Uncover the truth about insider trading and the shocking allegations surrounding Keith Gill (‘Roaring Kitty’), top politicians, and online brokerage platforms like Etrade

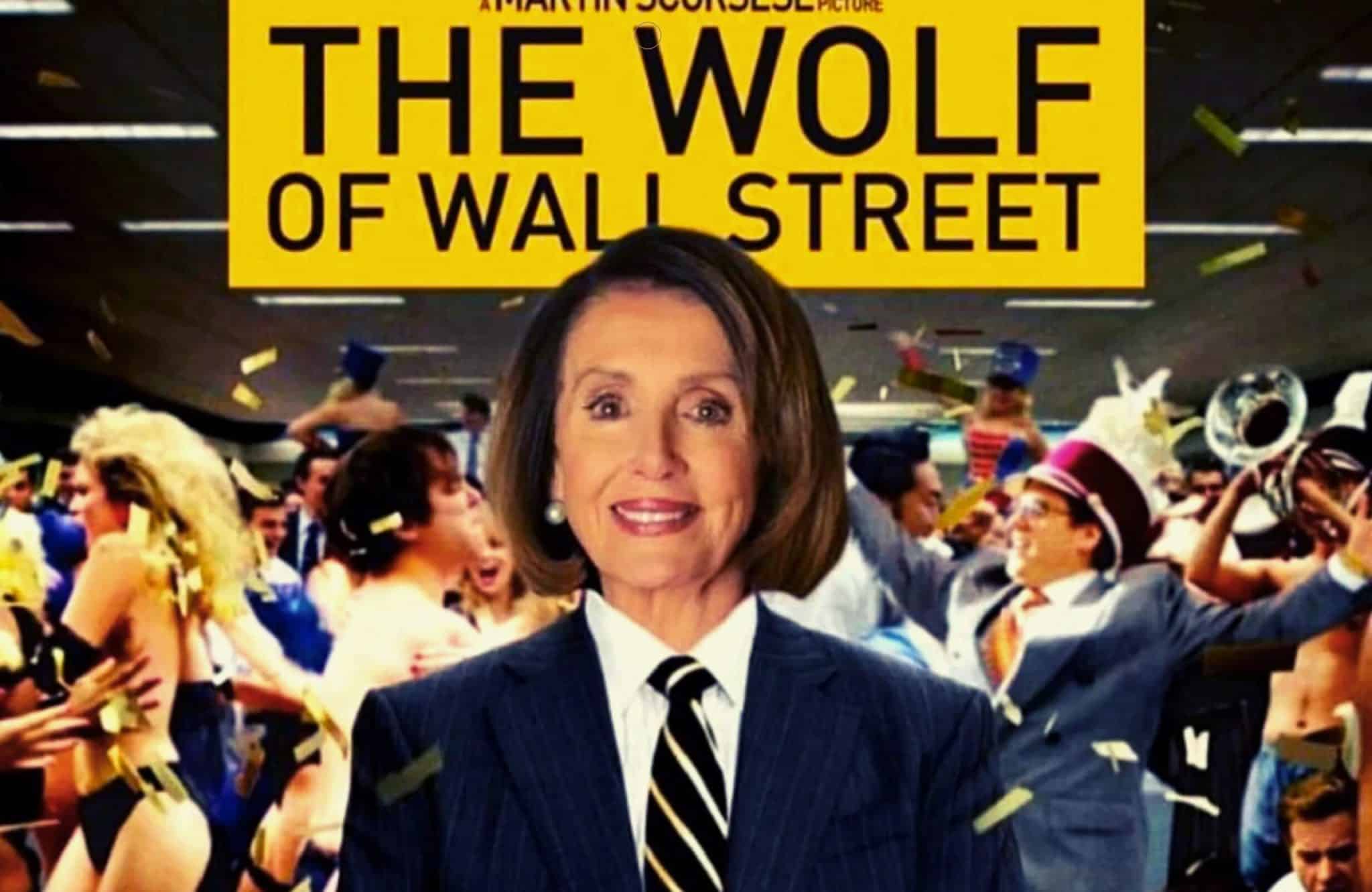

Ever wonder how a career politician earning a $200,000 salary is worth almost half a billion dollars? Insider trading.

