Coinbase Review and Comparison

By: John West | Last updated: 1/11/24

Disclaimer: We may be compensated for purchases made through links on this page.

I’ve been a Coinbase user since 2013, and a lot can be said about the company, both good and bad. In this review, I’ll try to give you the full rundown so you can evaluate for yourself if Coinbase is trustworthy or not.

Don’t Like to Read? Watch Our 2-Minute Coinbase Review

Coinbase Review Summary

Coinbase is one of the biggest cryptocurrency companies around, supporting over 100 countries with more than 89 million customers around the world.

Coinbase has a wide array of services, but their main service allows users to buy and sell crypto using a bank account, debit card, and even PayPal. Users in Europe and the UK can also use credit cards. The rates you’ll get on Coinbase are fair in general; however, the customer support is terrible.

That’s Coinbase in a nutshell. If you want to get familiar with Coinbase in depth, keep on reading. Here’s what I’ll cover in this review:

- Coinbase Overview

- Coinbase Services

- Currencies and Payment Methods

- Fees

- Buying Limits

- Supported Countries

- Customer Support and Reviews

- Coinbase vs. Other Exchanges

- Frequently Asked Questions

- Conclusion – Is Coinbase Good to Use?

1. Coinbase Overview

Founded in 2012 by Brian Armstrong and Fred Ehrsam as part of Y Combinator, Coinbase is one of the oldest exchanges around. Coinbase started out only as a Bitcoin brokerage service (selling Bitcoin directly to customers), but additional services were added along the way.

The company raised over $540m from leading investors such as Andreessen Horowitz, Ribbit Capital, and Intercontinental Exchange (the owners of the New York Stock Exchange). Coinbase became the first publicly traded cryptocurrency exchange in the US in April 2021 through its direct listing.

2. Coinbase Services

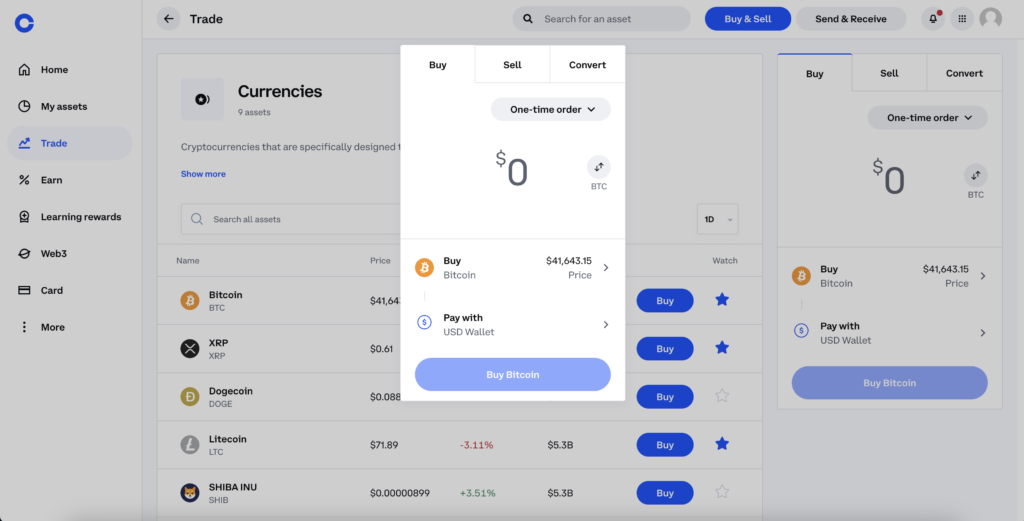

Coinbase brokerage service

The main service Coinbase offers is a brokerage service for buying and selling cryptocurrencies. New cryptocurrency users often find themselves buying their first Bitcoin through Coinbase thanks to the company’s reputation, marketing, and beginner-friendly user interface.

On the downside, one of the main complaints users have towards Coinbase is the lack of control users have over their own funds. When you open a Coinbase account, you don’t have direct access to your coins, and you don’t get any private key or a seed phrase. For this, you will need to download the standalone Coinbase Wallet app or transfer the coins to another non-custodial wallet.

Coinbase stores your coins for you. It’s the equivalent of putting your cash in the bank – you don’t own it, the bank does.

