8 Ways to Buy Bitcoin with a Debit Card

By: Alexander Reed | Last updated: 2/20/24

Buying Bitcoin with a debit card has become relatively easy in the past few years with the introduction of anti-fraud systems for Bitcoin exchanges. However, these systems are quite expensive to operate, and therefore, exchanges will usually charge a premium for buying Bitcoin with a debit card.

Buying Bitcoin with a Debit Card Summary

The fastest way to buy Bitcoin with a debit card would be through CEX.IO. Here are the steps:

- Visit CEX.IO

- Decide on a deposit amount

- Complete the ID verification process

- Enter your Bitcoin address

- Complete the payment with your debit card

If you’re looking for additional options, here’s a complete list of exchanges that allow Bitcoin purchases with a debit card.

If you want a summarized review of each exchange with its pros and cons, keep on reading. Here’s what I’ll cover:

- Where Can I Buy Bitcoin with a Debit Card?

- Coinmama

- Bitstamp

- CEX.IO

- Coinbase

- Bitpanda

- eToro

- Coingate

- Guardarian

- Conclusion – Is it Safe to Buy Bitcoin with a Debit Card?

1. Where Can I Buy Bitcoin with a Debit Card?

Using your debit card to purchase Bitcoin hasn’t always been as easy as it sounds. Some exchanges are afraid of fraud and, therefore, don’t accept debit cards. However, many exchanges have started implementing services to detect fraud and are more open to credit and debit card purchases these days.

As a rule of thumb, an exchange that accepts credit cards will also accept a debit card. If you’re not sure about a specific exchange, you can just Google its name + “payment methods,” and you’ll usually land on a review covering what payment method this exchange accepts.

2. Coinmama

Pros: Good support, fast turnaround, respectable company

Cons: Certain US states not supported (New York, Hawaii, Louisiana)

Coinmama supplies an easy way to buy Bitcoin with a debit card while charging a premium. The company has been around since 2013 and supplies a wide variety of cryptocurrencies aside from Bitcoin. Recently, the company has improved its customer support substantially and has one of the fastest turnarounds for buying Bitcoin in the industry.

Visit Coinmama Read reviewBuying Bitcoin with a debit card through Coinmama

- Visit Coinmama and choose the amount of Bitcoin you want to buy

- Sign up on the site and verify your identity

- Get a Bitcoin wallet and an address (Coinmama does not hold Bitcoin for you)

- Supply Coinmama with your Bitcoin address

- Complete debit card information

- Coins will be sent instantly

3. Bitstamp

Pros: One of the oldest and most reputable exchanges around; good support

Cons: Not very user-friendly; verification process can take a while

Bitstamp is a fully licensed Bitcoin exchange that has been around since 2011. The website provides mainly trading services. However, they also have a brokerage option for buying Bitcoin directly with your debit card.

To finish your order, you have to use 3D Secure. The exchange is open mostly to the US, EU, and Asia, with a total of around 80 countries currently supported.

Visit Bitstamp Read reviewBuying Bitcoin with a debit card through Bitstamp

- Go to the Bitstamp deposit page and select “card purchase” from the side menu

- Pick which cryptocurrency you want to buy

- Choose a currency to pay with

- Enter how much cryptocurrency you want to purchase

- Enter your card details

- Confirm the purchase

4. CEX.IO

Pros: Reputable company, high buying limits

Cons: Support sometimes slow, relatively high exchange rate

CEX.IO supplies trading services and brokerage services (i.e., buying Bitcoin for you). If you’re just starting out, you may want to use the brokerage service and pay a higher fee. However, if you know your way around exchanges, you can always just deposit money through your debit card and then buy Bitcoin on the company’s trading platform with a much lower fee.

Visit CEX.IO Read reviewBuying Bitcoin with a debit card through CEX.IO

- Visit CEX.IO and sign up

- Go to “Finance” -> “Deposit” (make sure to select your own currency)

- Use your debit card to fund your account

- If you want to use the easy but expensive brokerage service, go to “buy/sell”

- If you want to use the complex but cheap service, go to “trade” and choose BTC/USD (or any other currency)

5. Coinbase

Pros: User-friendly interface, relatively low fees, established reputation

Cons: Support is slow to respond

Note: credit card purchases are not available for US customers.

