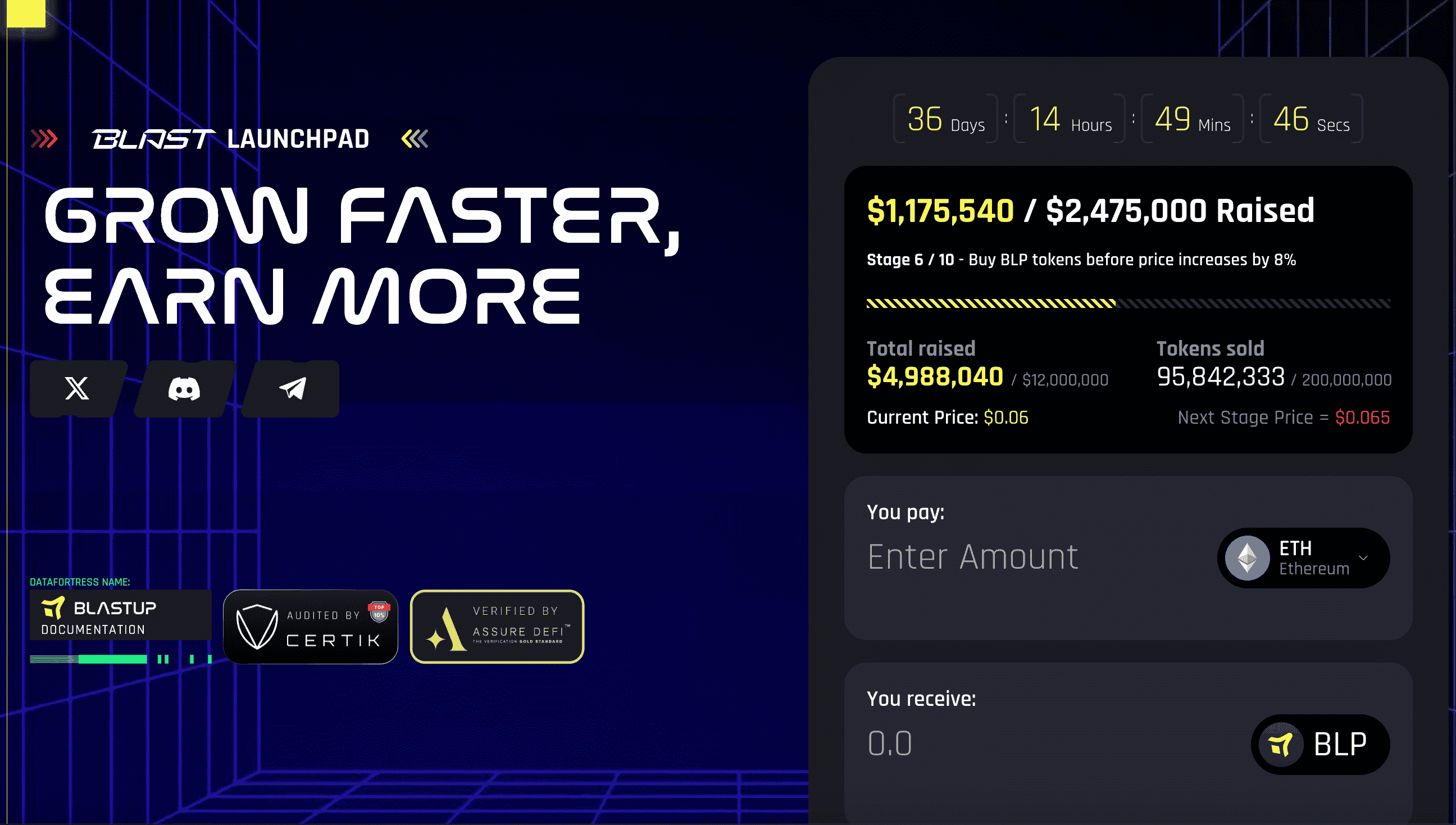

7. BlastUp – New L2 Ethereum Launchpad, $5 Million Raised on Presale

BlastUp ($BLP) is a layer-two Ethereum launchpad, giving users access to new and upcoming projects on the Blast ecosystem. $BLP, the native cryptocurrency, will be used to get a portion of BlastUp’s revenues from new projects and earn bonuses and NFT rewards.

