Bitcoin Trading Guide for Beginners

By: Alexander Reed | Last updated: 3/6/24

This post covers the basics of Bitcoin trading. It will help you get familiar with basic terms, understand different ways to “read” the market and its trends, make a trading plan, and learn how to execute that plan on Bitcoin exchanges or via a Bitcoin ETF.

Don’t Like to Read? Watch Our Video Guide Instead:

Jump to: Bitcoin resource section

Bitcoin Trading Summary

Successful Bitcoin trading involves buying low and selling high. Unlike investing, which involves holding Bitcoin for the long run, trading involves trying to predict price movements by studying the industry as a whole and price graphs in particular.

People use two main methods to analyze Bitcoin’s price – fundamental analysis and technical analysis. Successful trading requires a lot of time, money, and effort before you can actually get good at it.

In order to trade Bitcoin, you’ll need to do the following:

- Open an account on a Bitcoin exchange (e.g. CEX.IO, eToro, Bitstamp)

- Verify your identity

- Deposit money into your account

- Open your first position on the exchange (i.e., buy or short-sell)

eToro disclaimer: This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU protections & not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

CFDs are not available to US customers.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

That’s Bitcoin trading in a nutshell. If you want a really detailed explanation, keep on reading.

- Bitcoin Trading vs. Investing

- Trading Methods

- Analysis Methods – Fundamental vs. Technical

- The ‘Stock-to-Flow’ Model

- Bitcoin Trading Terms

- Reading Price Charts

- Common Trading Mistakes

- Frequently Asked Questions

- Conclusion

1. Bitcoin Trading vs. Investing

The first thing we want to do before we dive deep into the subject is to understand what Bitcoin trading is and how it is different from investing in Bitcoin.

When people invest in Bitcoin, it usually means that they are buying Bitcoin for the long term. In other words, they believe that the price will ultimately rise, regardless of the ups and downs that may occur along the way. Usually, people invest in Bitcoin because they believe in the technology, ideology, or developers behind the currency.

Bitcoin investors tend to HODL the currency for the long run (HODL is a popular term in the Bitcoin community that was actually born out of a typo of the word “hold”—in an old 2013 post in the BitcoinTalk forum).

Bitcoin traders, on the other hand, buy and sell Bitcoin in the short term whenever they think a profit can be made. Unlike investors, traders view Bitcoin as an instrument for making profits. Sometimes, they don’t even bother to study the technology or the ideology behind the product they’re trading.

Having said that, people can trade Bitcoin and still care about it, and many people out there invest and trade at the same time. As for the sudden rise in popularity of Bitcoin (and several altcoins) trading – there are a few reasons for that.

Firstly, Bitcoin is very volatile. In other words, you can make a nice profit if you manage to anticipate the market correctly. Secondly, unlike traditional markets, Bitcoin trading is open 24/7. Most traditional markets, such as stocks and commodities, have an opening and closing time. With Bitcoin, you can buy and sell whenever you please.

Finally, Bitcoin’s somewhat unregulated landscape makes it relatively easy to start trading—without the need for long identity verification processes.

2. Trading Methods

While all traders want the same thing – profit – they practice different methods to generate it. Let’s review some examples of popular trading types:

Day trading

This method involves conducting multiple trades throughout the day and trying to profit from short-term price movements. Day traders spend a lot of time staring at computer screens and usually close all their positions by the end of each day.

Scalping

This day-trading strategy is becoming popular lately. Scalping attempts to make substantial profits on small price changes and is often likened to “picking up pennies in front of a steamroller.”

Scalping focuses on extremely short-term trading and is based on the idea that making small profits repeatedly limits risks and creates advantages for traders. Scalpers can make dozens—or even hundreds—of trades in one day.

Swing trading

This type of trade tries to take advantage of the natural “swing” of the price cycles. Swing traders try to spot the beginning of a specific price movement and enter the trade then. They hold on until the movement dies out and take the profit.

Swing traders try to see the big picture without constantly monitoring their computer screens. For example, swing traders can open a trading position and hold it open for weeks or even months until they reach their desired result.