Coinbase no longer has a clear fee structure for debit card purchases, but you can double-check what you’re being charged during the final steps of a conversion. Keep in mind you will need to upload a government-issued ID in order to prove your identity before being able to buy the coins.

Buying Bitcoin with a debit card through Coinbase

- Create a Coinbase account

- Go to “settings” – “payment methods” and click “add payment method”

- Add your debit card

- Confirm your debit card

- Go to “buy/sell” and select the amount of Bitcoin you want to buy

6. Bitpanda

Pros: Low fees, intuitive interface, multiple payment options

Cons: Better suited for EU customers

Bitpanda was founded in October 2014, and it allows residents of the EU (and a handful of other countries) to buy Bitcoin, other cryptocurrencies, stocks, and precious metals through a variety of payment methods (Neteller, Skrill, SEPA, etc.). The daily limit for verified accounts is €2,500 (€300,000 monthly, or €5,000,000 total) for debit card purchases.

You can deposit nine major fiat currencies at Bitpanda: the Euro, US dollar, Swiss franc, British pound, Swedish krona, Hungarian forint, Czech koruna, Polish zloty, and Danish krone.

There are no fees for depositing Swedish krona (SEK) via Visa or Mastercard.

The minimum deposit and withdrawal amount is 10 EUR.

Visit Bitpanda Read reviewBuying Bitcoin with a debit card through Bitpanda

- Visit Bitpanda and sign up

- Verify your identity

- Choose a cryptocurrency (e.g., Bitcoin) and click “Buy”

- Choose the “Visa/Mastercard” payment method

- Enter the amount you wish to buy

- Click on “Next step”

- Confirm your order

7. eToro

**Content does not apply to US users

Pros: Suitable for beginners, great support

Cons: Limited countries available, long process to withdraw your coins

If you’re into Bitcoin (or any other cryptocurrency) just for price speculation, then the easiest and cheapest option to buy Bitcoin may be through eToro. eToro supplies a variety of crypto services, such as a trading platform, a cryptocurrency mobile wallet, an exchange, and CFD products.

When you buy Bitcoin through eToro, you’ll need to wait and go through several steps to withdraw them to your own wallet. So, if you’re looking to actually hold Bitcoin in your wallet for payment or just for a long-term investment, this method may not be suited for you.

Visit eToro Read reviewImportant!

eToro disclaimer: This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU protections & not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

CFDs are not available to US customers.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn moreCrypto assets are highly volatile, unregulated investment products. No EU investor protection.

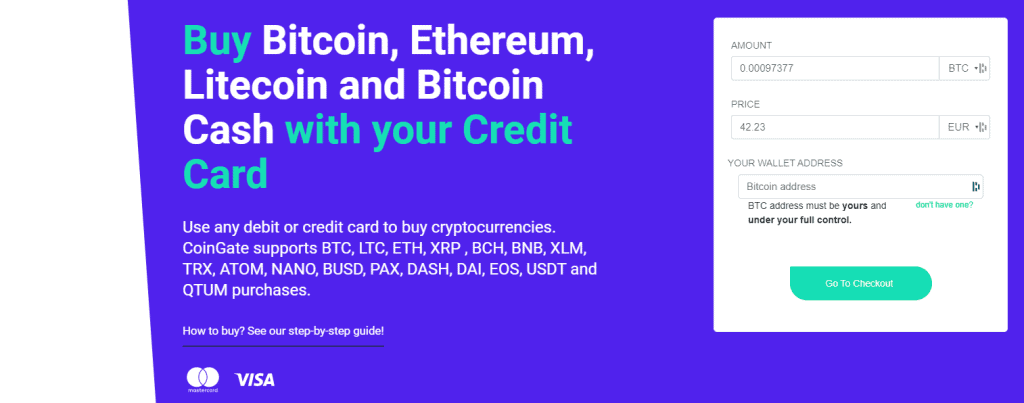

8. CoinGate

Pros: Non-custodial, friendly UI

Cons: Intensive KYC, relatively high fees, many countries not supported

CoinGate is a Lithuania-based crypto exchange and payments processor that allows users to buy Bitcoin and other cryptocurrencies with their debit card or other payment options.

