Bitcoin Loan Sites

By: Alexander Reed | Last updated: 3/12/24

Bitcoin loans allow customers to borrow money by placing their Bitcoin as collateral or investing their Bitcoin for interest. This post covers the leading Bitcoin loan sites around.

Bitcoin Loan Sites Summary

Bitcoin loans are loans given to individuals or businesses in exchange for Bitcoin (or other cryptocurrencies) as collateral. Loans vary from one another in their length, the annual interest, their repayment schedule, and their loan-to-value ratio.

That’s Bitcoin loans in a nutshell. For a more detailed explanation of Bitcoin loans and different loan sites, keep reading. Here’s what I’ll cover:

1. What is Bitcoin Lending?

Bitcoin lending is the process of taking out a loan in fiat (USD, EUR, GBP, AUD, etc.) while putting your Bitcoin as collateral against the loan.

Many people want to keep their cryptocurrencies as a long-term investment (also known as hodling). However, they still require cash for rent, starting a business, a vacation, or a variety of other reasons.

Bitcoin or cryptocurrency lending allows them to receive a loan in fiat by placing their cryptocurrency as collateral. This way, you can get instant cash, and when you get enough money to repay the loan, you can get your collateral back.

Another reason to take a loan instead of selling your Bitcoins could be to avoid a tax event that will require you to pay for the profits gained by the purchase.

Due to the fact that your cryptocurrency is placed as collateral, most crypto-backed loans don’t require any credit checks and can be executed instantly.

Lending Bitcoin for Interest

Most companies that supply Bitcoin loans also allow customers to lend out their Bitcoin for interest. If, for example, you don’t need cash, you can still deposit your Bitcoin and receive an annual interest on your deposit.

This means your Bitcoin can generate additional income for you instead of just lying around in your Bitcoin wallet.

Calculating a Bitcoin-backed loan

When you take out a crypto-backed loan, you’re placing your cryptocurrency as collateral. Since cryptocurrencies tend to be extremely volatile, the loaning company needs to make sure your collateral value can always cover the loan in case you can’t repay it back in fiat.

One of the ways a company can make sure your collateral will be able to cover the loan is by calculating the loan-to-value (LTV) ratio of the loan.

LTV Ratio

A loan’s LTV ratio determines the amount of crypto collateral you need to post in order to take out or maintain a loan. It is calculated by dividing the amount loaned by the amount put as collateral.

For example, a $10,000 loan with collateral of 2 BTC, each worth $10,000, has an LTV of 10,000/2*10,000 = 0.5 or 50%.

Here’s another example – A $10,000 loan with collateral of 5 BTC, each worth $10,000, will have an LTV of 10,000/5*10,000 = 0.2 or 20%.

Keep in mind that when cryptocurrencies fluctuate in price, the LTV changes as well. For example, if Bitcoin suddenly drops to $5,000, the LTV of our latter example would be 10,000/5*5000 = 0.4 or 40%.

A lower LTV means that your collateral can easily cover the loan if needed, while a high LTV puts the lending company at risk, as you may not be able to repay your loan.

Margin Calls

If your LTV becomes too high, a margin call may occur by the lending company. A margin call means that you, the borrower, would need to take steps to lower your LTV. This can be done by either depositing more cryptocurrency as collateral or by paying back some of the loan in fiat.

In case you can’t do either of the above, the lending company may sell some of your collateral in order to lower the LTV into the safe zone.

Origination Fee

Many companies take an origination fee for setting up the loan. For example, a company that charges a 2% origination fee for a $10,000 loan will take $200 as payment for the service.

Loan APR

APR stands for annual percentage rate. The APR is the overall annual interest you would require to pay for your loan, all fees included (interest + origination fee). The APR is calculated by dividing how much you pay at the end of 12 months with the original loan amount.

For example, if you took a loan for $10,000 with an origination fee of 1% and an interest rate of 5%, the APR would be 6% (5+1), and at the end of 12 months, you’ll need to pay $10,600.

Important: Some companies calculate interest rates on a compounding basis, making the APR a bit harder to calculate.