Currently, $BLP is priced at $0.06 per token during the ongoing ICO stage. From a 1 billion token supply, 200 million tokens are being offered through the ICO. So far, the ICO has raised $5 million.

Token holders can stake $BLP on smart contracts to earn high interest and passive income. Those staked holders who invest in new IDO projects through the launchpad also earn exclusive loyalty rewards on BlastUp.

By purchasing $BLP, you can also start collecting ‘Booster Points,’ – another utility token on BlastUp. Those holding at least 1,000 points can open a ‘Blastbox’ and win a range of NFTs and ETH tokens.

BlastUp also offers a portion of funds raised from upcoming projects to staked token holders through staking pools. All these use cases have helped $BLP blast off since its ICO launch.

For more project updates, join the BlastUp Telegram channel and follow the project on Twitter.

| ICO Project | Ticker | Total Supply | Chain | ICO Payment Methods |

| BlastUp | BLP | 1 billion | Ethereum | ETH, USDT, BNB, MATIC, credit cards |

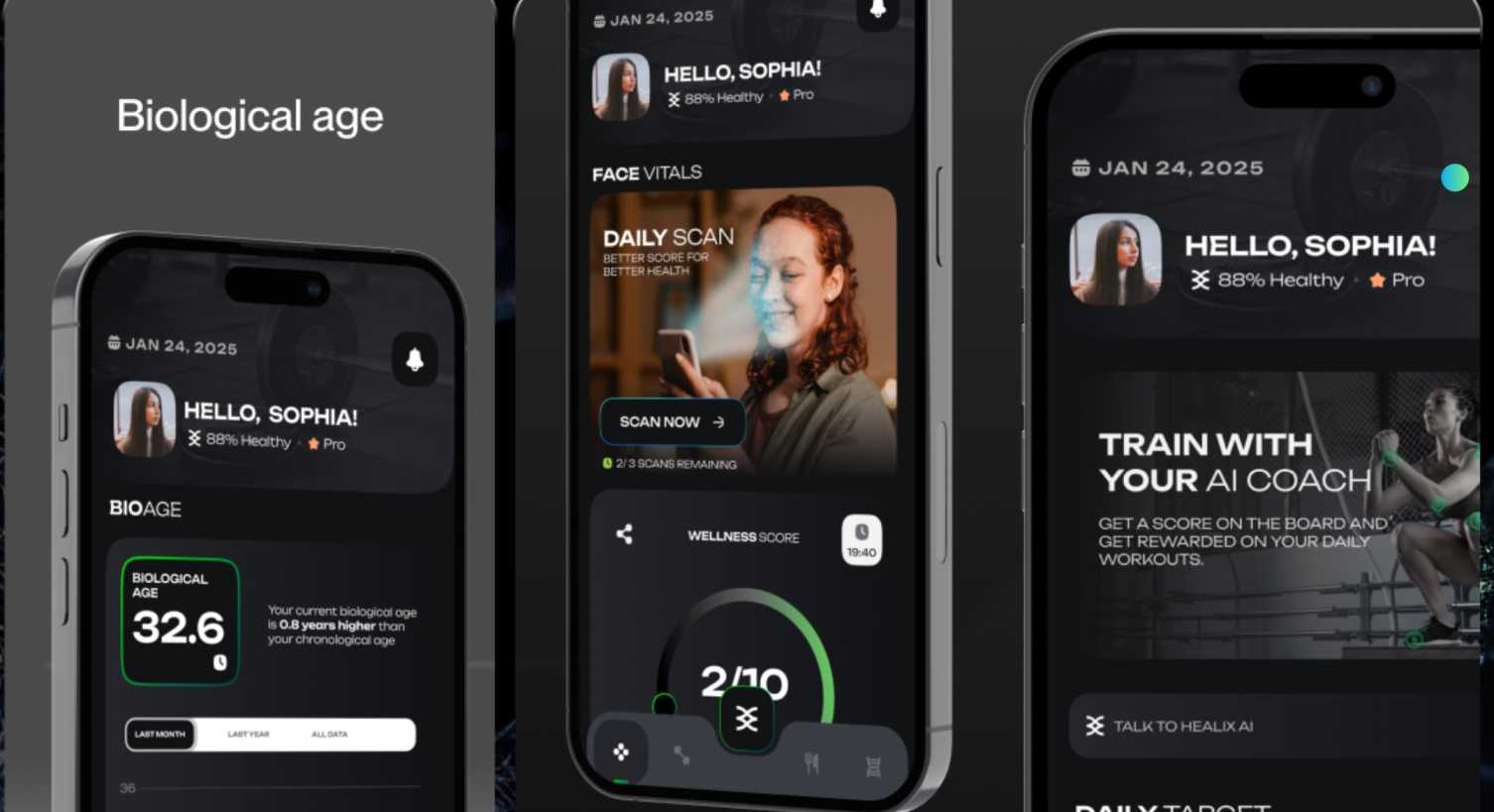

8. Healix – AI-Integrated Platform Making Health and Well-being More Affordable

Healix (HLX) is operating in a multi-trillion marketplace; health and well-being. It has developed an inclusive ecosystem that’s fueled by artificial intelligence and data science. It aims to make healthcare more affordable. Healix has created a mobile app that connects healthcare practitioners and fitness coaches to the masses.

The app leverages biometrics to obtain real-time data, which is securely held on the blockchain. This offers many use cases, such as sleep tracking, stress monitoring, and wellness scoring. It also offers AI-backed training, allowing users to set and track fitness goals.

There is also a rewards-based system, meaning users can earn HLX tokens when achieving health objectives. HLX is also a payment currency, enabling users to purchase health services and well-being products. The Healix ICO is in stage one, so just over $62,000 has been raised so far. This enables early investors to secure the lowest price of $0.03.

| ICO Project | Ticker | Total Supply | Chain | ICO Payment Methods |

