When I read that Coinbase was opening a licensed Bitcoin exchange, after receiving $75 million in investment capital, it made complete sense to me. That is the obvious next step for the company. However, what has thrown me off is their claim to be the first “regulated” Bitcoin exchange. This claim is confusing, for a few reasons, and they do not provide a lot of information about what they really mean by the term “regulated”.

Coinbase’ Claims Seem Misleading

As mentioned before, what does “regulated” mean? Yes, exchanges have certain regulations they must follow, and many exchanges have not followed the required regulations, but some have. The requirements for complying with current regulation is complicated, and requires many steps, but even after going over each step, it is difficult to see how they are the “first” to do so.

Coinbase is Not the First Bitcoin Exchange Registered as a MSB

Basically every US-based Bitcoin exchange has registered as a Money Service Business (MSB). If they were not at least registered as such, it would be even more difficult to find banking partners. However, being registered as a MSB does not make one compliant to current regulations, even in states that do not require specific licensing for MSBs.

Coinbase is Not the First Bitcoin Exchange to Implement KYC / AML Compliance Policies

Again, nearly every large Bitcoin exchange, and many other Bitcoin-based MSBs, have implemented Know Your Customer (KYC) and Anti-Money Laundering (AML) policies. These policies are an absolute requirement to be in compliance with most state and federal MSB regulations, and have been a sore spot in the Bitcoin community for quite a while. Many do not want to provide personal details to exchanges, but it is unavoidable if an exchange wants to operate within the US without breaking the law.

Still, being an MSB and implementing KYC / AML policies does not mean an exchange is truly “regulated”, as they are still missing one key piece of the puzzle.

Coinbase is Not the First Bitcoin Exchange to Obtain MTLs in Multiple US States

This final piece of the puzzle comes in the form of a Money Transmitter License (MTL). The process of obtaining a MTL varies from state to state. Some require no MTL at all. Many others have very lenient requirements for obtaining the license. However, quite a few states have extremely strict requirements to obtain a MTL, and even when a company complies with all the requirements, it can often takes months, or years, to be approved.

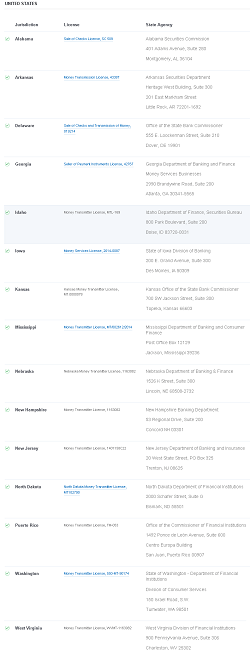

According to Coinbase’s website, they currently have obtained the required licensing in 15 states. While this is an impressive feat, and does indeed show that they are following the require regulations, and laws, for the states that have issued licenses to the company, as well as states that do not require licensing, it does not make them the first.

While many exchanges are working on obtaining the proper licensing, there is one exchange that certainly launched before the Coinbase exchange, and has licensing in more states than Coinbase, or any other Bitcoin exchange: CoinX.

CoinX has been in development since 2012, and launched in December 2014. At the moment, the company lists 37 states as 100% licensed, which means the company is either registered as a MSB (for states where a MTL is not required), or has obtained the proper licensing in the states that require it.

It seems that most people haven’t heard of CoinX, or had no idea they had launched…in fact, I only knew this because of my work with Trucoin. Trucoin partnered with CoinX, as an authorized delegate, to provide debit/credit card purchases of bitcoins, as well as Bitcoin ATM services, which resulted in an additional partnership with Bitpay to sponsor the Bitcoin Bowl.

No matter how you slice it, Coinbase was not the first regulated US Bitcoin exchange, unless their definition of “regulated” includes something more than acquiring all the necessary licensing, and implementing the required policies, to legally operate under current US federal and state regulations.

Why Does It Matter if Coinbase Was the First Regulated Bitcoin Exchange or Not?

It really does not matter. Coinbase’s recent investment round, that generated $75 million, is incredible. Launching an exchange directly after that was a smart move, and has obviously been in development for quite some time.

The problem is the way it was announced. Falsely claiming to be the first regulated Bitcoin exchange, or at least using some undefined version of the term “regulated”, was wrong. On top of that, it seems that the company incorrectly claimed to have regulatory approval in a few states in which they are actually not licensed or approved. Then again, these states, specifically New York and California, are in a regulatory “grey area”. They have mentioned potential regulations on Bitcoin, or other digital currency, such as New York’s Bitlicense, but have yet to finish developing special licensing that digital currency may end up requiring.

Both California’s Department of Business Oversight and New York’s Department of Financial Services have since released statements proclaiming that Coinbase does not have regulatory approval to operate in either state. This has prompted Tripp Levy PLLC, a “national securities and shareholder rights law firm” to launch an investigation into Coinbase, Inc. for “allegedly making false and misleading statements to prospective and current users of Coinbase’s Bitcoin Exchange regarding its business.”

Many were praising Coinbase’s move when the first announcements were made, criticizing Cameron and Tyler Winklevoss for not launching their exchange / ETF sooner, and even mentioning that,”CoinX lost this opportunity!” However, it isn’t that simple. In the end, Coinbase may succeed in becoming the dominant Bitcoin exchange, or they may lose out to competitors who are taking a more cautious route. Both Gemini and CoinX seem to be using this, strategically, and that may end up being the better long-term choice.

On the next page, I will go into more detail about these two exchanges, and how they may have advantages that aren’t immediately noticeable.

1 Comment

1 Comment

@devnullius @coinxinc @GeminiDotCom @coinbase isn’t @cryptsy regulated? They allow fiat trading.