CoinGate offers a non-custodial service, which means that when making a purchase, users will receive the coins directly in their wallet. Card purchases incur an 8% fee. Most crypto purchases on CoinGate are fulfilled by Simplex or Paybis – two very well-known crypto payments processors.

Visit Coingate Read reviewBuying Bitcoin with a debit card through CoinGate

- Visit CoinGate

- Enter the amount of BTC you wish to buy + your BTC address

- Enter your card details

- Verify your identity

- Submit payment

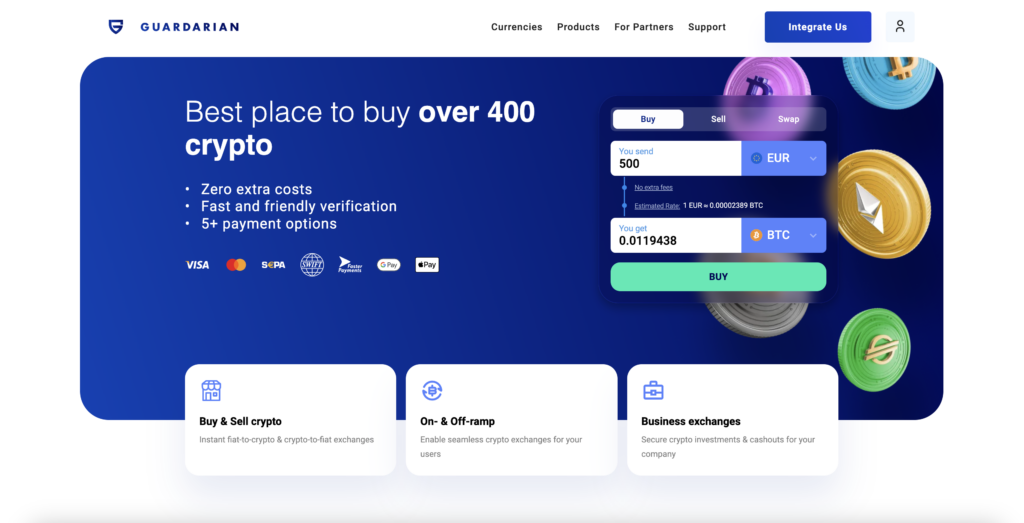

9. Guardarian

Pros: Easy to use, non-custodial

Cons: Purchases sometimes declined (but refunded)

Guardarian is a useful fiat on-ramp that allows users to buy Bitcoin with several payment methods, including a debit card. The platform has been around since 2017 and supports Bitcoin and over 400 other cryptocurrencies.

Guardarian has a very straightforward user interface and is non-custodial, so they send the coins straight to your wallet. The standard rate for exchange fees is somewhat unclear. However, the platform will tell you exactly how much crypto you’re getting before you go ahead with the purchase.

The service is available worldwide and focused on the EU, with a handful of countries and US states excluded.

Buying Bitcoin with a debit card through Guardarian

- Visit the Guardarian website

- Enter the amount of BTC you wish to buy + your payment currency

- Select your payment method

- Enter your BTC address

- Verify your identity

- Enter card details + submit payment

10. Conclusion – Is it Safe to Buy Bitcoin with a Debit Card?

As long as you’re using a trusted exchange, using your debit card to buy Bitcoin is perfectly safe. The main thing I would advise is not to keep the Bitcoin on the exchange after you buy it but to move it to your own Bitcoin wallet.

Keep in mind that using your debit card may be convenient, but it’s also more expensive. If you’re buying a relatively large amount of coins and you have the option, I suggest always using a bank transfer. However, if the amount isn’t that big, sometimes paying the extra 3%-5% is worth the time saved.