3. Analysis Methods: Fundamental vs. Technical

Can I predict Bitcoin’s price movement?

The short answer is that no one can really predict what will happen to the price of Bitcoin. However, some traders have identified certain patterns, methods, and rules that allow them to make a profit in the long run. No one exclusively makes profitable trades, but here’s the idea: at the end of the day, you should see a positive balance, even though you may have suffered some losses along the way.

When analyzing Bitcoin (or anything else they want to trade, for that matter), people follow two main methodologies: fundamental analysis and technical analysis.

Fundamental analysis

Fundamental analysis is used to predict the price by looking at the bigger picture. In Bitcoin, for example, fundamental analysis evaluates Bitcoin’s industry, news about the currency, technical developments of Bitcoin (such as the lightning network), regulations around the world, and any other news or issues that can affect the success of Bitcoin.

This methodology looks at Bitcoin’s value as a technology (regardless of the current price) whilst considering relevant outside forces in order to determine what will happen to the price. For example, if China suddenly decides to ban Bitcoin, this analysis will predict a probable price drop.

Technical analysis

Technical analysis tries to predict prices by studying charts and market statistics, such as past price movements and trading volumes. It tries to identify patterns and trends in the price and, based on these, deduce what will happen to the price in the future.

The core assumption behind technical analysis is this: Regardless of what’s currently happening in the world, price movements speak for themselves and tell some sort of a story that helps you predict what will happen next.

So, which methodology is better?

Well, as I said in the previous section, no one can accurately predict the future. From a fundamental perspective, a promising technological achievement might end up as a flop. From a technical perspective, the graph just doesn’t behave as it did in the past.

The simple truth is that there are no guarantees for any sort of trading. However, a healthy mix of both methodologies will probably yield the best results.

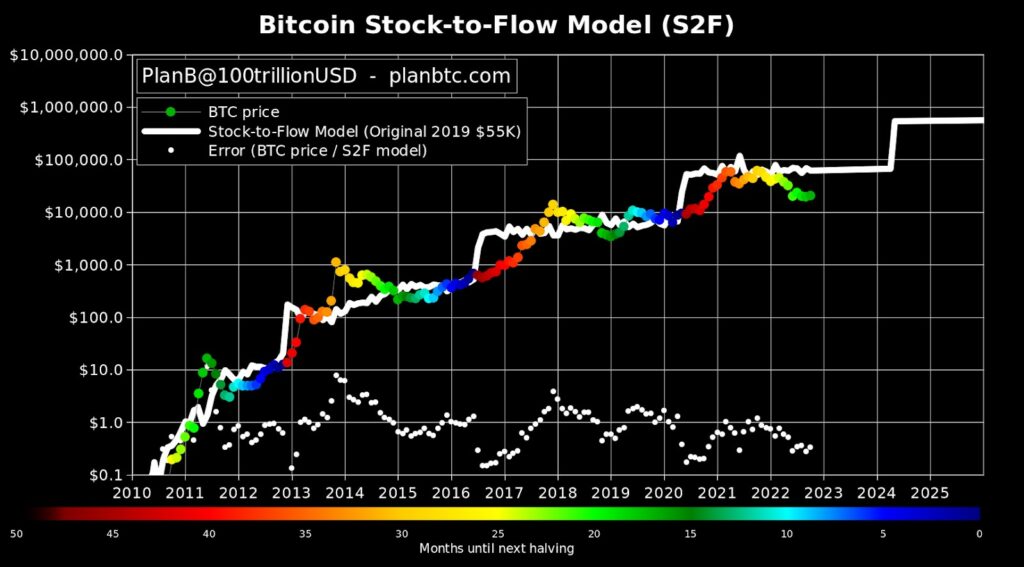

4. Stock-to-Flow Model

What is Stock-to-Flow?

The stock-to-flow model is a pricing model that predicts the price of Bitcoin based on the relative rate of new supply – that is, how much new Bitcoin is being created compared to how much Bitcoin already exists.

The model is based on scarcity and was originally applied to precious metals such as gold and silver. The word “stock” refers to the already-existing supply of the asset, while “flow” refers to the new supply entering the market.

