BitMEX Exchange Review and Comparison

By: Alexander Reed | Last updated: 12/21/23

Bitcoin Mercantile Exchange, or BitMEX, was founded in 2014 and is a cryptocurrency exchange that is best known for its derivatives products and high leverage. It now also offers spot trading and other services. This review will cover these products and services and some of the platform’s pros and cons.

BitMEX Review Summary

BitMEX is a cryptocurrency exchange focusing primarily on derivatives products. It allows users to speculate on the price of cryptos with high leverage. Although it also provides spot markets, the range of supported assets is currently small compared to competitors.

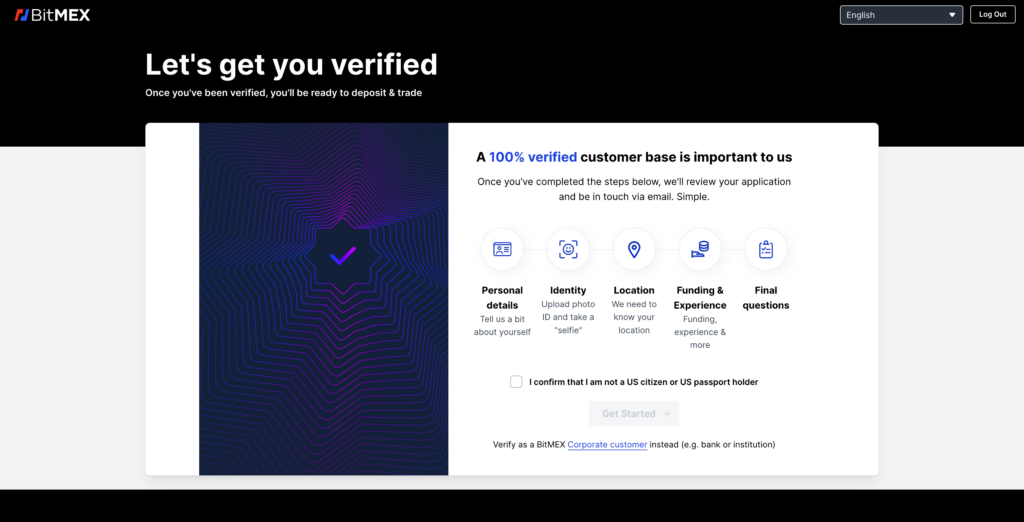

Whereas the exchange used to be non-KYC (not requiring users to verify their identity), it now enforces compulsory identity verification. See more in their blog article here. That’s BitMEX in a nutshell. If you want a more detailed review, keep on reading. Here’s what I’ll cover:

- BitMEX Overview

- BitMEX Services

- Currencies and Payment Methods

- BitMEX Fees

- Supported Countries

- Customer Support and Reviews

- BitMEX vs. The Competition

- Frequently Asked Questions

- Conclusion – Is BitMEX Legit?

1. BitMEX Overview

BitMEX was created by a selection of finance, trading, and web development experts. Arthur Hayes, Ben Delo, and Samuel Reed launched the exchange in 2014 under their company HDR (Hayes, Delo, Reed) Global Trading Ltd. It is currently registered in Seychelles.

The exchange became most popular for its derivatives products – most notably its Bitcoin perpetual swaps, collateralized with Bitcoin and accompanied by up to 100x leverage.

In October 2020, all three founders were indicted on charges of violating the U.S. Bank Secrecy Act and conspiracy to violate the law by failing to put in place the necessary anti-money laundering measures. All three pleaded guilty to the charges and agreed to pay $10 million each as criminal fines.

In May 2022, BitMEX expanded its platform to include spot trading services in an effort to compete with major competitors such as Binance and the former exchange FTX.

