In the latest Bitcoin FOMC Analysis, Bitcoin (BTC) price is falling and now all eyes are on Jerome Powell’s Federal Reserve FOMC meeting – here’s what to expect for crypto markets.

Bitcoin is no longer a small boys’ game. The approval of spot exchange-traded funds (ETFs) in January means that the deep-pocketed megaliths of Wall will closely watch the asset.

This means the world’s most valuable digital asset is more interwoven with traditional finance (TradFi). For this reason, fundamental events that would otherwise not cause much volatility, say in 2021, tend to move prices in 2024.

Right now, all eyes are on the United States Federal Reserve (Fed), and more are keen to know what Jerome Powell, the chair, has in store for the market.

If #Bitcoin drops to $60664, about $34 million in assets are set to be liquidated on #Binance!

FOMC based volatility expected. Looks like it’s a high stakes game. Hold onto your hats, folks!

Graphic: coinglass pic.twitter.com/rVcQ5JWjLH

— alpha CAPCOM (@alphacapcom) April 30, 2024

They might slash rates (improbable) or keep them steady (as largely expected). However, Jerome’s choice of words during the presser will move the market.

For this reason, the upcoming policy decision on Wednesday, May 1, is shrouded in uncertainty now that the United States economy is running hot and inflation is stubbornly high.

Federal Reserve Policy Stuck in Neutral

Everyone now knows the United States Fed hasn’t been successful even after rapidly hiking interest rates in 2022 and introducing fresh policies to prop up the country’s banking sector, causing pain to crypto holders.