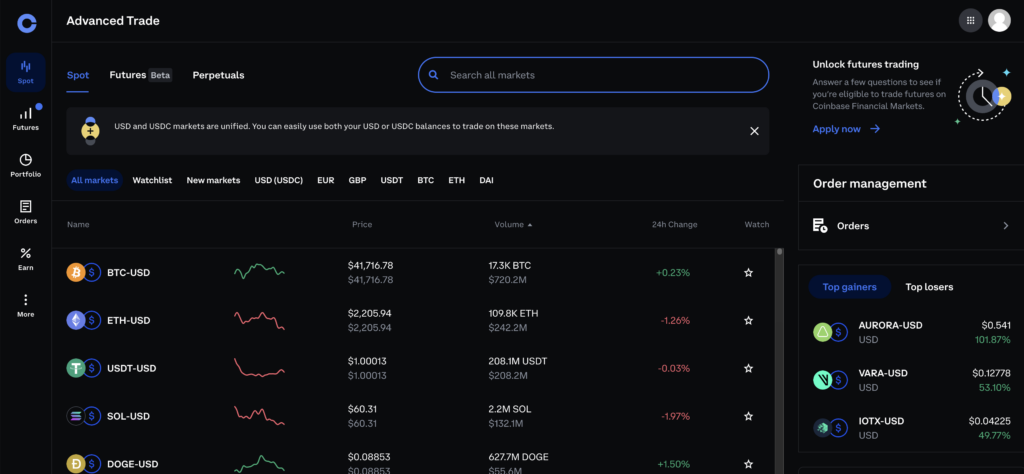

Coinbase Advanced

Formerly known as GDAX, Coinbase Advanced is a cryptocurrency trading platform. As opposed to the traditional Coinbase brokerage service, which simplifies buying cryptocurrencies at a premium, Coinbase Advanced is aimed at more experienced users.

Coinbase Advance allows users to trade several cryptocurrencies, including BTC, ETH, LTC, BCH, and many more. Fees are considerably lower than the brokerage service, and there are advanced trading options as well.

Coinbase Earn

One of Coinbase’s other features is an easy-to-use staking service, which enables users to earn staking rewards on selected proof-of-stake cryptocurrencies. Although users may have the option of staking these independently, Coinbase streamlines the process and removes any need for technical expertise or specialized hardware.

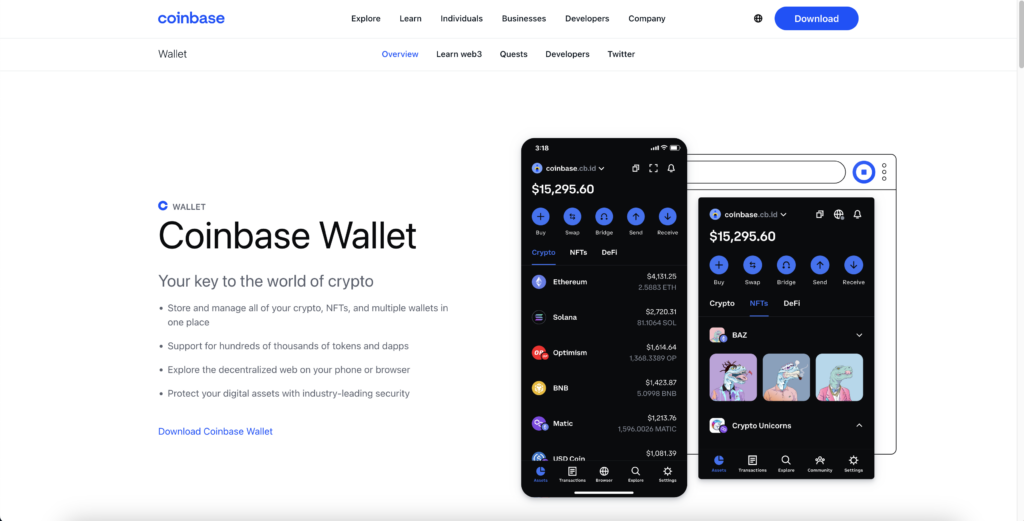

Coinbase Wallet

In 2017, Coinbase launched its independent mobile wallet for iOS and Android. The wallet stores the private keys on the user’s device, so only they have access to the funds. This brings Coinbase full circle since it started out as a wallet, transitioned to an exchange only, and then began offering wallet services again.