The underlying principle of stock-to-flow answers the following question: At the current rate of supply, how long would it take to replace all units of the asset already on the market?

For Bitcoin, this question is surprisingly easy to answer. Thanks to the hard-coded rate of supply in the Bitcoin protocol, we can estimate the stock-to-flow ratio at any point in the future with decent certainty.

Stock-to-Flow in practice

At the time of writing, the circulating supply of Bitcoin is around 19.5 million coins. At the current rate of new supply – around 900 BTC per day – it would take over 59 years to replace all of these 19.5 million bitcoins that are already on the market.

This is a good way to picture how scarce Bitcoin really is.

Of course, we know that it’s even more scarce than that calculation implies; Bitcoin really has a maximum supply of 21 million coins.

By combining this knowledge of supply with historical Bitcoin pricing data, we can create a formula that predicts the future price of Bitcoin based on that stock-to-flow ratio – and this is how the stock-to-flow pricing model came about.

The model was formalized and published by “PlanB” – a prominent crypto analyst who is supposedly a highly experienced former Dutch institutional trader.

Source: Planbtc.com

Does the model work?

The S2F model looks quite good at first glance, with the Bitcoin market price appearing to roughly follow estimations quite well. Upon closer inspection, however, the actual price has deviated very far from the model at times during its boom-and-bust cycles.

Overall, it could be argued that the model serves as a good baseline for a “fair” Bitcoin price, which would be best used as a guide.

For example, if the actual price is much higher than the predicted price, it may be a good “sell” indicator. Conversely, if the actual price is well below the model price, it may be a good “buy” indicator.

Praise and criticisms

Overall, the model has received more or less an equal amount of praise and criticism from the general community and more notable figures alike.

Most notably, Ethereum founder Vitalik Buterin was quoted saying he tends to dislike such models due to the fact they “give people a false sense of certainty and predestination that number-will-go-up…”

This is a fair conclusion, as there are no “downward” portions of the stock-to-flow model’s price curve.

It has also been widely acknowledged that the model cannot account for various external micro- or macro-economic factors, such as black swan events, significant inflation events, financial crises, or major regulatory changes.

Is it worth using?

Overall, the model is a good rough guide for long-term price predictions, taken with a pinch of salt due to its inability to capture external macroeconomic factors.

Its best application may be as a form of indicator when compared to the current market price, signaling whether Bitcoin is significantly over-priced or under-priced at any point in time.

5. Understanding Bitcoin Trading Terms

Let’s continue to break down some of the confusing terms and statistics you’ll encounter on most Bitcoin and crypto exchanges:

Trading Platforms vs. Brokers vs. Marketplaces

Bitcoin trading platforms are websites where buyers and sellers are automatically matched. Note that a trading platform is different from a Bitcoin broker, such as Coinmama.

Unlike trading platforms, brokers sell you Bitcoin directly, usually for a higher fee. A trading platform is also different from a marketplace, such as LocalCoinSwap and Paxful, where buyers and sellers communicate directly to complete a trade.

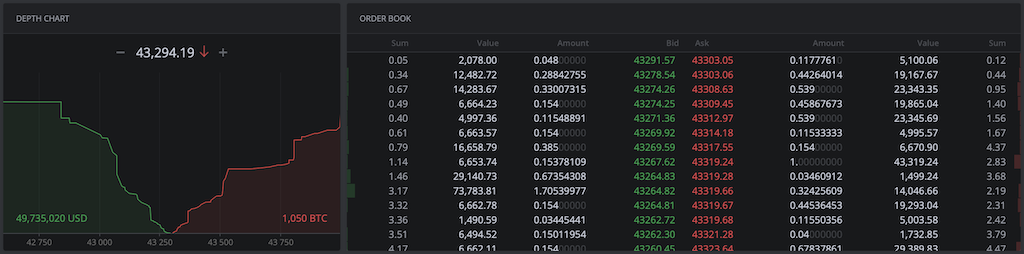

The Order Book

A trading platform’s order book contains a complete list of buy and sell orders. Buy orders are called bids because people are bidding prices to buy Bitcoin. Sell orders are called asks because they show the asking price the seller requests.

