Are you looking to build a portfolio of staking coins for passive rewards? The best crypto staking coins offer two key characteristics; attractive APYs and the potential for price appreciation.

Read on to discover 11 staking coins for your long-term crypto portfolio. I cover a blend of small and large-cap staking projects from multiple niches.

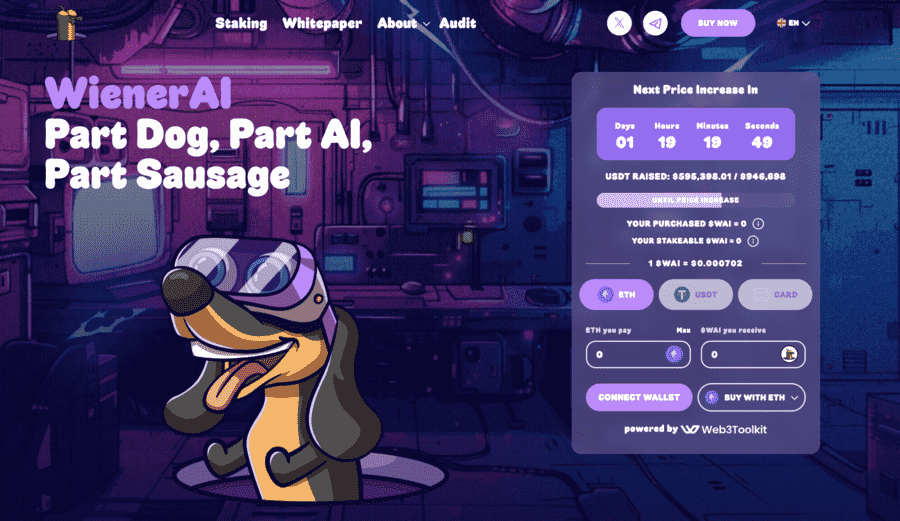

- New multichain meme token with over $13 million raised in its presale - ends soon.

- As a PoS token users can stake their holdings and earn passive rewards - currently over 80% APY.

- Wormhole and Portal Bridge technology gives holders access to other blockchains for cheaper fees and faster transactions.

ETH

ETH USDT

USDT BNB

BNB- +1 more

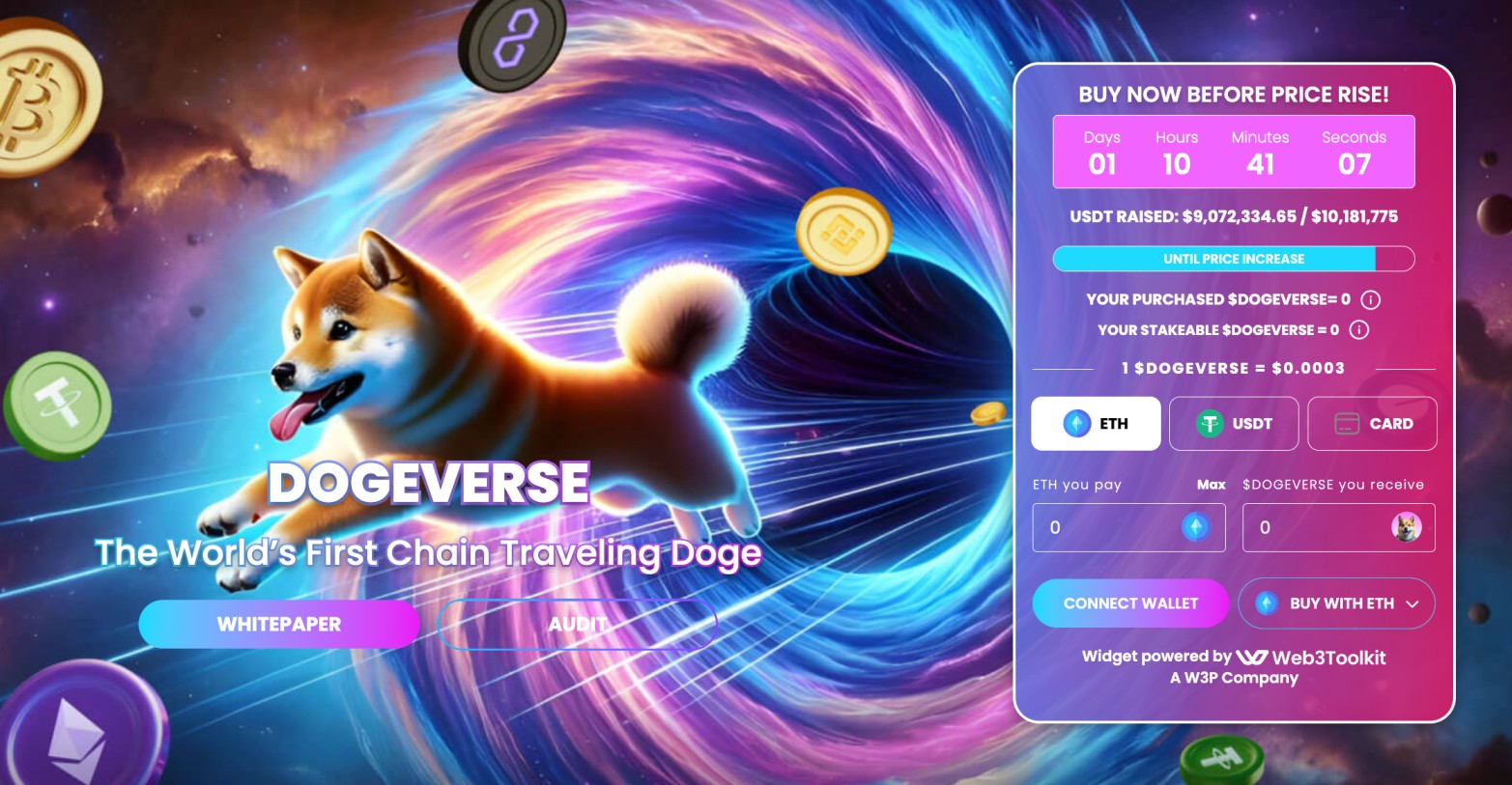

- Brand-new meme ERC20 token integrating two hot niches AI and crypto meme culture

- Degens can buy and stake $WAI to earn passive rewards in excess of 1,000% p/a

- WienerAI's presale is currently trending having raised over $700k

ETH

ETH USDT

USDT Bank Card

Bank Card- +1 more

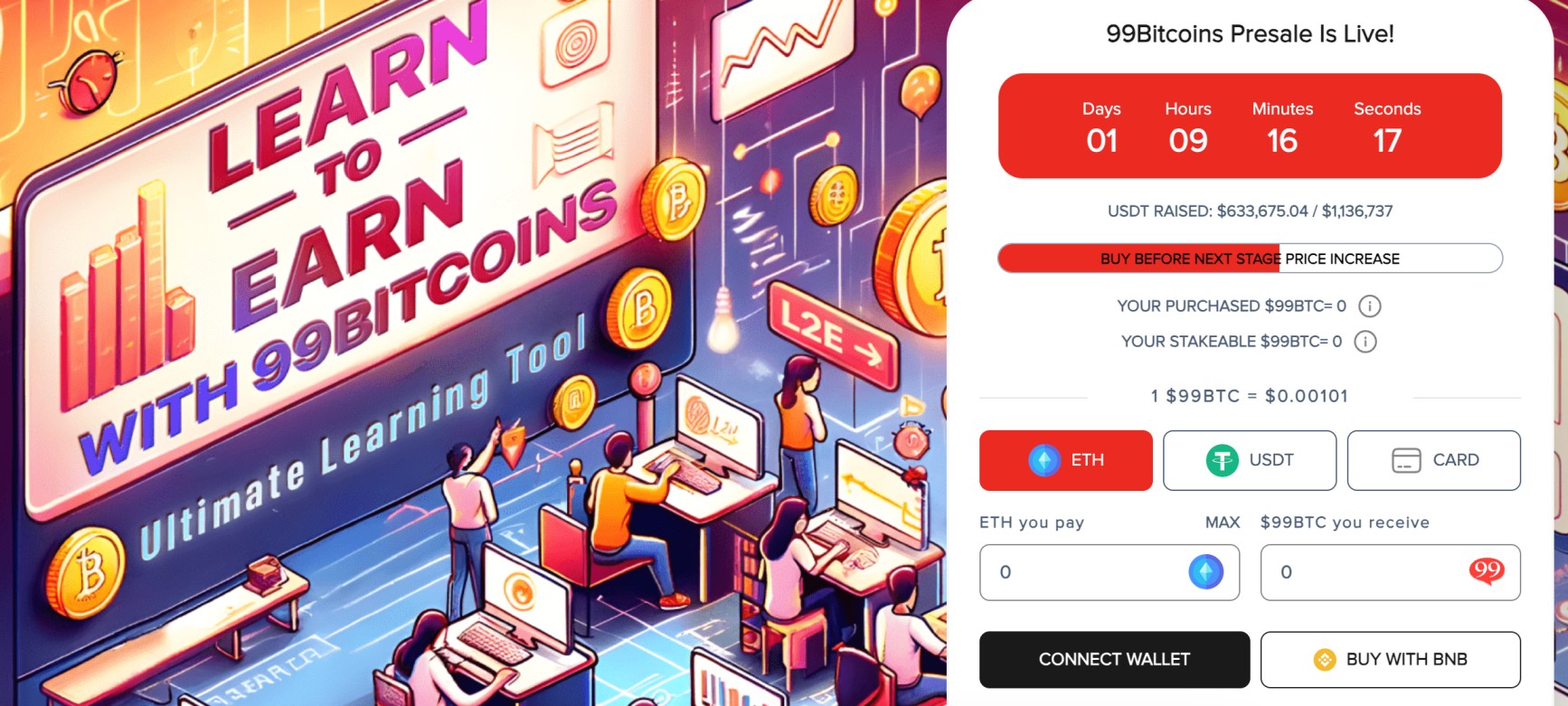

- Exciting new Learn-to-Earn ecosystem expected to 100x ahead of Bitcoin halving event.