Most companies will supply you with a loan calculator or some kind of estimate of your APR. Before taking out a loan, make sure you understand exactly how much you’ll need to repay.

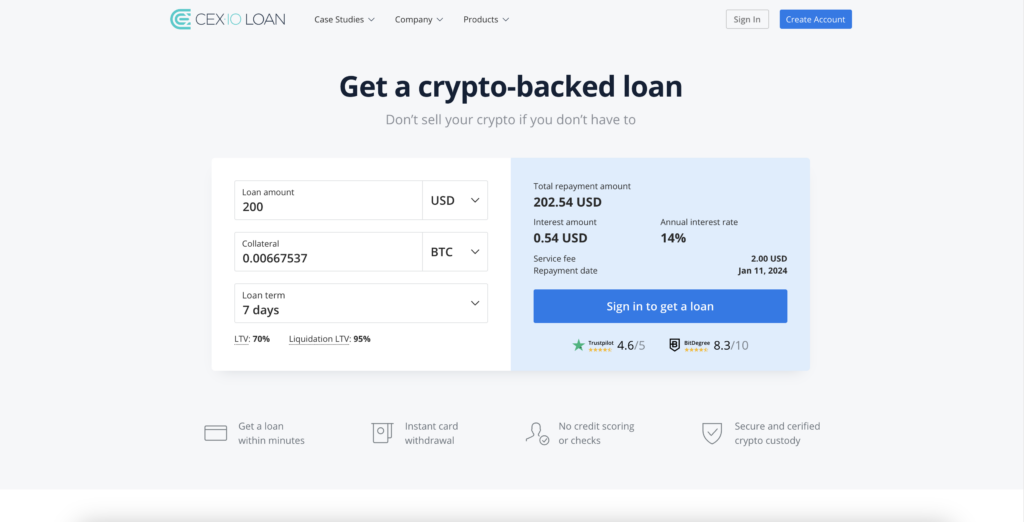

2. CEX.IO

CEX.IO started in 2013 and is one of the oldest Bitcoin exchanges around. The company offers several services, including a trading platform and brokerage service for Bitcoin, Ethereum, and a range of other cryptocurrencies.

CEX.IO also offers crypto-backed loans with an LTV of 70%. The cryptocurrencies currently accepted as collateral are Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Chainlink (LINK), XRP (XRP), and Stellar (XLM).

There are four options for term length: 7 days, 1 month, 3 months, and 1 year. For a 7-day loan, the interest rate is 14%. For 1 month, it’s 12.6%. For 3 months, it’s 11.2%. And for 1 year, it’s 9.8%. All loans have an additional 10 USD service fee.

Users can get a loan within minutes, and there are no credit checks or scoring. Loans are available in most countries except the USA, UK, Germany, Netherlands, Singapore, American Samoa, United States Minor Outlying Islands, Japan, and the sanctioned countries that are listed in the CEX.IO terms.