Bitcoin Price

Whenever people refer to Bitcoin’s “price,” they are actually referring to the price of the most recent trade conducted on a particular trading platform. This important distinction occurs because, unlike US dollars, for example, there is no single global Bitcoin price that everyone follows.

For instance, Bitcoin’s price in certain countries can be different from its price in the US since the major exchanges in these countries come with different market conditions.

Note: Next to the price, you will sometimes also see the terms “high” and “low.” These terms refer to the highest and lowest prices that Bitcoin traded at within the last 24 hours.

Volume

Volume is the total quantity of Bitcoin that has been traded within a given timeframe. Volume is used by traders to identify how significant a trend is – significant trends are usually accompanied by large trading volumes, while weak trends are accompanied by low volumes.

For example, a healthy upward trend will be accompanied by high volumes when the price rises and low volumes when the price declines.

If you are witnessing a sudden change of direction in the price, experts recommend checking how significant the trading volume is in order to determine if it’s just a minor correction or the beginning of an opposite trend.

Market (or Instant) Order

This type of order can be set on a trading platform and instantly fulfilled at the best price currently available. You only set the amount of Bitcoin you wish to buy or sell and order the exchange to execute it immediately. The trading platform then matches sellers or buyers to meet your order.

Once the order is placed, there is a good chance that your order will not be matched by a single buyer or seller but rather by multiple people at different prices.

For example, let’s say you place a market order to buy five bitcoins. The trading platform now looks for the cheapest sellers.

The order will be completed once it accumulates enough sellers to hand over five bitcoins. Depending on seller availability, you might end up buying three bitcoins at one price and the other two at a higher price.

In other words, in a market order, you don’t stop buying or selling bitcoins until the amount requested is reached. With market orders, you may pay more or sell for less than you intended, so be careful.

Limit Order

A limit order allows you to attempt to buy or sell Bitcoin at a specific price that you decide on. In other words, the order may never be filled, or only partially filled, until there are enough buyers or sellers willing to meet your requirements.

Let’s say that you place a limit order to buy five bitcoins at $10,000 per coin. You could end up only owning four bitcoins because no other sellers were willing to sell you the final Bitcoin at $10,000. The remaining order for one Bitcoin will stay there until the price hits $10,000 again, and the order will then be fulfilled.

Stop-Loss Order

With this type of order, you set an automatically executing price that you wish to sell at in the future in case the price drops dramatically. This type of order is useful for minimizing losses without actively monitoring price activity.

A stop-loss is an order that tells the trading platform: “If the price of Bitcoin drops below $X, sell my coins at the prevailing market price to avoid further losses.” A stop-loss order typically acts as a market order, which executes instantly.

In other words, once the stop price is reached, the market will start selling your coins at any price beneath it until the order is fulfilled.

Maker and Taker Fees

Other terms that you may encounter when trading are “maker fees” and “taker fees.” Personally, I still find this model to be one of the more confusing ones, but let’s try to break it down.

Exchanges want to incentivize people to provide liquidity. In other words, they want to “make a market.” Therefore, whenever you create a new order that can’t be matched by any existing buyers or sellers (i.e., a limit order), you are considered a “market maker” and will usually have lower fees.

Meanwhile, a “market taker” places orders that are instantly fulfilled (i.e., market orders) since there was already a market maker in place to match their requests. Takers remove liquidity from the exchange, so they usually have higher fees than makers, who add orders to the exchange’s order book.

For example, consider you place a limit order to buy one Bitcoin at $10,000 (at most), but the lowest seller is only willing to sell at $11,000. In this case, you’ve just created more liquidity for sellers who want to sell at $10,000.

So whenever you place a buy order below the market price or a sell order above the market price, you become a market maker.

Using that same example, perhaps you place a limit order to buy one Bitcoin at $12,000 (at most), and the lowest seller is selling one Bitcoin at $11,000. In this case, your order will be instantly fulfilled at $11,000. You will be removing orders from the exchange’s order book, so you’re considered a market taker.

6. Reading Price Charts

Now that you’re familiar with the main trading terms, it’s time for a short intro to reading price charts.