| Healix | HLX | 1 billion | BNB Chain | BNB, USDT |

9. Eosi Finance – Private-Round ICO With an Immediate Upside of 850%

Eosi Finance (EOSIF) has developed a consumer-friendly trading platform that supports passive investing. Put simply, users can copy pre-vetted crypto traders like-for-like. Anything the trader buys or sells is replicated in real-time. Eosi Finance has also integrated AI solutions. This helps users to choose the best trader based on their goals and risk tolerance.

The platform is on-chain, meaning that Eosi Finance never touches client funds. Instead, users securely connect a wallet and enable smart contracts to execute positions. The platform is also cloud-based, ensuring server uptime around the clock. EOSIF is the native ecosystem token backing the project.

It’s currently being sold via a private-round ICO, which anyone can access. The current ICO price is just $0.10. This increases to $0.60 when the public round starts. After the ICO, EOSIF will be listed on exchanges at $0.95. This offers an 850% upside for private-round investors. However, there is a vesting period, where 25% of tokens are released every four months.

| ICO Project | Ticker | Total Supply | Chain | ICO Payment Methods |

| Eosi Finance | EOSIF | 80 million | Polygon | MATIC |

What is an ICO in Crypto?

ICOs are initial coin offerings. They’re similar to initial public offerings, as they enable crypto projects to raise funds from retail investors. The process is simple; ICO investments are made with popular coins like ETH or USDT. In return, ICO investors receive the project’s native tokens.

This means ICO investors are buying a brand-new token before it launches on exchanges. Put otherwise, it’s like buying into a startup before it lists on a stock exchange. Just like ICOs, this offers preferential pricing for early investors. This is because you’re backing a project before it becomes mainstream.

However, ICOs are very risky. You’re often investing before the project has a working product or service. It might never achieve its goals and objectives, which can leave ICO investors with worthless tokens. That said, due to the increased risks, ICO investors expect significant returns.