- Token holders gain exclusive access to trading webinars, courses and more.

- Buy and stake $99BTC tokens to earn passive rewards.

BNB

BNB ETH

ETH Bank Card

Bank Card- +1 more

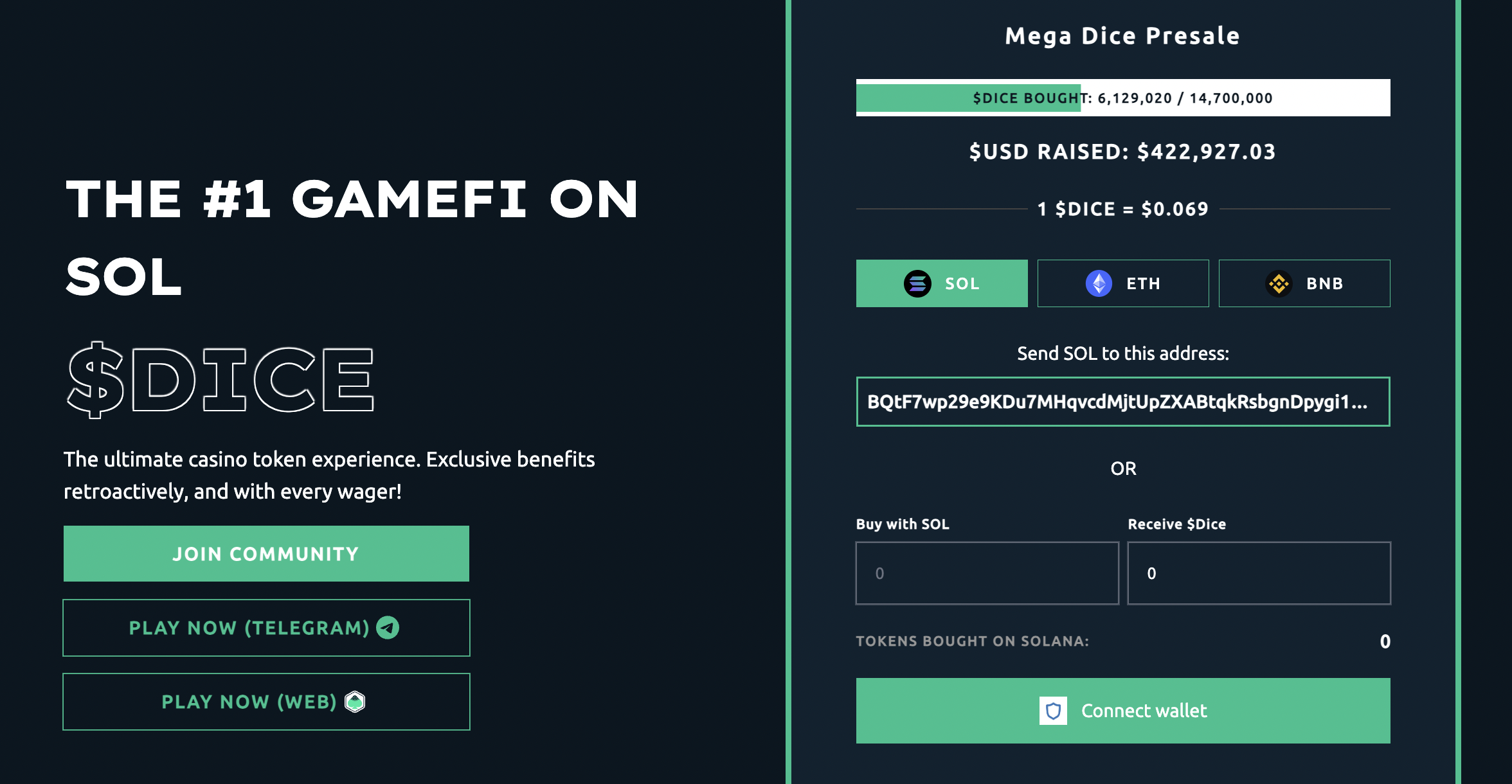

- The world's top GameFi token hosted on the Solana blochain

- Coming from an established crypto casino with over 50k players, $DICE offers new utility to this popular casino

- $2.25M available via airdrops for casino players

SOL

SOL ETH

ETH BNB

BNB

The 11 Best Staking Coins to Invest in

Listed below are the 11 best crypto staking coins to buy right now:

- Dogeverse – The overall best coin to buy and stake, a new presale project with over $9 million raised

- WienerAI – Hot new AI meme token with high staking APY that raised nearly $600K in a week

- Mega Dice Token – Innovative casino token with daily rewards, earn a share of net gambling revenues

- 99Bitcoins Token – Learn-to-earn education platform with tokenized rewards, APYs of 3028%

- Solana – Earn competitive staking rewards on the leading Ethereum Killer, trading 42% below ATHs

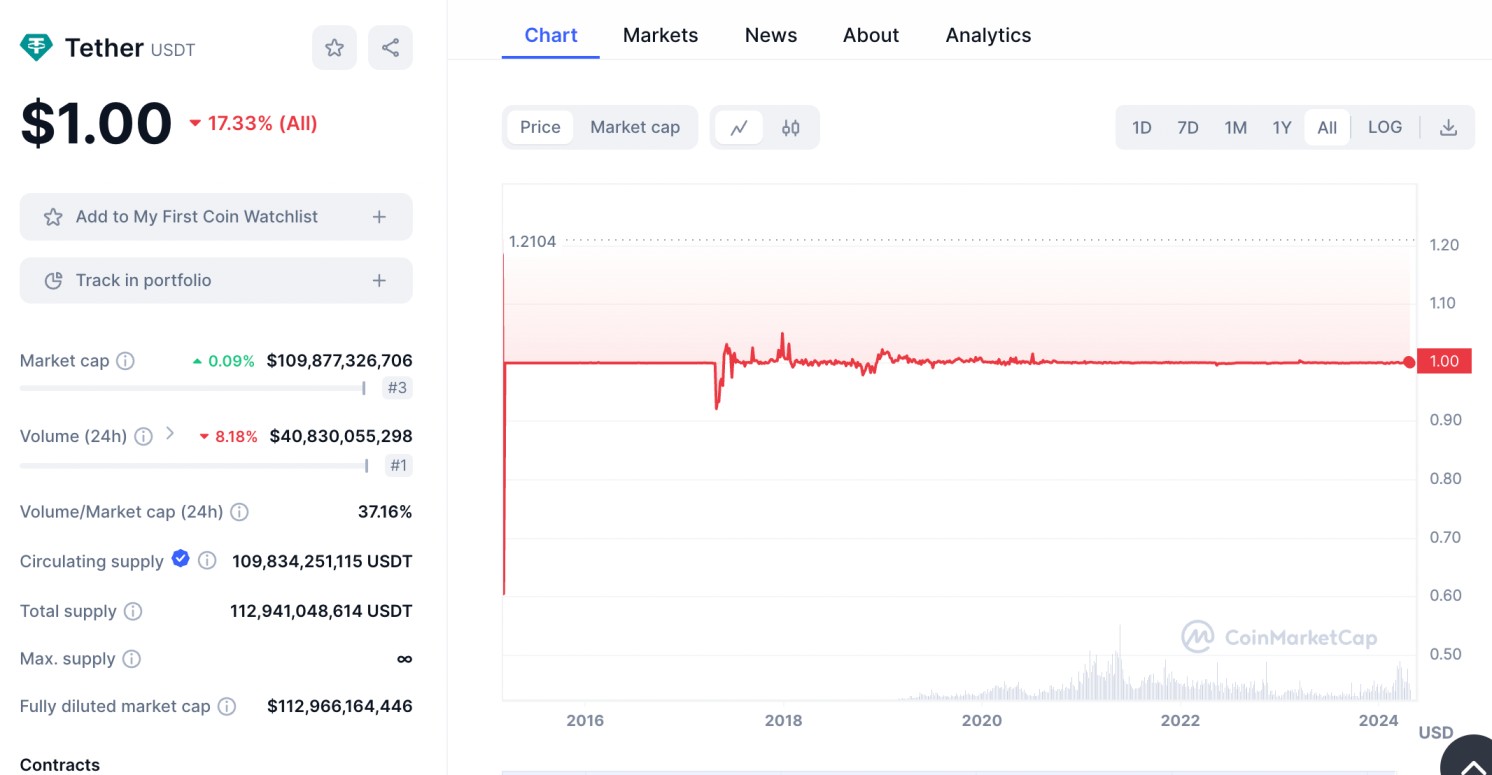

- Tether – The best option for staking crypto without volatility, earn APYs of over 8% on select platforms