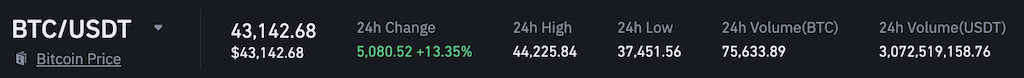

Japanese Candlesticks

A very widely used type of price graph, Japanese candlesticks are based on an ancient Japanese method of technical analysis used in rice trading in the 1600s.

Each “candle” represents the opening, lowest, highest, and closing prices of an asset during a given time period. Due to that, Japanese Candlesticks are sometimes referred to as OHLC charts (Open, High, Low, Close).

Depending on whether the candle is green or red, you can tell if the closing price of the timeframe was higher or lower than the opening price.

If a candle is green, it means that the closing price was higher than the opening price, so the price went up overall during this timeframe. On the other hand, if the candle is red, it means that the closing price was lower than the opening price, so the price went down.

In the image above, the opening price of the green candle is the wide-bottom part of the candle, the closing price is the wide-top part of the candle, and the highest and lowest trades within this timeframe are on the tips of the candle.

When we’re in a bull market, most of the candlesticks will usually be green. If it’s a bear market, most of the candlesticks will be red.

Bull and Bear Markets

These terms are used to indicate the general trend of the chart, whether it’s going up or down. They are named after these animals because of the ways they attack their opponents.

A bull thrusts its horns up into the air while a bear swipes its paws downward. So these animals are metaphors for the movement of a market: if the trend is up, it’s a bull market. But if the trend is down, it’s a bear market.

Resistance and Support Levels

When looking at market graphs such as OHLC, it may seem as though Bitcoin’s price cannot break through certain highs or lows. For example, you can witness Bitcoin’s price go up to $10,000 and then appear to hit a virtual “ceiling” and get stuck at that price for some time without breaking through it.

In this scenario, $10,000 is the resistance level – a high price point Bitcoin is struggling to beat. The resistance level is the outcome of many sell orders being executed at this price point, which is why the price fails to break through at that specific point.

Support levels, in a sense, are the mirror image of resistance levels. They look like a “floor” that Bitcoin’s price can’t seem to go below when the price drops. A support level will be accompanied by a lot of buy orders set at that price level. The high demand of buyers at that support level cushions the downtrend.

Generally, the more frequently the price has been unable to move beyond the support or resistance levels, the stronger these levels are considered.

Interestingly, both resistance and support levels are usually set around round numbers, e.g., 10,000, 15,000, etc. The reason for this is that many traders tend to execute buy or sell orders at round-numbered price points, thus making them act as strong price barriers.

Psychology also contributes a lot to support and resistance levels. For example, until 2017, paying $1,000 per Bitcoin seemed expensive, so there was a strong resistance level at $1,000. With Bitcoin having passed $68,000 in late 2021, the next psychological resistance level would have been $70,000.

7. Common Trading Mistakes

Great, you made it this far! By now, you should have enough know-how to get some field experience. However, it’s important to remember that trading is a risky business and that mistakes cost real money.

Let’s go over the most common mistakes that people make when they start trading—in the hopes that you’ll be able to avoid them.

Mistake #1 – Risking More than You Can Afford to Lose

The biggest mistake you can make is to risk more money than you can afford to lose. Take a look at the amount you feel comfortable with. Here’s the worst-case scenario: You’ll end up losing it all. If you find yourself trading above that amount, stop. You’re doing it wrong.

Trading is a very risky business. If you invest more money than you’re comfortable with, it will affect how you trade and likely cause you to make bad decisions.

Mistake #2 – Not Having a Plan

Another mistake people make when starting out with trading is not having a clear action plan. In other words, they don’t know why they’re entering a specific trade and, more importantly, when they should exit that trade.

Clear profit goals and stop-losses should be decided before entering any trade.

Mistake #3 – Leaving Money on an Exchange

This is the most basic ground rule for any crypto trader: NEVER leave your money on an exchange that you’re not currently trading with. If your money is sitting on the exchange, you don’t have any control over it. If the exchange gets hacked, goes offline, or goes out of business, you may end up losing that money.