2. BitMEX Services

Derivatives Trading

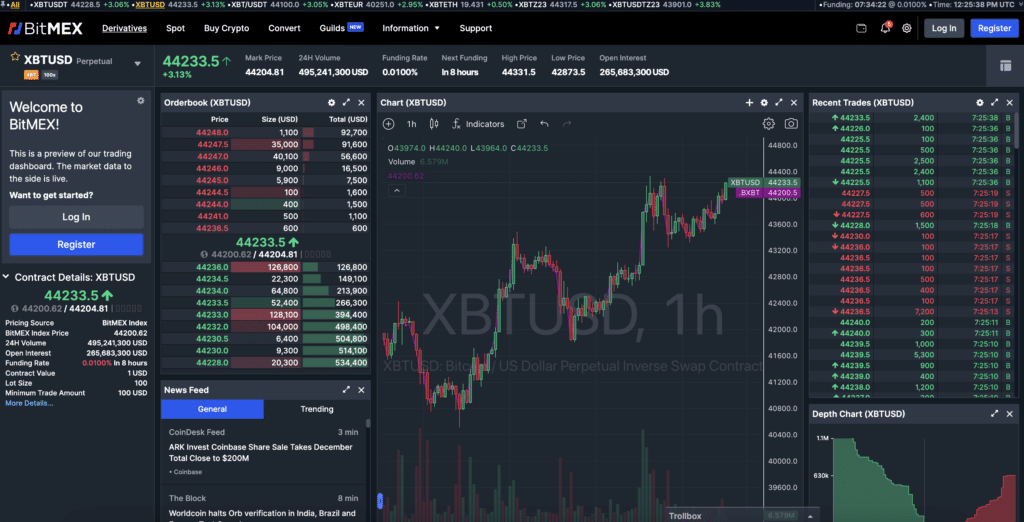

Derivative products are BitMEX’s claim to fame, featuring both perpetual swap contracts and quarterly futures contracts. These don’t involve directly trading cryptocurrencies; rather, you trade contracts that track the price of a certain cryptocurrency asset.

Perpetual swaps are the most popular product on the exchange. They provide traders with contracts that track the price of the underlying crypto asset with no expiry. These are available for a range of different cryptocurrencies, with up to 100x leverage on some contracts.

BitMEX also offers more standard futures contracts, which are settled on a quarterly basis. These have specific expiry dates, at which all open positions are automatically settled at the underlying asset’s market price.

All derivatives contracts on BitMEX are collateralized and settled in BTC or USDT, depending on the instrument at hand.

This type of trading is very volatile, for better and for worse. It means you can generate large profits with small amounts of money but also lose everything you’ve invested relatively quickly.

If all this sounds very confusing to you, it probably means you shouldn’t use BitMEX since this type of leveraged derivative trading is aimed mostly at experienced traders.

Spot Trading

In May 2022, BitMEX added a spot trading feature to the platform for the first time, enabling users to buy and sell cryptocurrencies rather than just speculate on their prices.

Spot trading on BitMEX is still limited to a handful of popular cryptocurrencies currently in USDT trading pairs. Two different interfaces are available for traders on the platform:

- The default spot trading interface has candlestick charts, order books, and a complete advanced trading experience.

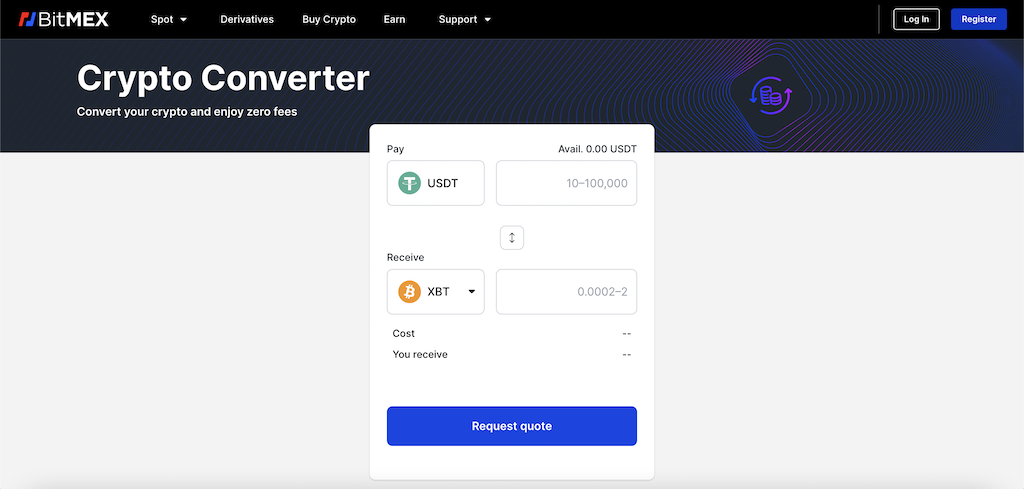

- A “convert” interface allows users to swap between any two supported cryptocurrencies at the going market rate. The convert feature is simple and beginner-friendly, with none of the advanced exchange features from the default spot trading interface.