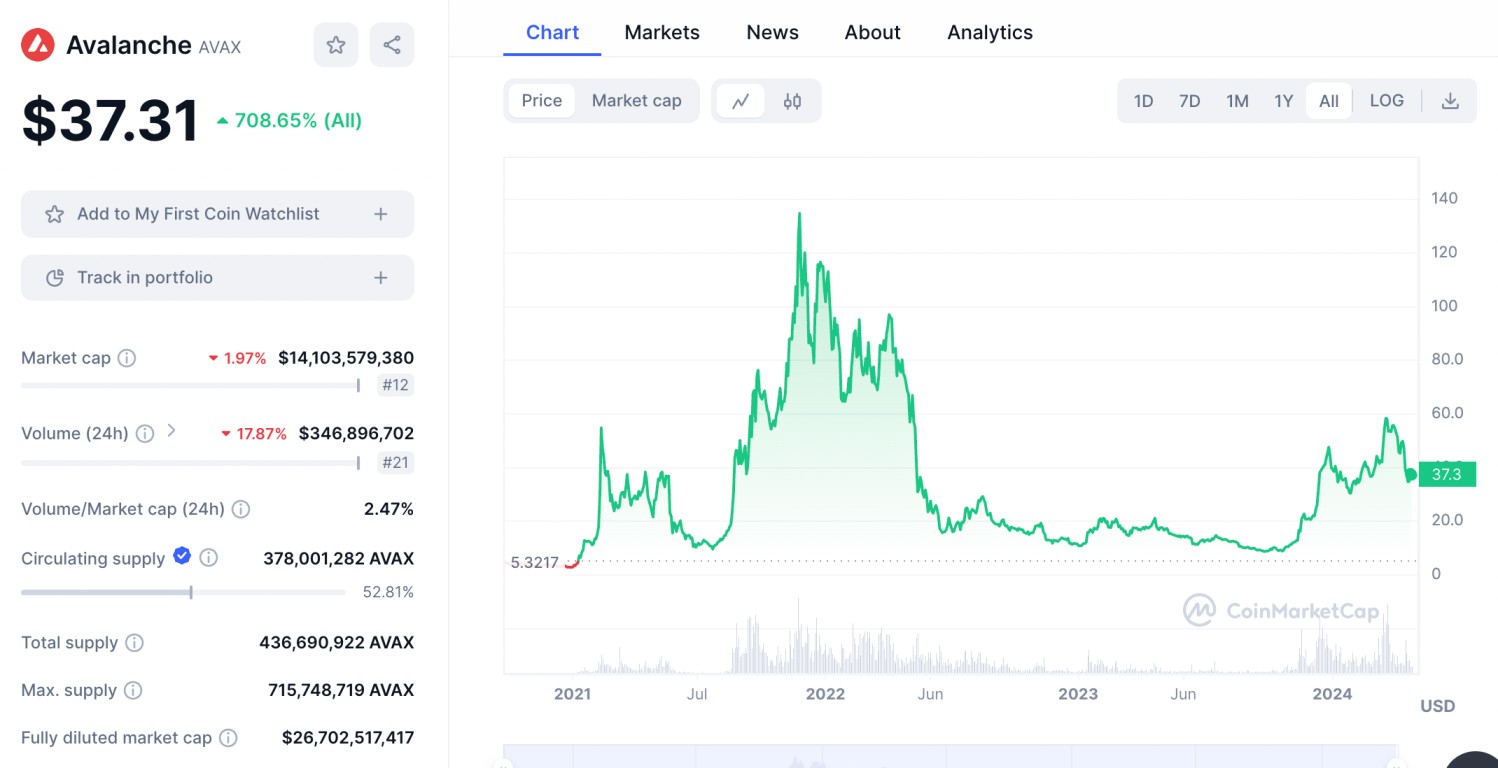

- Avalanche – Become a blockchain validator and earn annual staking rewards of 7.6%

- Polkadot – Invest in the future of blockchain interoperability, minimum staking requirements of 250 DOT

- Toncoin – Trending layer 1 blockchain with exclusive access to over 900 million users

- Sei – Proprietary network protocol with high speeds and scalability of 12,500 transactions per second

- Chainlink – Earn staking APYs of 4.32% with the world’s leading Oracles network, available at a 71% discount

Analysis of the Top Cryptos to Stake

I’ll now review the 11 top staking coins for 2024. Read on to explore APYs, price potential, market capitalization, and other important factors. This will help you choose the best coins for your staking portfolio.

