The European Union’s impending Markets in Crypto-Assets (MiCA) regulation is poised to reshape the digital asset landscape, with significant implications for stablecoins

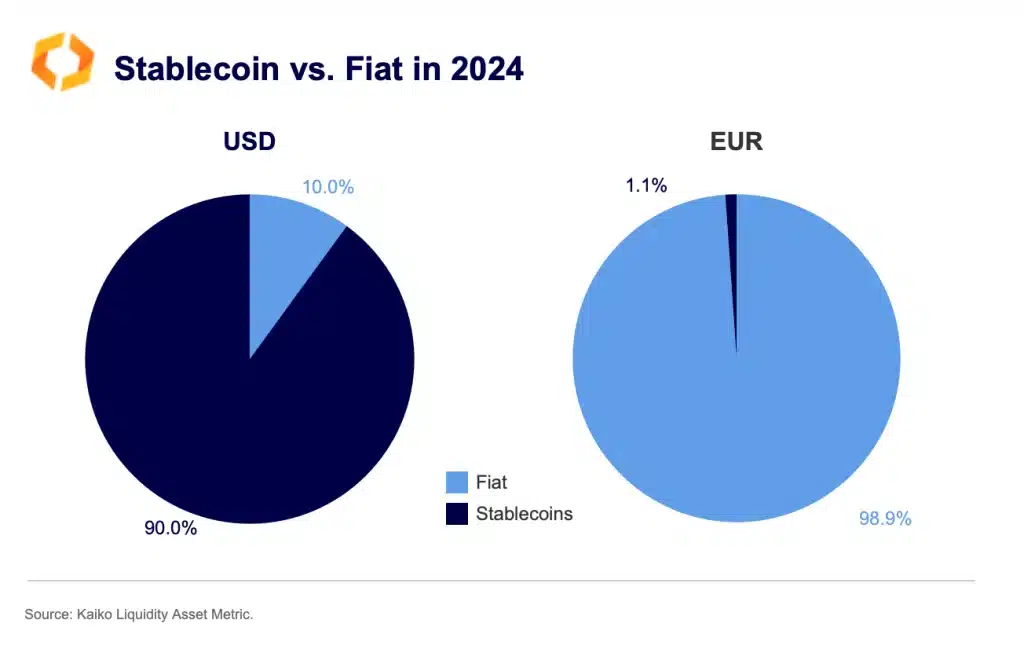

A recent analysis by Kaiko Research revealed that while Europe has traditionally lagged the US and APAC when it comes to crypto trading, Euro-backed stablecoin’s have consistently grown in volume since the beginning of the year. This concretely suggests that demand for stablecoin is finally picking up in European markets.

Particularly, Circle’s USDC stablecoin is expected to gain substantial market share from its larger rival, Tether’s USDT, found Kaiko.

Bloomberg reported that Anastasia Melachrinos, a Paris-based analyst at Kaiko Research, highlighted that USDC could potentially benefit the most from the new European guidelines.

Melachrinos pointed out that USDC’s association with Circle, a publicly-traded company, and its strong reputation for transparency and regulatory compliance could give it an edge over USDT. Tether, on the other hand, has faced scrutiny regarding its reserves and regulatory status, which could hinder its position under the new regulations.

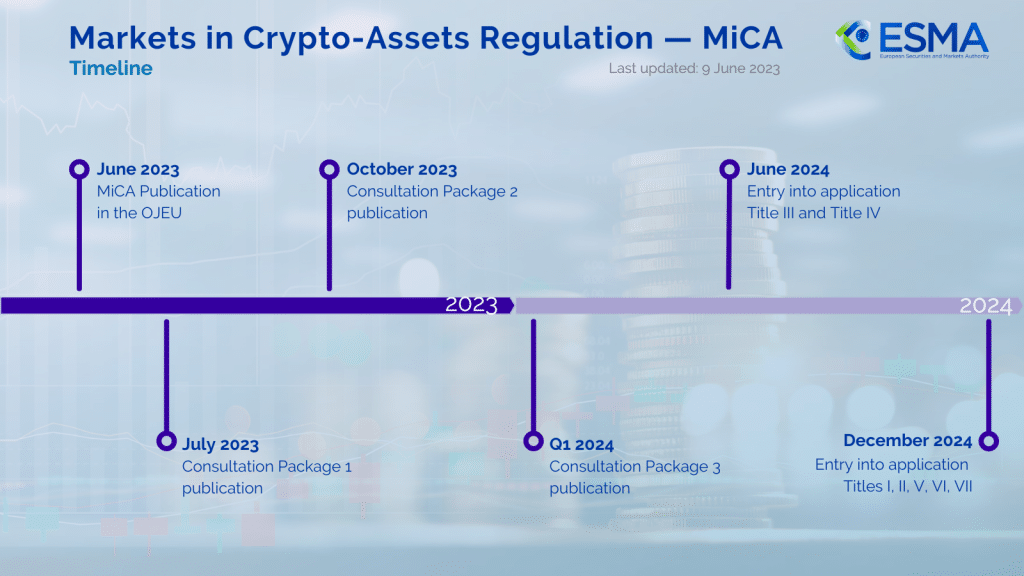

Europe’s MiCA Regulation: A Gamechanger For Stablecoins

One of the key aspects of MiCA is its stringent requirements for stablecoin issuers, including transparency in reserves and regulatory compliance. Unlike other cryptocurrencies, stablecoins are pegged to a stable asset, such as the US dollar, which helps maintain their value.

Moreover, Kaiko’s analysis observed that the combined weekly volume of Tether’s EURT, Stasis EURS, Société Générale’s EURCV, Anchored’s AEUR, and Circle’s EURCV has consistently exceeded $40 million since March, marking the longest period on record.

USDC and USDT are two of the most prominent stablecoins in the market, with USDT currently holding a larger market share.

EXPLORE: 12 Best Crypto Staking Coins to Invest in 2024

Circle’s USDC v/s Tether’s USDT

USDC’s competitive advantage lies in its commitment to transparency and regulatory compliance.

Circle, the issuer of USDC, has consistently emphasized its adherence to regulatory standards and has made efforts to ensure that its reserves are fully backed and audited.

This transparency is likely to resonate well with the new MiCA guidelines, which prioritize investor protection and market integrity.

In contrast, Tether has faced multiple controversies and legal challenges related to its reserves and regulatory practices.

These issues have raised concerns among investors and regulators, potentially making USDT less attractive under the new regulatory framework.

Read more: Tether Launches Alloy (aUSDT): The First Gold-Backed ‘Tethered’ Stablecoin

As a result, USDC’s reputation for reliability and compliance could lead to a significant shift in market share from USDT to USDC.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.