ICO Example: As per CoinCodex data, Solana held its fundraising campaign in April 2018. Early investors paid just $0.22 per SOL. Solana has since achieved an all-time high price of $260.06. This represented returns of almost 12,000%. So, for every $1,000 invested, you could have returned $120,000.

Is an ICO the Same as a Crypto Presale?

The terms ‘ICO’ and ‘presale’ are used interchangeably. They refer to the same mechanism. That is, new crypto projects sell their native tokens to raise funds. Anyone can invest in a presale/ICO.

In most cases, the project will run the fundraising campaign on its website. Investors connect a wallet, choose their payment currency (e.g. ETH or USDT), and purchase the tokens.

After the presale/ICO, the tokens will be listed on exchanges. This is usually a decentralized exchange, although some projects achieve centralized listings from the get-go.

ICOs vs IEOs

Another term you’ll likely come across is IEOs, or initial exchange offerings. IEOs are different from ICOs. This is because IEOs are held directly on crypto exchanges. This comes with several benefits. For a start, IEOs are typically pre-vetted by the exchange platform.

This gives investors confidence, as the project will have gone through a KYC (Know-Your-Customer) process. The exchange will also evaluate the project goals, token use cases, and smart contract audit. In addition, the tokens will usually be listed on the respective exchange once the IEO is over. This can offer immediate liquidity, although this depends on the exchange.

In contrast, ICOs sell their tokens directly to investors. While this means projects aren’t pre-vetted, ICO investors generally get a much better deal. I found that ICOs offer staggered pricing structures, meaning early investors secure the lowest entry price. What’s more, anyone can invest in an ICO. IEOs, however, might only be available to investors from eligible countries.

How do Crypto ICOs Work?

The best crypto ICOs are brand-new projects, so can yield significant upside. However, the investment process is different from buying tokens on an exchange.

Therefore, if you’re new to cryptocurrency ICOs, I’ll now explain how the process works. This will ensure you avoid mistakes, which can lead to a loss of funds.

Assessment Period

Once an ICO launches, new investors will initially research the project. This often means reading the whitepaper and exploring the token use cases. However, an increasing number of ICOs are launching without whitepapers or roadmap targets – especially meme coins.

This isn’t necessarily a drawback. After all, dogwifhat doesn’t have a whitepaper – and it’s since hit a $4 billion valuation. That said, investors should still research the tokenomics, such as the total token supply, whether there’s a transaction tax, and the network standard (e.g. Ethereum or Solana).

Token Creation

ICOs sell brand-new tokens before they trade on crypto exchanges. In the majority of cases, the tokens will be created before the ICO launches. This enables investors to evaluate the smart contract and ensure it’s been audited. Otherwise, there is a risk that the smart contract can be changed, resulting in a rug pull. More on this later.

The created tokens will operate on a legacy blockchain network. This makes it easy for investors to buy the token. For instance, Slothana is built on the Solana blockchain, which is popular with new meme coin projects. This means investors can buy Slothana with SOL. .

Soft and Hard Caps

Most ICOs come with a soft cap target. This is the minimum amount the project needs to raise during the cryptocurrency ICO. If the soft cap isn’t reached, then investors will receive their funds back.

The hard cap is the maximum amount the project wants to raise. Once reached, the ICO will usually end. However, some projects continue raising funds even though the hard cap has been achieved.

Setting up an ICO Order

ICOs usually run on the project’s website. Investors are required to connect a wallet, such as Phantom or MetaMask. They can choose their preferred payment currency (e.g. ETH) and type in the number of tokens they want to buy.

After confirming the order, the payment currency will be deducted from the wallet. The ICO tokens will then be deposited into the same wallet. This sometimes happens after the ICO has finished.

Exchange Listing

The final stage of the ICO process is exchange listings. This means the ICO tokens will be listed on public exchanges, allowing anyone to buy or sell them. Most projects will opt for a decentralized exchange (DEX) to begin with. No application is required; anyone can list tokens on DEXs like Jupiter and Uniswap.

