Recent Discussions on Bitcoin Price Volatility

In recent weeks, the issue of Bitcoin price volatility has come to the forefront as one of the most pressing issues in the Bitcoin ecosystem. And I honestly do not understand why. When I first got on board with Bitcoin in early 2014, the community’s stance on price volatility was pretty uniform and straightforward; volatility is the result of a small market, and will decrease over time as more people start using the digital currency.

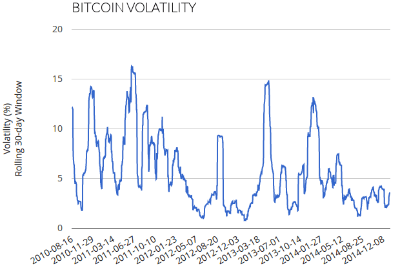

Now, however, it seems as if this opinion is starting to become slightly less concrete. I now see people regularly blaming price volatility for the slow growth in mainstream Bitcoin adoption. These claims are patently false, as demand for Bitcoin is based on its network effect. The network effect — and thereby demand — has been growing since Bitcoin’s creation, and price volatility has actually been falling over time. The economic theory behind these facts is beyond the scope of this article, so we will not delve any further into the arguments surrounding Bitcoin price volatility.

If we are going to decide to direct our energy towards volatility, though, then it is worth advancing some economics-based suggestions for how price volatility can be further decreased. This article will focus on what I believe could be one of the most powerful methods of lowering volatility: paying wages in Bitcoin. I argue that paying wages in Bitcoin would, ceteris paribus, create a chain reaction of Bitcoin adoption all the way up the production structure. This chain reaction would amplify the network effect and thereby lower price volatility. However, the theoretical clout behind this method does not by any means suggest that it will be the easiest one to implement, nor does it suggest that it is the most likely method to be implemented.

Paying Wages in Bitcoin Would Set Off a Chain Reaction of Bitcoin Acceptance

Initially, businesses paying wages and salaries in Bitcoin would create a spike in the demand for Bitcoin. In order to pay wages, businesses would have to either buy Bitcoin, directly increasing Bitcoin demand, or they would have to offer huge deals to customers who pay for goods and services in Bitcoin. These deals would push the business’s customers to increase their demand for digital currency. Alternatively, companies could use an intermediary, such as Bitwage. The effect would still be the same, though, as Bitwage would have to buy more Bitcoin to distribute to its clients.

Since employees would receive their paychecks in Bitcoin, demand for businesses to accept the currency would increase. These merchants would have to work with a payment processor to convert their Bitcoin revenue to fiat, in order to pay expenses. Since these businesses would have to process such huge volumes of Bitcoin revenue, processing fees would increase to a point where it would become cheaper to further integrate Bitcoin into their business models. Doing so would decrease the amount of Bitcoin revenue needing to be processed and converted to fiat. Thus, these companies would start paying their employees in Bitcoin as well.

Eventually, this process would conclude when all businesses at the lowest level in the production structure paid all their employees in Bitcoin. The completion of this process eliminates that initial spike in demand for the digital currency. Consumers would pay for goods and services in Bitcoin, which the companies would use to pay wages, which would then go out into the economy and be used to purchase goods and services, thus starting the cycle over again. Therefore, there would be less of a need for companies to buy Bitcoin, and the demand for the current supply of the currency against the demand for consumer goods would exert a greater influence over Bitcoin’s purchasing power.

However, there still remains one expense that cannot be paid in Bitcoin. These companies still have to pay their suppliers in fiat, as this higher level of the production structure has not yet integrated Bitcoin into their systems. Businesses would still have to sell large amounts of their Bitcoin revenue, then, in order to purchase supplies that they can sell to consumers.

To get rid of this final cost involved in selling Bitcoin to pay fiat expenses, businesses will begin demanding that their suppliers accept Bitcoin. These suppliers would have to meet these demands if they want to retain their clients, so they will start accepting Bitcoin. Now, the second lowest level of the production structure has a huge flow of Bitcoin revenue that they have to sell in order to pay expenses. The process begins again.

The same process outlined above will occur over and over again, at each level of the production structure, until the entire economy has fully adopted Bitcoin. Once this process has been fully completed, the network effect of the digital currency will have grown so strong, that the speculative buying and selling of Bitcoin will have very little impact on the currency’s purchasing power. Thus, volatility will have been greatly diminished.

Accomplishing Bitcoin Wages in the Real World

In the real world, this process will not occur as linearly nor as quickly as our description suggests. Nevertheless, there is one potential criticism regarding the argument for Bitcoin wages as a network effect amplifier and purchasing power stabilizer that I am sure people will bring up frequently. Those people will say: that process is all good and well, but how can you be sure that the first business will start paying wages in Bitcoin? Surely, your process cannot run its course at all if there is not a firm willing to be the first to pay wages in Bitcoin!

Before I respond to this potential criticism, I would like to point out the fact that the first businesses already have begun paying their employees in Bitcoin. There are several Bitcoin businesses, such as crypto-currency news websites, that pay their employees and contributors solely in Bitcoin. Furthermore, Amagi Metals has started paying portions of its employees’ salaries in Bitcoin, and Overstock has recently announced that it will be giving its staff the option of getting paid in Bitcoin.

Thus, even if it is impossible to explain how or why the first business would start paying its employees in Bitcoin, I would not have to give an explanation. I could simply start from the empirical fact that businesses do pay wages in Bitcoin, and deduce that, as long as this empirical fact remains true, the process outlined above will take place, ceteris paribus.

However, I believe that I am able to provide some insight on how businesses would start paying wages in Bitcoin. I believe the first business would choose to pay wages in Bitcoin for the same reason why the first individual decided to use Bitcoin as a medium of exchange: a desire to use the currency based on its qualities. These qualities could appeal to ideological beliefs, economic sensibility, or mere novelty. This reason for using Bitcoin seems to have been invoked by both Amagi Metals and Overstock, as the management of both companies are greatly influenced by philosophies that make them partial towards Bitcoin.