What is Tether – A Beginner’s Guide

By: John West | Last updated: 2/21/24

Tether is one of the most popular stablecoins around today. In this post, I’ll explain what a stablecoin is, what Tether is and how it works.

Don’t Like to Read? Watch This Video Instead:

What is Tether Summary

Tether is a stablecoin that is pegged to different fiat currencies. USDT is pegged to the US Dollar and is issued by the company known as Tether. This allows traders to transfer the “fiat equivalent” in value between exchanges, without the need for normal fiat currency regulation.

There are serious concerns about the solvency of the company issuing Tether, which has been neither based nor disproven so far.

That’s Tether in a nutshell. For a more detailed review keep on reading, here’s what I’ll cover:

- What are Stablecoins?

- What is Tether?

- How Tether Works

- Tether Advantages

- Best Tether Wallets

- How to Buy Tether

- Tether Controversy

- Frequently Asked Questions

- Conclusion

1. Stablecoins in a nutshell

A Stablecoin is a cryptocurrency that is pegged to a real world currency, also known as fiat currency (e.g. the US dollar, Euro, etc.).

Stablecoins are issued by centralized companies that maintain the peg, either by putting up collateral or through some sort of algorithm that manipulates the stablecoin’s supply, depending on the demand.

Stablecoins allow exchanges to create fiat currency pairs without actually accepting fiat. For example, you can have a BTC/USDT trading pair which simulates the BTC/USD market without the need for regulation.

2. What is Tether?

Tether (₮) is a stablecoin pegged to fiat currencies. The most popular peg Tether uses is to the US Dollar (ticker symbol USDT).

1 USDT is intended to remain exactly equal to $1—not a cent more or less. It’s basically a crypto dollar (at least in value).

Another currency that Tether uses is the Euro, in the form of EURT.

It’s worth noting that Tether users are protected from the volatility of cryptocurrency, but they’re still exposed to fluctuations in the price of the pegged fiat currency.

For example, consider what would happen if a momentous event occurred that halved the value of the US dollar overnight. If you hold USDT, it would lose an equal amount of value as the USD.

The Tether Bitfinex Connection

Tether is directed by some of the same people behind Bitfinex: Philip Potter and Giancarlo Devasini. This leadership was confirmed by the Paradise Papers leak, although the news didn’t come as a surprise to anyone paying attention.

New Tether accounts flow mostly to Bitfinex. In April 2017, Bitfinex and Tether experienced a freeze of their fiat operations, when US Bank and Wells Fargo withdrew as banking partners.

As a result, Bitfinex now refuses US customers and it no longer provides markets denominated in USD. Rather, it exclusively uses USDT.

3. How Tether Works

At first, all Tether was based on the Omni Platform. This platform is used for various digital assets, which are anchored to the Bitcoin blockchain. Following Bitcoin, Ethereum based Tether coins were launched as well, which is now their most-utilized network. They haven’t stopped there, however, with Tether tokens now existing on 8+ blockchains including Tron, OMG Network and Solana.

The Tether peg is maintained through collateral. They claim that for every 1 USDT in existence, there’s a US Dollar worth of currency or other assets sitting in deposit.

For 1 USDT to be worth $1, it must be redeemable at any time for $1 of fiat currency. At present, USDT is only directly convertible to USD via a small number of exchanges or through Tether itself (which requires a $100K minimum and charges considerable fees).

To sum it up, for 1 USDT to actually be worth $1, Tether and exchanges must keep a reserve of dollars to back every USDT in existence.

4. Tether Advantages

Since the majority of mainstream interest in cryptocurrencies is due to their fluctuation in price, one might question the purpose of a cryptocurrency, which is predicated on maintaining a fixed price. No pumps, no dumps, no bubbles.

Owning Tether is more like a deposit in a (somewhat risky) bank account that pays 0% interest.

So if Tether is riskier than regular cryptocurrencies and provides no possibility of financial gains, why use it at all?

The reality is that Tether is extremely useful to traders and investors as an alternative to fiat. There are several good reasons why:

Transaction Times

USD deposits and withdrawals to and from foreign exchanges are often a time-consuming process. On average, they take 1 to 4 business days to complete. If the transaction occurs after banks have closed for the night, weekend, or holiday, wait times may be considerably extended.

By contrast, Tether transactions are completed in minutes. This benefit is significant because cryptocurrency traders often need to rapidly shift funds, and take advantage of arbitrage opportunities.

Transaction Fees

SWIFT (Society for Worldwide Interbank Financial Telecommunication) transfers are very expensive. They cost upwards of $20 in fees and average around $30.

Additionally, if you’re using a fiat currency other than those supported by the exchange, the banks will charge an extra foreign exchange conversion fee and percentage on the transfer.

By contrast, Tether charges zero transaction fees between Tether wallets, however standard blockchain network fees apply.

Price Stability

Cryptocurrencies are notorious for being volatile, and trading one volatile currency for another creates a great deal of complication and extra risk. That’s why a stable base currency is extremely useful.

To understand why, imagine the following scenario, which involves trading Bitcoin for Ethereum:

- You convert BTC to buy ETH

- ETH rises by 10%.

