Bitcoin’s BTC price is moving sideways. However rising Bitcoin realized cap suggests that crypto institutions are doubling down – but what’s next for BTC?

Nobody knows where Bitcoin is headed next: Only time will confirm if the world’s most valuable coin will soar to $100,000 or drop to $20,000.

Before then, analysts were upbeat and continued to churn out optimistic forecasts.

#Bitcoin is going up forever. pic.twitter.com/jG2mchR9un

— Vivek⚡️ (@Vivek4real_) May 14, 2024

Most are price action related, based on how price charts are.

However, according to one analyst, citing on-chain data from actual transactions over the past few weeks, the future looks bright for Bitcoin.

Unpack: Bitcoin Realized Cap Hits All-Time Highs

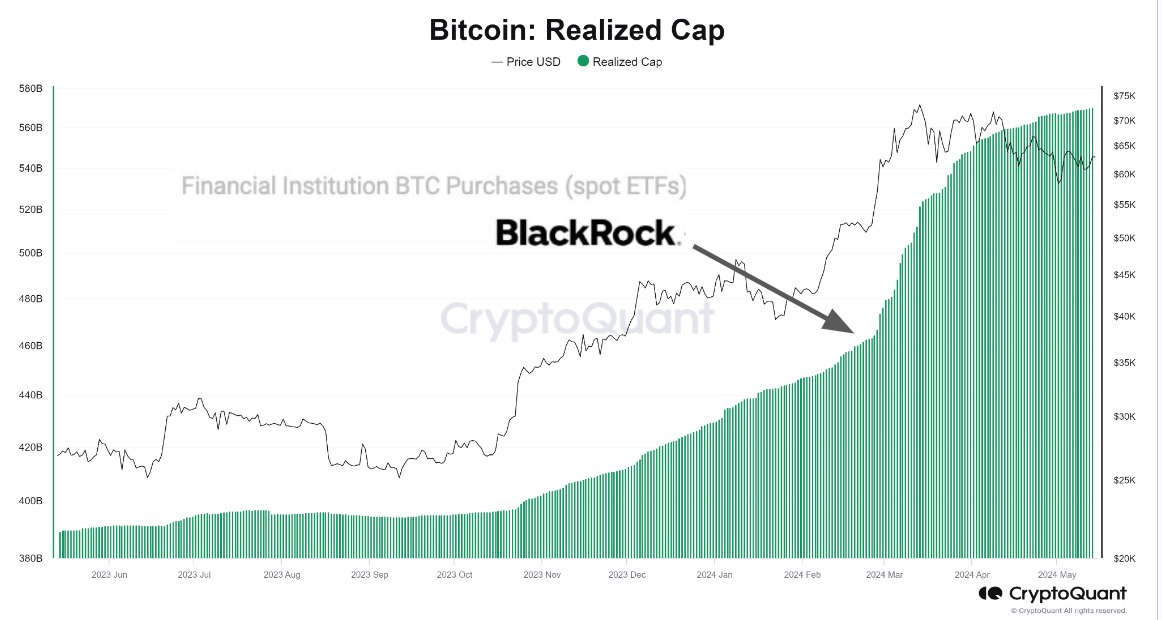

In a preview, the analyst noted that Bitcoin is flashing green as the Realized Cap, a key metric used by on-chain specialists, suggests that major institutions are taking advantage of the current low prices to buy more coins.

As of May 14, on-chain analysis shows that not only is the Realized Cap rising, but weeks after the approval of the first batch of spot Bitcoin ETFs in the United States, it has reached an all-time high.

This development shouldn’t be taken lightly. It is huge for bulls and could ignite more bullish sentiment going forward, regardless of the state of price action.

Usually, the Realized Cap reflects the total USD value invested into BTC at the time of each transaction. Since the number is rising, it indicates that institutions- most of whom place large block orders- are willing to buy at a higher price.

DISCOVER: How To Buy Bitcoin Anonymously in May 2024

Subsequently, this boosts sentiment, especially considering prices recently moved horizontally.

Rising Realized Cap points to an influx of institutional capital. As a result, the analyst says that Bitcoin has formed a strong support level cushioning against more sharp price drops.

Now, as prices steady and even rise, it instills confidence among traders and could act as a “launchpad” for more institutions to get exposure to BTC via spot ETFs issued by, among others, ProShares and even Bitwise.

Interest In Spot Bitcoin ETFs: Are Institutions Back?

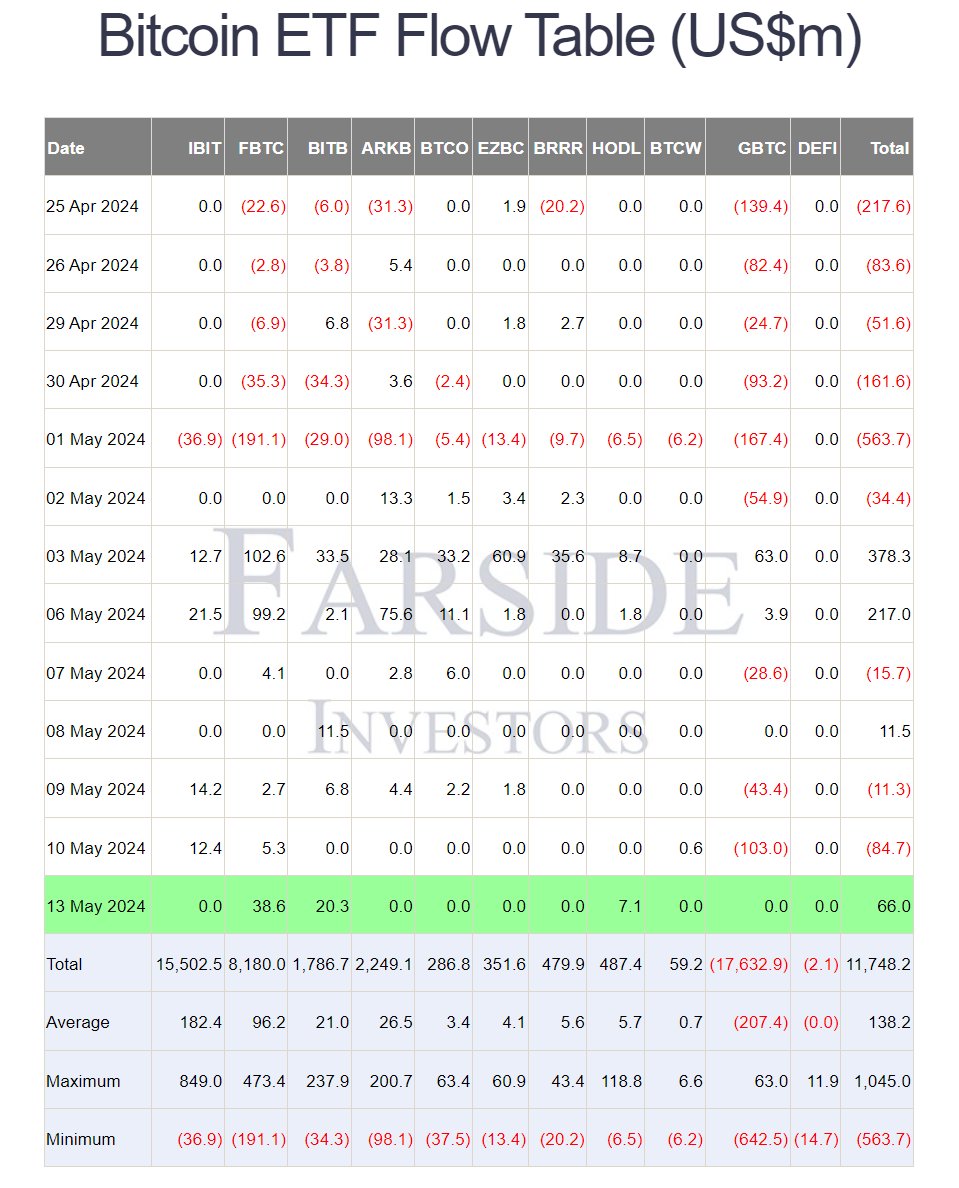

After days of outflow, institutions are beginning to look at Bitcoin.

(Farside)

Yesterday, trackers show a net inflow of $66 million. Leading the charge, Fidelity bought $38.6 million on behalf of their clients.

Next, Bitwise added $20 million. Of note, there were no outflows from GBTC, explaining why BTC prices steadied, even rising from key support levels.

(BTCUSDT)

The Bitcoin market is inactive. BTC price remains trading within a narrow range, with caps at $60,000 (a psychological number) and $66,000 on the upper end – despite worries around crypto institution like Coinbase.

EXPLORE: Best Crypto to Buy Now? As Bitcoin Trades Sideways These Altcoins Could Skyrocket

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.