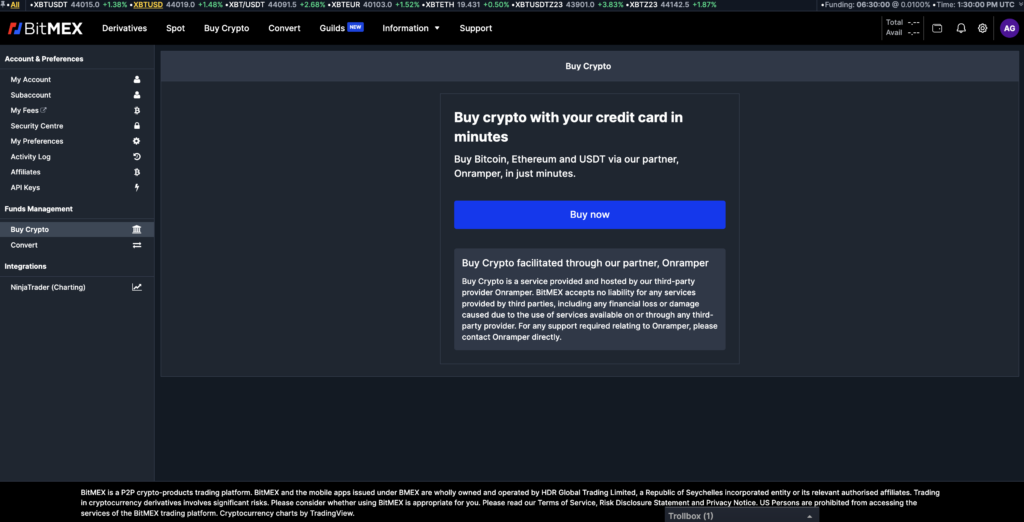

Instant Crypto Purchases

To complement its spot trading features, BitMEX has also added an instant purchase option that provides users with a fiat gateway onto the platform.

This feature is facilitated by third-party payment processors OnRamper, Banxa, and Mercuryo. All allow customers to purchase cryptocurrency using any Mastercard or Visa bank card. Bank transfer and Apple Pay options are also available through these providers.

BitMEX Mobile App

BitMEX also has a mobile app available for Apple and Google Play that provides wallet and portfolio management. Users can view their balance, history, transactions, and withdrawals. Trade spots and derivatives and monitor real-time markets directly on your phone. Get the BitMEX app here.

3. Currencies and Payment Methods

Derivatives

BitMEX derivative instruments allow users to go long or short on 45+ different pairs. BitMEX does not charge fees on Bitcoin deposits; deposits of Ether, Tether, and other ERC-20 coins are also free.

This means that to trade perpetual swaps or futures contracts on the platform, you will have to fund your account with one of these cryptocurrencies – swap inside the platform – and then begin speculating.

On the other hand, BitMEX provides derivatives instruments tracking the price of several assets, including:

- Bitcoin (BTC)

- Ethereum (ETH)

- Cardano (ADA)

- Chainlink (LINK)

- XRP (XRP)

- Avalanche (AVAX)

- Bitcoin Cash (BCH)

- Binance Coin (BNB)

- Dogecoin (DOGE)

- Polkadot (DOT)

- Litecoin (LTC)

- Shiba Inu (SHIBA)

- Solana (SOL)

- Tron (TRX)

Spot Trading

Fewer markets are currently available on BitMEX’s spot trading markets. However, the platform intends to list more assets as time goes on. Assets currently supported for spot trading include:

- Bitcoin (BTC)

- Ethereum (ETH)

- ApeCoin (APE)

- Axie Infinity (AXS)

- Chainlink (LINK)

- Polygon (MATIC)

- Uniswap (UNI)

- Solana (SOL)

- Tron (TRX)

Fiat Gateway

As mentioned above, BitMEX also offers a minor fiat gateway that facilitates instant crypto purchases using fiat currency. This feature is not handled by BitMEX itself but rather by third-party payment processors. BitMEX does not accept transfers or deposits.

Users are able to fund their BitMEX accounts by purchasing cryptocurrency through one of BitMEX’s trusted third-party partners.