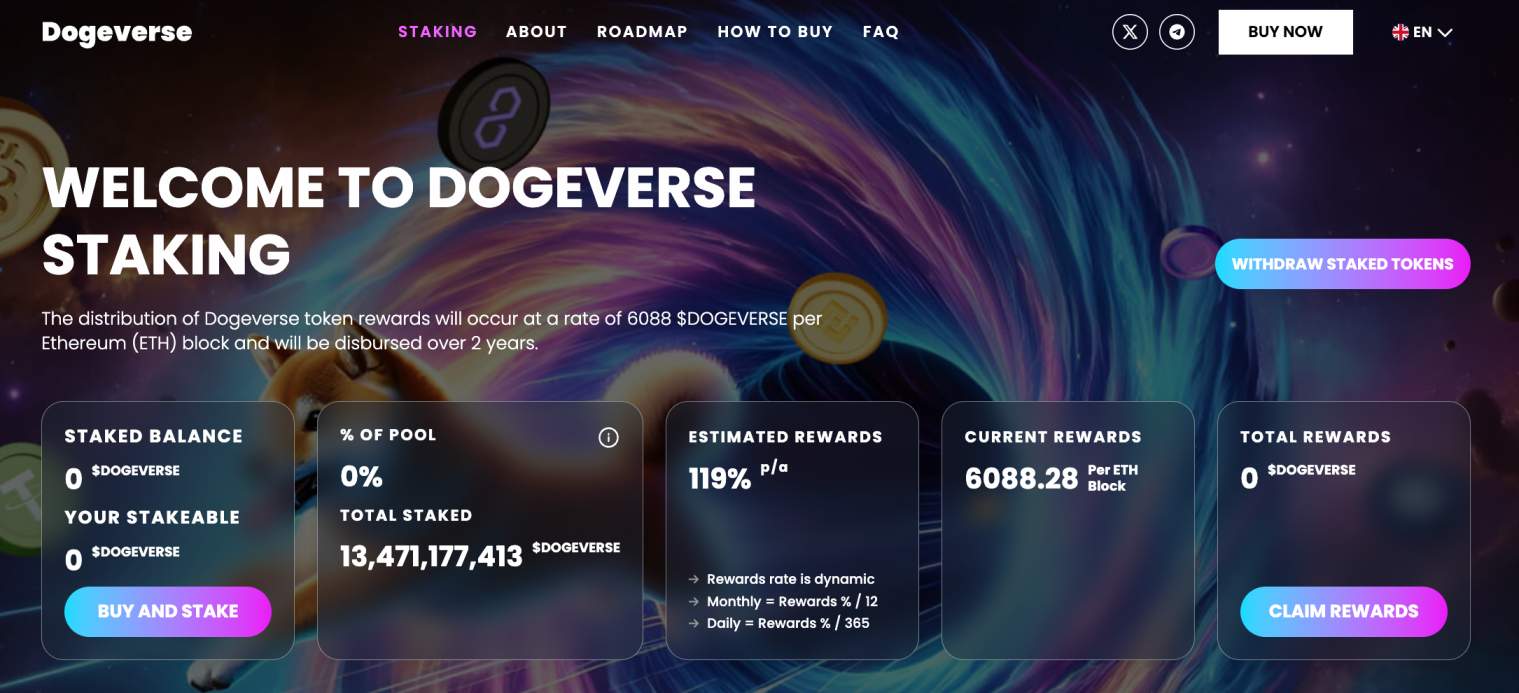

1. Dogeverse – The Overall Best Staking Cryptocurrency to Buy in Presale, Over $9 Million Raised

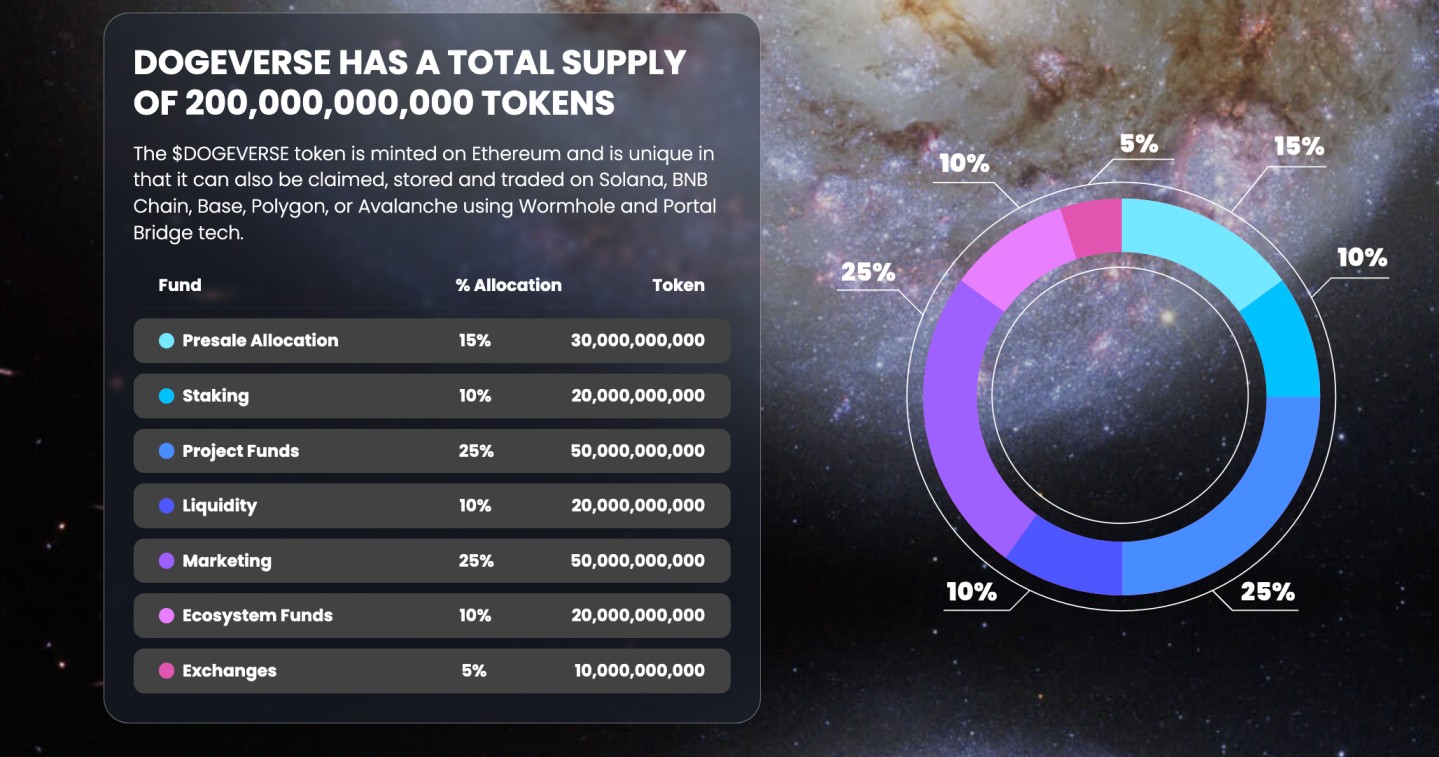

In my view, Dogeverse is the overall best option. Considered one of the best meme coins to buy, Dogeverse is a presale project. This means you can buy DOGEVERSE tokens at a discounted entry price. So far, the Dogeverse presale has raised more than $9 million. Presale investors are intrigued by Dogeverse’s multi-chain status.

It’s compatible with six leading networks, meaning exposure to the world’s most popular blockchain ecosystems. This includes Ethereum, Base, BNB Chain, Solana, Avalanche, and Polygon. Speculative traders can access DOGEVERSE tokens with their preferred coin. For instance, the presale accepts ETH, USDT, BNB, AVAX, and MATIC.

After the presale, Dogeverse will be listed on decentralized exchanges. The total supply of tokens is 200 billion DOGEVERSE. 10% of the supply has been allocated to staking rewards. The staking APY is currently 119%. This means Dogeverse offers the ideal balance between price appreciation and passive income.

Interested in learning more about this leading PoS token? Interested meme degens can follow the project on X and join the Telegram channel.

| Staking Project | Staking Chain | Current Staking APY |

| Dogeverse | Ethereum | 119% |

2. WienerAI – Hot New AI Meme Token With High Staking APY That Raised Nearly $600K In A Week

Next on our list of the best crypto staking coins is WienerAI ($WAI). It is a hot new meme token that’s quickly gaining massive popularity among investors due to its high staking rewards.

At the time of writing, it offers early buyers a massive staking APY of over 1,400%. But this rate will decrease as more people enter the staking pool.

It is also worth noting that over 730 million $WAI tokens have been staked on the platform, showing strong community support.

Early buyers can get the $WAI tokens for only $0.000702 in the ongoing presale phase. This price offers an exciting opportunity to buy these tokens before they hit the market.

What makes the token special is that it combines the idea of AI with the fun theme of dogs. It is attracting many new investors because of its potential and new approach. The platform aims to change the meme coin space with its ability to upgrade and evolve over time.

Please note that the current $WAI price will surge in the upcoming presale rounds. You can buy WienerAI tokens during the presale using ETH, USDT, BNB, or a credit/debit card.

Interested buyers can enter WienerAI’s Telegram group and follow it on X (Twitter) for the latest updates.

| ICO Project | Ticker | Total Supply | Chain | ICO Payment Methods |

| WienerAI | WAI | 69 Billion | Ethereum | ETH, USDT, BNB, Card |

3. Mega Dice Token – Innovative Casino Token With Daily Rewards, Earn a Share of Net Gambling Revenues

Mega Dice Token is also one of the best crypto staking coins to buy. This brand-new token backs the Mega Dice gambling suite; a profitable casino averaging $50 million in monthly revenues. What’s more, Mega Dice is regulated by the Governor of Curaçao and it boasts over 50,000 registered players.

Mega Dice Token offers direct exposure to the casino’s growth. This is facilitated by daily staking rewards; distributed only to $DICE holders. The staking APYs haven’t been announced yet as Mega Dice Token is currently in presale. Nonetheless, Mega Dice revenues will contribute to the APY, ensuring competitive rewards.

In addition to staking rewards, $DICE holders will also receive generous bonuses and early access to new gambling products. $DICE holders can also participate in a referral program and earn 25% of the generated gambling proceeds. The Mega Dice Token presale is now live; over $420,000 has been raised so far. $DICE operates on the Solana network.