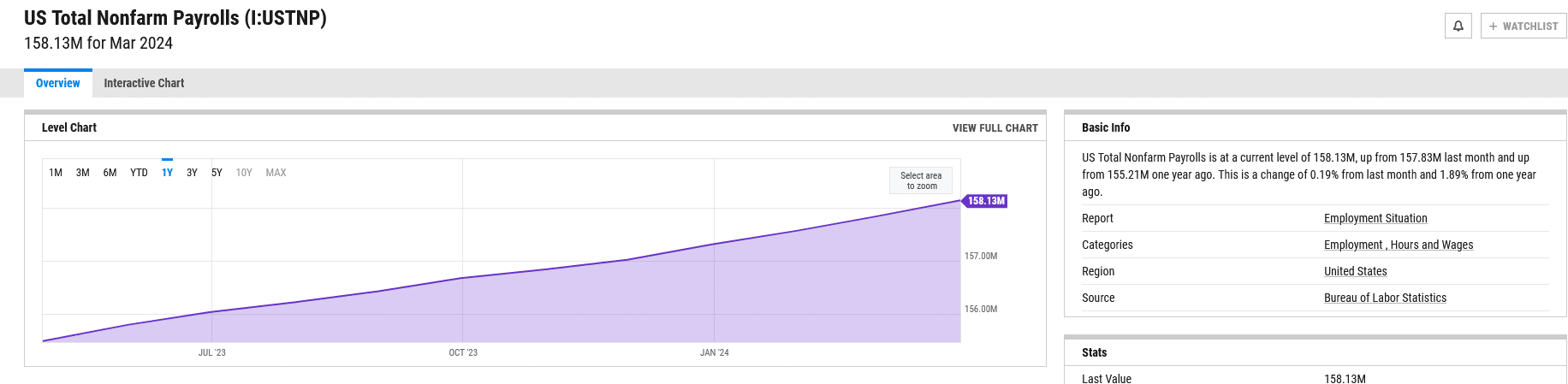

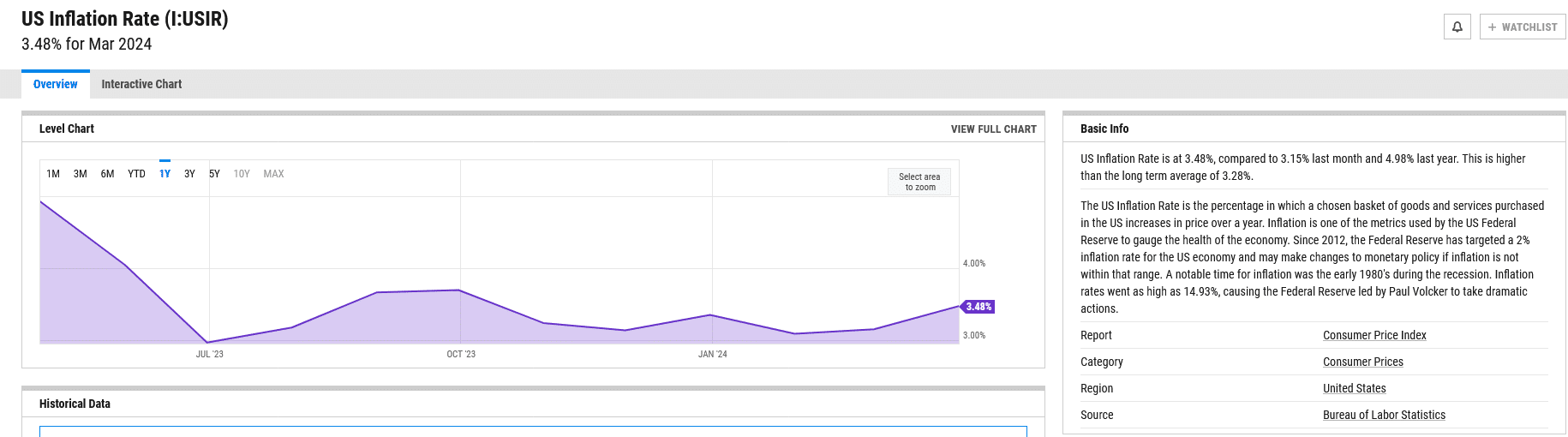

As of late April, inflation is high, dashing hopes of imminent rate cuts that were highly expected in early Q1 2024. Since inflation and other economic data like the labor market are essential for the data-driven Fed, they will probably hold rates steady.

Others believe Jerome Powell will change the tune and even consider raising them.

(yChart)

Buttressing this prediction is that inflation is falling slower than expected, even with housing prices cooling down. The key driver of inflation in the United States is energy. Prices remain elevated, leading to a cascading effect.

If rates remain at the 5.50% zone, the cost of borrowing for mortgages and other loans will stay elevated. Savers will only benefit from higher yields on their deposits.

Here’s What to Expect from Powell’s Speech – Implications for Bitcoin?

So, ahead of May 1, analysts expect Powell to reiterate the central bank’s confidence that inflation will eventually decline but will take longer than expected.

Moreover, since the economy is in a precarious position and the impact of further rate hikes will cause more damage, the chair would likely suggest keeping rates at current levels if inflation remains sticky.

(yCharts)

However, save the words and expectations. Analysts will rush to comb through the FOMC minutes a few weeks later. This document will offer insightful details to help understand whether more FOMC members are rooting for rate cuts and whether rate hikes have been discussed.

DISCOVER: How To Buy Bitcoin Anonymously Without an ID in 2024

Bitcoin Caught in the Crossfire of TradFi Uncertainty

Two days before this event, Bitcoin remains under pressure, trading above $60,000. Interestingly, despite being a solid alternative to gold following the historic Halving event on April 20, the coin is bearing the brunt.

Bitcoin is often marketed as a hedge against inflation and offers better qualities than clunky gold.

The coin is trading within a tight range but inside the bear bar of April 13. Even after attempts for higher highs post-Halving, prices collapsed earlier today, swinging price action in favor of sellers.

(BTCUSDT)

Any drop below $60,000 would likely see BTC collapse to $53,000 and even $45,000 in the coming weeks – so watch out for volatility around Bitcoin FOMC.

EXPLORE: Ethereum Exchange Supply Tanking: Last Chance To Buy ETH Below $4,000?

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

No Comments

No Comments