Spot Ethereum ETF listings have been approved by the United States SEC, but with over $380 million of leveraged positions closed by Spot ETH ETF move – sell-pressure has dampened market reaction.

On Thursday, Gary Gensler told reporters to stay tuned when asked to comment on spot Ethereum ETF filings.

Hours later, reports circulated that the United States Securities and Exchange Commission (SEC) had asked for six more hours as their decision on the VanEck spot Ethereum ETF ruling deadline approached.

Ethereum supporters were optimistic. They knew something big was coming, especially after the regulator suddenly started engaging spot Ethereum ETF applicants asking for the re-filling of 19b-4 forms.

we really went from racing hamsters to getting the eth etf approved pic.twitter.com/63gKm4N3kc

— hersch 🪢 (@tittyrespecter) May 23, 2024

United States SEC Approves Listing Of 8 Spot Ethereum ETFs

After much anticipation, the United States SEC on May 23 took a major step after approving the listing of all spot Ethereum ETF applications.

The product is yet to launch since it must be registered. This process could take weeks.

However, for clarity, the regulator approved rule changes laid out by eight spot Ethereum ETF issuers, including Fidelity, Invesco, and BlackRock.

Following this endorsement, changes from the 19b-4 filing submitted this week will allow applicants to launch spot Ethereum ETFs after the regulator once more approves S-1 registration statements.

The United States SEC’s decision to greenlight the listing of this product is massive for ETH and crypto. Officials claim that crypto is full of fraud and scams. The collapse of high-profile exchanges and hedge funds like FTX and 3AC worsened the overview.

Though the rule changes approved bars spot Ethereum ETF issuers from staking ETH, some observers think this greenlight means ETH is a commodity, similar to Bitcoin.

The United States SEC has not commented on ETH’s status, even after issuing a Wells Notice to ConsenSys regarding its staking activities via MetaMask, a non-custodial wallet.

Surprise, they did https://t.co/C65hJ78hvN

— Scott Johnsson (@SGJohnsson) May 23, 2024

On the other hand, ConsenSys–an Ethereum-focused company–is still suing the United States SEC. They claim the regulator’s unofficial position on ETH is harming the network.

DISCOVER: How to Buy Spot Ethereum As a Beginner in May 2024

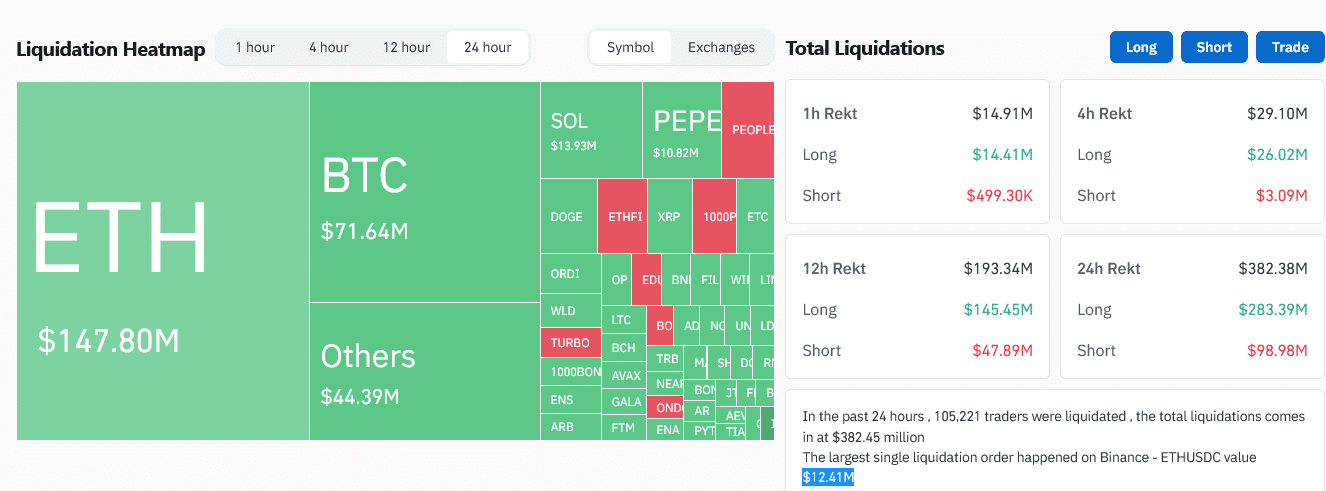

ETH Price Volatile, Over $380 Million Of Leveraged Positions Liquidated

Like events preceding the spot Bitcoin ETF approval in January, ETH prices shot higher this week. The coin soared above $3,300 and $3,700 before peaking at around $3,940.

(ETHUSDT)

Prices have since cooled off, with the resulting volatility leading to over $380 million in liquidation across the board. Over 104,000 traders were liquidated, with most of those losing their shirts being ETH bulls. According to Coinglass, over $100 million of longs were forcefully closed.

So far, ETH is up a massive 30% from May lows. The coin will likely edge even higher as institutions allocate billions.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.