| Staking Project | Staking Chain | Current Staking APY |

| Mega Dice Token | Solana | TBA |

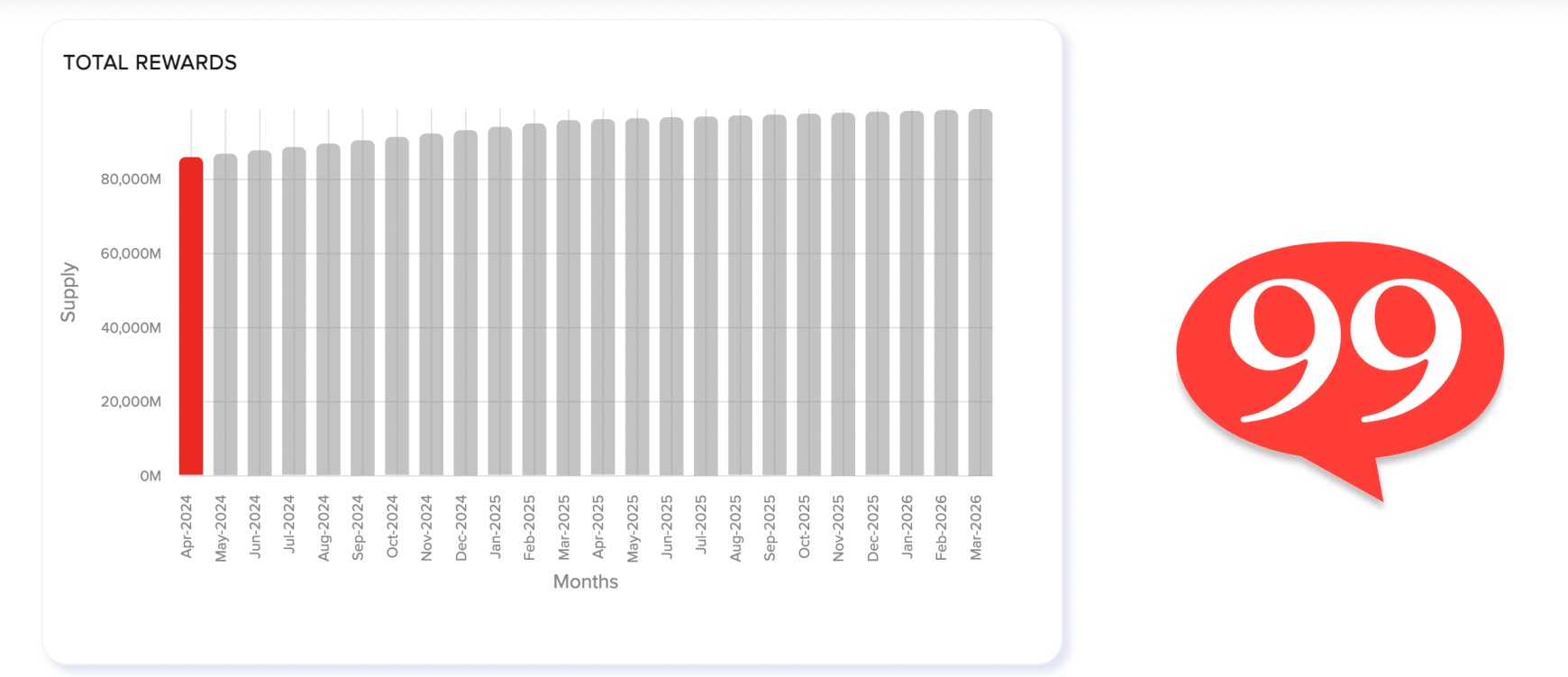

4. 99Bitcoins Token – Learn-to-Earn Education Platform With Tokenized Rewards, APYs of 3028%

99Bitcoins Token is revolutionizing the crypto education niche. It has developed a learn-to-earn concept. This means students earn tokenized rewards for their participation. Exclusive training courses cover basic concepts like wallet transfers and blockchain decentralization.

As students progress the modules tackle more advanced topics like mining consensus mechanisms and DEX trading. Overall, the 99Bitcoins education platform covers 79 hours of content. Students will be joining an established community with over 709,000 followers and 2.8 million email subscribers.

Learn-to-earn rewards are distributed in $99BTC tokens. The tokens double up as a staking coin with competitive rewards. The APY currently stands at 3028%. 99Bitcoins Token has just launched its presale campaign, so investors can secure early access. Over $630,000 has been raised so far and the current token price is $0.00101.

| Staking Project | Staking Chain | Current Staking APY |

| 99Bitcoins Token | Ethereum | 3028% |

Visit 99Bitcoins Token Presale

5. Solana – Earn Competitive Staking Rewards on the Leading Ethereum Killer, Trading 42% Below ATHs

Solana should also be considered when choosing the best cryptocurrency for staking. Considered the leading ‘Ethereum Killer’, Solana offers the perfect combination of scalability, speed, and low fees. Solana states that transactions take just 400 milliseconds at an average fee of $0.00064.

What’s more, the Solana ecosystem continues to grow, with leading projects including dogwifhat, Jupiter, Raydium, and Bonk. That said, Solana often experiences network issues, including failed transactions. So, while Solana potentially offers a greater upside than Ethereum, it’s also a much riskier long-term play.

In terms of staking rewards, this depends on the chosen validator. I found the APY averages 6-8%. Solana is also one of the top-performing crypto projects right now. SOL’s value has increased by over 600% in the prior year. That said, SOL trades 42% below all-time highs, as per CoinMarketCap data. This offers an attractive entry point.

| Staking Project | Staking Chain | Current Staking APY |

| Solana | Solana | Averages 6-8% |

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. [website domain name] is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

6. Tether – The Best Option for Staking Crypto Without Volatility, Earn APYs of Over 8% on Select Platforms

Tether is one of the best cryptos for staking without volatility. This means you’ll know exactly how much you’re making, as you won’t need to worry about price fluctuations. After all, Tether is pegged to the US dollar, so it always trades around the $1 level. However, do note that stablecoins aren’t 100% safe; so never assume Tether’s peg is guaranteed.

Nonetheless, Tether is the largest stablecoin by market capitalization. While it doesn’t directly support staking, you can easily earn rewards via third parties. This includes centralized and decentralized exchanges. For example, I found that MEXC is one of the best crypto staking platforms for Tether.

It offers APYs of up to 8.8% with flexible terms, meaning withdrawals can be made at any time. Margex is also a good choice. While Tether APYs are lower at 5%, the staking funds can be used as collateral. This means traders can open leveraged positions without needing to withdraw their staking coins.

| Staking Project | Staking Chain | Current Staking APY |

| Tether | Ethereum | 8.8% at MEXC |

7. Avalanche – Become a Blockchain Validator and Earn Annual Staking Rewards of 7.6%

Avalanche is a popular layer 1 blockchain that simplifies Web 3 integration for developers. It supports decentralized applications in a smooth and cost-effective ecosystem. Moreover, Avalanche is an energy-efficient network; it consumes the same annual energy levels as just 46 US households.

Avalanche leverages the proof-of-stake mechanism, allowing holders to earn passive rewards. Becoming a blockchain validator enables you to stake AVAX directly. Competitive APYs of 7.6% are currently being paid. However, the minimum validator requirement is 2,000 AVAX. This amounts to about $74,000 based on current AVAX prices.

Alternatively, casual investors can stake AVAX on third-party platforms. Avalanche is also one of the best staking tokens to buy at discounted prices. It currently trades 74% below all-time highs, which were hit during the 2021 bull market. This gives Avalanche a market capitalization of $14 billion. Avalanche has increased by over 120% in the prior year.

| Staking Project | Staking Chain | Current Staking APY |

| Avalanche | Avalanche | 7.6% |

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. [website domain name] is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

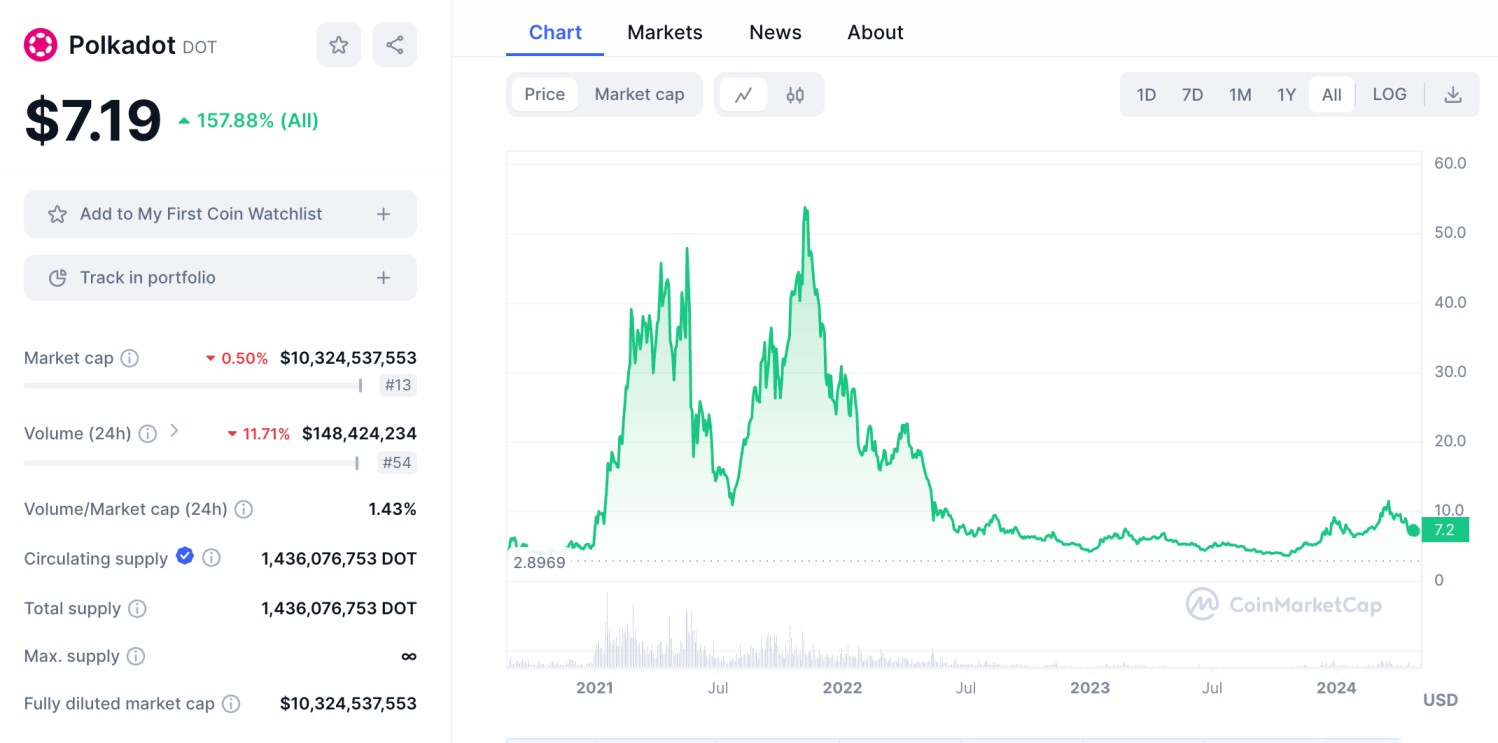

8. Polkadot – Invest in the Future of Blockchain Interoperability, Minimum Staking Requirements of 250 DOT

Polkadot is an established project that specializes in blockchain interoperability. This enables two or more blockchains to connect and share data, regardless of the underlying network standard. For example, connecting Bitcoin data with Ethereum or Cardano with Litecoin.