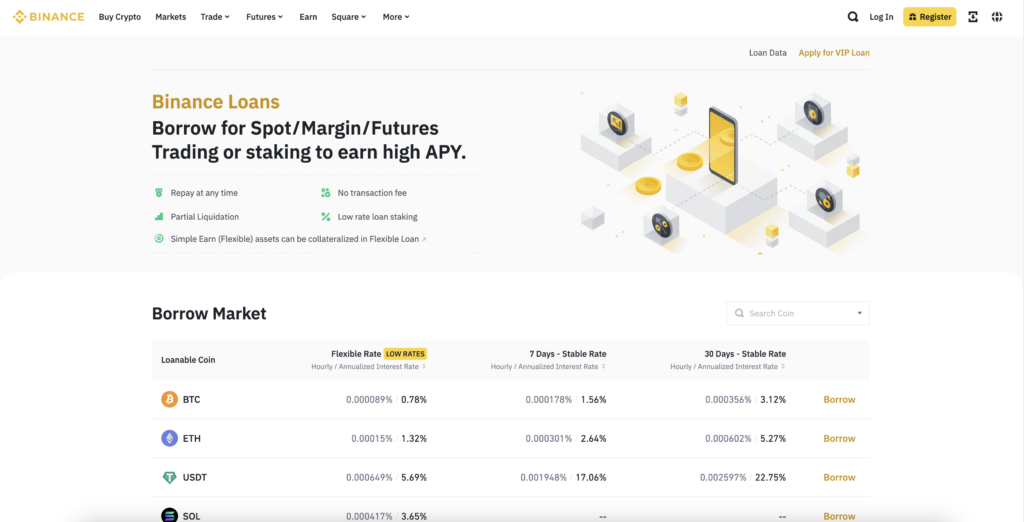

3. Binance

Binance is a cryptocurrency exchange that was founded in July 2017 by Chinese-Canadian developer Changpeng Zhao (aka CZ). It has grown to become the most popular and largest-by-volume crypto exchange in the world.

In addition to the exchange’s trading platform, Binance also offers a service called Binance Loans. Users can put up a number of different cryptocurrencies as collateral to borrow other cryptocurrencies. However, Binance does not offer crypto-to-fiat loans, only crypto-to-crypto loans. But you can borrow a stablecoin like Tether (USDT) and then withdraw that on your own for fiat currency.

Since there are hundreds of pairs, the interest rates vary wildly depending on which coin you’re looking to borrow and which one you’re using as collateral.

The LTV for these crypto-backed loans is 70%. There are no transaction fees, and users can repay the loan at any time.

4. Unchained Capital

Note: As of January 1, 2024, Unchained will no longer originate consumer loans and will only originate loans to entities (such as LLCs and corporations) with stated business/investment purposes.

Unchained Capital was founded in 2017 by Joe Kelly and Dhruv Bansal in Austin, Texas. The company offers several services, including personal and business vaults to store Bitcoin holdings offline in a multisig address, crypto-backed loans, inheritance plans, trading, and Bitcoin IRAs.

When requesting a crypto-backed loan from Unchained Capital, your collateral will be held in a multisig address that is controlled by you, Unchained Capital, and a 3rd party key agent. Any 2 out of 3 signatures can release the funds needed.

This multisig model is much better than the usual model, where you grant total control over your funds to the lending company for several reasons:

- You can always see the status of the collateral and make sure it’s not used for additional purposes.

- If Unchained Capital goes out of business, you can still withdraw the funds using the key agent.

- The additional 3rd key acts as a backup in case you lose your own private key.

Unchained Capital accepts only Bitcoin as collateral. The minimum loan is $10,000, and the maximum term length is 360 days. The interest rate is either 14% or 15%, with either a 1.25% or 1.50% origination fee, depending on term length – 180 days or 360 days.

Unchained Capital is available in most US states except for Idaho, Massachusetts, Nevada, New Mexico, New York, North Dakota, South Dakota, and Vermont.

5. Nexo

Nexo allows its customers to receive crypto-backed loans in exchange for collateral in any of the over 60 cryptocurrencies they support. Nexo can supply loans in 30+ fiat currencies in numerous jurisdictions worldwide. It is not available in the USA, Canada, Estonia, or Bulgaria.

Nexo loans have an LTV value of 50% for Bitcoin and Ethereum-backed loans, 30% for XRP-backed loans, and 15% for NEXO Token-backed loans.

The loan interest rate depends on your Loyalty Tier, which is determined by the ratio of NEXO Tokens against the rest of your portfolio balance:

- Base (No NEXO Tokens are needed) – 15.9%

- Silver (The ratio of NEXO Tokens in your account against the rest of your portfolio must be at least 1%) – 14.9%

- Gold (The ratio of NEXO Tokens in your account against the rest of your portfolio must be at least 5%) – 10.9%

- Platinum (The ratio of NEXO Tokens in your account against the rest of your portfolio must be at least 10%) – 7.9%

NEXO Tokens were issued in Nexo’s ICO back in 2017 and can be purchased on several exchanges, such as Binance, Bybit, and several others. Nexo’s team is the same team behind Credissimo, a public European company supplying instant online consumer loans, e-commerce financing, and bill payment services.

Nexo has an “Excellent” Trustpilot score from its users, which is quite rare in the cryptocurrency market.