The project will choose the initial listing price and add liquidity. This ensures new investors can trade the tokens in smooth market conditions. Once trading begins, ICO investors will hope the token price increases. This will happen if the token attracts more buyers than sellers. However, the opposite can also happen, meaning the token price declines.

Why Invest in Initial Coin Offerings?

I’ll now reveal the core benefits of investing in new ICO crypto projects. After that, I’ll move on to the risks.

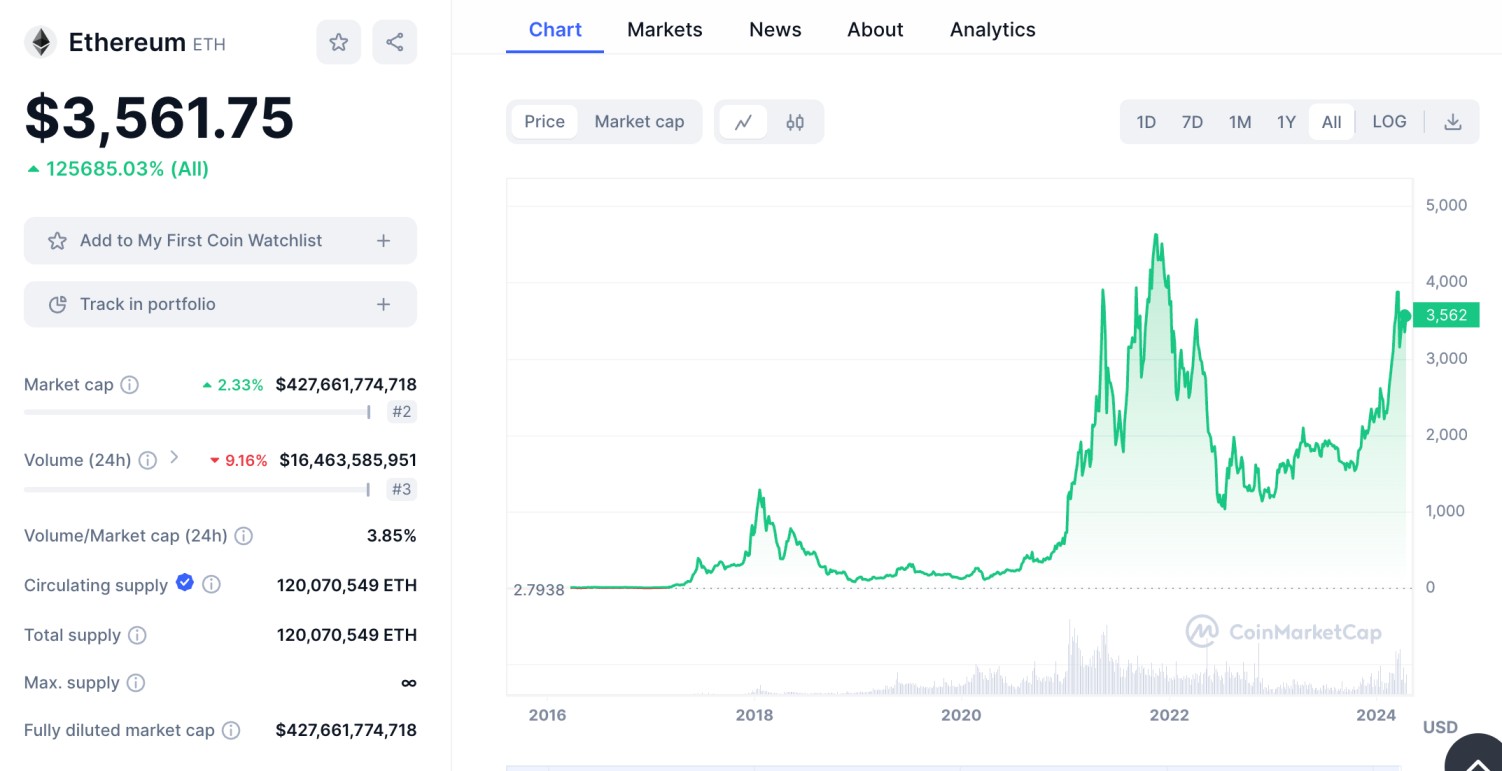

Long-Term Profit Potential

Investing in the right ICO can yield significant long-term profits. This is because you’re investing in a new project from the ground up. While investments can take several years to truly blossom, ICO returns can be substantial. Crucially, you’re taking on increased risks by investing in an unproven concept, so high returns should be expected.