This increases the use cases for the respective blockchains without needing an intermediary. Polkadot also ensures connected blockchains benefit from fast and cost-effective transactions. Not to mention energy efficiency and scalability. The best way to stake Polkadot is by becoming a validator.

Minimums are much lower than other staking networks; you can become a Polkadot validator with just 250 DOT. As per current DOT prices, that’s about $1,800. Based on historical staking rewards, APYs average 14.79%. In terms of price potential, Polkadot currently trades 87% below all-time highs. It has a market capitalization of over $10 billion.

| Staking Project | Staking Chain | Current Staking APY |

| Polkadot | Polkadot | 14.79% |

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. [website domain name] is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

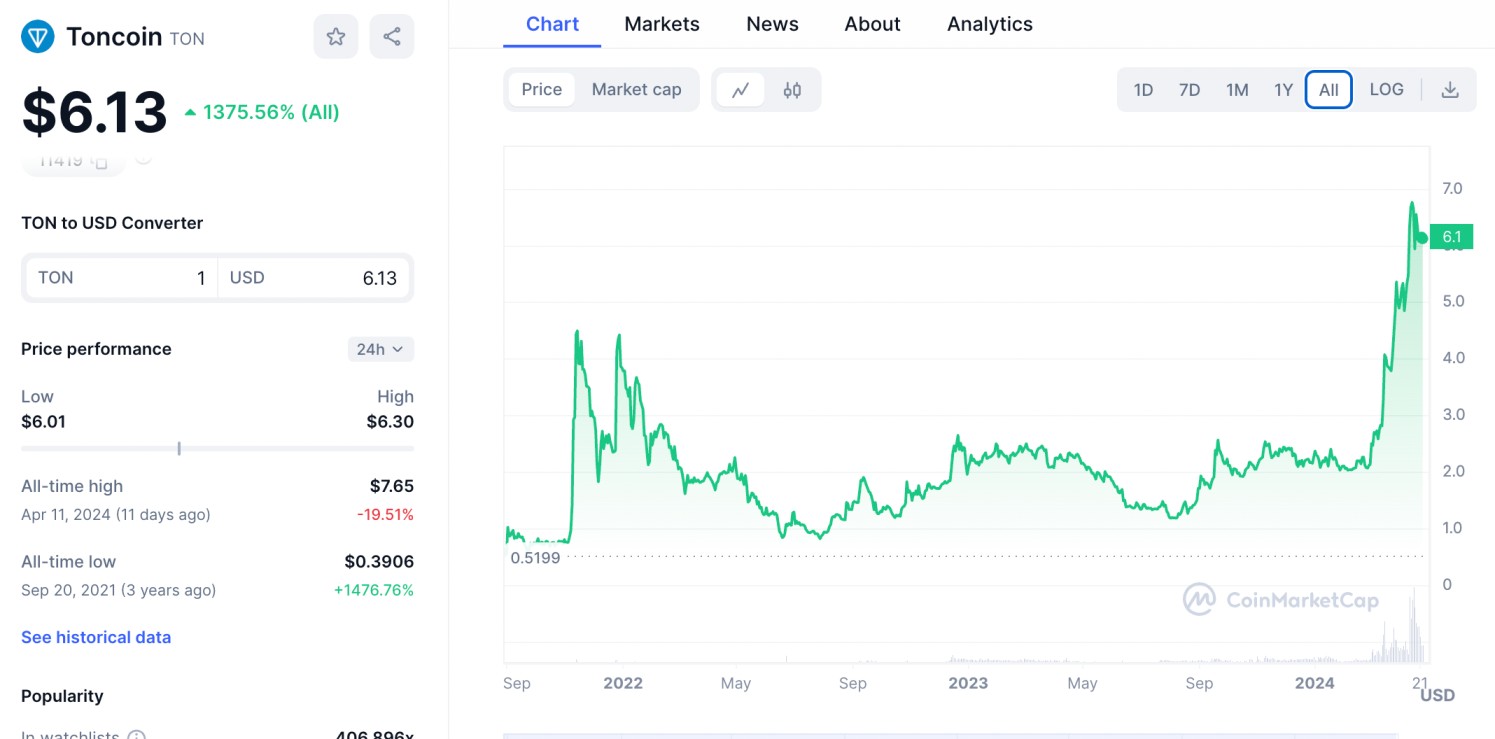

9. Toncoin – Trending Layer 1 Blockchain With Exclusive Access to Over 900 Million Users

Toncoin is a trending layer 1 blockchain that recently became a top-10 coin by market capitalization. It was created by Telegram – a popular messaging app with over 900 million users. However, due to regulatory issues, Telegram no longer runs the project. That said, its native coin, TON, has exclusivity on the Telegram app.

This means creators must accept TON when monetizing their channels. Toncoin’s relationship with Telegram means the upside potential is still huge – even though it’s already worth over $21 billion. What’s more, while Toncoin is up over 172% in the prior year, it currently trades almost 20% below all-time highs.

Toncoin is also one of the best crypto staking coins. The Toncoin website recommends various staking pools; some can be accessed directly on Telegram. This includes the Stakee bot, which has a minimum requirement of 1 TON and APYs of up to 5%. There are also pools aimed at Toncoin ‘whales’, although this requires just 50 TON (about $300).

| Staking Project | Staking Chain | Current Staking APY |

| Toncoin | Toncoin | Averages 3-5% |

10. Sei – Proprietary Network Protocol With High Speeds and Scalability, No Validator Minimums

Sei is also one of the best staking crypto coins for becoming a validator. Unlike other protocols, Sei doesn’t have any minimum requirements. This means you can stake Sei directly on the network, regardless of your budget. The APY fluctuates based on demand, although this typically averages 4-5%.

Like most staking coins, Sei can also be staked on third-party platforms. Sei is also a good option for long-term investors seeking price appreciation. It’s one of the up-and-coming layer 1 networks with high-performance metrics. For example, Sei transactions require just 380 milliseconds to reach finality.

The network is highly scalable too; Sei can handle up to 12,500 transactions per second. Sei also has some notable financial backers. This includes Coinbase, Circle, and Delph Digital. Sei has a market capitalization of just $1.7 billion, which is modest for a layer 1 project. It has increased by more than 7,500% in the prior year. Even so, Sei trades 46% below all-time highs.

| Staking Project | Staking Chain | Current Staking APY |

| Sei | Sei | Averages 4-5% |

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. [website domain name] is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

