The Securities and Exchange Commission (SEC) decision on the Ethereum ETF Approval on May 23 will mark a turning point, with opinions divided on whether we’re getting the green flag for ETH ETF, or, told to wait until 2025.

Bloomberg’s Eric Balchunas highlighted the formidable regulatory challenges faced by Ethereum ETFs compared to Bitcoin, notably probing the Ethereum Foundation’s centralized impact on the token.

Ethereum (ETH) isn’t Bitcoin (BTC)—it has layers of complexity, making it hard to determine where the SEC stands.

So with that, here is what the expert bull and bear crypto traders are saying about the Ethereum ETF approval:

ETHEREUM continues to bleed vs Bitcoin.

And very likely the Ethereum ETF Spot applications will be rejected “en masse”

Things can get ugly for ETH-boys 📉 pic.twitter.com/auBTDmY1Ud

— Alessandro Ottaviani (@AlexOttaBTC) May 13, 2024

The Bear Case Against Ethereum ETF Approval – Things Could Get Ugly For ETH Price

Earlier this year, Matthew Sigel, head of VanEck’s digital assets, predicted that Ethereum ETFs would be dead in 2024 giving them a better chance in 2025.

In an interview, he said, “If [Eth ETFs] are approved before the next election in November, I’ll eat my hat.”

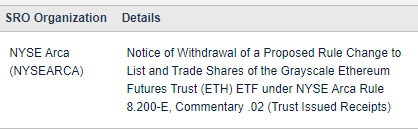

The SEC’s history of rejecting Bitcoin ETFs was eventually counteracted by legal pushback, a tactic that appears less viable for Ethereum. Firms like Grayscale, instrumental in challenging Bitcoin ETF rejections, are notably cautious about taking the same stance with Ethereum.

November’s upcoming US presidential election introduces further unpredictability. Eric Balchunas of Bloomberg speculates on changes in SEC leadership that could emerge, especially if Donald Trump were to return to office.

While Trump’s administration might create a more crypto-friendly atmosphere, his track record suggests a nuanced stance toward cryptocurrency regulation.

With the current regulatory and political climate, Balchunas agrees with VanEck’s assessment, extending the timeline for potential spot Ethereum ETF approval to as far out as December 2025.

There’s also the looming question of Ethereum’s classification as a security. Despite SEC’s 2018 declaration that Ethereum is not a security, rumors persist of an internal reversal that could change Ethereum’s regulatory landscape.

DISCOVER: How to Buy Bitcoin ETF In May 2024

The Bull Case For Ethereum ETF Approval – A Potential 5x for Eth?

At the heart of the bullish case for Ethereum ETFs is Grayscale’s CEO, Michael Sonnenshein.

Speaking at the Financial Times Live’s Crypto and Digital Asset summit, Sonnenshein expressed confidence in the SEC’s forthcoming approval to convert Grayscale’s Ethereum Trust (ETHE) into a spot ETF, a significant shift from the bears.

Adding to the speculative buzz, Ark Invest recently made a notable amendment to its Ethereum spot ETF application by removing staking features.

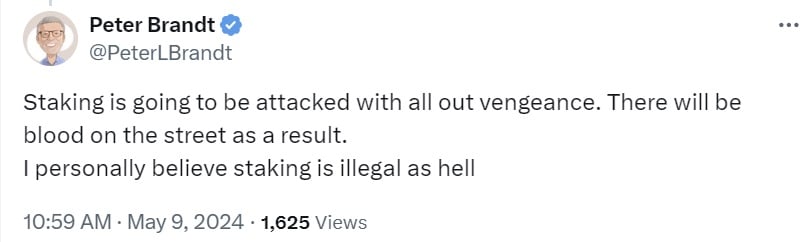

This comes after longtime crypto trader Peter Brandt called staking in cryptocurrency “illegal as hell.”

Fox Business’ Eleanor Terrett suggested that Ark’s removal of the staking feature may suggest SEC engagement, a departure from prior silence.

The Bottom Line – Yes or No for Ethereum ETF Approval?

The SEC’s verdict on spot Ethereum ETFs isn’t just about greenlighting new financial products; it’s a pivotal moment that could shape the regulatory landscape for cryptocurrencies, influence market stability, and define the interplay between traditional finance and digital assets.

A nod of approval might open floodgates to investment opportunities like Solana or Avalanche, while rejection or indecision risks cementing the wall against institutional entry into this space.

What do we think? We’re taking the side that if 1) They are rejected, ETF and altcoins will prove to be a great buying opportunity amid a wholesale dip, or 2) They get approved, and altcoin summer will officially begin.

EXPLORE: $5 Billion Worth Of Bitcoin Shorts Will Be Liquidated If BTC Rockets Above $75,000

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital