Ahead of the Bitcoin Halving event, retail investors are asking ‘What is Fear and Greed Index Crypto?’. In this article, deep dive into the fear and greed indicator and discover what it means for the BTC market in the weeks to come.

Originally a stock market tool by CNNMoney, the Crypto Fear and Greed Index measures the pulse of the cryptocurrency market.

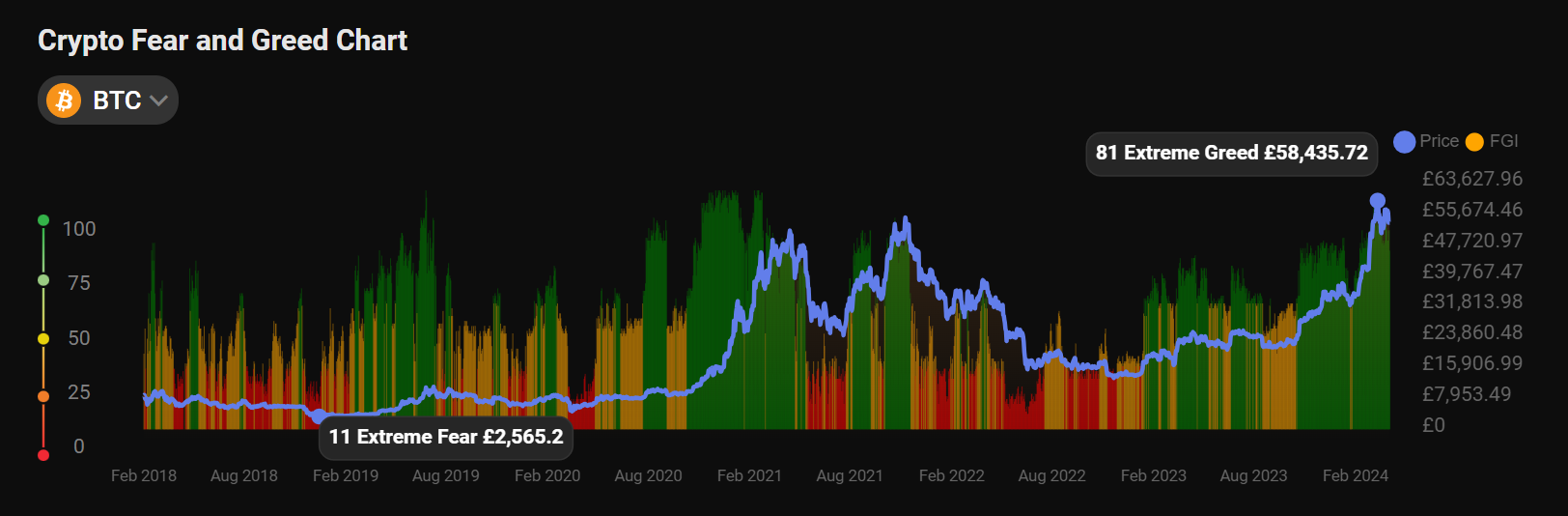

The indicator and its readings are simple to understand, on one end of the spectrum – extreme fear suggests undervalued markets, while greed suggests overvalued markets due for correction.

For the stock market, CNN considers factors like junk bond demand, market momentum, and safe-haven demand, among others, each equally weighted at 14.2%. However, crypto’s Fear and Greed Index works much differently.

What is the Crypto Fear and Greed Index? How Does It Work?

Like the Bitcoin Rainbow Chart, the F&G index is a momentum indicator, and like other oscillators, it trends in one direction whenever the market is running.

The Crypto Fear and Greed index evaluates several factors to gauge market sentiment:

-

- Volatility (25%)

- Volume (25%)

- Social Media buzz (15%)

- Surveys (currently paused, 15%)

- BTC Dominance (10%)

- Google Trends (10%)

As CoinGecko, one of the leading independent cryptocurrency data aggregators, wrote, “The Fear and Greed Index has shown impressive accuracy over the years; this is as regards its ability to correctly represent investors’ sentiments in figures and scales.”