Let’s consider some real-world examples. I mentioned earlier that Solana raised funds at $0.22 per SOL in 2018. In 2024, SOL hit all-time highs, increasing by almost 12,000% from its initial funding price. What’s more, many investors believe Solana is still worth a fraction of its true potential. So sizable gains are also possible during the next bull cycle.

Similarly, Ethereum has also rewarded early backers. As per CoinCodex data, Ethereum’s ICO was priced at $0.31 per ETH. In 2021, ETH hit all-time highs of almost $5,000. This represents ICO gains of over 1.6 million percent. Just like Solana, Ethereum has a long way to go before reaching its true potential.

A more recent success story is Avalanche. CoinCodex data shows that the Avalanche ICO sold AVAX for just $0.50. AVAX hit an all-time high of $146.22 in late 2021. This represents gains of over 29,000% for ICO investors. That’s $290,000 for every $1,000 invested.

An Opportunity to Make Rapid Short-Term Gains

The most substantial ICO returns are made when investing long-term. This is evident with projects like Solana, Ethereum, and Avalanche. However, ICOs are also ideal for making short-term gains. This is because ICO projects typically have a small market capitalization.

So, when the tokens list on exchanges, they can increase at a much faster pace than large-cap projects. What’s more, there’s often FOMO (fear of missing out) when an ICO sells its full allocation. This means investors will often buy the tokens once they trade on public exchanges.

A recent example is BOOK OF MEME. According to CoinCodex data, BOOK OF MEME was listed at $ 0.00005880 on March 14th, 2024. Just two days later, BOOK OF MEME hit an all-time high of $0.02805. This early means investors made over 47,000%.

Secure an ICO Discount

Another benefit of investing in ICOs is that many campaigns offer discounted pricing. This means investors can secure an upside before the tokens list on exchanges. For example, the 5th Scape ICO offered a stage one price of $0.00187. Once 5th Scape is listed on exchanges, it will be priced at $0.01.

This means investing in stage one secured an immediate upside of over 400%. While the 5th Scape ICO is now in stage four, discounted prices are still being offered. At $0.00285, that’s an upside of 250%. However, do remember that tokens can decline once traded on exchanges. This means ICO upsides aren’t guaranteed.

Fun Fact: The biggest ICO of all time is EOS. The EOS ICO, which concluded in 2018, raised more than $4 billion. Today, EOS is worth just over $1 billion – highlighting that many ICOs fail to live up to expectations.

What are the Risks of Initial Coin Offerings?

Even the best ICOs are inherently risky.

Consider the following risks before investing in an initial coin offering:

- Scams: Some ICOs are scams, meaning the sole aim is to defraud investors. The project might have no intentions of achieving success. Rather, the ICO will collect funds from investors before disappearing. Therefore, research is crucial when investing in ICOs.

- Contract Amendments: Another risk is that ICO projects could amend the smart contract. For instance, they might restrict sell transactions. This means people can buy the tokens but not cash out. To avoid this risk, make sure the smart contract has been audited and renounced. This means the contract can’t be changed.

- Price Depreciation: ICO token prices will rise and fall once listed on exchanges. This can’t be controlled by the ICO project, as crypto prices are determined by market forces. If the price declines below what you paid during the ICO, you’ll be running at a loss. The best defense here is to ensure you’re well-diversified.

- Wallet Hacks: ICO tokens are deposited into the investor’s wallet. This also presents a risk, as wallet hacks are increasingly becoming popular. If the wallet is hacked remotely, the ICO tokens will be stolen. This is also the case for any other tokens stored in the wallet. Ensure you’re using a reputable wallet with suitable security controls.