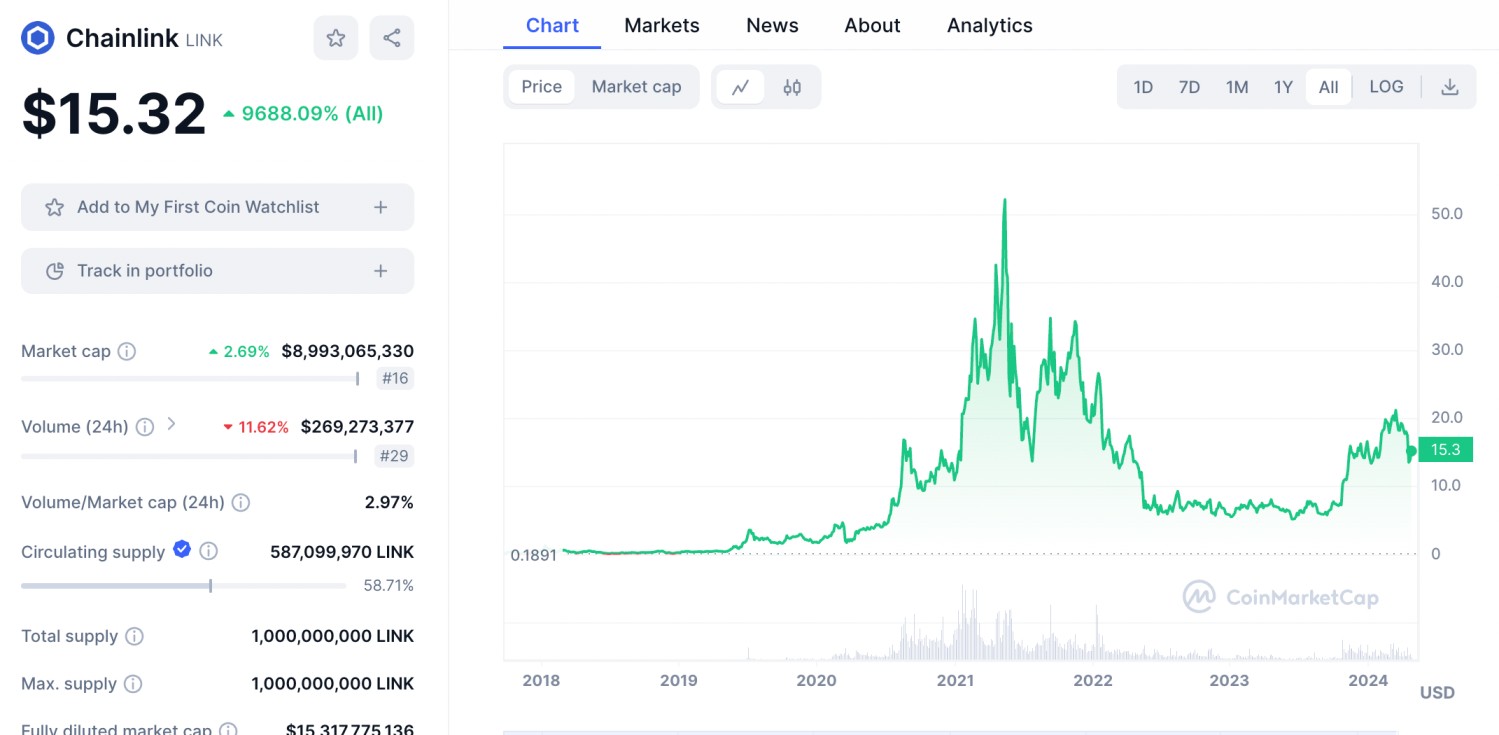

11. Chainlink – Earn Staking APYs of 4.32% With the World’s Leading Oracles Network

Last on this list of the best crypto staking coins is Chainlink. Investors are currently earning staking rewards of 4.32%. This is offered directly on the Chainlink platform, meaning counterparty risk can be avoided. In addition to competitive returns, Chainlink’s current price could be heavily undervalued.

It’s the world’s leading supplier of Oracle networks. Oracles provide real-time, accurate, and unbiased data to decentralized applications. Put otherwise, Chainlink bridges the gap between real-world data and the blockchain ecosystem. Data integrity is assured through Chainlink’s incentivization model.

Those providing reliable data earn LINK tokens. And those needing data pay fees in LINK, ensuring the network is sustainable and self-sufficient. According to CoinMarketCap data, Chainlink is currently valued at almost $9 billion. That’s 71% below all-time highs. That said, Chainlink has increased by nearly 115% in the prior year.

| Staking Project | Staking Chain | Current Staking APY |

| Chainlink | Ethereum | 4.32% |

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. [website domain name] is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

What is Crypto Staking?

Staking enables investors to earn passive rewards on their crypto coins and tokens. The process is similar to earning interest on bank account deposits. For example, consider an investor holding Solana. They can deposit their SOL coins into a staking pool and earn average APYs of 6-8%. The rewards are distributed in the respective coin, so that’s SOL in this example.

Staking is usually only possible if the coin operates on the proof-of-stake mechanism. This is why Bitcoin can’t be staked, as it uses proof-of-work. There are several different ways to stake coins online. One option is to become a ‘validator’. This means you’re directly contributing to the network’s safety.

The coins are locked on the network while they’re being staked. This is essentially a ‘security deposit’ to ensure network integrity. If the validator causes issues (such as downtime), they can lose the deposit. In addition, validator staking often comes with high minimums. For example, you’d need at least 2,000 AVAX to stake on Avalanche, which is about $74,000.

An alternative option is to stake coins on a third-party platform, like centralized and decentralized exchanges. This increases the counterparty risk but can yield higher APYs. That said, some projects support staking directly on their websites. For example, the Dogeverse presale is directly offering staking APYs of 119%.

How Does Staking Crypto Tokens Work?

Let’s take a closer look at how crypto staking works in the traditional sense. First, I mentioned that staking is directly offered by proof-of-stake blockchains. Some of the popular examples include Ethereum, Solana, Toncoin, Avalanche, Polkadot, and Sei. Each proof-of-stake blockchain has a native coin. For example, Avalanche and Solana are backed by AVAX and SOL respectively.

Now, to directly earn staking rewards with a proof-of-stake blockchain, you’d need to become a validator. This means that alongside other validators, you’re responsible for keeping the network operational and secure. You do this by having a financial ‘stake’ in the network, as validators typically need to deposit a minimum number of coins to be eligible.

While there are some exceptions, validator minimums are often high. This ensures that validators are reliable and honest. After all, validators lose the coins they stake if network requirements aren’t met. Validators earn additional coins as a reward. The coins are newly issued by the network whenever a block of transactions is confirmed.

Put otherwise, proof-of-stake blockchains are inflationary, which is why they rarely have a maximum supply. All that said, staking has evolved in recent years, meaning you don’t need to become a validator to earn passive income. There are several different options in this regard, such as:

- Centralized Exchanges: Some of the best crypto staking coins can be staked on centralized exchanges. The benefits of this option include low staking minimums, higher APYs, and more flexible withdrawal terms. The downside is counterparty risk; you’re trusting a centralized platform to keep your staking coins safe.

- Decentralized Exchanges: It’s also possible to stake crypto coins on decentralized exchanges. You’ll deposit the coins into a staking pool, which operates on decentralized smart contracts. This means the exchange never directly touches the staking coins.

- Wallets: Many crypto wallets support staking tools. This is a convenient option for long-term investors, as there’s no requirement to transfer coins to another platform. However, wallets often take a cut from the staking rewards generated, so ensure you understand the fee structure before proceeding.

- Directly With Staking Tokens: Staking ‘tokens’ are different from ‘coins’. They operate on a proof-of-stake network but aren’t proprietary to the ecosystem. For example, Mega Dice Token operates on the Solana network. $DICE holders can stake their tokens directly on the Mega Dice website. No minimums are required. The benefit of staking tokens is that projects can set their own terms.

Always research a staking mechanism before proceeding; each comes with benefits and drawbacks. In particular, ensure you understand the risks, withdrawal terms, APYs, and fees.

Is Staking Crypto Worth it?

If you’re a long-term investor then staking is a no-brainer. After all, it’s a choice between earning passive rewards or letting the coins sit idle in a crypto wallet. However, there are also risks to consider. For example, some staking pools come with long lock-up terms. This means you can’t withdraw the coins until the term passes.

Let’s take a closer look at the benefits and drawbacks of crypto staking. This will help you determine whether or not staking is worthwhile.

Earn Passive Crypto Rewards

The obvious benefit of staking is that it generates passive rewards. This is the case regardless of the staking mechanism. Whether you become a blockchain validator or use a third-party platform, you’ll organically increase your holdings.

For example:

- Let’s say you invest $1,000 in the Dogeverse presale. This will get you about 3.3 million DOGEVERSE tokens.

- You instantly add the tokens to the Dogeverse staking pool. This currently offers an APY of 119%.

- You’re a long-term investor, so you stake DOGEVERSE tokens for 12 months.

- In doing so, you’ve increased your holdings by 119%. That’s approximately 4 million extra DOGEVERSE tokens.

- This is in addition to the original 3.3 million tokens that you deposited.

- As such, you’ve now got approximately 7.3 million DOGEVERSE after 12 months of staking

Now let’s say that instead of staking DOGEVERSE tokens you keep them in a private wallet. After 12 months of holding you would still have 3.3 million tokens. Put otherwise, your ‘opportunity cost’ is approximately 4 million DOGEVERSE, as this is what you could have earned through staking.

Importantly, staking APYs are almost always variable. This means they can rise and fall at any time. In most cases, APYs decline as more people stake; and vice versa.

Ideal for Compound Growth Strategies

The best crypto staking coins offer compound growth opportunities. This is because long-term investors will reinvest their staking coins as soon as they’re received.

Depending on the mechanism, you could receive staking rewards every few days or weeks. The coins can then be deposited in the same staking pool. Those newly deposited coins will also earn interest, which compounds the growth trajectory.

