eToro Review – A Complete Beginner’s Guide

By: Alexander Reed | Last updated: 2/21/24

eToro is a digital global trading platform for currencies, cryptocurrencies, commodities, indexes, and stocks. It currently has over 20 million users worldwide. Taking an angle on cryptocurrencies, in this review, I’ll take a hands-on look at the eToro platform and its pros and cons.

Note: This content is not intended for US residents and is not authored by eToro USA LLC or a US affiliate. Also, this review will focus on eToro’s trading platform. For a complete review of eToro’s cryptocurrency exchange, eToroX, read this post.

Don’t Like to Read? Watch Our 2-Minute eToro Review

eToro Review Summary

eToro is a pioneering trading company that puts an emphasis on cryptocurrency. It supplies users with an easy-to-use trading platform for investing in cryptocurrencies, which pairs easily with their mobile wallet for swapping, sending, and receiving coins.

The company does a great job allowing people to invest easily in Bitcoin and a variety of other leading cryptocurrencies, with a variety of payment methods. Having said that, eToro is recommended mostly for crypto speculation, as the option to withdraw your crypto assets to your private wallet is still not as straightforward as with other trading platforms.

That’s eToro in a nutshell. If you want a more detailed review of eToro, keep on reading. Here’s what I’ll cover:

- eToro Overview

- eToro Services

- Currencies and Payment Methods Supported

- eToro Fees

- Supported Countries

- Customer Support and Reviews

- My Personal eToro Experience

- Frequently Asked Questions

- Conclusion

1. eToro Overview

In operation since 2007, eToro’s service enables users to trade almost anything in one platform. Branded as a social investment network, it combines a modern trading system with the ability to interact with other users.

CEO Yoni Assia wants the platform to disrupt the outdated banking system and help usher in a new digital financial age. If you’re investing in cryptocurrencies, then there are probably some ideals to be matched in this respect. eToro enables the trading of cryptocurrencies but only allows the withdrawal of a select number of cryptocurrencies through a secondary wallet app.

The company went through many different cycles, the most recent one being the introduction of eToroX – a fully regulated cryptocurrency exchange.

2. eToro Services

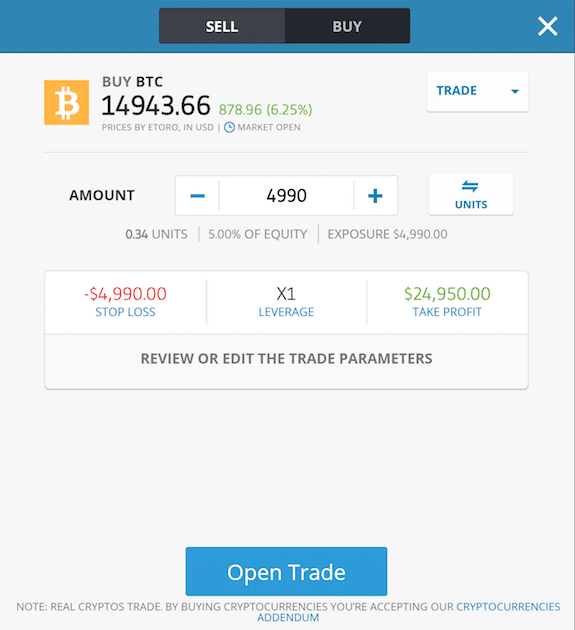

eToro’s platform allows users to invest in (and trade) a variety of assets, including commodities, stocks, currencies, indices, and of course, cryptocurrencies. This includes plenty of advanced trading tools such as stop-loss, take-profit, and set orders, which execute automatically according to a coin’s price. It should be noted that stop-loss and take-profit are not guaranteed.

eToroX is only available for institutional clients. Cryptocurrencies are unregulated, and highly volatile, and there is no consumer protection.

The main “twist” eToro added to its platform is the ability to follow and copy other traders, making eToro a social trading platform – there’s even a “newsfeed” with users sharing their trades publicly.

Copy Trading and Smart Portfolios

Aside from deciding on your own what to invest in, eToro gives you two other options: Copy other traders with CopyTrader™, or invest in a Smart Portfolio.

CopyTrader™ allows you to copy the trades of successful traders of your choice on the platform. You can even enable your own trades to be copied and earn commissions for successfully doing so.

