A Complete Guide to Facebook’s Diem Coin (Formerly Libra)

By: Alexander Reed | Last updated: 1/6/24

Note: Facebook’s Libra (Diem) project was shut down in early 2022.

Facebook’s Diem (formerly known as Libra) is set to launch in early 2022. This post covers how the coin works, who controls it, and what you should be aware of before buying it.

Don’t Like to Read? Watch Our Video Guide Instead

What is Diem Summary

Diem, formerly known as Libra, is a centralized, global, stable cryptocurrency project set to launch in 2022, headed by Facebook and a consortium of major companies around the world. Diem’s value is maintained by a reserve of liquid stable assets that back each coin created. Diem is set to become completely decentralized 5 years after it launches.

That’s Diem in a nutshell. For a more detailed explanation keep on reading. Here’s what I’ll cover:

1. What is Diem?

Diem (formerly Libra) is a cryptocurrency project pioneered by Facebook, that is presumed to launch sometime in early 2022. Its purpose is to connect the billions of people living together on this planet through one digital currency.

As the world moves into a cashless, digital only economy, many unbanked or underbanked people may be left out. The Libra cryptocurrency aims to help people that don’t have any access to the banking system to participate in the digital economy.

Libra is designed to work much like a stablecoin – a cryptocurrency with a relatively stable value against real world currencies also known as fiat currencies.

Unlike Bitcoin or Ethereum, which widely fluctuate in value due to price speculation, Libra’s value will have low volatility due to a reserve of currencies and assets that back it.

The Novi Wallet

Facebook also set up a subsidiary called Novi Financial Inc. which is currently developing the first Diem wallet now called Novi.

Novi is set to work as an independent wallet for Diem but will also integrate with other services such as Facebook and Whatsapp allowing billions of users to send funds to each other with a single tap and with low fees.

Here’s a demo of how it will look:

The Novi wallet is still in development, but according to its site, you will be required to verify your identity with a government ID in order to sign up. The wallet will also allow you to purchase Diem in exchange for fiat currencies.

While the Diem initiative was set in motion by Facebook, some of the major companies around the world are partners in it. Uber, Coinbase, Spotify and Shopify to name a few.

These companies will be part of the Diem Association and will manage the development of the currency and its network.

2. The Diem Association

Diem is set to start out as a centralized currency, but claims that within 5 years will become completely decentralized just like Bitcoin.

In its initial stages, the Libra project will be managed and controlled by the Diem Association; A nonprofit organization of global companies, social organizations, and academic institutions.

How to Become a Founding Member

To become a founding member you will need to stake $10 million. Each founding member will also be required to run a validator node – a computer that validates and approves transactions following the Diem rules. This is a bit similar to what a miner does in the Bitcoin network.

But money and computing power aren’t enough to join the Diem association as a founding member. You’ll also have to pass a certain scalability bar.

For example, commercial companies need to have more than $1 billion in market value, reach over 20 million people a year and be recognized as a top 100 industry leader.

Cryptocurrency focused investors need to have at least $1 billion in assets under management. Social organizations will need to have a track record of working on poverty alleviation, ranked in the top 100 in their field and have an operating budget of over $50 million.

Lastly, academic institutions wanting to join will need to prove they are in the top 100 universities in the world according to certain standards.

While Diem’s vision is that anyone with a sufficient stake in the Diem network will be able to serve as a validator, the network was initially targeting 100 qualified founding members and validators.

How the Diem Association Works

The Diem association is in charge of the Diem protocol, meaning the rules of the network, and managing the Diem reserve (which I’ll get to in a moment).

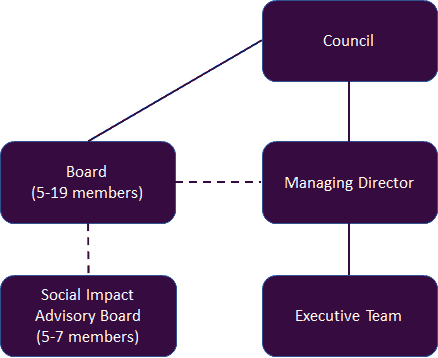

The governing body of the Diem Association is the Diem Association Council, comprised of one representative from each member of the association.