- You wish to make a profit and sell your ETH for BTC.

- While the trade is being processed, Bitcoin shockingly falls by 15%

Despite being correct about ETH’s direction, you would take a loss, due to the fall of BTC. By using USD₮, your sole concern is the price of Ethereum.

Staying on the Sidelines

Frequently, the best position to take in a market is no position at all. Let’s say you feel that a certain cryptocurrency price, which you own, is unsustainably high. Your best move, in this case, would be to cash out, then wait for a dip or crash to buy back in.

5. Best Tether Wallets

Ledger

The most secure way to keep your USDT safe would be in a hardware wallet. A hardware wallet keeps your coins offline making them impossible to steal unless someone gains physical access to the wallet.

Ledger has two wallet models that support Tether and over 1200 additional cryptocurrency assets. The Model S and Model X both offer USDT support, the main difference being that the Model X can be controlled from your mobile phone as well.

You can read my complete Ledger Nano X review here.

Trezor

TREZOR is another hardware wallet manufacturer that supports Tether. There are two models available from TREZOR – the TREZOR One and the TREZOR Model T. The Model T is the newer model featuring a touch screen.

TREZOR wallets are compatible with desktops only. You can my complete TREZOR Model T review here.

Coinomi

Coinomi is a multicurrency, multiplatform software wallet that allows you to store over 1,500 cryptocurrency assets including USDT. The wallet is user friendly, with a built-in exchange function so you can exchange your current holding into USDT and back.

Coinomi is available for iOS, Android, Windows, Mac, and Linux. You can read my complete Coinomi review here.

Exodus

Exodus is a beautifully designed cryptocurrency software wallet that can hold over 100 different crypto assets, including Tether. Exodus is extremely recommended if you’re just starting out with crypto as it’s super beginner friendly.

Exodus is available for iOS, Android, Windows, Linux, and Mac. You can read my complete Exodus review here.

Tether

It’s important to note that Tether also supplies their own dedicated web interface for holding Tether. This interface isn’t highly recommended due to the fact that it supports only Tether and no other cryptocurrency. Additionally, this service has been suspended in the past due to a $30m USDT hack.

6. How to Buy Tether

By far, the most common method of buying USDT is to exchange it for another cryptocurrency. For the full list of USDT crypto markets, check out CoinMarketCap’s list. (For your convenience, they’re sorted by “pair.”)

There are also several exchanges that offer a USDT/USD trading pair:

7. Tether Controversy

The New York Times, Bloomberg, and Fortune all recently published articles that express concerns about Tether. These articles reflect doubts and fears that have been percolating in certain corners of the crypto community for years.

The true wellspring of skepticism about Tether and Bitfinex skepticism is undoubtedly the writer known as Bitfinex’ed. He is notorious for his ongoing, fervent criticism of Bitfinex’s operations.

Critics accuse Bitfinex and Tether of running a fractional reserve scheme: More USDT are issued than are backed by fiat dollars. Critics further allege that unbacked Tether accounts are used to inflate the price of Bitcoin for the purpose of market manipulation.

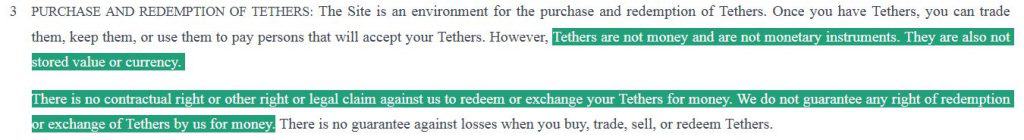

Tether’s self-reported finances claim full—and even excess—reserves. However Tether doesn’t guarantee USD convertibility, check out Tether’s terms of service:

On March 2019, Tether changed the statement on their website from this:

“every tether is always backed 1-to-1, by traditional currency held in our reserves. So 1 USDT is always equivalent to 1 USD.”

To this:

“Every Tether is always 100% backed by our reserves, which include traditional currency and cash equivalents and, from time to time, may include other assets and receivables from loans made by Tether to third parties, which may include affiliated entities (collectively, “reserves”). Every tether is also 1-to-1 pegged to the dollar, so 1 USD₮ is always valued by Tether at 1 USD.”

Suggesting that the company is no longer fully backed by US Dollars (if they ever were).

8. Frequently Asked Questions

Who Owns Tether?

Tether is controlled by Tether Holding LTD. A company based in the British Virgin Islands and Hong Kong. The CEO of Tether is JL Van Der Velde, the CFO of the company is Giancarlo Devasini and Suart Hoegner acts as the general counsel.

It’s important to note that both Van Der Velde and Devasini have the same positions at Bitfinex.

Is Tether Backed by USD?

Tether is backed by currencies and assets that are equivalent to the number of USDT in circulation. However, the company does not keep a 1 to 1 dollar to USD in deposits.

Is Tether ERC-20?

Initially, Tether was Bitcoin-based, issued via the Omni Layer Protocol. However, today there are also Ethereum-based Tether for US Dollars and Euros, compatible with the ERC-20 standard.