Smart Portfolio is a portfolio management product. It’s somewhat similar to investing in a specific index where someone chooses a mix of assets to invest in for you. Investing in it will automatically copy multiple markets or traders based on a predetermined investment strategy.

You can invest in two types of Smart Portfolios:

Partner Portfolios – An investment vehicle Created by eToro partners.

Market Portfolios – Top-performing assets from a specific market.

Smart Portfolios aim to help investors minimize long-term risk by creating diversified investments. Once you invest in a Smart Portfolio, your capital is professionally managed by eToro’s investment committee. Each CopyPortfolio’s performance is analyzed in depth.

eToro’s CryptoPortfolio

eToro also has a very special product called a CryptoPortfolio. It basically allows you to invest in the most popular cryptocurrencies like Bitcoin, Ethereum, Dash, Cardano, ZCash, and Iota. The minimum investment for the CryptoPortfolio is $500.

Investing in this portfolio will expose you to more currencies simultaneously and diversify some of the risk involved with investing in only a single cryptocurrency. There are several requirements that a cryptocurrency has to meet in order to be included in the CryptoPortfolio, including:

- Minimum market cap of $1 billion

- Minimum average monthly trading volume of $20 million.

Each currency will have a weight in the portfolio that is relative to the size of its market cap (the minimum is 5%). If, for some reason, a currency drops below the minimum requirements, it is automatically removed from the portfolio.

The CryptoPortfolio is analyzed and rebalanced on the first trading day of each month.

eToro’s Cryptocurrency Wallet

eToro has also launched its own wallet for iOS and Android called eToro Money. The wallet links directly to a user’s eToro trading account, enabling them to more easily withdraw coins they have bought on the platform. Users can also use the eToro Money wallet to swap between cryptocurrencies instantly, as well as buy, store, receive, and transfer more than 120 different assets.

It is important to note that users cannot use the wallet to deposit crypto into their eToro trading accounts – only withdraw some selected coins.

Whereas eToro users previously did not have control of their private keys, the eToro Money wallet now provides users with a true private key and on-chain addresses.

eToroX

On April 26, 2019, eToro announced the launch of eToroX – A fully regulated cryptocurrency exchange. In contrast to the primary eToro platform, eToroX gives users direct access to crypto assets rather than requiring additional withdrawal steps and transfer rules. However, eToroX is only available for institutional clients. Cryptocurrencies are unregulated and highly volatile, and there is no consumer protection.

3. Currencies and Payment Methods

Cryptocurrencies supported

Cryptocurrency investment and trading on eToro can be done by buying and trading actual coins or trading derivatives in the form of CFDs. It is important to understand that CFDs only involve speculating on the price of an underlying asset but not owning that asset outright.

Read this article from eToro to understand which types of investments are available to you per your preferences and location.

There are 25+ coins listed on eToro, including but not limited to:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Solana (SOL)

- Bitcoin Cash (BCH)

- Chainlink (LINK)

- Uniswap (UNI)

- IOTA (MIOTA)

- Stellar (XLM)

- EOS (EOS)

- NEO (NEO)

- Zcash (ZEC)

- Binance Coin (BNB)

- Decentraland (MANA)

- Shiba (SHIBxM)

Deposit methods

eToro supplies a wide range of options for depositing money to its platform, including:

- Debit card

- Wire transfer

- Skrill

- Neteller

- Webmoney

- Giropay

- Rapid Transfer

- iDEAL

- POLi

- Local Online Banking

See the list of deposit limits depending on location here. eToro accounts are denominated in USD, so whatever currency you deposit will automatically be converted to USD.

4. eToro Fees

Due to the complex amount of trading options on eToro, the fee structure varies from asset to asset. Looking directly at the cryptocurrency trade fees will be quite a shock for serious investors.

Bitcoin and other coins cost a hefty 1% fee when exiting a position, higher than most other exchanges. Check out the full list of fees here.

There’s also a withdrawal fee applicable when you decide it’s time to cash out. When cashing fiat money out of eToro, you’ll be charged $5 for each withdrawal.

Another sting in the tail exists for some unfortunate users. eToro charges an inactivity fee to users who have not logged in for 12 months.

If you’re a long-term holder, don’t get caught out by this; your account balance will be debited $10 per month once it’s deemed inactive. Remember to log in and check up on your investments every quarter.