How to Find the Best Crypto ICOs

I’ve explored the benefits and risks of new ICOs. Next, I’ll explain how to find upcoming ICOs with the most potential. After all, there isn’t a centralized database with ICO listings, so you’ll need to put in some legwork.

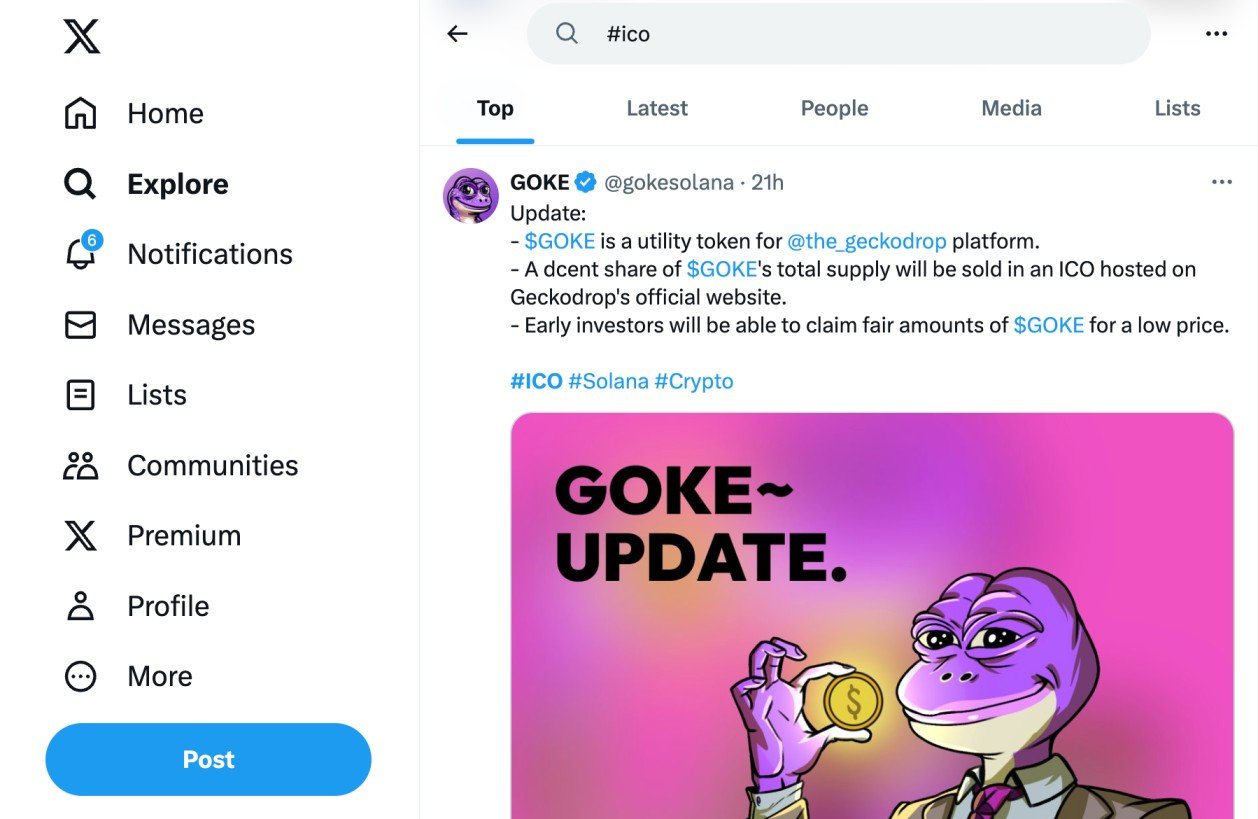

X (Formally Twitter)

I’d suggest starting with X when searching for the best ICOs. This is the de-facto social media platform for crypto projects. Growing a strong following on X is crucial to building a strong community, which is why it’s often the first port of call for ICOs.

First, search for #ICO and focus on the most recent posts. You might find an ICO gem straightaway. Similarly, it’s worth searching for #presale too. In addition, there are also pages on X dedicated exclusively to upcoming ICO campaigns. ICO Announcement is a good example, which has over 477,000 followers.

