INX Review and Comparison Guide

By: Alex Miguel | Last updated: 2/29/24

INX is a US-based crypto exchange focusing on securities tokens, including issuing and trading them. In this review, we’ll go over INX’s services, fees, structure, and geographic availability.

INX Review Summary

INX is a crypto exchange that offers both regular crypto trading and the ability to issue and trade security tokens. Its regular crypto offering is somewhat limited; however, it has a ton of features relating to security tokens.

It’s a regulated and compliant platform that gives an air of security and safety but is definitely better for security token activity than regular crypto trading.

That’s INX in a nutshell. For a more detailed review, continue reading below. Here’s what I’ll cover:

- INX Overview

- INX Services

- Currencies and Payment Methods

- Fees

- Buying Limits

- Supported States and Countries

- Customer Support and Reviews

- Conclusion

1. INX Overview

INX was founded in 2017 by Shy Datika. The company is incorporated in Canada, with offices in Gibraltar and the US. It has Money Transmitter licenses to operate in most US States and Dealer and Alternative Trading System licenses granted by the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

The list of US states and territories not permitted for trading includes American Samoa, Guam, Hawaii, New York, Tennessee, Texas, and the U.S. Virgin Islands.

The platform takes pride in its INX Token (INX) being the world’s first SEC-registered security token to IPO on the blockchain.

2. INX Services

Cryptocurrency Trading

INX allows users to trade a select few popular cryptocurrencies on a well-regulated platform.

These include Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Avalanche (AVAX), Zcash (ZEC), and more.

The exchange is responsive for desktop and mobile devices, featuring all the usual features you’d expect to see: candlestick charts powered by TradingView, order books, and depth charts.

Users can post limit, market, stop-limit, and stop-market orders.

Trading volumes and liquidity are definitely lacking compared to popular exchanges. However, this is somewhat expected for a highly regulated exchange with a narrow geographical focus.

Users can track all of their assets (crypto and security tokens) in the same place on the INX.One platform. They can also receive reports on transactions and automated trading confirmations.

Security Token Trading

INX’s most interesting and unique feature is the ability to trade security tokens as well as issue them.

Security tokens are SEC-registered tokens that are similar to traditional securities but can be verified and exchanged directly on the blockchain without a middleman.

Users can trade SEC-registered security tokens on the exchange’s INX.One platform 24 hours a day, every day of the year, just like typical cryptocurrency markets.

The platform also offers users access to security token offerings directly from the issuing company for early investment before public trading goes live.

Security Token Issuing

On the business side of things, INX also enables companies to raise capital by issuing their own security tokens. This enables businesses to get funding in a non-dilutive way to shareholders and be available to investors via crypto and fiat while being able to customize token holder rights and be traded 24/7. Security tokens are also still compliant with important KYC and AML standards.

INX offers to guide issuers through the entire process with an end-to-end solution, including pre-issuance steps, SEC registration, token creation, the primary offering, and even establishing a secondary market on the platform.

INX Token

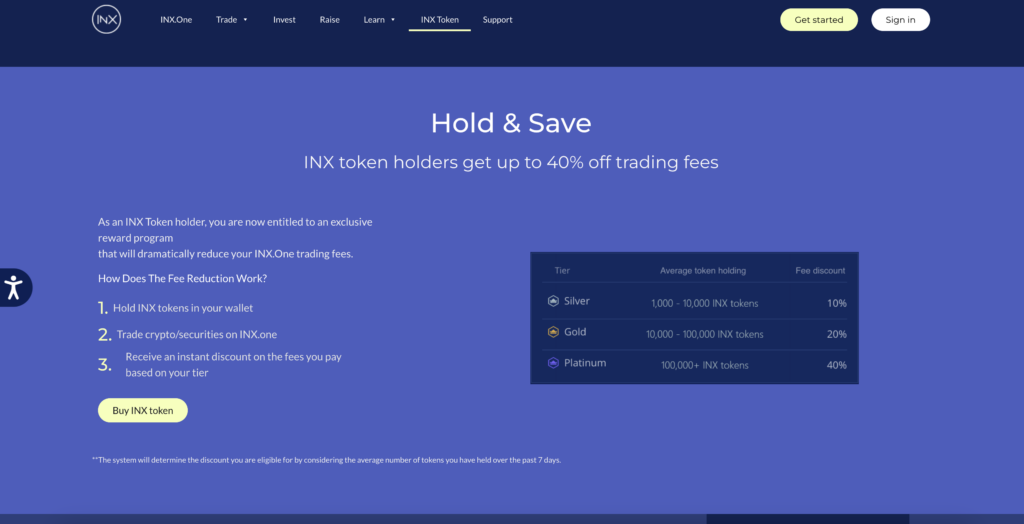

INX has its own SEC-registered security token, known simply as INX Token (INX).

Through the Hold & Save Discount Program, the INX token gives holders up to 40% discounts on trading fees, with a minimum discount of 10% on the INX.One platform. The discount’s degree depends on the user’s total INX holdings.

More interestingly, INX holders also receive an annual pro-rata redistribution of 40% of the company’s cumulative adjusted net operating cash flow.

3. Currencies and Payment Methods

Fiat deposits and withdrawals

For fiat currency deposits in USD not relating to security tokens trading, users can use the following payment options:

- Bank wire

- Credit/debit card (US customers only). Visa and Mastercard only.

Withdrawals can be executed via bank wire; however, withdrawals to a credit or debit card are not permitted.

For securities trading, users can also deposit Avalanche (AVAX), Ethereum (ETH), or USDC (USDC) in their security tokens account directly from their linked wallets.