Whenever you have money that isn’t needed in the short term for trading on an exchange, make sure to move it into your own Bitcoin wallet or bank account for safekeeping.

There are useful tools that allow you to track your portfolio and make sure this doesn’t happen to you. Read our full review here to learn what the best crypto portfolio tracker apps are out there.

Mistake #4 – Giving into Fear or Greed

Two basic emotions tend to control the actions of many traders: Fear and greed. Fear can appear in the form of prematurely closing your trade because you read a disturbing news article, heard a rumor from a friend, or got scared by a sudden dip in the price (which may soon be corrected, and, potentially, reverse back up).

The other major emotion, greed, can actually also be based on fear: The fear of missing out (often referred to as “FOMO”). When you hear people telling you about the next big thing or when market prices rise sharply, you don’t want to miss out on all the action. So you may get into a trade too soon or even delay closing an open trade.

Greed can also influence traders to oversize their positions or not exit a successful trade that has already reached its target – hoping to make even more profit.

Remember that, in most cases, our emotions rule us. So, never say, “This won’t happen to me.” Be aware of your natural tendency towards fear and greed, and make sure to stick to the plan that you had before entering the trade.

Mistake #5 – Not Learning the Lesson

Regardless of whether or not you made a successful trade, there’s always a lesson to be learned. No one manages only to make profitable trades, and no one gets to the point of making money without losing some money on the way.

The important thing isn’t necessarily whether you made money. Rather, it’s whether you gained some new insight into how to trade better next time.

8. Frequently Asked Questions

How do I trade Bitcoin?

In order to trade Bitcoin, you’ll need to do the following:

- Open an account on a Bitcoin exchange (e.g. CEX.IO, eToro, Bitstamp)

- Verify your identity

- Deposit money to your account

- Open your first position on the exchange (i.e., buy or short-sell)

Is day trading a good way to make money?

Day trading is just one method of trading. Other examples include swing trading or scalping.

While many people will argue day trading is a good way to make money, more than 90% of people quit day trading in the first 3 months.

Any type of trading strategy can work as long as you’re consistent and willing to put in the time and effort to learn how to be better than other traders out there.

9. Conclusion

We covered a lot of ground about Bitcoin trading, but I have to warn you: the majority of people who start trading Bitcoin stop after a short while, mostly because they don’t make any money.

Here’s my opinion: if you want to be successful at trading, you’ll have to put in a significant amount of time and money to acquire the relevant skills, just like any other venture. If you want to get into trading just to make a quick buck, then perhaps it’s better just to avoid trading altogether.

There’s no such thing as quick, easy money—without risk or downside at the other end. However, if you’re committed to learning how to become a professional Bitcoin trader, take a look at our resource section below. These resources will help you get the best possible tools and continue your education.

You may still have some questions. If so, just leave them in the comment section below.

Bitcoin Trading Resource Section

The following sites offer helpful resources:

- Cointelligence Academy – An A to Z trading course by Cointelligence and Mati Greenspan

- TradingView – The most popular trading software around

- Coinigy – Another Bitcoin trading software

The following sites are suited for Bitcoin trading:

Good lecture

How can I learn?

Hey Sam, here are some ideas you can use that may help you:

Visit bitcoin faucet sites – these sites will give you a small amount of bitcoins just for visiting them. https://99bitcoins.com/top-10-bitcoin-faucets/ to our Top 10 Bitcoin Faucet article.

Try to work for bitcoins – https://99bitcoins.com/work-bitcoins-4-ways-earn-bitcoin-online/ to get an idea of how to get a job for bitcoins.

Play bitcoin gambling games – https://99bitcoins.com/bitcoin-casinos-review-best-bitcoin-gambling/ of the different sites.

If you want some more ideas you can read our https://99bitcoins.com/how-to-earn-bitcoins-fast-and-free-in-2016/

Hope this helps!

How can I learn please

ALL i see here is affiliate marketing… so i will say the best to learn is learn how to use affiliate marketing… 🙂 blessed day for you

How can I learn

Thanks for the crash course

You are welcome!

Ok if you are ready for business am in for business

Hi

Nice one