Bitcoin and ETH prices shot up hot on the heels of positive news about Ethereum ETF approval from the SEC – read on to learn more.

A time last week last week, Ethereum shot up rather unexpectedly. Bitcoin did the same.

However, no one knew what was “cooking” behind the scenes. There could have been valid triggers with the United States Senate voting to overturn the SEC rules, barring interested public companies in the country from being custodians of crypto assets.

Indeed, it was massive and looks like it will permanently shape the crypto landscape, encouraging heavyweights to participate.

Fast-forward to this week and Ethereum is hogging all the limelight.

The United States SEC and Spot Ethereum ETFs

The crux of the matter is not prices but the United States SEC now moving to approve the first spot Ethereum ETF likely.

Looking at events in the past 24 hours, the race is heating up–fast. By yesterday, five spot ETH approval applicants, including Fidelity, Grayscale, and VanEck, submitted revised 19b-4 filings after receiving unexpected feedback from the regulator.

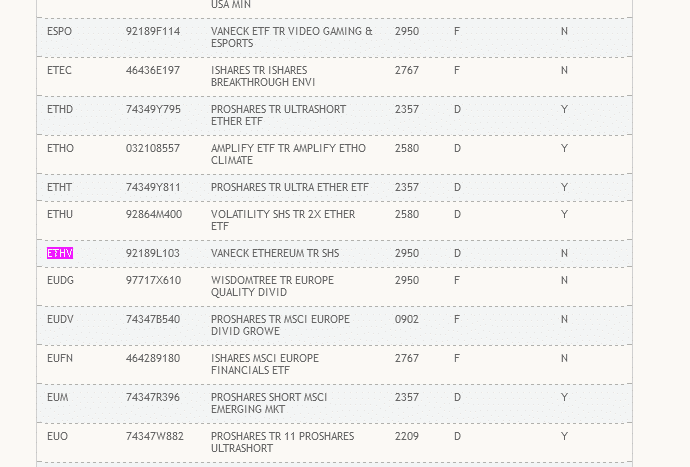

Here's a list of all entrants in the spot #Ethereum ETF race. The 'ETHness Stakes'

(h/t to @LongTailFinance for the name) pic.twitter.com/ZBQVJ6ppKp

— James Seyffart (@JSeyff) May 20, 2024

Currently, the application by VanEck has already been uploaded to the Depository Trust and Clearing Corporation’s (DTCC) website on May 21. Listing on DTCC means that the product has been registered and is compliant. Even so, it doesn’t guarantee its eventual approval. Only the SEC has the powers.

(DTCC)

Back at amendments, key changes had to do with staking, a core feature of Ethereum.

While staking helps secure Ethereum, the SEC thinks this feature qualifies ETH as a security due to the expectation of profits. All stakers receive a reward when they stake.

Reading from this, it isn’t surprising that all these submissions did away with staking from their proposals.

Should the SEC approve all applications by tomorrow or later, all issuers will simply buy ETH from the secondary market and send it to custodians. There won’t be staking involved, meaning the role of security will be entirely in the hands of the community.

Even so, with possibly scarce ETH (due to accelerated removal from circulating supply), whether staking yield will decrease or increase remains to be seen.

If ETFs absorb a ton of ETH but don't stake it – it could actually result in the native staking and restaking APYs all rising.

Network is becoming more valuable, but only native users staking.

Probably get a good staking/restaking mania prior to election.

— Adam Cochran (adamscochran.eth) (@adamscochran) May 21, 2024

ETH Soars, Gains 30% From May 2024 Lows

The excitement around spot Ethereum ETF approval has lifted prices. Looking at the formation in the daily chart, ETH is up by 30% from May 2024 lows. At the same time, the coin powered above the local resistances at $3,300 and $3,700.

(ETHUSDT)

If bulls press on, ETH will likely breach March 2024 highs of $4,100 and race towards all-time highs.

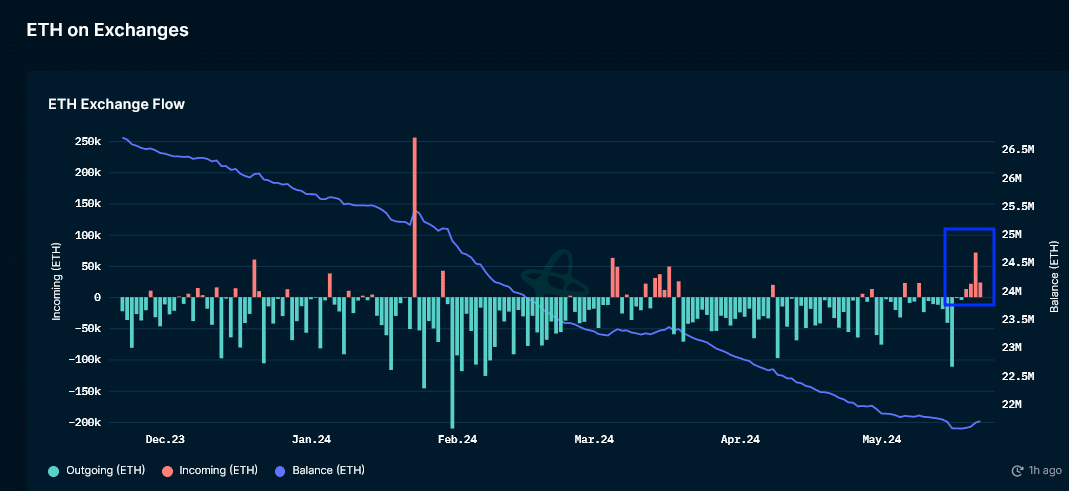

Even amid this optimism and expectation of even higher prices, Nansen data shows that more ETH holders have been sending coins to leading exchanges. Inflows to Binance and others started trickling in from May 18, a few days after ETH broke above $3,000.

While they may not necessarily sell, transfers to exchanges is bearish.

RELATED: BTC Price Analysis: How Is Bitcoin Price Shaping Up Ahead of the Summer?

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.