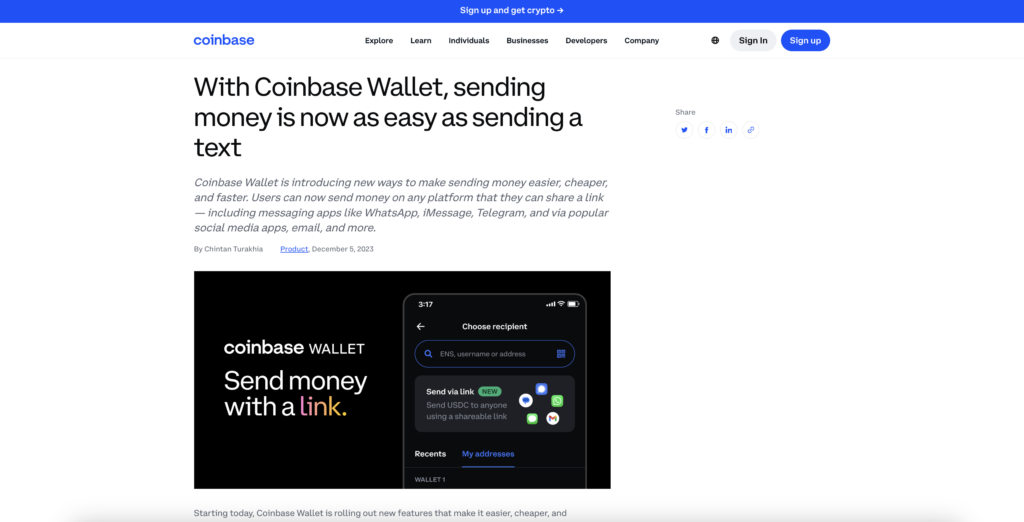

Coinbase Wallet – Send & Receive Crypto Via a Link

Note: Coinbase recently added a new feature that allows you to send crypto from your Coinbase Wallet to any recipient via a link that they can then claim.

Users can now send money anywhere they can share a link, whether it’s through messaging apps like WhatsApp, iMessage, and Telegram, social media platforms like Facebook, Snapchat, TikTok, and Instagram, or even via email.

This feature is free and you will not pay any fees to claim the funds that have been sent to you.

To send crypto via a link:

-

Download the Coinbase Wallet mobile app if you don’t have it already.

-

Select Send on the home screen.

-

Select the amount and cryptocurrency you would like to send*** (See below)

-

Click on the Send via link banner and confirm all the details are correct, then click Create. The funds will be immediately removed from your wallet.

-

Once the link has been generated and appears on the next screen, copy the link and share it with the intended recipient. You can also use the Share button to automatically open your preferred app to share the ink. The recipient will be able to access the funds without the need to add “gas” (such as ETH or MATIC) to their wallet.

***Currently, only Native USDC on Base, ETH on Base, Native USDC on Polygon, Bridged USDC on Polygon, and MATIC are the only coins supported for this feature.

Please check the link for authenticity. Legitimate CB Wallet claim links will start with https://wallet.coinbase.com or https://go.cb-w.com/claim.

To claim your funds:

-

Click on the link.

-

If you have a Coinbase Wallet, you’ll be able to proceed in-app.

-

If you don’t have a Coinbase Wallet, you’ll be taken to the iOS or Android store to download the Coinbase Wallet app. Once you open the app, you can select Create a new wallet, or I already have a wallet if you want to import your recovery phrase from another wallet provider.

-

-

A tray will pop up to show the amount that has been sent to you. Select Claim Now to claim the funds.

Coinbase Commerce

Coinbase supplies online merchants with the ability to accept cryptocurrencies on their websites via a dedicated plugin. The plugin is supported by some of the biggest CMS (content management systems) around, such as Shopify, Jumpseller, Primer, and WooCommerce.

Additional projects

Aside from the above, Coinbase supplies additional services such as:

- USD Coin (USDC) – A stablecoin Coinbase helped build.

- Custodian services – Safeguarding cryptocurrencies for institutional investors.

- Coinbase Ventures – Investing in companies that are building the open financial system.

- Coinbase Card – A debit card that enables users to spend crypto and earn crypto rewards.

- Coinbase Borrow – Borrow fiat currency using BTC as collateral.

- Base – Coinbase’s Ethereum Layer 2 network. Base is secured by Ethereum and offers a low-cost, developer-friendly way to build dapps on-chain.

