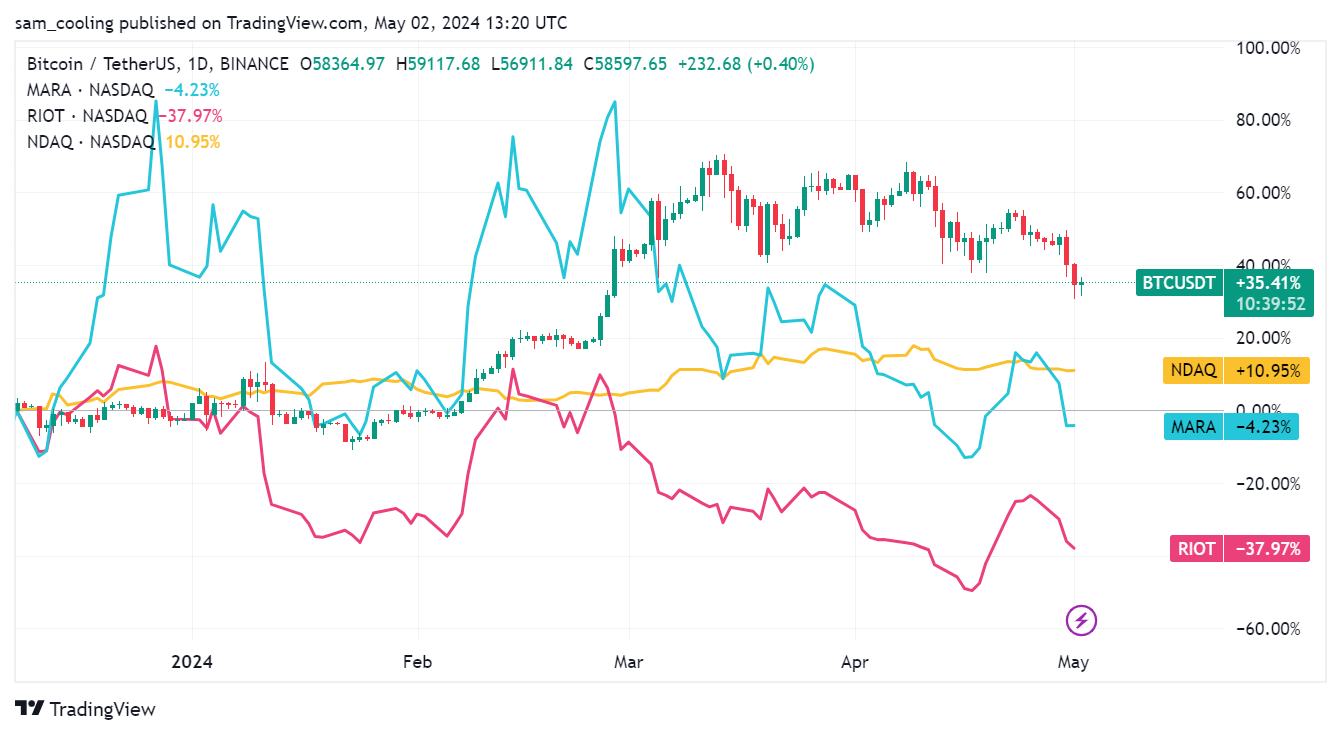

Bitcoin Mining Stocks including Riot (RIOT) and Marathon Digital (MARA) are slumping a few days after the Bitcoin Halving, deep-dive the reason Bitcoin mining stocks are falling as BTC price plummets below $60,000.

Only a few believers have the “strength” to hold Bitcoin right now. Not after the slide and billions in liquidation (I’m talking about those leveraged long bets).

Bitcoin Price Fall is Wrecking Bitcoin Mining Stocks

If Bitcoin can hold these lows and move higher the chart will qualify as a very common bull market continuation chart construction. $BTC pic.twitter.com/M8pBTUwszt

— Peter Brandt (@PeterLBrandt) May 2, 2024

After sharp gains in Q1 2024, Bitcoin rose to as high as $73,800, only to pull back strongly in the second half of March.

April was simply a continuation of the pain, with the dagger sinking deeper on April 30 when prices crashed below $60,000.

This development was different from what many fresh retail investors envisioned. On April 20, Bitcoin halved miner rewards, making BTC even scarcer. Believers and permabulls said this was the perfect recipe for a surge above $74,000 – however, in classic form a retracement move has engulfed the post-halving chart.

(BTCUSDT)

The downside move has left hodlers buying the dip, with BTC currently changing hands at just over $57,000.

For now it seems that BTC bears are in charge, with many prominent short sellers targeting $50,000.

Falling prices are a wrecking ball for miners, especially following a -50% reduction in block rewards – fuelling a sell-off in the equities market.

