Top altcoin tokens like Avalanche (AVAX), dYdX, Arbitrum (ARB) might extend losses in Q2 2024 as they head for a major $2Bn altcoin unlock – here’s how it could worsen the altcoin dip.

If you bought Bitcoin or Ethereum above $73,000 and $4,000, respectively, and are still holding, you must have diamond hands, as crypto fans say.

Crypto prices have been falling in recent weeks. Looking at price action, Bitcoin and Ethereum found glass ceilings at around $74,000 and $4,100 before crashing to spot rates. Besides the occasional but refreshing pullbacks, it has all been southwards for most altcoins.

(BTCUSDT)

Bitcoin, Ethereum Prices Falling Amid Supply Concerns

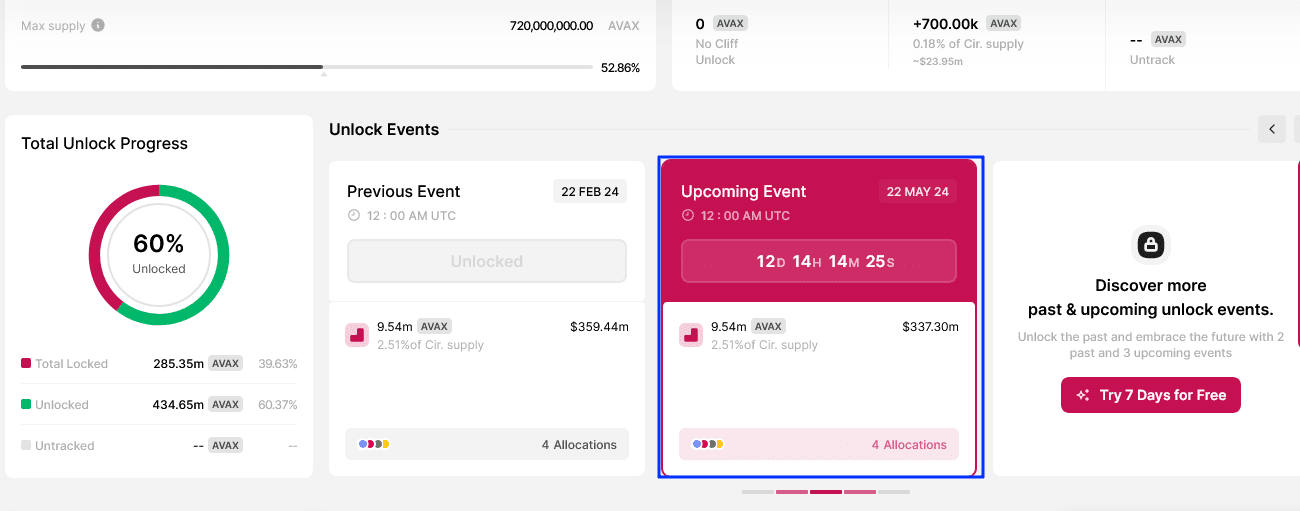

It remains a bad start for Q2 2024 for the crypto market, but it could be worse if the upcoming unlocks hits tokenomics before capital returns to the market. According to Token Unlocks, various crypto protocols across DeFi and RWAs will unlock tokens worth billions in the next two months.

You may be wondering what the heck is going on here. Let me fill you in.

Depending on the token release model a project adopts from the start, it may choose to release all tokens from the beginning or opt to release them in bits. If it opts to release tokens later, project leaders must “unlock” them, distributing them to investors, the team, and other interested parties.

Bitcoin releases BTC whenever a block is mined. Litecoin, Monero, and most proof-of-work blockchains use this system. Other platforms, like Arbitrum, a layer 2 platform for Ethereum that conducted presales, opt for a different route.

They chose not to release all tokens during ARB’s initial listed. The remainder will be “vested” and released over time.

The decision to undertake an altcoin unlock at a later date is strategic. In some cases, releasing all tokens immediately after a presale might lead to a crash. To prevent this, there must be a “wait” period, with the unlocking date ending this wait time.

In Q2 2024, the main concern is that roughly $2Bn worth of tokens will “hit” the secondary market through unlocking.

Therefore, it is highly probable that some recipients (not all) will be quick to dump, increasing supply on exchanges and lowering prices.

Subsequently, this will significantly dampen any hopes of a swift recovery, with the added challenge of hodling altcoins during this corrective phase.

DISCOVER: Best DeFi Loan Sites to Collateralize Your Crypto Pre-Unlock

Altcoin Unlock Set for Avalanche, Arbitrum, dYdX: Millions Worth of Tokens to Inflate Circulating Supply

Token Unlocks data show that several projects will release different amounts to the secondary markets next week.

Aptos (APT), dYdX (DYDX), Pendle (PENDLE), Avalanche (AVAX), Arbitrum (ARB), and others will be on the front line. However, analysts are examining the amount released. Usually, the more, the stronger the potential liquidation force.

Data shows that Avalanche plans to release $337 million worth of AVAX. The blockchain will release over 9.5 million AVAX, translating to roughly 2.5% of the total supply in 12 days.

At the same time, Aptos and Arbitrum will release $97m and $95m of APT and ARB onto the market, respectively.

Specifically, 92.65 million ARB (or 3.49% of the total supply) will hit the market in a week.

Though millions of tokens will be released, whether receivers will sell is not immediately clear. In the past, following token releases, some addresses quickly moved tokens to exchanges.

Even so, falling crypto prices might force “weak” hands to cash in. Analysts say the repayment of victims from Mt. Gox, one of the first crypto exchanges hacked for hundreds of millions of dollars in 2014, and Gemini’s Earn program might see BTC prices contract.

EXPLORE: Australia Intensifies Scrutiny On Crypto Exchanges, Demands Data From 1.2 Million Accounts

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

No Comments

No Comments