3. Coinbase Currencies and Payment Methods

Coinbase supports numerous coins, including the following:

- Bitcoin (BTC)

- Ethereum (ETH)

- USD Coin (USDC)

- Solana (SOL)

- Dogecoin (DOGE)

- Polkadot (DOT)

- Shiba Inu (SHIB)

- Polygon (MATIC)

- Litecoin (LTC)

- Cosmos (ATOM)

- Chainlink (LINK)

- Uniswap (UNI)

- Bitcoin Cash (BCH)

- Ethereum Classic (ETC)

Payment methods vary slightly depending on your country of residence, but for US customers, Coinbase accepts the following payment methods:

- Bank Account ACH (SEPA in the EU)

- Wire transfer (only for adding cash or withdrawals)

- Debit cards (only for buying tokens or withdrawals)

- Cryptocurrency deposit and withdrawal

- PayPal (for buying tokens, adding cash or withdrawals)

- Apple Pay & Google Pay (only for buying tokens)

- Gift Cards

4. Fees

Over time, Coinbase has become vague about its fee structure, even removing the specific fee amounts from its pricing and fees page.

Although the actual costs may be similar to historical Coinbase fees, you will not know the exact amount charged until the order creation process. This amount varies according to your payment method, the size of the order, and market conditions.

As a rough guide, Coinbase’s old fee schedule included a 1.49% fee for most transactions and 3.99% for bank card purchases.

As for Coinbase Advanced (for actively trading cryptocurrencies), trading fees begin at 0.60% and decrease according to your trading volume, as well as whether you make a “maker” order or a “taker” order.

Fiat deposits and withdrawals via ACH are free, while USD wire deposits and withdrawals have fees of $10 and $25, respectively. SEPA deposits and withdrawals are almost free at €0.15 each. Swift deposits of GPB are free, but £1 for withdrawals

Coinbase Advanced fees can be seen in more detail here.

5. Buying Limits

Once your Coinbase account is set up, you will be able to buy a small amount of Bitcoin until you raise your limit. In order to raise your limits, you will need to do the following:

- Provide and verify your phone number

- Provide and verify your personal information

- Provide and verify your photo ID

If you are a fully verified US resident, you can reach the highest limit, which is currently $25K a day. Limits may also be set depending on the payment method you choose to buy the cryptocurrencies.

6. Supported Countries

Coinbase offers its services in 100+ countries around the globe:

North America

Aruba, Bahamas, Barbados, Bermuda, Canada, Costa Rica, Curaçao, Dominican Republic, El Salvador, Guatemala, Honduras, Jamaica, Mexico, Nicaragua, Panama, Trinidad & Tobago, United States, British Virgin Islands.

South America

Argentina, Brazil, Chile, Colombia, Ecuador, Paraguay, Peru, Uruguay.

Europe

Andorra, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Gibraltar, Greece, Guernsey, Hungary, Iceland, Ireland, Isle of Man, Italy, Jersey, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, Montenegro, Norway. Poland, Portugal, Romania, San Marino, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom.

Asia

Armenia, Bahrain, Brunei Darussalam, Hong Kong, India, Indonesia, Japan, Jordan, Kazakhstan, Kuwait, Kyrgyzstan, Macao, Maldives, Mongolia, Nepal, Oman, Philippines, Singapore, Taiwan, Turkey, Uzbekistan.

Oceania

New Zealand.

Africa

Angola, Benin, Botswana, Cameroon, Ghana, Kenya, Mauritius, Namibia, Rwanda, South Africa, Tunisia, Uganda, and Zambia.

7. Coinbase Customer Support and Public Opinion

Coinbase has a very extensive support page. Most standard requests will probably find an answer there. If you are submitting a support ticket via email, you can expect a response within 48-72 hours (from personal experience).

Coinbase also operates a phone support line, although from the reader feedback we have received, it seems it’s hard to get someone to solve your problem there.

As for the quality of the support, the overall sentiment is negative. Most of the time, the support team won’t dig deep into your issue on their first response, and it is quite common to receive “canned responses” that don’t really address the problem.

Many people in the community complain that Coinbase isn’t really very support-oriented and that, many times, issues aren’t explained to the customer.

Furthermore, BBB rates Coinbase “B+” with the negative remarks being:

- Government action(s) against the business

- Length of time business has taken to respond to complaint(s)

To sum it up, there has been a lot of controversy over Coinbase within the Bitcoin community. If you’re new to Coinbase, this is perhaps the one thing you need to take into account before making your decision to buy cryptocurrency through Coinbase.

Closed or frozen accounts

The most commonly held grudge against Coinbase appears to be the sudden freezing of user accounts or outright closures – often occurring without warning or reason. This may be a somewhat expected outcome from tight compliance with traditional banking laws. However, it can still be a massive pain in the butt when combined with slow and unhelpful customer support.

Coinbase was the first to receive US regulatory approval. As a result, Coinbase has AML (Anti-Money Laundering) and KYC (Know Your Customer) practices much like any regular bank.