If you have any questions or comments about the process, feel free to leave them in the comment section below.

Again, one more useful article. Thank you for the valuable info!

Great article.. but please as of today 25th of August… which are the best exchanges to buy btc from in the United States using a debit card…

Also, is it possible to buy btc with a registered prepaid card here in the United States? If so please what are the best exchanges for this here in the United States, Michigan to be precise?

Please a trusted response will be more than appreciated… ASAP

Hi Josh,

As far as I know, all these exchange will work for what you want to do. I would say just choose from these options based on the pros and cons, it’s hard to go wrong as they’ll all work.

How can i get to know about this

Get your s….t together with these dumb ass blogs with fake information…

U claim one of these sites actually asks to verify information to verify identity… ?

Every single fuking site here asks for that…

sending people to create accounts thinking they dont ask for identity checks and yet they do

stop wasting space on the web with a crappy website with non credible information already

what a joke people actually read this ..

Hey, if you want to buy bitcoin without verification, it is possible. You might want to read this article instead if you want to buy Bitcoin without an ID: https://99bitcoins.com/buy-bitcoin/anonymously-without-id/. If you have read the article you can see that we have clearly articulated that buying Bitcoin with a debit card involves an ID verification in most cases.

Is here any site where we buy crypto without OTP

Hi Jamil K,

Due to regulatory requirements, most cryptocurrency exchanges require one-time passwords (OTPs) for transactions to enhance security and prevent unauthorized access. OTPs serve as an additional layer of protection by requiring users to enter a unique code sent to their registered phone number or email address before completing a transaction.

However, there are a few platforms that allow users to buy cryptocurrency without OTP verification. These platforms typically operate in jurisdictions with less stringent regulations or cater to users who prefer a more streamlined buying process. It’s important to note that using these platforms may come with increased security risks, as they may not have the same level of safeguards as regulated exchanges.

Here are a few updated examples of platforms that allow users to buy cryptocurrency without OTP:

– Changelly: Changelly is a non-custodial exchange that allows users to instantly swap cryptocurrency without creating an account. OTP verification is not required for small transactions, but it may be necessary for larger amounts.

– MoonPay: MoonPay is a cryptocurrency payment gateway that allows users to buy crypto using various payment methods, including credit cards, debit cards, and bank transfers. OTP verification is not required for transactions under a certain amount, but it may be necessary for larger amounts.

– Paxful: Paxful is a peer-to-peer (P2P) marketplace where users can directly buy and sell cryptocurrency from each other. While OTP verification is not strictly required, some sellers may request it as an additional security measure.

– QuickSwap: QuickSwap is a decentralized exchange (DEX) that allows users to swap cryptocurrency without creating an account or going through KYC/AML procedures. However, it’s important to note that DEXs are generally less user-friendly and may have lower liquidity than centralized exchanges.

– AtomicDEX: AtomicDEX is another decentralized exchange that allows users to swap cryptocurrency directly with other users without the need for intermediaries. Similar to QuickSwap, AtomicDEX may not be as user-friendly as centralized exchanges and may have lower liquidity.

As with any platform that allows cryptocurrency purchases without OTP verification, it’s crucial to exercise caution and conduct thorough research to understand the risks involved. Prioritize security and choose platforms with a proven track record and reputation.

hello

Good afternoon, colleagues. I want to ask why there are no services in the ratings say there are not from the TOP10 of the market? There are many services that are aimed at serving customers in emerging markets, such as the CIS countries, Africa and others. I am one of the founders of the largest service in the CIS. In our industry there are many services that are not inferior to the largest in terms of speed, safety, manufacturability.

Dennis, I wish you wouldn’t use abbreviations or acronyms. What is “CIS”? And what is the name of the largest service in the CIS? Thank you.

Coinbase does not support debit from Bank of America, chase, Wells Fargo and a few others. They also unverify inactive accounts, so you have to resubmit ID and wait weeks… They’re the product of “regulation”… If you’re into any crypto, consider human to human trade and not through any institution.