DISCOVER: What is Bitcoin Mining and How Does It REALLY Work

RIOT, MARA Share Prices Fall Despite Plans To Expand Hash Rate

(BTCUSDT)

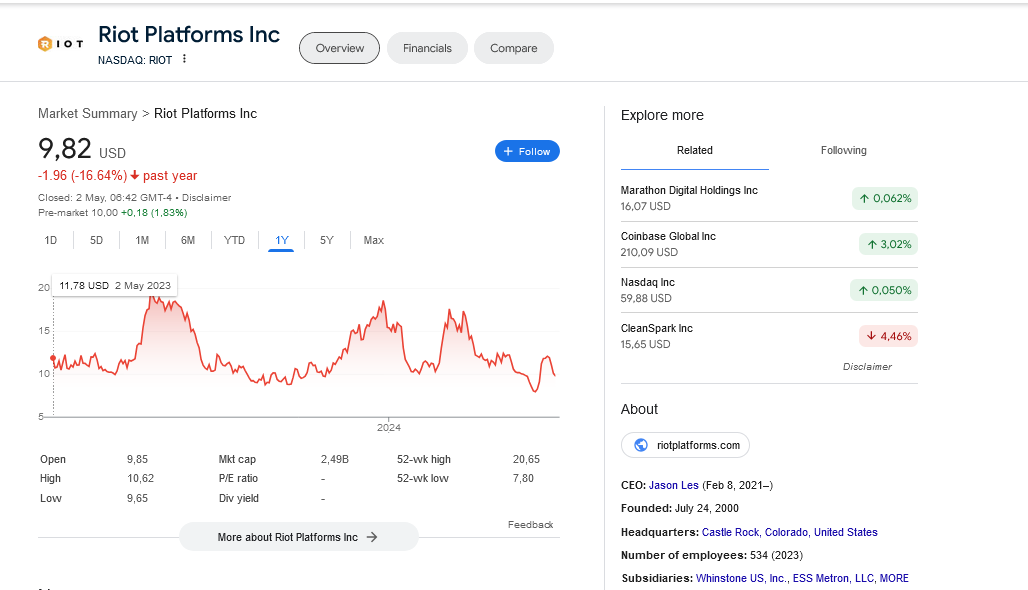

On May 1, the public Bitcoin mining firm Riot Platforms delivered mixed results in its Q1 2024 financial report, forcing RIOT share prices below $10.

While net income of $211.8 million, a jaw-dropping 10X increase year-over-year, was record-breaking, analysts weren’t convinced. Riot’s revenue fell short of economists’ expectations by -14%.

(RIOT)

Profitability was driven mainly by rising mining revenue, which increased by +55%. The price increase in Q1 2024 played a huge role. The problem is that economists expected much more.

Analysts noted that the lower BTC production rate–mining 1,364 BTC in Q1 2024–was made worse by rising mining difficulty and swelling hash rate, which slowed down revenue growth since average mining costs rose in tandem.

To illustrate, each BTC mined was more than double the cost used in the same period in 2023.

Riot will expand operations, even with stiffer competition expected after the April 20 halving. They will open up a new facility in Texas, helping push their hash rate (a measure of computing power) to over 41 EH/s by next year.

Their goal is to drive their hash rate to 31 EH/s by the end of the year and 100 EH/s by, at most, 2027. So far, the total Bitcoin hash rate is at 578 EH/s.

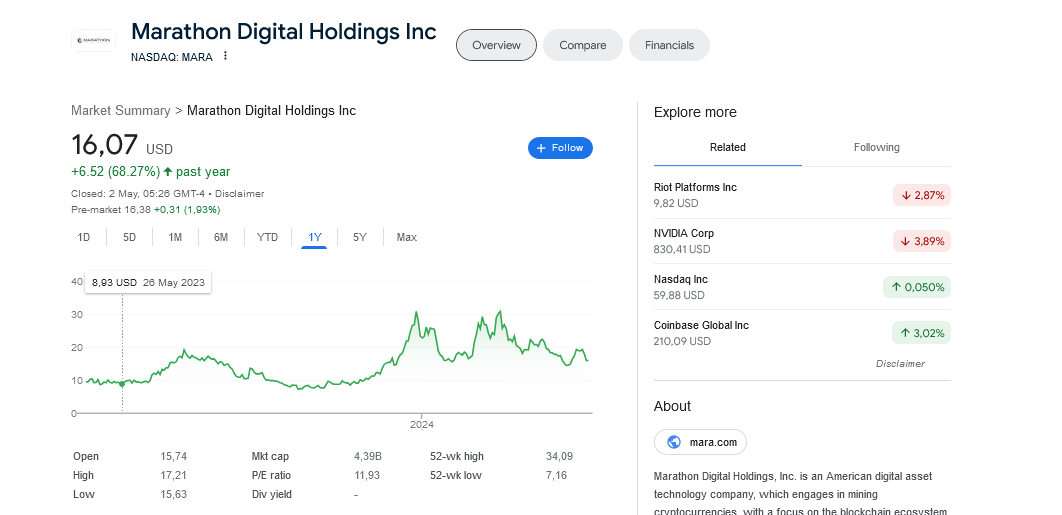

However, RIOT wasn’t the only miner slumping. Its competitor in the United States, Marathon Digital, also crashed, extending losses from February. MARA share prices are nearly down by 50% from 2024 peaks.

(MARA)

Marathon Digital aims to boost the hash rate to 37 EH/s by the end of the year without raising more capital.

Peter Thiel, the CEO, said they are currently fully funded. MARA share prices fell from around $19 to $16 this week but remain up 68% in the last year.

EXPLORE: Kamino Finance Partner with JitoSOL: Fuelling Market Defying Gains Could Wiener.Ai be Next?

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital

No Comments

No Comments