The Bitcoin community was ecstatic yesterday over news that PayPal, the online payment business owned by eBay, has given the go-ahead for bitcoin integration with Braintree — a subsidiary of PayPal that was acquired last year.

The reason for that acquisition was Braintree’s app which acts as a payment processor for merchants on the internet and mobile web. The app, executed by a few lines of code, allows the merchants to take credit and debit card payments, as well as PayPal — and now bitcoin.

In order to accept bitcoin payments, Braintree is working with Coinbase — one of the primary Bitcoin payment processors, which has already enabled bitcoin payments for 36,000 businesses across the world. Coinbase works by instantly exchanging the customer’s bitcoin for fiat money, and paying dollars to the merchant’s account within three business days.

Now with the new partnership between Braintree and Coinbase, online services such as Uber, Airbnb and GitHub can potentially accept payments in bitcoin. However, they have to opt-in by creating their own account and wallet with Coinbase.

PayPal Friendly Toward Bitcoin

While it’s worth stressing that PayPal itself isn’t enabling bitcoin payments — a small subsidiary is merely enabling them within its own collection of merchants — this is still an interesting development. It shows that PayPal isn’t too concerned about having its own service compete alongside Bitcoin within the same app.

PayPal is demonstrating its openness to Bitcoin as a regular payment channel, just like credit cards. Bill Ready, Braintree’s chief executive, referred to the announcement as “PayPal’s first foray into Bitcoin,” implying that deeper integration could be on the horizon — perhaps within PayPal’s app itself.

For now, though, this is simply Coinbase’s current merchant service piggybacking on the product of a small eBay subsidiary. It’s similar to past partnerships such as when BitPay, and then Coinbase, enabled Bitcoin payments for all 75,000 merchants in the Shopify network. Such an agreement opens up thousands of new options for Bitcoin owners to easily spend their money.

Merchants are able to decide what fraction of the payment they want in bitcoin vs. dollars, and Coinbase waives processing fees for the first $1 million of income. In addition, payments can’t be retroactively reversed by unscrupulous customers — as is the case with credit cards or regular PayPal payments. For these reasons, accepting Bitcoin payments has proven to be a no-brainer for thousands of businesses worldwide.

Merchant Adoption Impacts Bitcoin Price

But are there any losers in this situation? Potentially. With so many options for spending bitcoin on practically anything, many people may decide it’s less desirable to hold large amounts of the digital currency. Why remain heavily invested in something that has lost 25% of its value in the last six months, and that can now be exchanged for all kinds of awesome and useful stuff?

Despite the practice of some users who re-buy whatever bitcoin they spend, and that some merchants accept at least a fraction of their payments in Bitcoin itself, the fact remains that Coinbase’s main role in this situation is facilitating the seamless conversion of bitcoin into dollars. This inevitably puts selling pressure on the Bitcoin price.

Unless Coinbase has a limitless supply of dollars ($25 million is a lot, but not limitless), holds the vast majority of its profits in bitcoin, or manages to sell an equalizing amount of bitcoin to its own customers — the overall result of further merchant acceptance of bitcoin is downward pressure on Bitcoin’s value.

While the price of Bitcoin hasn’t necessarily been in free-fall, overall it’s been dropping since almost a year ago, when merchant adoption started ramping up.

As more large businesses start to accept it as payment — including the big players like Overstock, Newegg, and the myriad retailers available through gift card sites like Gyft and eGifter — more and more people who once held Bitcoin are now encouraged to spend it on things that they actually want.

Consumerism, so to speak, has taken over the Bitcoin payments space. It’s a great thing for merchants, consumers, and the overall economy, but its not necessarily a great thing for people who hope for a rise in the Bitcoin price.

This isn’t to say that the PayPal / Braintree integration of Bitcoin couldn’t have an overall positive impact on the digital currency. Such a partnership can have a lasting impression on the general public, many of whom are still skeptical of Bitcoin due to the failure of Mt. Gox or other factors.

With PayPal’s outright acknowledgement of Bitcoin’s legitimacy, many consumers may be encouraged to learn more about the digital currency and get involved. Also, if PayPal eventually integrates Bitcoin into its official payment system, that will go a long way toward improving cryptocurrency’s legitimacy in the public eye.

No New Bitcoin Features

In terms of actual utility, however, the PayPal / Bitcoin integration falls far short of what the partnership could actually accomplish.

As referenced earlier, expanding merchant adoption has been a steady trend for the past year. Extending that trend to Braintree’s collection of merchants is a fairly mundane improvement to Bitcoin overall, at least in this point in its history.

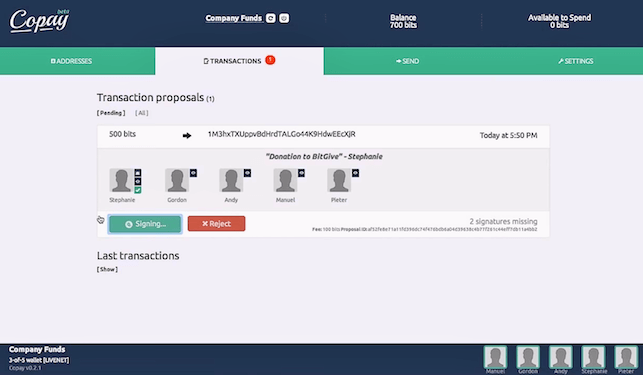

What Bitcoin truly needs is not more places to spend it, but more features built into and on top of the protocol itself. Tools like multi-sig, crowdfunding, and marketplaces are incredibly useful services that are built directly on top of Bitcoin and provide innovative new features. Multi-signature transactions, for example, are just not feasible with any of the legacy payment networks.

But for now, PayPal has elected to not actually innovate on top of Bitcoin, but simply acknowledge its legitimacy and include it as an option within a subsidiary’s payment application.

The announcement finally confirms an endless stream of rumors that eBay and PayPal have been actively looking into Bitcoin, and now they have given the digital currency their blessing by permitting Braintree to implement it as payment.

This is a win for those who root for Bitcoin’s legitimacy in the public eye. It’s a win for the thousands of merchants who could see a new source of income thanks to Bitcoiners, Coinbase and Braintree. But it will likely be a loss for longtime Bitcoin investors — at least in the short term, until consumers and investors start buying bitcoin en masse again.

Deeper Bitcoin Integration in the Future?

As of the current implementation, it’s a net neutral development for those who hope for improvements to Bitcoin’s utility. At this point, the Bitcoin community doesn’t really need more places to spend its money seamlessly — what it really needs is more tools to manipulate that money with innovative features and useful methods not available with other kinds of money.

One day, if PayPal and eBay truly want to leverage the Bitcoin protocol for all its worth, they could use the digital currency as a way for micro-bidding on eBay, or allowing secure multi-sig transactions between sellers and buyers. These is the interesting and innovative possibilities that could be in PayPal’s future if it decides to delve deeper into the possibilities of Bitcoin.

For now, though, we can spend bitcoin on products from a few thousand more merchants.

No Comments

No Comments