Fears of a potential World War 3 (WW3) are growing, as Iran-Israel tensions rise, and now retail investors are flocking to gold and gold-backed crypto, in this article explore whether these 3 gold-backed cryptos are the best political risk hedge in 2024.

Inflation is raging, and analysts are concerned that World War 3 is brewing. Given the current uncertain political climate, investors are increasingly looking for safe havens to preserve value and protect themselves from possible turmoil.

Gold is traditionally a go-to option when investors seek refuge from uncertainty. However, its physical constraints can be cumbersome, turning away investors who naturally gravitate toward the fluidity of digital assets.

(BTCUSD)

To accommodate these choosy investors, developers launched gold-backed crypto assets that offer a secure and convenient way to get exposure to gold – with 24/7 liquidity.

Explore The 3 Best Gold-Backed Crypto to Hedge WW3

Currently, there are several gold-backed crypto coins increasing in volume amid the Iran Israel tensions, but these are the top 3 for investors seeking to hedge Iran war risk:

Gold Crypto #3 – Paxos Gold (PAXG)

(PAXG)

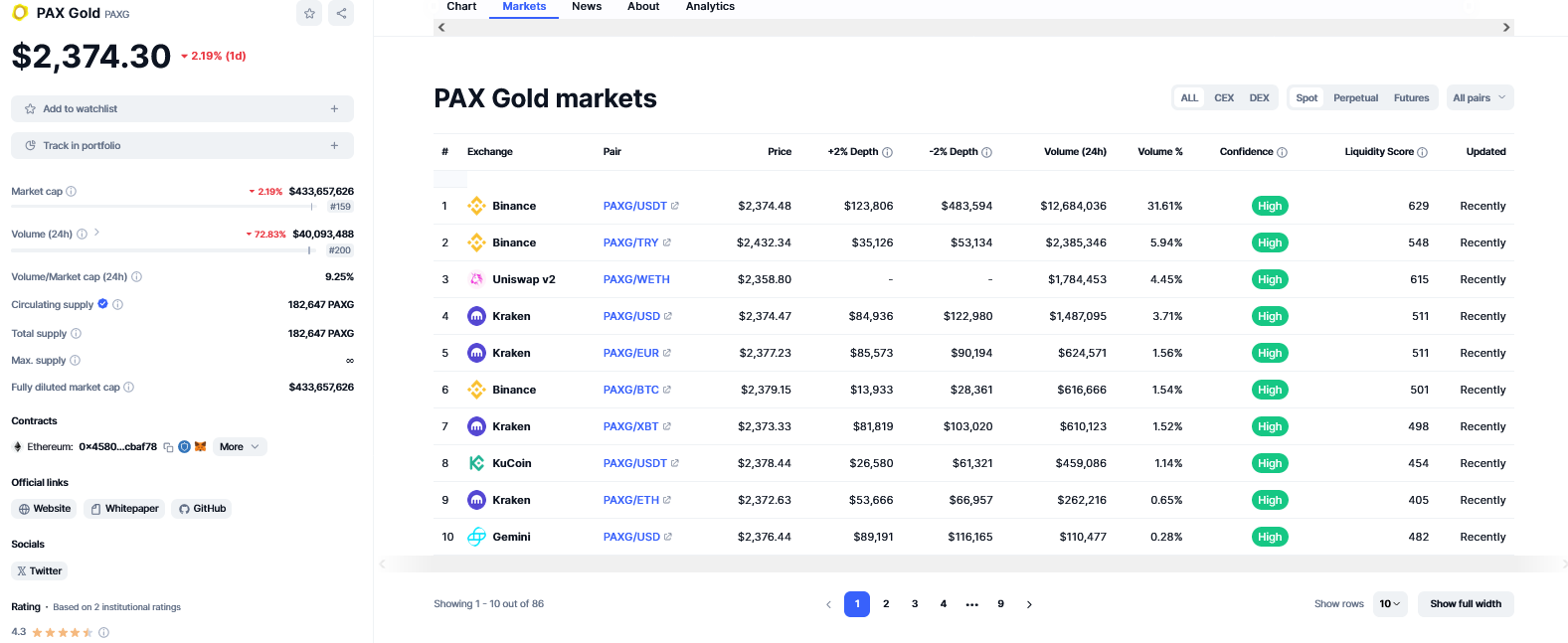

The Paxos Gold (PAXG) gold-backed asset is issued by Paxos, a crypto custodian and the former issuer of BUSD, a popular stablecoin.

