Crypto stock heavy hitters are getting slaughtered, in the latest development, MicroStrategy’s stock crash took a -15% beating and Coinbase (COIN) is down even harder.

Meanwhile, crypto mining group Marathon Digital Holdings is on a downward spiral, losing more than -28% of its share value – in this article, we’ll explain when the sell-off will end.

The message ostensibly is clear: Any company involved with digital assets is f-… they’re screwed.

The broader crypto economy has shed approximately $420 billion in market value over the last month, with Bitcoin and Ethereum witnessing over -15% and -17% declines. Boomers are selling.

(BTCUSDT)

MicroStrategy Stock Crash: Why MSTR is Going Down Further

BTC’s descent to a low of $59,100 represents its weakest performance since late February, marking a significant retreat from its mid-March peak above $73,000.

This is the worst month Bitcoin has had since the FTX crash of 2022. That’s saying a lot.

Tom Brady's last three weeks:

* Lost to the Panthers (the worst team in the league)

* Got divorced

* Had $650 million rugged by FTX

How is your fall going?

— Jim Bianco (@biancoresearch) November 10, 2022

As for the MicroStrategy stock crash, Michael Saylor, Microstrategy’s CEO, and cheerleader for Bitcoin, has reduced his stake in the company, selling thousands of shares amidst its declining stock price.

This move raises questions about his outlook on the company’s share value. The aggressive stance of companies like Microstrategy towards accumulating Bitcoin does not necessarily translate to shareholder value.

(MSTRUSDT)

With Microstrategy trading at significantly high multiples, including 45.73 times its GAAP-measured earnings, investors might find better value in directly purchasing Bitcoin or a spot Bitcoin ETF. No offense Mikey.

MicroStrategy Stock Vs. Coinbase (COIN): Which is Better Buy & Hold?

Michael Saylor’s recent sale of thousands of MicroStrategy shares speaks volumes about his confidence in the company’s stock value stability.

But Coinbase’s COIN stock isn’t looking any better:

(COINUSDT)

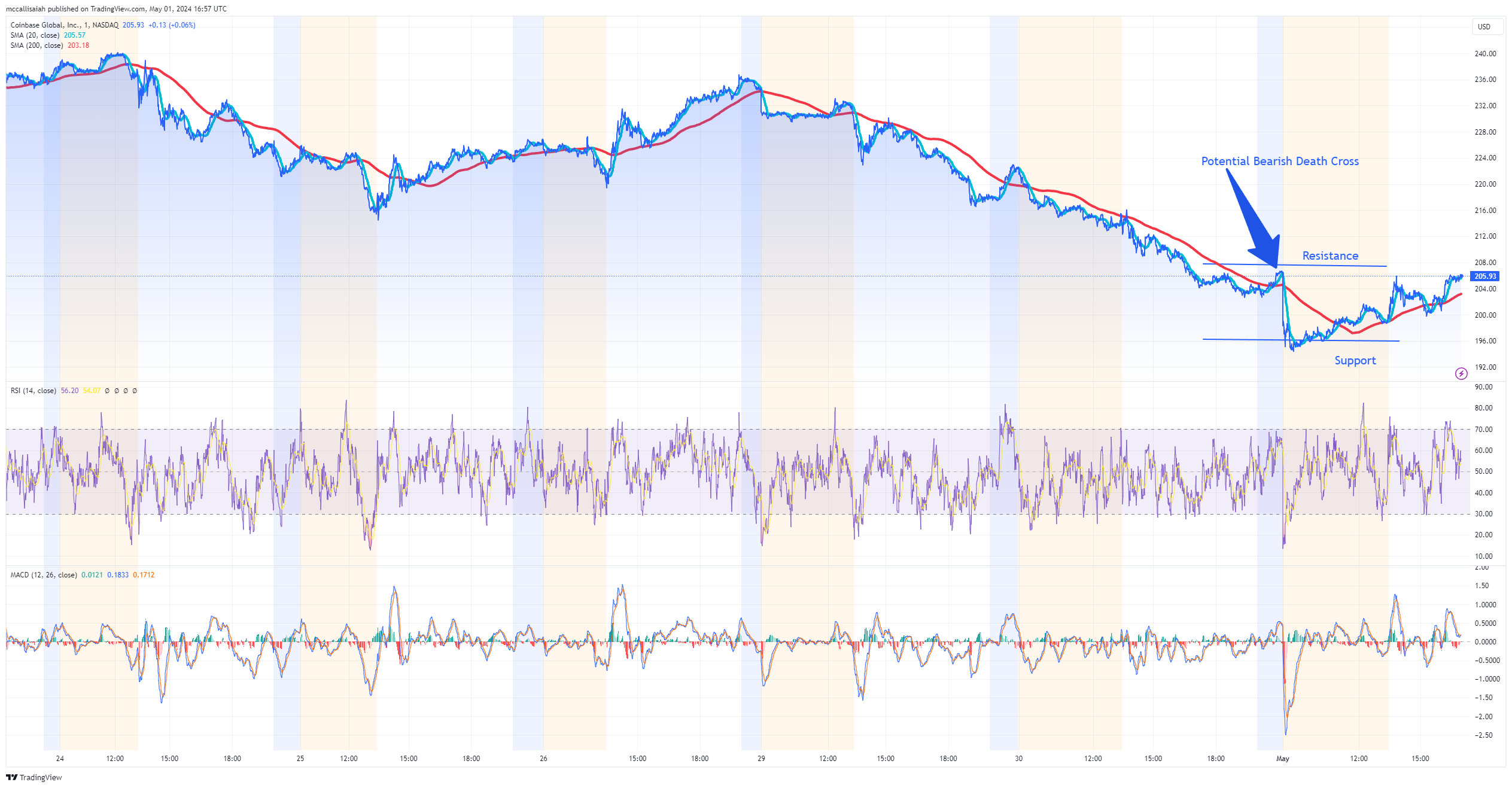

A recent bearish crossover with the 20-day MA dropping below the 200-day MA, often referred to as a “death cross,” suggests that there may be prolonged downward pressure.

The 200-day moving average (red line) seems to have stabilized recently around the $204 level. This area has acted as significant support and resistance in the past few weeks.

Both Coinbase and the MicroStrategy stock crash indicate it might be better (and less volatile) to buy and hold Bitcoin.

DISCOVER: How to Trade Bitcoin in 2024

The Bottom Line: Red, Red Everywhere!

A series of U.S. economic reports with a stagflationary tone – indicating slowing growth alongside accelerating inflation – has rattled traditional markets, contributing to the Nasdaq and S&P 500 declines.

These conditions have dampened expectations for U.S. Federal Reserve rate cuts, further pressuring digital assets.

With geopolitical tensions also in the gutter, it should be a rough early summer for crypto.

EXPLORE: Is BTC Set for a Quiet Spring After Bitcoin Halving Event? Here’s Why Traders Eye Altcoins in Q2

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

No Comments

No Comments