4. BitMEX Fees

Derivatives

BitMEX‘s fees are very competitive, and their fee schedule is very detailed and elaborate. In fact, most users will find them almost negligible relative to the chunky profits to be made if you’re a savvy operator.

The taker fees start at 0.075% and decrease as your 30-day trading volume increases; the highest volume traders only get charged 0.0175% on trades. Makers get a rebate the higher the trader volume goes.

It is also important to consider the funding rate on perpetual swap contracts, a variable fee (or rebate) designed to keep the contract price in line with the underlying asset. This can be positive or negative depending on whether you have taken a long or short position and whether the contract price is above or below the spot price of the underlying asset.

Again, be sure to check out the full fee schedule for derivatives products here.

Spot Trading

Spot trading fees begin at 0.075% for takers and -0.025% for makers, which is highly competitive. These fees decrease for users with higher trading volumes and can reach as low as 0.03% for taker orders and 0.00% for maker orders for traders in the highest volume bracket.

Fees can be reduced further for BMEX token stakers, depending on the quantity of BMEX staked.

A complete overview of spot trading fees can be viewed here.

Deposits and Withdrawals

BitMEX does not charge fees on withdrawals on Bitcoin. When withdrawing Bitcoin, the minimum Bitcoin network fee is set dynamically based on blockchain load and can be viewed on the Withdrawal Page.

BitMEX does charge fees on Ether and Tether withdrawals. The withdrawal fee of Tether can be viewed on the Withdrawal Page.

5. Supported Countries

BitMEX itself is a registered company in the Republic of Seychelles. It’s a worldwide service except for the following countries:

- United States of America

- Natural or legal persons located in, established (respectively) in, or a citizen (where applicable) of Cuba, Iran, Syria, North Korea, Crimea and Sevastopol, Donetsk People’s Republic, Luhansk People’s Republic of Ukraine, Kherson Oblast and Zaporizhzhia Oblast (altogether, “Sanctioned Jurisdictions”).

- Natural or legal persons, resident or established (respectively), in Seychelles, Bermuda, Japan, Hong Kong SAR (in respect of spot and derivatives only), and Canada (altogether, “Restricted Jurisdictions”).

- Russian citizens or residents, including such person trading on behalf of any legal persons, who access our Services from the European Union, unless such customers are residents in the European Union or Switzerland, or dual citizens of the European Union or Switzerland and reside outside Russia.

- Legal persons located in, or established in, Russia, whose authorized persons access our Services from the European Union.

The exchange doesn’t limit access to any locations because it does not handle fiat currency deposits or trading pairs. Local laws may affect your use of the service, but this is out of the exchange’s control. If you are located in one of the aforementioned sanctioned countries, use BitMEX at your own risk.

6. Customer Support and Reviews

Customer support

Support is offered via an email ticket and live chat support, which is pretty standard for the industry. Testing this earlier, I was able to get ahold of an agent in under 20 seconds by just providing my email address in the live chat. I received a chat transcript shortly after our conversation. It’s worth mentioning that I received this support without being a member or user of BitMEX.

Simple inquiries and issues can be resolved by BitMEX staff in the “Trollbox,” a public chatbox where traders can also chat with each other. While this may not be a direct line to BitMEX, it’s still really cool to be able to interact with other Bitcoin traders from within the exchange.

Aside from email tickets and the “Trollbo,” you can also contact BitMEX using their Twitter, Telegram Channel, or through their Discord server, which has a dedicated support channel. The service’s really nice aspect is the website, which is packed full of useful information and features. The support center gives a slick rundown of the exchange and helps educate users on complex trades.

Live updates fill the site too. An announcement box keeps users up to date with any updates and issues.

Security information is loaded into the website, which is always a must for me when I’m looking at a new exchange. With BitMEX, you can quickly discover who owns the platform and how they keep funds secure.

Multisig withdrawals that only partners can sign, cold storage, and Amazon Web Services are the highlights when it comes to security.

Reviews

No horror stories have offered themselves despite a decent hunt. Reddit and similar forums tend to be more filled with technical questions and chatter.

7. BitMEX vs. Bitfinex and other competitors

BitMEX isn’t the only exchange built around supplying futures trading options. Exchanges like Bitfinex and OKCoin are considered worthy alternatives. However, there are some differences between these exchanges and BitMEX.

Here they are in a nutshell:

- BitMEX allows higher leverage with a lower margin and a smaller minimum contract amount.