Crypto deposits and withdrawals

Users can deposit and withdraw the following cryptocurrencies:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Zcash (ZEC)

- USD Coin (USDC)

- Avalanche (AVAX)

- Fantom (FTM)

- Uniswap (UNI)

- CURVE (CRV)

- AAVE (AAVE)

4. Fees

Fiat Deposits

Bank wire deposits, both US and international, have no deposit fees. Debit and credit card deposits incur a 3.75% fee.

Fiat withdrawals

Bank wire withdrawals, both US and international, will be charged a $35 dollar withdrawal fee.

Crypto deposits and withdrawals

Depositing crypto is free, while crypto withdrawals are subject to a reasonable withdrawal fee, which appears to be designed only to cover blockchain network fees. This withdrawal fee depends on the asset’s native blockchain.

Converted deposits and withdrawals

Users crediting their USD balance from their linked MetaMask using Ether (ETH), Avalanche (AVAX), or USD Coin (USDC) will incur a fee of 1.2% of the total deposit amount. The deposit will be converted to USD and added to your USD balance.

Withdrawals made from USD into Ether (ETH), Avalanche (AVAX), or USD Coin (USDC) will be charged a fee of 1.2% of the total amount, with a minimum fee of $30. The chosen USD amount will be converted and sent to your linked MetaMask.

Trading fees

Trading fees are 0.3% of the notional amount for maker orders, while taker orders are charged 0.4% of the notional amount.

For a full breakdown of INX’s platform fees, visit their official fee schedule here.

5. Limits

Only bank card deposits appear to have limits on INX. These limits are made according to their tiered system. “Basic” users can deposit up to $1,000 daily, “Pro” users can deposit up to $10,000 daily, and “VIP” users are permitted to deposit up to $20,000 a day.

It is also worth noting that there is a withdrawal hold of 5 business days on any deposits made via bank card for fiat or crypto. This amount also cannot be transferred to a securities account in USD during the hold period.

6. Supported States Countries

Although INX is highly focused on the US market, several other countries are also permitted to use the platform. You should also note that some US states are not supported.

Currently, the list of US states and territories not permitted for trading includes American Samoa, Guam, Hawaii, New York, Tennessee, Texas, and the U.S. Virgin Islands.

INX does not have a readily available list of supported countries. According to their General Terms, using the website outside the USA comes at your own risk:

“INX makes no representation that materials on the Site or the Services are appropriate, lawful or available for use in any location other than the United States of America. Those who choose to access or use the Site or Services from locations outside the United States of America do so on their own initiative and are responsible for compliance with local laws, if and to the extent, local laws are applicable.”

However, using the links, you can easily check your region’s availability for security tokens or crypto trading.

7. Customer Support and Reviews

As with most exchanges, INX has a handy FAQ section that will answer most general queries regarding the platform.

A support bot can also be queried and will point you toward relevant articles. You can also leave a message for support through the bot.

There is also a video help section, but only a handful of videos were available when I looked, mostly focusing on security tokens.

If neither of these resources does the trick, users can fill out the contact form for one-on-one email assistance. The website promised a response within 24 hours, but it took around 36 hours when I submitted a support ticket of my own.

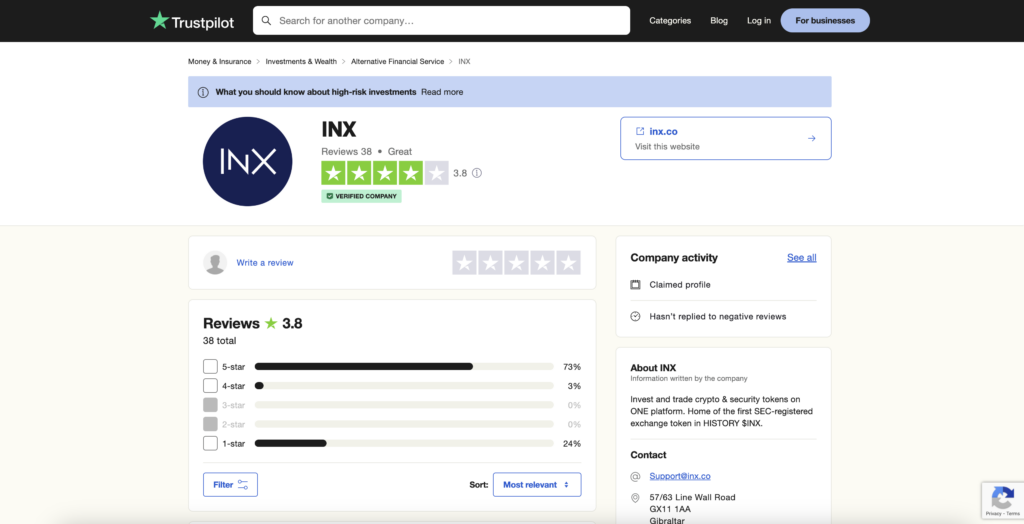

INX also has an overall rating of “Great” on Trustpilot, with a majority of reviews being 5 stars.

Some 1-star reviews from disgruntled customers mostly complained about KYC and customer support taking too long.

Others also complained about high fees; however, these are easy to evaluate before signing up.

8. Conclusion

INX is an innovative platform that seeks to bring new securities into the future of finance on the blockchain. By ensuring that it is highly compliant with US laws and regulations, INX offers a safe place for forward-thinking businesses, investors, and traders to experiment with the budding asset class of security tokens.

As such, INX offers a regulated and safe platform if you want to trade BTC, ETH, LTC, AVAX, or a few other cryptos. However, trading volume and liquidity are somewhat lacking at the time of writing. But, if you’re looking to participate in some of the very first securities token offerings – or even issuing your own security token – then this is what makes INX stand out.

That’s it! If you have any personal experience with INX or have any thoughts, please share them in the comments section below.