Like a stablecoin, each PAXG in circulation is backed by a fine troy ounce of physical gold.

The digital nature of PAXG means each token can be settled instantly, just like any other token – yet, at the same time, because the token is listed on various crypto exchanges, it is more liquid.

Investors can also choose to redeem each PAXG for physical gold. According to CoinMarketCap data, 182,647 PAXG are in circulating supply and available on over ten markets.

Gold Crypto #2 – Kinesis Gold (KAU)

(KAU)

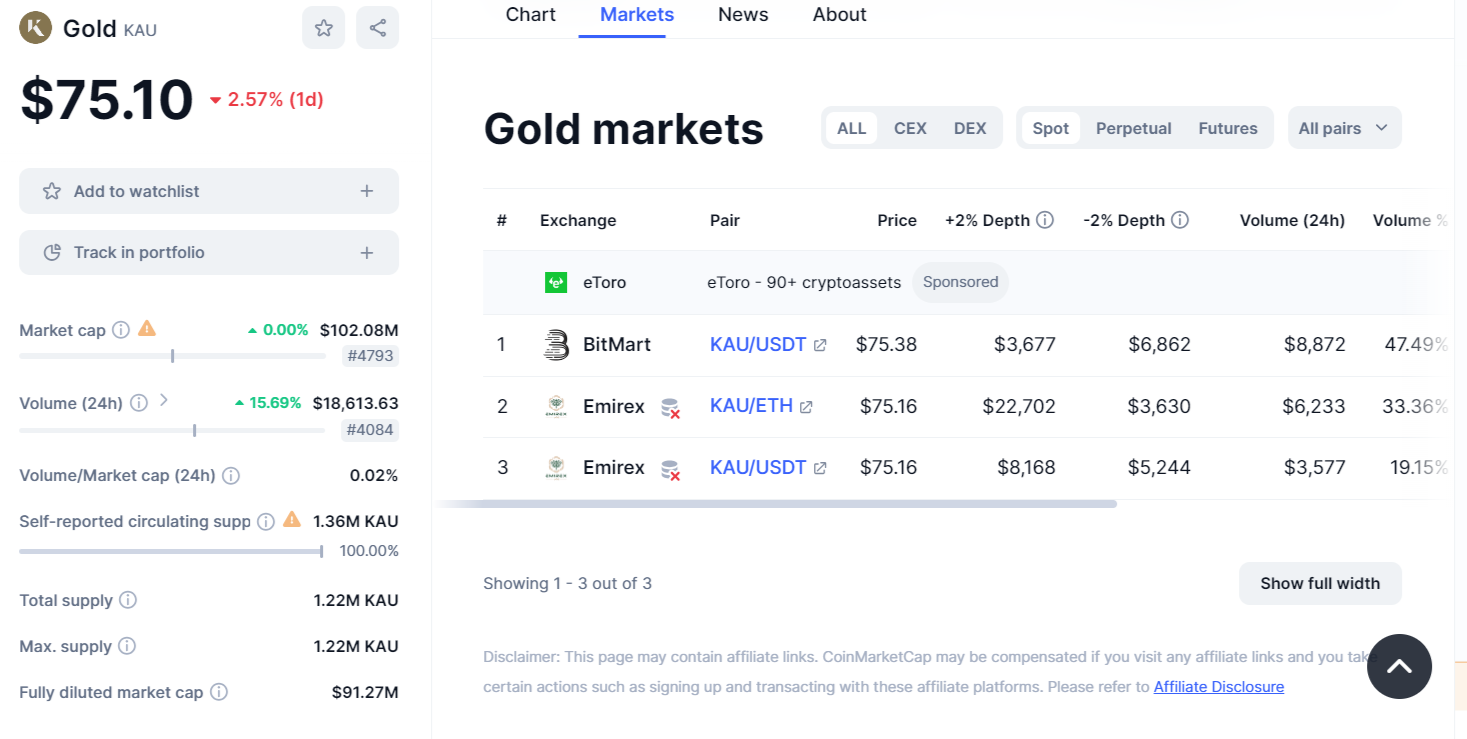

Another token, Kinesis Gold (KAU) offers a unique twist to the gold-backed crypto scene regarding divisibility.

Each KAU in circulation represents one gram of physical gold – because of KAU’s high divisibility, it is available to a wide range of investors.

However, like PAXG, the token is not tradable on leading crypto exchanges. So far, KAU is only available on Bitmart.

Even so, investors aiming to redeem KAU for physical gold must control at least 100 KAU, translating to 100 grams of gold. This requirement can be an impediment for smaller investors.

Gold Crypto #1 – Meld Gold (MCAU)

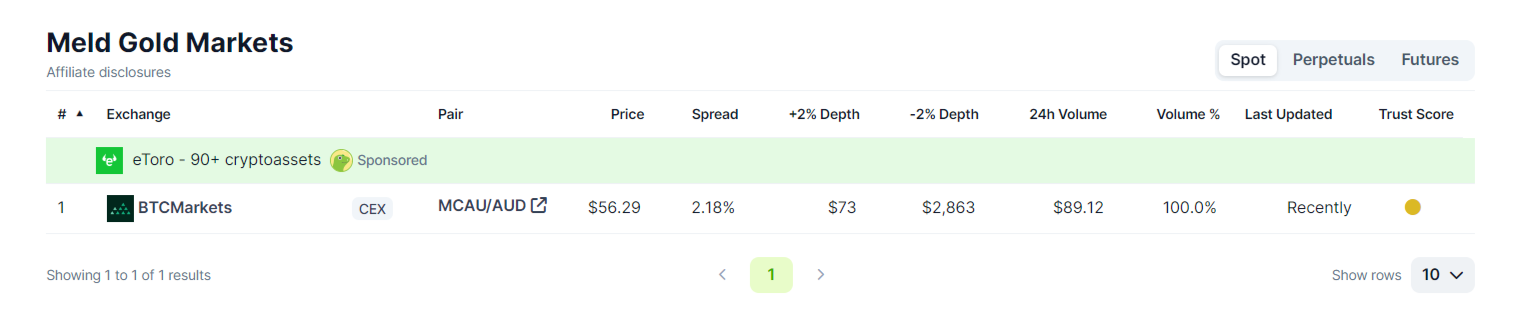

Meld Gold is a gold-backed token launched on Algorand, a scalable and secure blockchain.

Of note, each MCAU token represents a Meld Digital Gold Certificate backed by physical gold – the tokenization of gold and launch as MCAU eliminates slow transaction times and improves liquidity.

Holders can convert MCAU to physical gold or swap them for fiat or other cryptocurrencies.

Currently, MCAU is supported by Fireblocks, a crypto custodian, and BTC Markets, a crypto exchange.

The Bottom Line: Gold Still Seen as King Amongst Investors

Gold will continue to be an integral asset in global finance. It is by far the largest by market cap and is preferred by most traditional finance players – especially in times of crisis such as the heightened Iran Israel tensions.

Even so, the emergence of gold-backed cryptocurrencies represents a welcomed shift offering advantages of the physical world and the convenience of crypto assets.

Their convenience, security, and potential hedge against political risk continue to attract investors looking to diversify their portfolios in face of a feared ‘WW3’ scenario.

RELATED: 99BTC Presale Launches – Here’s Why Big Money Investors Are All In On This Learn-To-Earn Token

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

No Comments

No Comments