- BitMEX uses the underlying index price for purposes of margin calculations, not the last traded price. This means that a malicious trader cannot manipulate the order book and cause erroneous liquidations.

- BitMEX allows customers to select the leverage they desire via the Leverage Slider or edit it manually even while in a position.

Binance Futures is now the next closest competitor to BitMEX, featuring up to 125x leverage and similar trading features.

For a detailed review of BitMEX and its competition, read this post.

8. Frequently Asked Questions

Can US Customers Use BitMEX?

BitMEX states they do not accept US traders in their terms of service. BitMEX recently updated its terms and conditions, so they require all customers to provide a photo ID, proof of address, and a selfie.

Is BitMEX a Legal Company?

Yes. BitMEX is wholly owned by HDR Global Trading Limited. The company was incorporated under the International Business Companies Act of 1994 of the Republic of Seychelles with a company number of 148707. It is worth noting, however, that whilst the company is legal and registered, the exchange itself is unregulated, and its founders have been found guilty of violating the Bank Secrecy Act in the US in February 2022.

Is BitMEX a Secure Platform for Trading Cryptocurrencies?

BitMEX’s positions and margins are checked multiple times a minute, with balances cross-checked against on-chain records every 10 minutes. Bugs, flaws, or intrusions that cause positions not to match will immediately halt our exchange.

Furthermore, BitMEX’s Bitcoin custody involves multi-signature wallets with a set of private keys that control access to the BitMEX public address. A quorum of signers is randomly nominated and required to sign before any transfer occurs. No private keys are kept on any cloud server, and even in the event of a full system compromise, there would not be enough private keys available to an attacker to steal funds that are held and protected by BitMEX.

9. Conclusion: Is BitMEX Legit?

If you know what you’re doing and want a market-leading cryptocurrency derivatives trading platform, then BitMEX is a great choice for you. For those looking for a simpler exchange to buy and sell some Bitcoin, I suggest you look into other more user-friendly options.

The BitMEX team has used their financial and web development experience to create a slick platform that allows smooth trading while keeping users informed.

Live update features, such as the announcement tab and the live chat function, provide that little extra bonus in making sure you never miss out on crucial news. The fees round things off to make the exchange an attractive all-around package.

Have you had any experience with BitMEX? I’d love to hear about it in the comments section below.

Transparent operation

This is not the case.

On the first sight, bitmex is a great trading platform. But things get wacky if you look closely.

Once you try to start trading seriously, you will recognice that there are lots of shady things.

The system is often overloaded during critical moments. As a result, you cannot create or cancel orders. So if bitmex decides they need cash, they manipulate the market in one direction, deactivate trading except for thir dedicated profit trading desk (which trades against their customers) and crush you.

What can you do? Nothing.

If you now think, this might happen once or twice a day, your wrong.

While we were trading, there were hundreds of situations where the system was overloaded and sometimes for multiple minutes.

Stay away, unless you plan to go long or short for a long duration (hours or days).

Hey, thanks for your comment. Note that due to cache, you probably have not seen your comment right away, but it was approved and not deleted.

Stay away from Bitmex. You WILL be Liquidated and LOSE ALL your ASSETS. They are laughing and taking EVERYONES money. PERIOD. Use ANY other exchange and DO NOT EVER USE MORE THAN 10x Leverage! YOU WILL BE LIQUIDATED 100% AND LOSE 100% OF YOUR MONEY.

you are looser

I have similar experience with bitmex, you need at the very minimum 130 usd or so in stop loss distance to btc price, otherwise most of the time the price will simply dive towards your stop loss price. This is possible only with huge fake volumen, as my contract size is rather small. this is not just that “they know where the stops are placed”, its often happening as you put your stop loss order. During the night us/eu time where traders are not awake to buy into their stop loss hunts, i had a position taken out more then 130 usd to the dollar almost. Only to bounce back up to the exact price of the evening.

Other things they do is disable their exchange to you cant market buy into btc dumps or pumps.

When your position is close to be liquidated, IF they didnt shut down market trading, i tried to liquidate part of the position with a market order, but before you have time to adjust the margin, they stop run your position, and not only this, but with a market buy/sell often much beyond the price peak. I got mine executed more than 50 dollars beyound what the price had listed.