5. Supported countries

Due to recent changes in regulations, eToro is NOT available in the following countries:

Afghanistan, Aland Islands, Albania, Anguilla, Antarctica, Antigua and Barbuda, Armenia, Aruba, Bahamas, Barbados, Belarus, Belize, Benin, Bermuda, Bhutan, Bonaire, Bosnia and Herzegovina, Botswana, Bouvet Island, Brunei, Burkina Faso, Burundi, Cambodia, Cameroon, Canada, Cape Verde, Central African Republic, Chad, Chagos Islands, China, Christmas Island, Cocos Islands, Comoros, Congo Republic, Cook Islands, Cote d’Ivoire, Crimea Region, Cuba, Curacao, Democratic Republic of the Congo, Djibouti, Dominica, El Salvador, Equatorial Guinea, Ethiopia, Faeroe Islands, Falkland Islands, Fiji, Gabon, Gambia, Ghana, Greenland, Grenada, Guatemala, Guinea, Guinea-Bissau, Guyana, Haiti, Heard Island and McDonald Islands, Honduras, Hong Kong, India, Indonesia, Iran, Iraq, Jamaica, Japan, Kiribati, Kosovo, Kyrgyzstan, Laos, Lebanon, Lesotho, Liberia, Libya, Macau, Madagascar, Malawi, Maldives, Mali, Marshall Islands, Mauritania, Mauritius, Micronesia, Moldova, Mongolia, Montenegro, Montserrat, Morocco, Mozambique, Myanmar, Namibia, Nauru, Nepal, Netherlands Antilles, Nicaragua, Niger, Nigeria, Niue, Norfolk Island, North Korea, North Macedonia, Northern Cyprus, Pakistan, Palau, Palestinian Territories, Panama, Papua New Guinea, Paraguay, Pitcairn Islands, Russia, Rwanda, Saint Helena, Saint Kitts and Nevis, Saint Lucia, Saint Pierre, Saint Vincent and the Grenadines, Samoa, San Marino , Sao Tome, Saudi Arabia, Serbia, Sierra Leone, Sint Maarten (Dutch Part), Solomon Islands, Somalia, South Africa, South Georgia and the South Sandwich Islands, South Sudan, Sri Lanka, Sudan, Suriname, Svalbard and Jan Mayen, Swaziland, Syria, Tajikistan, Tanzania, Timor-Leste, Togo, Tokelau, Tonga, Trinidad and Tobago, Tunisia, Turkey, Turkmenistan, Turks and Caicos Islands, Tuvalu, Uganda, Uzbekistan, Vanuatu, Vatican City, Venezuela, Virgin Islands (British), Yemen, Zambia, Zimbabwe

Up until recently, eToro was closed for US investors but now is available for people within most US jurisdictions, except:

American Samoa, Guam, Hawaii, Minnesota, Nevada, New York, Northern Marianas, Puerto Rico, Tennessee, U.S. Armed Forces – Americas, U.S. Armed Forces – Europe and US Virgin Islands.

6. Customer support and online reviews

eToro generally has very good reviews across the internet, often commended on customer service and the user-friendliness of the mobile app.

Common complaints about the platform involve slow or difficult withdrawals due to intensive identity verification processes and restrictions. At the same time, it appears that eToro is happy to allow users to continue to deposit money into the platform even if they have not been permitted to withdraw – unfortunately, a common occurrence across many crypto and trading platforms.

An online help center is available on the eToro website to answer most common inquiries related to a wide range of platform features, while more specific and individual user issues can be answered via the customer support page. This involves submitting a written support ticket for your issue, which will be responded to via email.

Customer support is available in 9 different languages, but there is no option for a live chat of phone support.

7. My personal experience with eToro

The usability of eToro is astonishingly fluid. It’s painless and straightforward to get started. Signing up takes less than five minutes, and there’s no need for slow verification methods or confirmations. Simply hit the Sign Up button and add your personal details.

Next, you’ll be greeted with a questionnaire to assess your trading personality—quite a nifty feature on the face of it, but it rang more alarm bells than I would have liked.

Revealing my income levels, my employer, and my other investment levels felt like a bit too much. Still, this is part of a standard KYC (Know Your Customer) process eToro is compelled to perform as part of it being a regulated company.

Portfolio trackers, watch lists, featured markets, and the ability to follow successful traders are all sitting in this slick, modern trading interface. In under ten minutes, you can be ready to go and open positions on Bitcoin and Facebook simultaneously.