Using the index as a guide, buying during periods of extreme fear can be an opportunity to invest at lower prices, while setting personal sell targets rather than relying solely on the index for exit signals.

Indeed, the F&G helps us remember the most important piece of advice you can get in the market: The trend is your friend. Don’t fight it.

Warren Buffett’s famous quote – “Be fearful when others are greedy and greedy when others are fearful,” also comes to mind.

One limitation to this, however, is you can get double all-time highs. In 2021, Bitcoin went from $60,000 to $30,000, to $68,000 in a matter of months. Sometimes, the greed doesn’t stop – but it almost always retraces.

What Does This Mean For The Upcoming Bitcoin Halving Event?

(BTCUSDT)

Are you wondering when Bitcoin will go bullish post-halving? Mark your calendars for approximately a week after the Halving Day around April 20.

In 2020, the bull run did not kick off on the Halving Day itself. Just a day after the Halving, Bitcoin plummeted by -40%.

This suggests that post-Halving, the market sentiment, as reflected in the Fear and Greed Index, will result in a “sell the news” phase before any bull run starts.

Yet, rest assured – the supply shock introduced by the event will take effect with time – and bullish investors expect BTC to reach $200k by 2025.

The Bottom Line: Fear And Greed Index Crypto Suggests Halving Is Sell The News

The Crypto Fear and Greed Index is useful for making informed decisions without succumbing to emotional biases, and provides a multi-faceted insight into the macro market sentiment.

Markets in Turmoil 🚨

Fear & Greed Index plummeting to the lowest level since January 17th pic.twitter.com/WltKGunEYH

— Barchart (@Barchart) April 2, 2024

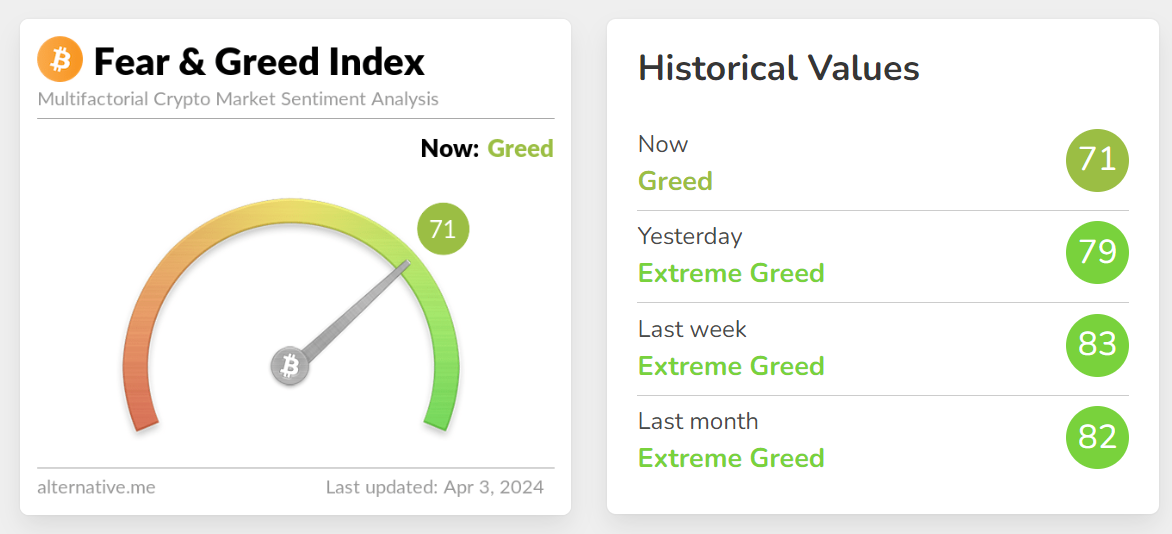

Recently the index has shown extreme greed levels not seen since November 2021, however, recent weeks have seen a noteworthy drop in the intensity of greed in the market suggesting we may be at the early stages of a significant bull run or a historic crash. Either way, stay tuned with 99Bitcoins.com as we ride to Valhalla together.

EXPLORE: What is Spatial Computing Crypto? What Are the Top 3 Spatial Computing Crypto to Buy in 2024?

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

No Comments

No Comments