Expect Coinbase to track how you spend “their” coins and to summarily shut your account for the following activities:

- Transactions related to adult services.

- Sale or purchase of contraband through darknet markets.

- Other arbitrary reasons which rub their algorithm the wrong way.

As you can see, you can get your Coinbase account shut down rather easily. While you will almost certainly get your money back, it will likely prove to be an inconvenient, frustrating, and potentially costly experience.

Additional criticism

Aside from the above, Coinbase has been the focus of additional criticism, including:

Affiliate reward abuse – Coinbase offers a referral program. However it hasn’t always paid its partners according to what is stated (based on my personal experience).

Taking a stand in Bitcoin debates – There are many “internal debates” within the Bitcoin community that Coinbase voiced its opinion on. Usually, it’s expected from a service to remain neutral in these debates and follow the natural market movements.

Patenting blockchain – Coinbase has a history of filing patents for cryptocurrency-related “innovations,” including “Bitcoin exchange,” “hot wallet for holding Bitcoin,” and “tips button.”

Such patents are obviously not Coinbase innovations and obviously clash with the open-source nature and the philosophy of Bitcoin. Coinbase expects people to trust them and to refrain from using any such patents to block competition.

Frankly, no company, agency, or entity can or should be trusted with legal authority over any aspect of the Bitcoin ecosystem. Bitcoin was designed to obviate the need for such trusted parties.

8. Coinbase vs. Other Exchanges

In the following section, I will compare Coinbase and its trading platform (i.e., Coinbase Advanced) to other trading platforms around.

Coinbase vs. Coinbase Advanced

If you’re new to crypto, then it will probably be easier for you to use Coinbase (i.e., the brokerage service) than Coinbase Advanced (formerly GDAX). As the name suggests, Coinbase Advanced is for more experienced users who know how to handle advanced trading methods.

However, if you are an experienced trader, Coinbase Advanced offers a much cheaper solution with a max 0.6% fee. This fee goes down as your trading volume increases, with the lowest tier being just 0.05%.

Coinbase vs. Gemini

Gemini is a crypto exchange founded by the Winklevoss brothers. Gemini’s fee structure is even more complex than Coinbase, and its overall fees are higher. The starting point for Gemini is 0.35%, whereas Coinbase Pro charges up to 0.6%.

Having said that, you should always check the market exchange rate on both exchanges since there can be some differences.

While most of the time, they are more or less the same, in some cases, price differences can occur, and then the overall price you pay may be cheaper on Gemini (since the lower price compensates for the higher fee). Click here to read our complete Gemini review.

Coinbase vs. Binance

Binance has some fiat-to-crypto options available. This includes deposits and withdrawals via ACH, domestic wire transfers, and debit card transfers. Check Binance’s fees page for complete details.

Binance.US is a crypto-only exchange.

When looking strictly at crypto-to-crypto exchanges, Binance beats the competition with an extremely low fee of 0.1% as opposed to Coinbase Advance fees that reach as high as 0.6%. Binance also offers a wider variety of cryptocurrencies to trade. Click here to read our Binance review.

Coinbase vs. Robinhood

US investors can also use the Robinhood trading app to invest in cryptocurrencies.

Robinhood is available in 48 US states (not Hawaii or Nevada) and claims to have 0% trading fees. However, you will want to be wary of hidden costs via the market spread. In addition to trading cryptocurrencies, Robinhood also allows you to trade traditional stocks.

9. Frequently Asked Questions

If you want to withdraw money from Coinbase, you can do so with the following options:

- To your bank account (via ACH, instant cash-out or wire transfer)

- To your debit card

- To your PayPal account

- To your cryptocurrency wallet (if you’re withdrawing cryptocurrencies)

Withdrawals from Coinbase are usually instant. However, it may take up to 3 days for your bank to process the transfer. Cryptocurrency withdrawals should arrive within the hour (depending on how long it takes the next block to be confirmed).

Coinbase may delay digital currency transactions sent from your Coinbase account if they suspect that you did not authorize the transaction. In this case, you can either:

- Wait 72 hours, and the transaction will go through automatically

- Accelerate the withdrawal by verifying your identity again

In general, Coinbase is considered a very safe place to buy cryptocurrencies.

Yes, you can keep your cryptocurrency on Coinbase. However, I wouldn’t recommend it. It’s always best to keep your crypto assets in a non-custodial wallet (i.e., a wallet where only you hold the private keys). Something like a hardware wallet.