Another thing they do is run stoplosses just before the price is about to reverse. Very simply put, the bots give up to drive price lower/higher, and bitmex simply executes the liquidations at that point.

Total fraud. The exchange is working but dont trade with higher leverage than 10 or so, as the exchange is designed to hunt your stops.

Hey Shawn,

Thanks for sharing your experiences.

Personally, I don’t think it’s wise to use any leverage at all when trading an asset as volatile as Bitcoin. As far as I’m concerned, such positions are only useful for hedging (or advanced option plays).

I haven’t used Bitmex myself so can’t really comment on what goes on in their order book. A stop loss $130 from your position does seem highly likely to get hit though, given Bitcoin’s high volatility. That’s less than a 2% move from the current price…

Bitmex.com is an absolute fraud. I plead with the admin of this site to take another look and update his review.

First of all it is obvious that most of the volume is fake, generated by bitmex itself. There are only about 8K-10K people online and they claim they generate 5 billion dollars in volume every day, which is a complete lie to keep suckers coming in.

Second, you will get liquidated, and they will take your money. What bitmex does is they open the opposite position as you. So if you go long, they will open a short. And since they see every customer’s liquidation price and stop price, AND they can move their mark price as they please, AND they are unregulated, they very often do so to hit your liquidation price and bankrupt your account.

Third, when you get liquidated, YOU LOSE MUCH MORE THAN THEY TELL YOU. They say that’s because of “risk” to their platform, which is nonsense. If you leverage 10x, you will lose when price falls just 5%, not 10%!

The only thing Bitmex is good at is FOOLING people. Their CEO went on CNBC to talk to completely clueless anchors, and now people think they are legitimate. PLEASE DO YOUR RESEARCH – THIS IS A FRAUDULENT COMPANY.

THEY REFUSE TO ACCEPT US PEOPLE so that they do not have to deal with US LAW. If they had accepted US people, THEY WOULD BE SHUT DOWN AND INCARCERATED immediately given the fraudulent operation they are running.

People are just getting the hang of this and the true nature of the scam that Bitmex is running. PLEASE SPEAK UP if you have been a victim of this scam.

can any one tell me the procedure how to trade with bot on bitmex

Hey yusuf,

Well, you’ll need to sign up to the exchange, fund your account, figure out their API, test then select a bot, input the correct BitMex API commands into the bot, run it while monitoring until you’re certain it can be left to function alone… That should do it.

Easier said than done of course. It will take quite some time to test and select the proper bot. You should go through every line of its code and ensure you know what it all does. There have been people who’ve been scammed by bots so be careful.

hey Steven ,

i have a coustom made indicator of my on trading view, how can i use my custom maded indicator on bitmex on bot and can i use autoview bot for bitmex? please help me by replying me

thanks.

Hi Yusuf,

Well, you’d have to examine the PineScript for your custom TV indicator and translate that logic into code the bot can understand. I guess that would depend what language your bot is built in…

If you get the bot working right, then it should be able to execute trades via BitMEX’s API, based on trading signals from your indicator.

Sounds to me like you might need to hire a coder for this work, if you’re not one yourself. In theory though, it’s straight-forward.

I don’t know about Autoview bot, sorry. I haven’t investigated crypto trading bots in any detail.

Look at scavengerbot.io they charge 15% of profit billed weekly. Just a tip don’t withdraw, deposit, or trade manually once you set it up. Just set it and forget it for a few months and shut it down and pull your btc out. Then destroy the bots and setup a new one. It averages about 1% per day with the 0.2btc deposit. Well worth it if you got some btc to put in. I have been in the open beta since the beginning I was running cryptohopper but it cost $100 per month for the best account and you got to watch everytime the market shifts to much watching to make it worth it in my opinion. I really like the results of scavenger and I don’t have to watch it every day! I like the pay when you make profit model better 😀 but read about it and talk to them on discord they are very helpful it’s the best bot in my opinion but research for your self. Good luck👍 oh and if you are in the USA always use a VPN!!! When connecting to bitmex unless you want to loose your btc. I wouldn’t leave too much btc on bitmex I don’t trust them myself to have a large balance, I really don’t trust any exchange you shouldn’t leave too much on any of them. Being in the US.S.A makes everything even more scary but I am stuck here for many more years yet before I can leave so I make the best of it Lol. Just protect yourself and always use a VPN or multiple ones like I do and keep your large funds in a hardware wallet that you control.