The Ethereum-based Tether allows for tokenized USD and EUR to be transferred over the Ethereum network. This enables interoperability with Ethereum-based protocols and Decentralised Applications (DApps) whilst allowing users to transact and exchange fiat pegged currencies across the Ethereum Network.

Although Tether has since been issued on other blockchains, most of their stablecoins still run on Ethereum.

9. Conclusion

Tether is uncomfortably close to the fiat banking system, and not just because of its obvious fiat linkage. Compared to Bitcoin, Tether is centralized, permissioned, and trust-dependent.

As a result, many crypto enthusiasts are naturally skeptical of Tether. However, without solid evidence of misconduct, the allegations made against Tether and Bitfinex are just elements in another FUD (fear, uncertainty, doubt) campaign.

While there are several valid concerns about Tether, which certainly bear noting, stories about how Tether will crash the crypto ecosystem seem overblown.

But perhaps this anti-Tether campaign may achieve some good results. A critical glare might force Tether to adhere to the highest professional standards and to shore up any potential weaknesses.

If you are interested in using Tether, I’d advise never storing significant sums in it. Always use Tether with caution. USDT should only be used for short-term crypto trading and transfers. If converting to and transferring large amounts as USDT, do so in batches, which will reduce your overall exposure.

Don’t expect to convert massive amounts of USDT to fiat without encountering a price disruption. Remember this: While Tether offers the advantages of cryptocurrency with the price stability of a traditional fiat, it also exposes you to the risks that are inherent in both systems.

Have you used Tether yourself? What are your thoughts about the currency? I’d love to hear about it in the comment section below.

“USDT is a scam, be careful. You start with a small amount of money, and it lets you win and withdraw money (sell the crypto), everything seems fine. Then, you get excited. To cut the story short, I bet $30,000 and won about $104,000 – subtracting the $30,000 I invested, my profit was $74,000. The platform sends you a message saying that since you won more than 200%, you have to pay 20% of the total to claim the money. I was supposed to pay $14,800, which I did. But magically, my account froze, and the person who was advising me disappeared, with no one responding. I hired lawyers to report it, and they told me it’s a common tactic used by scammers. So, be cautious. Today it was me, tomorrow it could be you.”

Hello, I’m here on this position. What was the company name. Mine is Instrument.

I just want to tell every Crypto Trader and investors to be careful before trading with any company out there. I’m a crypto trader and I got into the scene when crypto volatility was really high

I transfered 35 USDT from one wallet (coin wallet) to another wallet. I paid $6.8 in transfer fee which I expected. However, at the end of the day I received 0 (zero) USDT. Looking at the Etherscan transaction, it appears it was all eaten by various fees…..hmmm….is it worth dealing with USDT?

Hi does this mean that USDT doesn’t have any standard transaction fee at all? like for bitcoin example they have 3.055? I want to know if there is a standard fee for tether .

It depends on the network it is running on and it is a typical network fee. Also, you are not right that you think Bitcoin has a set standard transaction fee. Bitcoin fee may vary depending on the network congestion albeit not by much.

Hi … again, thank you for your informative and concise explanations. I am right in concluding as the purchasing value of the USD drops with the flood of unprecedented QE – Covid ‘help money’ Tether will maintain 1:1 and go down with it?

Surely that defeats the purpose of a crypto community free from Central and private banks? Perhaps tether is just the fashionable thing … for now – remember when Americans went crazy over owning a pet rock?

Confused!

Hi Douglas,

Yes, that would follow, as Tether’s value is tied to the value of the USD.

So, Tether isn’t a true cryptocurrency and so shouldn’t be viewed in the same light as something like Bitcoin, which does indeed present an alternative to central bank money.

Tether is by design part of the central bank system, albeit indirectly. The main use of Tether is for crypto traders to convert back to fiat without having to touch a regular bank account.

Hi Douglas,

Yes, quite correct, the value of 1 Tether is maintained at the value of $1. Right now the USD is losing some relative value, I’m not quite sure what’s driving that move, but yes, it means the value of Tether is declining accordingly.

I think stablecoins make more sense if you see them as a hybrid of crypto and fiat. They have the advantage of crypto in that they’re cheap, fast, and easy to send. They also have the advantage of fiat, in that their value is fairly stable (hence the name) and well-defined.

However, they’re kind of a compromise position, so they do suffer from the disadvantages of both types of money as well. I think they have some applications, mostly for traders, but I certainly wouldn’t recommend them for investment purposes.

With Poloniex closing up shop on US customers, I attempted to transfer funds to my Coinbase ETH wallet using USDTETH, my understanding being that “Ethereum-based Tether allows for tokenized USD and EUR to be transferred over the Ethereum network. This enables interoperability with Ethereum-based protocols and Decentralised Applications (DApps) whilst allowing users to transact and exchange fiat pegged currencies across the Ethereum Network.”

Now funds/amounts are nowhere to be found on either platform.

Have I simply lost my funds, or is there ANY way to track them down & reclaim?

– Clueless

Hi Clueless,

Your best approach would definitely be to contact Poloniex support and request the return of your money.