You can think of the council as shareholders in the Diem association. They get to vote on key decisions but they’re not involved in the day to day management.

The voting powers in the council are equal for each representative – each representative is entitled to one vote.on each matter that is up for approval.

The council appoints an executive team under a managing director to carry out decisions and manage day to day issues, similar to shareholders appointing a CEO.

Additionally, a Diem Association Board, composed of 5 to 19 members of the council, will provide guidance to the executive team. This would be similar to a board of directors to which a CEO is accountable.

Finally, we have the social impact advisory board led by nonprofit organizations and academic institutions. This advisory board seems to have limited influence since the board has to approve its recommendations.

It’s important to note that while Facebook Inc. is indeed the initial founding member of the Diem project, it has the same commitments, privileges, and financial obligations as any other Founding Member.

For Diem’s vision of decentralization to indeed be realized, the association would eventually become unnecessary and the Diem project would be controlled through the public’s participation in the network.

3. The Diem Reserve

Most cryptocurrencies aren’t backed by any commodity or fiat currency. That’s why they often fluctuate so dramatically in price since a lot of people are speculating on how much they will be worth in the future.

Diem, on the other hand, is set for day-to-day use, which requires it to have a less volatile nature. That’s why for every Diem created there will be a set of stable and liquid assets backing it.

This backing, known as the Diem reserve, helps make Diem more stable so users will be able to sell Diem coins at or close to the value for which they bought them.

The Diem reserve expands and shrinks according to supply and demand for Diem from the market.

So unlike many cryptocurrencies that have a limited supply, or use mining to generate new coins, the Diem supply is ever changing.

If people demand Diem – more coins will be created in exchange for the fiat currency used to buy it. If people sell off the Diem – the reserve will shrink accordingly and so will the Diem money supply.

The initial funding for the reserve will come from founding members of the Diem Association and from users buying the coin once it launches. It will be safeguarded by several different custodians, to avoid centralization risk, and it will be audited periodically.

It’s important to point out that the reserve isn’t actively managed, it responds to market conditions. There is no monetary policy set by the Diem Association on when to create or destroy coins.

Instead you could say the reserve inherits the policies of the central banks represented by the currencies in it such as the US dollar or the Euro.

The reserve backs the Diem in full with a goal to always preserve Diem’s purchasing power.

This type of reserve discourages a classic run on the bank. The typical rationale behind a bank run is that a coin is only fractionally backed, and there isn’t enough hard cash to go around if everyone were to decide to cash out at the same time.

A fully-backed reserve promises that everyone would be able to cash out at any moment even if the market was to panic.

The Diem Investment Token

The reserve funds I mentioned earlier will be invested in low-volatility, highly liquid assets like bank deposits and government bonds with low default probability and low inflation expectations.

The yield from the reserve will be used to support the operating expenses of the Diem Association but will also be distributed to the holders of the Diem investment token.

The Diem Investment Token is, in fact, a security token issued by the Diem Association which, unlike the Diem coin, can, and probably will fluctuate in value.

When a founding member of the Libra association invests an initial amount in the reserve, they get the Diem Investment Token in return. This token can be considered as a share in the Diem association. If the Diem reserve generates a profit, it will be distributed to the token holders.

Since the Diem Investment Token is considered a security, it will be available only to founding members of the Diem Association and to accredited investors from the general public.

Keep in mind that since the reserve is invested in very low risk – low yield assets, it’s planned to make a substantial profit only if the Diemproject were to truly take off. The reserve needs to be large enough to generate substantial profits even from low interest rate investments.

4. Diem criticism

As you can imagine, the Diem project attracts its share of criticism. Let me point out some of the more concerning points about Diem.

“Just another fiat currency”

Diem seems to be just another fiat currency, only this time it’s controlled by corporates and not by central banks.

The Diem Association states that in the early development of the Diem network, its founding members are committed to working with authorities and to address all regulatory concerns.

Basically, this means that Diem will probably be available only for people who pass a certain verification process, making it still unreachable to many unbanked and underbanked people around the world.

Keep in mind that over half of the 1.7 billion underbanked come from just seven countries: Bangladesh, China, India, Indonesia, Mexico, Nigeria, and Pakistan; in more than half of these places, cryptocurrencies are banned, Facebook can’t freely operate, and heavy regulatory restrictions exist to combat crime and money-laundering concerns.

