Lugano was a success once again, and Tether (USDt) revealed they just became the seventh largest BTC holder. The use of stablecoins is also gaining popularity through Tether casinos and these updates. Tether is making sure if it fails, we all fail.

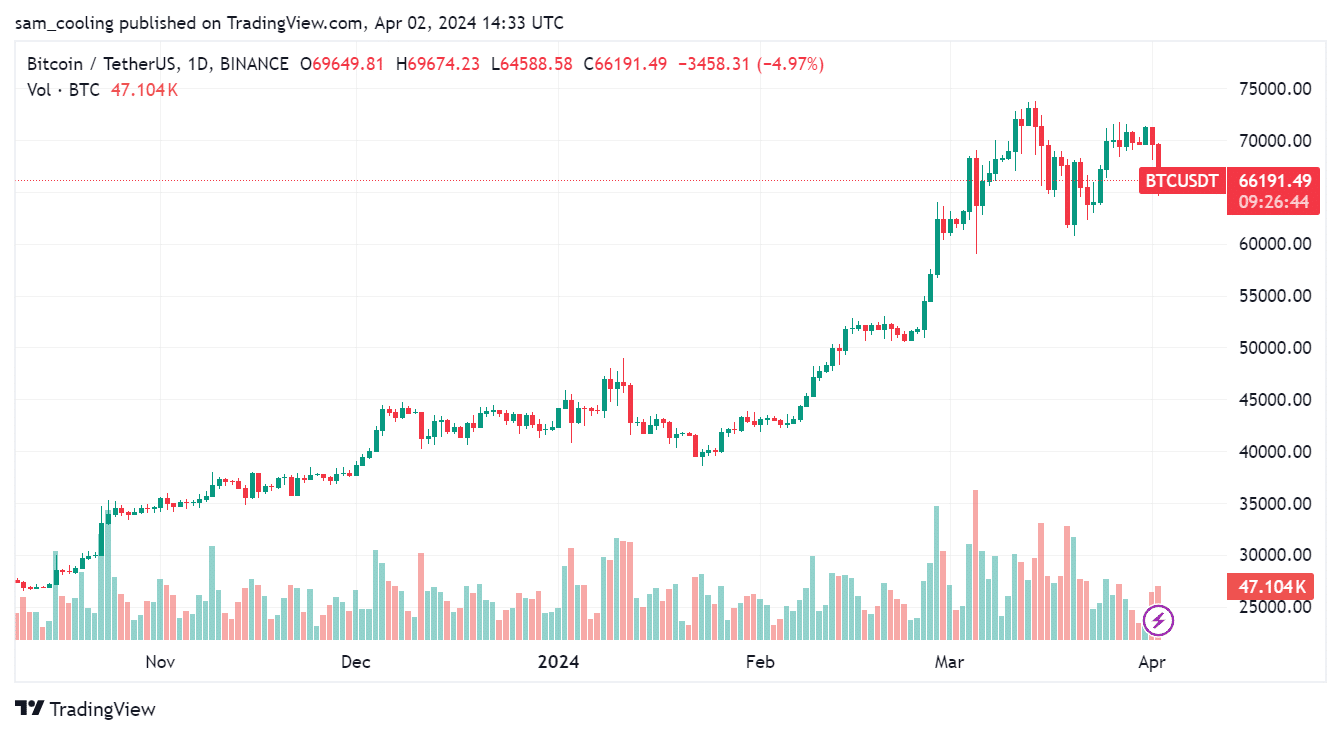

On March 31, Tether, the titan behind the USDT stablecoin, made a splash that rippled through the crypto market, acquiring a further 8,888 Bitcoins, showing confidence in current pricing and deep pockets at the firm.

This investment, valued at $618 million, cranked Tether’s Bitcoin holdings up to 75,354, locking in at a coveted average buy-in rate of $30,305.

🚨BREAKING:

1,000,000,000 worth of #USDT just got minted at Tether treasury.

When tether mints, #Bitcoin pumps

— Elja (@Eljaboom) April 2, 2024

Today, their pile of digital gold is worth an eye-watering $5.2 billion – making Tether the seventh largest BTC holder in the world.

Unlike other stablecoin protocols, like the now-defunct Terra Luna, Tether has 84.58% of its stablecoin backed in cash, cash equivalents, and other short-term deposits, with the rest in precious metals, Bitcoin, and secured loans. And, since 2023, Paolo Ardoino announced Tether is buying Bitcoin with its profits.

(BTCUSDT)

Their Bitcoin investment, first made in May 2023, has already yielded over 128% in unrealized profits. Here’s what else you should know about the play:

The Rise of USDt: Tether’s Bitcoin Play and Tether Casinos

With this acquisition, Tether now ranks globally as the seventh-largest Bitcoin holder, a testament to its aggressive investment strategy in the face of growing institutional interest in Bitcoin. Only three corporate entities – MicroStrategy, Bitfinex (another company affiliated with Paolo Ardoino), and Binance own more Bitcoin.

This move aligns with significant market events, including the approval of U.S.-based spot Bitcoin ETFs and the eagerly anticipated Bitcoin halving, set to slash block supply issuance in half.

“The decision to invest in bitcoin, the world’s first and largest cryptocurrency, is underpinned by its strength and potential as an investment asset,” CTO of Tether Paolo Ardoino said in the statement.

Tether plans to invest 15% of its net profits in Bitcoin to diversify beyond conventional assets like U.S. Treasuries. In early March, USDT’s market cap reached $100B with a robust YTD growth of +9%.

The use of stablecoins is also gaining popularity through Tether casinos. Tether casinos are a new phenomenon that allows users to use Tether to bet on games like those found in Vegas or on professional sports such as NFL or NBA matches. Some websites offer matched deposit bonuses of up to 240%.

Inside Lugano: Swiss City Goes Full Crypto Using Tether

The narrative around cryptocurrency adoption finds a compelling example in Ardoino’s initiative in Lugano, Switzerland, where over 15% of citizens use the city’s LVGA stablecoin for daily transactions.

This trend, supported by the city’s PlanB initiative and Bitfinex, uses a unique platform to support Bitcoin payments via the Lightning Network and Tether.

Residents of the Swedish town can make payments by scanning a QR code on their bill and selecting a digital wallet. They can also pay their taxes in cryptocurrency, and plans are afoot for the city to expand the number of stores that accept cryptocurrency to 2,000 in the coming years.

The Bottom Line: Bitcoin Making Big Moves in the Tether Casinos

In a parallel development, Bitcoin staking has gone viral due to Lorenzo Protocol, a well-known advocate for Bitcoin decentralized finance and BTC liquid staking, announcing integration with Babylon, a BTC staking framework.

The integration aims to create a secure and modular Bitcoin Layer 2 ecosystem, making Bitcoin more useful and accessible throughout the global financial system. Other developments from this partnership include:

- Smart Contract Execution: Smart contract execution is seamless, paving the way for numerous dApps using Bitcoin assets.

- Customizable L2 Solutions: Offering Bitcoin L2 solutions, fortified by re-staking and timestamping, with unparalleled security through an L2-as-a-service model.

- Decentralized Asset Compatibility: Supports decentralized wrapping of Bitcoin-native assets to the L2

Overall, Bitcoin is a nice way to double capital in the long term, and Tether is clearly taking note as they take position as the seventh largest BTC holder.

The strategic buy, timed with the Bitcoin price dip, signals a sophisticated approach as they up the ante, ahead of the Bitcoin halving event on April 20.

EXPLORE: Tether is Most Popular Crypto for Crime, Is it Also the Largest Ponzi Scheme?

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

No Comments

No Comments