America’s leaders are so blatantly obvious about it that it’s unbelievable.

House Speaker Nancy Pelosi and other members of Congress are either the luckiest people on the planet, who know exactly when to buy or sell their assets, or they’re gaming the system.

With that said, in an unexpected twist, Etrade might boot Roaring Kitty, aka Keith Gill, over claims of GameStop stock manipulation. The drama ignited after Gill flaunted a screenshot showing $65.7 million in GME call options and $115 million in shares.

This is peak hypocrisy.

Etrade’s Stirs Controversy Over US Insider Trading

In 2022, when asked about a proposed ban on members and their spouses holding and trading stocks while in office, Nancy Pelosi had this to say:

“This is a free market, and people — we are a free market economy,” Pelosi said during a weekly press conference. “They should be able to participate in that.”

Ok. Fine. The problem is that when you pass meaningful legislation that affects America’s top businesses, you aren’t just trading confidential information; you’re creating the rules of the game.

Shares of GameStop (GME) have skyrocketed by 21.11% this week since Gill returned to Reddit under his infamous username, u/deepfuckingingvalue. Additionally, AMC shares climbed over 11%, while meme coins like GME, WSB, and KITTY saw gains ranging from double to triple digits.

Call it stock manipulation if you want, but when a former insurance salesman like Gill goes toe-to-toe with the kleptocrats running our trading system, it reeks of hypocrisy.

The Wall Street Journal’s AnnaMaria Andriotis reported that Etrade is evaluating whether to ban Gill from its platform.

According to sources familiar with the matter, the platform is “concerned about potential stock manipulation around his recent purchases of Gamestop GME.”

The Hypocrisy of Political Insider Trading

U.S. politicians are getting a free pass on insider trading, and social media isn’t having it.

Unusual Whales, a Twitter account renowned for tracking Congressional trades, noted this week that the battle against insider trading has worsened since 2020:

“For reference, Congress has direct oversight over the entire market, as well as rule over individual companies who also lobby to them,” pointed out the X account Unusual Whales, which frequently reports on Congressional insider trading. “Congress, despite conflicts, trade these companies and have consistently outperformed the market since 2020. I hear little noise from media on this issue though.”

Armed with confidential information, lawmakers buy and sell stocks, creating massive conflicts of interest. Critics point out they often invest in firms they oversee, raising serious ethical questions.

Nancy Pelosi, for instance, is responsible for the following:

- Blocking bills that would’ve hurt Visa’s stock price after her husband loaded up on them before the IPO.

- In March 2021, her husband exercised $2 million in Microsoft options before the company landed a huge contract with the US Army to provide high-tech headsets.

- Just before Biden announced his incentives on electric vehicles, the Pelosis picked up $1 million in Tesla stock.

The STOCK Act of 2012 was supposed to stop Congress from trading on insider info by forcing them to disclose their trades. Yet, nothing has changed.

To date, Senator Richard Burr, Kelly Loeffler, Dianne Feinstein, and many others have abused this law.

The Bottom Line: A Call for Change

At Consensus 2024, a good friend of mine, Gary Sheng, rocked the stage with a new idea: use blockchain to track public funds and expose where the money really goes, especially in the hands of public servants.

Remember: these people are supposed to be working for us.

I think it could be a great idea and you should follow his work on the matter.

Meanwhile, the Keith Gill/GameStop frenzy has ignited a firestorm, pushing for tighter regulations on political insider trading. The argument is simple: if Gill can be targeted, politicians with power should be held to stricter standards.

Let’s keep making noise on this.

EXPLORE: Crypto Developments In Asia: UAE, Singapore and Bangkok In Focus

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.