On top of that, Diem’s value is backed by major fiat currencies making it inherently attached to their fluctuations.

Privacy issues

Much like Bitcoin, Diem transactions are pseudonymous. This means all transactions are public and visible to everyone, but you can’t tell who sent what to whom, since Diem addresses are just random letters and numbers.

However, if you take into account that Diem wallets will require some sort of user verification, you can easily see how financial information can be constructed by certain entities like Diem wallets and therefore possibly leaked.

Centralization

Another important issue is the fact that Diem is a centralized, also known as permissioned, blockchain with intentions of becoming permissionless, but it remains unclear how and if this transition will actually occur.

The financial interests of the companies behind Diem may collide with this vision if Diem becomes extremely popular, and it requires a significant level of trust on the public’s part to believe that those organizations would lobby for Diem’s vision over their own interests.

Some of the challenges the switch to decentralization presents include:

- How to decentralize the reserve function?

- How to scale the system so it will work fast enough with more than 100 validators?

- How to secure a decentralized network against fraud?

- How will decisions be made once there is no centralized council?

Bitcoin proponents would argue that if you want to create a decentralized coin, you should make it decentralized from the get go, since a decentralized model is something that needs to be taken into account when building the foundations for any blockchain.

One theory suggests that when building a blockchain you’re ideally looking for three main elements:

- Decentralization – Meaning anyone can participate and it’s free for all.

- Security – Since these are digital currencies you need to protect against double spending issues.

- Scale – You want the system to be able to have a high rate of transaction approval, so it can easily be adopted worldwide.

The problem is that by design you can only have two out of the three. Currencies that are decentralized and secure, like Bitcoin, aren’t really scalable. Currencies that are scalable and secure aren’t truly decentralized, like Ripple and its XRP currency.

Currencies that are decentralized and scalable are inherently insecure since it takes time for the data to travel between all participants in a large system, and bad actors can take advantage of this lag in information.

In Diem’s case – while it starts out as secure and scalable, there’s no clear understanding of how it will become decentralized as well.

Governance

Finally, we have Diem’s governance model and regulation. one of the most interesting points of criticism about this issue comes from an article by Dmitriy Brenzon, a research partner at Bollinger Investment Group.

Brenzon says it is unclear whether the benefits of the public good which Diem aims to serve, is a strong enough incentive for competing organizations with conflicting priorities.

For example, what happens if Novi, the Diem wallet developer, wants to launch in the same market as Celo, a platform for stable, secure digital payments? Celo is a portfolio company of Andreessen Horowitz and Coinbase, which are part of the Diem council.

Brenzon puts it this way, “With only 28–100 Council members, politics should be expected; after all, there will be individuals from organizations who know how to play that game.”.

His final point really hits the mark:

“What is the incentive for companies to participate, and will it be strong enough to stand up against regulators and governments when push comes to shove?

While Diem intends to create a network that operates across any country, it’s actually creating a network that will have to comply with every country’s regulatory regime.”

Several regulators from countries around the world like France and Germany have already lashed out against Diem.

Subsequently, major council members Visa, Mastercard, PayPal, Stripe, eBay, Booking.com and Mercado Pago decided to withdraw their membership, leaving Diem with no major US payment provider and with hindered momentum.

5. Conclusion

As you can see, there’s still a big question mark on whether Diem will actually launch and if so, how successful it will become.

But there’s no doubt about it: Diem is a groundbreaking move on Facebook’s part. It shows we’re entering a new world where not only governments can create money, but also corporations.

A lot of crypto-anarchists believe that the world is already run by a corporatocracy – companies that dictate national interests through lobbying, and this is just another step towards increasing the corporate hold over governments.

No matter how the Diem project pans out, it’s a statement that cryptocurrencies are the future of the global economy.

I don’t trust Zuckerberg, but this is a very well-written and easy-to-understand article, as we have come to expect from 99Bitcoins. Well done.

Excellent information, I would like to post this to LinkedIn

Thanks for the feedback, if you share it, please give us proper credit and link our site.

What is Libra and does it much earning My urgent needed issue is Bitcoin Address in order to facilitate my trading .