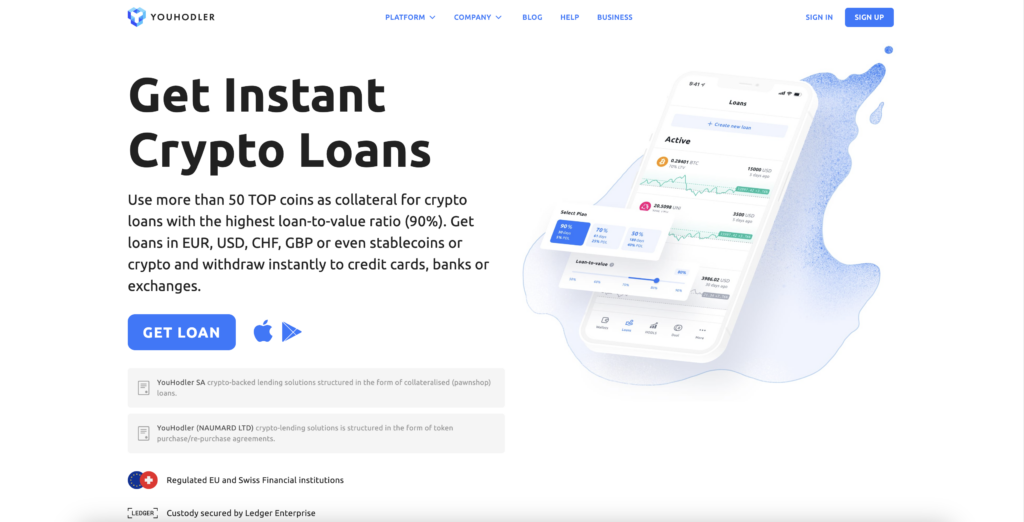

6. YouHodler

YouHodler is a European-based lending platform with two main offices: Cyprus and Switzerland. The company is regulated in the EU (Italy) and in Switzerland. It allows users to borrow USD, EUR, GBP, CHF, stablecoins, or other popular cryptocurrencies.

YouHodler currently accepts more than 50 different cryptocurrencies as loan collateral. The platform offers one of the highest loan-to-value (LTV) ratios of any cryptocurrency lending platform, with a maximum LTV of 90%. It also allows one of the smallest minimum loan sizes at just 100 USD. There is no cap as far as maximum loan.

Borrowers can select a loan term up to a maximum of 364 days. YouHodler also provides cryptocurrency lenders with up to 15% APR for crypto and stablecoins with their YouHodler Loyalty Program. Currently, more than 55 coins are accepted.

Aside from the usual lending and saving features, YouHodler also offers a duo of trading-like services called MultiHODL and Turbocharge. In a nutshell, these services allow users to speculate on the price of an asset on margin, using loans as leverage.

YouHodler doesn’t have a huge online presence. However, they are rated rated “Excellent” on Trustpilot.

7. Conclusion

Bitcoin lending is a new form of “modern banking,” allowing businesses and individuals to get instant loans by putting their crypto up as collateral.

Since not all lending sites are alike, I highly advise to take a deep look into the following aspects before choosing a lending site:

- Are loans collateral-backed? This is crucial if you’re an investor.

- Loan terms (APV, LTV, payment schedule)

- Collateral holding (multisig vs. custodial vs. in the company’s wallet)

- Does the company use user funds for additional investments?

Have you had any experience with Bitcoin or other cryptocurrency loans? I’d love to hear about it in the comment section below.

Interesting, thanks. I wonder about in the future when BTC is worth a lot more and getting longer term loans for higher value items such as to buy a house, and having more realistic interest rates for such a high value asset, where the collateral can be spread between the BTC and the house itself. I guess banks will need to be involved before this sort of thing can happen.

Why there is no information about coinrabbit.io ? Used this service through the whole last year – great experience. They also had reopen my loans after liquidation. Just amazin

I have 2 Blockfi loans. I paid one off completely and my collateral was redeposited into my account within 24 hours. I have had great customer service and no issues!

How

Thanks for all the information here.