ICO Aggregation Websites

Next, check out some of the leading ICO aggregation websites. These platforms offer an initial coin offering list in real-time, so you can find suitable projects at the earliest stage possible.

The two market leaders in this space are ICOBench and ICO Drops. Their crypto ICO list will state the start and end dates, current fundraising amount, pricing, and links to the respective website.

Telegram Groups

I’d also suggest finding some top-rated Telegram groups that specialize in crypto investments. More specifically, make sure the group is focused on finding small-cap gems, which should include ICOs.

Prioritize groups with the largest number of members, as these are likely to be active.

The best crypto ICOs are often advertised or discussed on Reddit. The best group is r/CryptocurrencyICO, which has over 187,000 members.

Just be careful when engaging on Reddit, there are many scammers. Never click links from Reddit and avoid responding to private messages.

How to Invest in an ICO

Once you’ve discovered the top ICOs for 2024, you’ll need to complete an investment.

The step-by-step process is summarized below:

- Step 1: Get Some Crypto: You’ll need some crypto before you can invest in an ICO. Visit the ICO website and check what coins are accepted. If it’s an Ethereum-based ICO, you can typically use ETH and USDT. If it’s Solana-based, then you’ll likely need SOL. The best altcoins can be purchased at reputable exchanges like eToro, Coinbase, and Kraken.

- Step 2: Transfer Crypto to a Wallet: Once you’ve bought crypto from an exchange, transfer the coins to a suitable wallet. A good option for Ethereum-based ICOs is MetaMask. Phantom is a good option for Solana-based ICOs.

- Step 3: Connect Wallet to ICO Website: You should now have a funded wallet. Next, connect the wallet to the ICO website. You’ll need to confirm authorization from within the wallet.

- Step 4: Set up ICO Order: After connecting the wallet, fill out the ICO order form. You’ll need to select the purchase currency (e.g. ETH or SOL) and type in the investment size.

- Step 5: Complete ICO Investment: Check everything is correct and confirm the ICO investment. Finally, open your wallet and provide authorization for the transaction.

Once authorization is provided, a smart contract will complete the investment. This means the original coins are deducted from your wallet. Then, the ICO tokens are deposited into the same wallet.

Conclusion

ICOs are inherently risky. But by conducting adequate research and ensuring you’re well diversified, ICOs can generate significant profit potential. In my view, Dogeverse is the best crypto ICO for 2024.

This is the first multi-chain meme coin to launch, with compatibility including Ethereum, BNB Chain, Solana, Base, Avalanche, and Polygon. Over $1.4 million has already been raised and there’s an attractive discount for current-round investors.

FAQs

What is an ICO in cryptocurrency?

ICOs are initial coin offerings, which allow investors to buy a brand-new crypto token before the broader market. The tokens will be listed on exchanges after the ICO, often at a higher price.

Are crypto ICOs legal?

ICOs are legal in most countries, but there are some exceptions. Some countries require ICOs to be registered as securities, while others ban them outright. Check the laws in your home country before investing in ICOs.

Are ICOs safe to invest in?

The investment process itself is safe, but not all ICOs are credible projects. Ensure you’re well diversified, conduct plenty of research, and never invest more than you can afford to lose.

What are the best ICOs to invest in right now?

Some of the best ICO cryptos are Dogeverse, Slothana, 99Bitcoins, and 5th Scape. This covers a blend of niches, including meme coins, VR gaming, and sustainable transportation.

Are ICOs a good investment?

Picking the right ICO can yield significant gains, especially if the project becomes mainstream. However, most ICOs fail, meaning you could lose money.

References

- Crypto gets crazy again with dog-inspired tokens and Bitcoin eyeing $45,000 (Bloomberg)

- Consumer warning about the risks of Initial Coin Offerings (‘ICOs’) (FCA)

- How to avoid getting duped by a bogus initial coin offering (CNBC)

- A blockchain start-up just raised $4 billion without a live product (CNBC)

- Risks of cryptocurrencies, initial coin offerings and other digital tokens (MoneySense.gov)