8. Frequently Asked Questions

Yes, eToro is fully regulated.

eToro (Europe) Ltd. is a Financial Services Company authorized and regulated by the Cyprus Securities Exchange Commission (CySEC) under license # 109/10.

eToro AUS Capital Pty Ltd. is authorized by the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services Licence 491139.

eToro (UK) Ltd. is a Financial Services Company Authorised and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263.

eToro (Seychelles) Ltd. is licensed by the Financial Services Authority Seychelles (“FSAS”) to provide broker-dealer services under the Securities Act 2007 License #SD076.

Yes, users can now withdraw cryptocurrencies from eToro via the eToro Money wallet. Provided that your position on eToro is a non-CFD, non-leveraged “buy” position, you will be able to withdraw your coins to the eToro Money wallet.

From there, the coins can be used as normal, including transferring them to any other crypto wallet.

Cryptocurrencies withdrawable from eToro include:

– BTC

– ETH

– XRP

– LTC

– BCH

– XLM

This feature is only available to users of eligible countries, with a standard fee of 0.5% per withdrawal.

Yes, you can withdraw fiat currencies from eToro.

Withdrawals are all initiated in USD, with conversion fees applying if the final currency is different. The supported fiat currencies for withdrawal are:

– USD

– AUD

– EUR

– GBP

– SEK

– DKK

– NOK

– PLN

– CZK

– MYR

– PHP

– THB

– IDR

– VND

A full table of conversion fees for fiat withdrawals can be found here.

The withdrawal fee is $5 for global and $0 for US users + conversion fees if you withdraw a currency that is not USD (between 50-250 pips).

9. Conclusion – Is eToro Reliable?

eToro’s platform as a whole is a joy to use. Its interface is responsive, intuitive, and packed with handy features. Add a decent selection of cryptocurrencies to this, and you can really get a lot out of the exchange, like trading and opening positions in Bitcoin, Ethereum, XRP, Litecoin, and more.

That being said, there are some mild drawbacks. The main drawback is that withdrawing cryptocurrencies to your own wallet is somewhat cumbersome and requires some extra steps.

First, you need to withdraw the cryptocurrency to your eToro Money wallet, a process that takes up to 5 business days. Only after that can you complete the withdrawal to any non-personal wallet. If you need to hold the actual cryptocurrency you’re looking to buy, perhaps check out eToroX instead.

Additionally, the fees for cryptocurrencies are also overpriced, and for me, that’s a big turnoff.

To sum it up, if you’re a speculator – eToro might be suited for your needs. If you’re a hardcore Bitcoiner, you’ll probably want to stay away from it.

Note: eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Have you tried eToro yourself? I’d love to hear what you think about it in the comment section below.

Disclaimer:

eToro is a multi-asset platform that offers both investing in stocks and crypto assets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. The trading history presented is less than 5 complete years and may not suffice as a basis for investment decisions.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs, makes no representation, and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity-specific information about eToro.

I can’t relate to the negative experiences in the comments. My own experience with eToro has been great. I started using eToro 18 months ago, as a complete noob. Absolutely loving it. Markets have been a roller-coaster, but regardless I’ve made $55k profit. I recently withdrew all my money (so that I can move it to a more tax-effective structure /account) – it was so easy, and happened within 2 days. I was impressed!

The best thing is I’m not even having to do the hard work of trading. Instead I just use their legendary “Copy Trader” feature. It’s not hard to know who to copy – simply spot the ones with a track record, and strategy/drawdown to suit your appetite.

They sent me a tax form

I live in Tenn and I didn’t get to my money back

“”Up until recently eToro was closed for US investors but now is available for people within most US jurisdictions, except:

American Samoa, Guam, Hawaii, Minnesota, Nevada, New York, Northern Marianas, Puerto Rico, Tennessee, U.S. Armed Forces – Americas, U.S. Armed Forces – Europe and US Virgin Islands””

Why is Ghana not supported by etoros

Etoro is a scam, they earn a loot with spreads. Getting money back costs 25$. Makes investing and day trading look easy, which it is not. Run away!

I saw an advert online about Bitcoin which i clicked and filled in my details only for me to get a call from someone saying he is my account manager from he told me they also trade on the bitcoin he said all i need to do is to invest the minimm of 250$ due to my curosity i invested the 250$. Only for me to get a call the next day from another person sayinng he is my Personal account manager and i need to invest additional 5k$ before he can start tradding with me. When i told him i don’t have such money he hung up the call.

Does this have anything to do with eToro?