For example:

- Let’s say you deposit 10,000 coins into a staking pool. To keep things simple, we’ll say you get weekly staking rewards of 1%.

- After week one, your original deposit has generated staking rewards of 100 coins (1% of 10,000 coins).

- You then deposit those 100 coins into the same staking pool. This means your staking balance is now 10,100 coins.

- After week two, you receive another 1%. This means you receive staking rewards of 101 coins (1% of 10,100 coins).

- Again, you reinvest the rewards. This means your new staking balance is 10,201 coins.

You’ll begin to see rapid growth after several months of repeating this process.

Benefit From Price Appreciation

The best crypto staking coins are not only ideal for earning passive rewards. On the contrary, investors also make money if the coin increases in value. The returns are amplified when staking, as you’re increasing the number of coins you own.

- For example, suppose you buy 15 SOL at $130 each. This brings your total investment to $1,950.

- You then stake that 15 SOL at APYs of 8%.

- 12 months have passed and you have generated 1.2 SOL (8% of 15 SOL) in staking rewards.

- In addition, SOL is now trading at $200.

- So, your original 15 SOL is now worth $3,000 (15 SOL x $200). You’ve also got 1.2 SOL in staking rewards, which is worth $240 (1.2 SOL x $200).

- Therefore, your Solana portfolio is now worth $3,240. You originally invested $1,950, so your net gain is $1,290.

Crucially, price appreciation is another means to compound your investments. This is because the staking rewards themselves benefit from price increases.

However, never assume that your staking coins will increase in value. The opposite can happen. In this instance, your staking rewards might not cover the losses. This means your portfolio can still lose money even when generating attractive APYs.

High Minimum Requirements and Validator Risks

I’ve established that the main benefits of crypto staking are passive rewards and the ability to compound returns. However, there are also some drawbacks to consider, such as high minimum requirements.

- For example, you need 32 ETH to become an Ethereum validator. That’s about $96,000.

- I also mentioned that Avalanche requires 2,000 AVAX or about $74,000.

If the validator minimums are too high for your budget, you’ll need to use a third-party platform. This means you won’t be staking coins directly on the network.

In addition, the validator deposit is at risk of being confiscated by the network. This will happen if the network deems the validator unreliable. This can happen for several reasons, such as server downtime, technical issues, incorrect configuration, or security breaches.

Be Aware of Lock-Up Terms

Another drawback of crypto staking is that some pools come with unfavorable lock-up terms. This is the minimum number of days the coins must remain in the pool. During which, they can’t be withdrawn. While this is often fine for long-term investors, staking lock-ups can cause liquidity issues.

For example, suppose you discover some new cryptocurrencies that are worth buying. If the only funds available are locked in a staking pool, you won’t be able to invest. In addition, you might need the staked coins for an emergency. Once again, you won’t have access until the staking term has passed.

How to Pick the Best Coins to Stake

Assessing the pros and cons of staking is just one part of the process. You also need to choose the best crypto staking coins to invest in. There are many considerations to make.

- On the staking front, you’ll need to evaluate APYs, lock-up terms, minimum requirements, and counterparty risks.

- In addition, you also need to assess the upside potential. This is because price appreciation can yield much higher returns than staking rewards.

I’ll now take a closer look at how to choose the best cryptocurrencies to buy for staking.

Staking APYs

First, it’s a good idea to short-list staking coins based on the available APY. Just remember that the APY will vary depending on the staking mechanism. For example, staking ETH directly on the Ethereum blockchain currently yields 3.1%. However, staking ETH on MEXC or Margex increases the APY to 4.8% and 4.7% respectively.

Shopping around for the best crypto staking rewards is always advisable.

Don’t forget that investing in staking tokens often comes with increased flexibility. For example, Dogeverse and 99Bitcoins Token can be staked directly with the respective platform. The yields currently offered are 119% and 3,028%, although these are subject to fluctuation.

Note: Staking ‘coins’ are proprietary to the respective network. For example, the staking coins backing Solana and Toncoin are SOL and TON. Staking ‘tokens’ operate on a proof-of-stake network, but they’re not native to the blockchain. For example, tokens on the Solana network (like dogwifhat and Bonk) are known as SPL tokens. While those on Ethereum are ERC-20 tokens.

Staking Terms

It’s also wise to consider the terms when choosing staking coins to buy. For a start, assess whether you need to lock the coins away for a minimum number of days. No withdrawals can be made during this period. Longer lock-up terms usually mean higher APYs. And vice versa when opting for flexible terms.

Also, consider the minimum staking requirement. This will likely be high if you stake coins as a validator. Ensure the minimum aligns with your investment budget and risk tolerance. If you do become a validator, evaluate your responsibilities and whether any financial penalties are enforced if they’re not met.

Distribution Frequency

The best crypto staking coins offer frequent distributions. This is often daily or weekly, which is ideal for compound growth. After all, you can immediately reinvest the staking coins.

This will increase the rate of growth considerably. Frequent distributions also reduce the risk curve. This is because you’ve got regular access to new funds.

Market Capitalization

Investors should choose staking coins with a suitable upside potential. This should be prioritized over staking APYs. The upside potential is often determined by the market capitalization. Those looking for the highest gains should build a portfolio of small-cap staking coins.

For example, the Mega Dice Token presale has a $10 million hard cap. 35% of the total supply is being sold to presale investors. Hitting the hard cap will mean a fully diluted market capitalization of under $30 million. While the risks are also high, $DICE investors will be targeting gains of at least 10x.

It’s also worth adding some large-cap staking coins to your portfolio. While the upside potential is lower, so are the risks. For example, Solana is an established layer 1 blockchain currently valued at $67 billion. There’s plenty of room for growth, but expect more modest returns when compared to small-caps.

Tokenomics and Staking Sustainability

Experienced investors are right to question the sustainability of crypto staking. After all, staking offers passive rewards simply for holding coins. Understanding how the staking rewards are funded is crucial.

In some cases, the best crypto staking coins have an inflationary supply. New coins enter circulation every time a new block of transactions is confirmed. For example, Solana currently has an inflation rate of 8%. This means the total supply increases by 8% annually. This will be reduced over time.

However, small-cap staking coins don’t have the same luxury. Due to limited liquidity and market awareness, creating new coins through inflation isn’t a smart move. It can damage investor confidence and result in major price declines. This is why projects like Dogeverse and Mega Dice Token have a fixed total supply.

This means there are zero inflationary risks, as no more tokens can be created. Staking is still sustainable though. For example, Dogeverse has allocated 10% of its overall token supply to staking rewards. Distributions will be made at a fixed rate over two years. After that, no more staking rewards will be earned.

Focus on Long-Term Projects With Utility

Risk-averse investors should focus on staking coins with long-term objectives. These projects often have real-world use cases. This can increase the coin’s demand in the long run. In the meantime, you’ll earn passive rewards as the project is being developed.

For example, Chainlink’s native token, LINK, is needed to request data. The tokens are sent to Oracle network providers, which supply real-world data to decentralized applications. This means over time, demand for LINK will increase, which can help its value appreciate organically. Chainlink currently offers staking rewards of 4.32%.

Solana is another option for long-term investors. It has developed a faster, cheaper, and more scalable alternative to Ethereum. Any projects operating on Solana must settle transaction fees in SOL. This means the demand for SOL will increase as more decentralized applications join the Solana ecosystem.

Conclusion

In summary, staking coins are a great addition to long-term crypto portfolios. You can earn passive staking rewards in addition to price appreciation. In my view, Dogeverse is the best crypto for staking and upside potential.

Having raised over $9 million, the Dogeverse presale has proven popular with growth investors. It’s a new meme coin that’s compatible with six blockchain networks. Visit the Dogeverse presale for more information about this trending project.

FAQs

Which coins have the highest staking rewards?

Small-cap coins offer the highest staking rewards, although expect increased volatility and risk of loss. For example, the Dogeverse and 99Bitcoin Token presales are currently offering staking rewards of 199% and 3,028%, respectively.

Is crypto staking safe?

Crypto staking presents several risks, such as the coins declining in value, a sudden drop in APYs, and unfavorable lock-up terms. Also consider the risks of staking coins on a third-party platform, such as crypto exchanges.

Is coin staking profitable?

Staking can be profitable – especially if the value of the coins increases. However, the opposite can also happen, meaning staking can yield losses.

What does APY mean in crypto?

The APY in crypto stands for annual percentage yield. It’s used to express the annualized interest rates when staking crypto.

References

- Telegram will ‘probably’ hit one billion users within the year – what is it and why is it so popular? (Sky News)

- Proof of Stake: A process used to validate crypto transactions through staking (Business Insider)

- Earn rewards while securing Ethereum (Ethereum Foundation)

- What investors need to know about ‘staking,’ the passive income opportunity at the center of crypto’s latest regulation scare (CNBC)