Bitcoin ETF appetite is back as TradFi flips bullish. Recent filings show Susquehanna International Group bought over $1 billion worth of BTC this month.

Bitcoin price has had a rough start to Q2 2024, dropping by over -15% from all-time highs. But this was mostly expected. After the tear it had from October 2023 to March 2023, the cool-off was needed. It is healthy.

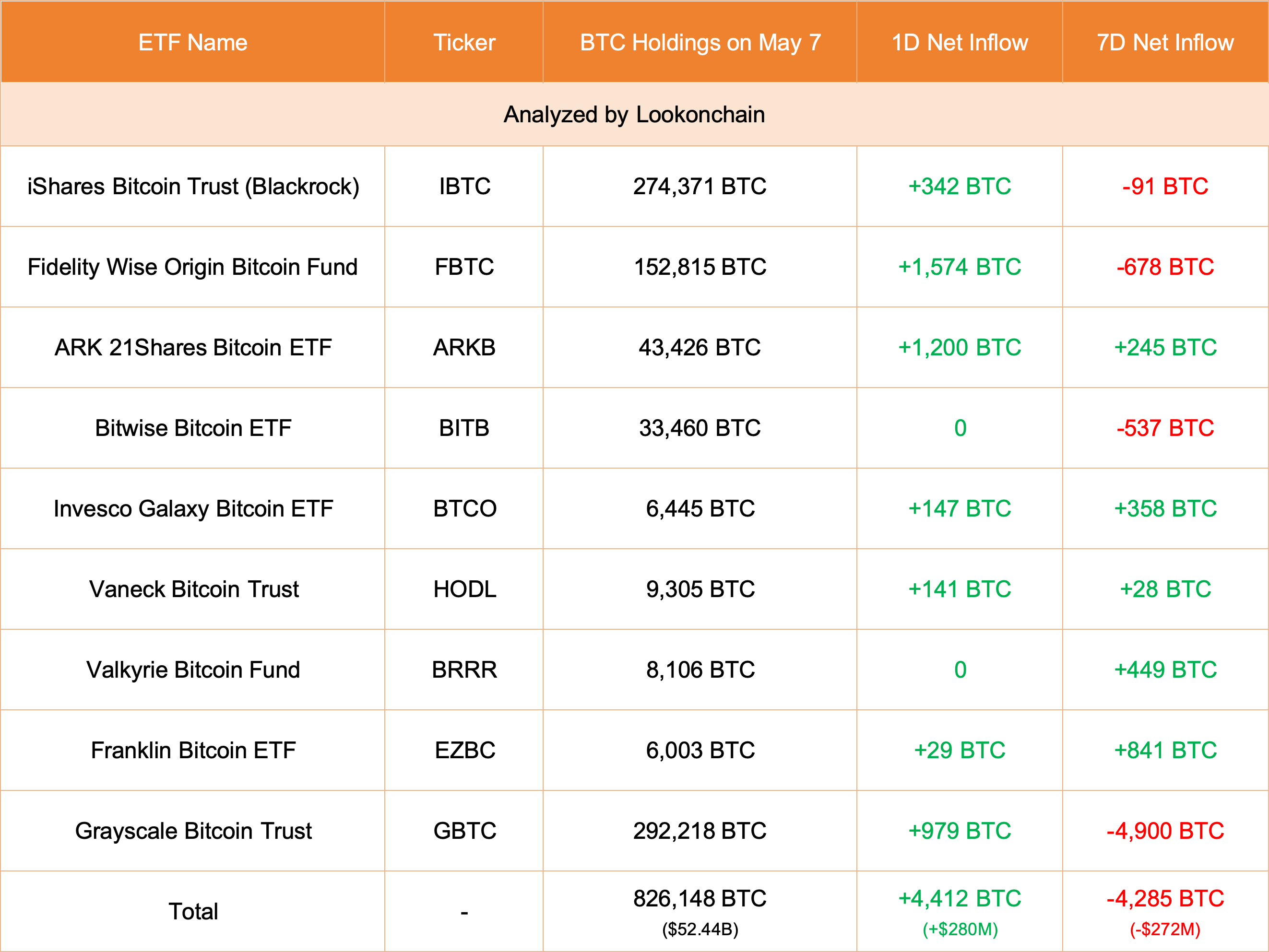

#BTC ETFs saw $217M inflows yesterday.

Also, for the 2nd time ever Grayscale's BTC ETF recorded positive inflows.

These ETFs will have a huge positive impact on BTC in the long run. pic.twitter.com/9oZOGqMa1R

— The DeFi Investor 🔎 (@TheDeFinvestor) May 7, 2024

Why Bitcoin Retracement Is Healthy: BTC Dip Appetizes TradFi Investors

From mid-Q4 2023 to mid-Q1 2024, Bitcoin doubled and broke above $70,000, printing a new all-time high of over $73,800.

The spike follows the community’s anticipation of the United States SEC approving spot Bitcoin ETFs after an over 10-year delay.

(BTCUSDT)

And with spot Bitcoin ETFs now open to the broader market, allowing institutions to get exposure, the excitement is evident.

Not only have Wall Street players like Fidelity and BlackRock enabled the inflow, but the crypto market and Bitcoin have massively improved liquidity.

The coin now has a market cap exceeding $1.3 trillion. It will only grow if recent SEC filings showing investors’ activity in Q1 2024 are anything to go by.

By law, every SEC-regulated firm managing over $100 million in assets must submit 13F-HR files quarterly as part of the regulator’s transparency requirements.

GUIDE: How to Buy The Dip on Bitcoin ETFs in May 2024

Susquehanna International Group Buys Over $1 Billion Of Spot ETF Shares

According to a report, released as part of 13F-HR filing, it is now emerging that the quantitative trading giant Susquehanna International Group (SIG) spent over $1 billion buying shares of various spot Bitcoin ETFs.

Combining these filings, the quant firm surprisingly spent roughly $1.09 billion on GBTC. They also bought spot Bitcoin ETF shares issued by Fidelity while increasing their stake in ProShares.

Interestingly, SIG also reduced its holding of MicroStrategy shares. As of May 8, MicroStrategy has the largest exposure to Bitcoin of any public company worldwide. Most analysts are convinced that MicroStrategy, like Nvidia, is overvalued.

Before the approval of spot Bitcoin ETFs, traders bought MSTR shares available on NASDAQ as they indirectly tracked BTC’s performance. By unloading, it is clear that the firm is shifting strategy, favoring direct exposure to regulated ETFs over indirect ownership via MicroStrategy.

Are BTC Bulls Back? Inflow Picking Up Momentum

SIG’s exposure to spot ETFs is a mere fraction of its over $575 billion portfolio, but its decision to buy is a massive endorsement of Bitcoin. It also follows the broader trend of regulated firms in the United States purchasing hundreds of millions worth of these derivative products.

Even so, inflow has decreased in recent weeks, mirroring the decline in BTC prices in the better part of April and early May.

(Source)

Yesterday, Lookonchain data showed that spot Bitcoin ETF issuers added 4,412 BTC worth over $280 million.

EXPLORE: PEPE Price Analysis: As PEPE Leads Meme Coin Resurgence, Is 99BTC Next to Explode?

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

No Comments

No Comments