10. Conclusion – Is Coinbase Good to Use?

Coinbase is simple and easy to use. The company has invested a lot of time and money into making their user experience smooth and painless. However, you are not entirely in control of your crypto assets if you leave them in Coinbase. Using Coinbase to purchase crypto for fiat, then moving it off the platform, or selling crypto for fiat and cashing out are the best ways to use Coinbase.

I think Coinbase is currently focused on growth and less on satisfying its existing customer base, which can be seen by the number of negative reviews it receives, and that’s a shame. However, if you don’t encounter any issues, then their prices are fairly competitive.

My personal opinion is this – if possible, use Coinbase to buy cryptocurrencies; that service is solid. However, once you buy your coins, get them the hell out of there to a wallet that you completely control, like a Ledger or TREZOR hardware wallet.

Like others my account is under manual review and has been for several months. I’ve sent the documents required, spoken on chat more than 4 times all of which promised an email escalation which never arrives. Luckily I have very little money in there. DO NOT USE COINBASE

Update 18/04 – Coinbase, via trust pilot, have asked for more information i.e a ticket number. I have never had a ticket number, this is the issue, despite being told 4 times on chat someone will email, last week it had been ‘escalated’ to their specialist team and to wait for an email. There is no way to get your chat history. Joke of a company.

Update 18/04 – I have received the below acknowledgement and in this coinbase notes ‘ we have located your compliance case (reference)’ this is the first email I have had with any existing reference number. I have searched my inbox, spam and deleted. I will update in due course.

CONT@CT vschk dot live for immediate aid

The best option to recover your money after gathering all the proof is by contacting a legitimate recovery company for help.Recommendation is: Contactzattechrecovery @ Gmail com

Investing online nowadays has been a risky move but compared to the nature of stress our present government and bank has been putting my ass through, sometimes I still take that risk. Few months back I took the wrong risk by investing into a fake blockchain platform. I already got used to the blockchain and didn’t quite notice they were imposters. I later contacted Blockchainrecall.com, a group for an online recovery team who helped me track my funds and recover all from scam companies. Thanks to them now I am able to recover my scammed funds and through their help know the right platform online to invest with at best interest.

I was scammed a huge sum of money and decided to contact a recovery company via their email address: dorisashley71 at gmail com they help me recover all my lost funds and profits. They are very honest and reliable with great support to answer your questions 24/7 service. They have good reviews online and they are the best …if you need help with funds recovery you can always get in touch by mail and they can direct you to their recovery website. Everything about them is legit, their English is good ,I highly recommend them due to my experience and have finally got my $25,350 back. I’m so happy.

The thought of losing your Bitcoin or any digital asset can be overwhelming and confusing. It’s like losing a treasure chest with immense potential for financial growth. However,

(TRADESREFUNDS COM) understands this perplexity and offers a solution that brings hope into the equation. When I first discovered

it was like finding a light at the end of a dark tunnel. Their comprehensive range of services, specifically tailored to help individuals recover lost bitcoin, caught my attention. With their expertise and track record of successful recoveries, I felt reassured that I was in capable hands.

approach is characterized by bustiness, providing quick and effective solutions, mitigating the continuous crypto scam and bringing to bear these perpetual scammers. Thanks again

my 3.9 BTC without any kind of hiccup.

In 2023, amidst the global uncertainty, I entrusted a significant portion of my savings an investment company that promised substantial returns. The initial months were promising, and I dreamed of financial freedom for my family. However, as the year unfolded, my dreams turned into a nightmare. The investment that was supposed to be my safety net vanished into thin air due to unforeseen market dynamics and mismanagement by the investment company.

Feeling betrayed and helpless, I was on the brink of giving up. The loss was not just monetary; it was a blow to my confidence and future plans. It was during this darkest hour that I stumbled upon a group of recovery experts. Skeptical yet desperate, I reached out to them via Regainranger @ gmail . com, clinging to the last strand of hope.

To my astonishment, this decision marked the turning point in my life. The experts at the recovery firm were not just professionals; they were compassionate individuals who understood my anguish. They worked tirelessly, navigating through complex recovery processes and, against all odds, managed to reclaim my lost funds.

This experience taught me resilience and the importance of seeking help from the right people. If you find yourself in a situation similar to mine, don’t lose hope. Reach out to the recovery experts at Regainranger @ gmail . com . Let them guide you from despair to hope, as they did for me.

Don’t let financial loss be the end of your story. Contact the recovery experts today, and take the first step towards reclaiming not just your funds, but also your peace of mind and confidence in the future.