The Hong Kong crypto hub is heating up after the approval of Ethereum ETF and Bitcoin ETF triggers a landmark moment in the China cryptocurrency market – let’s dig in.

All-time highs not seen for Bitcoin and Ethereum in four years may come this summer, based on the news of Hong Kong launching spot ETH and BTC ETFs next week.

Following the United States’ sizable leap into the crypto with 11 Spot Bitcoin ETFs back in January, Hong Kong decided it needed to move fast to catch up – in an unfolding geopolitical battle over crypto regulations.

This has led to the Securities and Futures Commission of Hong Kong giving the green light for a lineup of Bitcoin and Ethereum spot ETFs to hit the market.

Both ETFs will make their debut Hong Kong Stock Exchange this Tuesday, April 30, 2024.

Hong Kong’s seal of approval on the Ethereum and Bitcoin ETF side marks a significant stride forward, especially considering that the US SEC is hitting the pause button on Ethereum spot ETFs until June.

Hong Kong Ethereum and Bitcoin ETF Start April 30th

Despite banning cryptocurrency mining once, (actually 30 times – off and on in China), China Asset Management (China AMC) executives now welcome Web3 with open arms.

At the heart of these ETFs is their regulated status, which adds convenience, efficiency, and safety to BTC and ETH, making them attractive for retail and institutional investors alike.

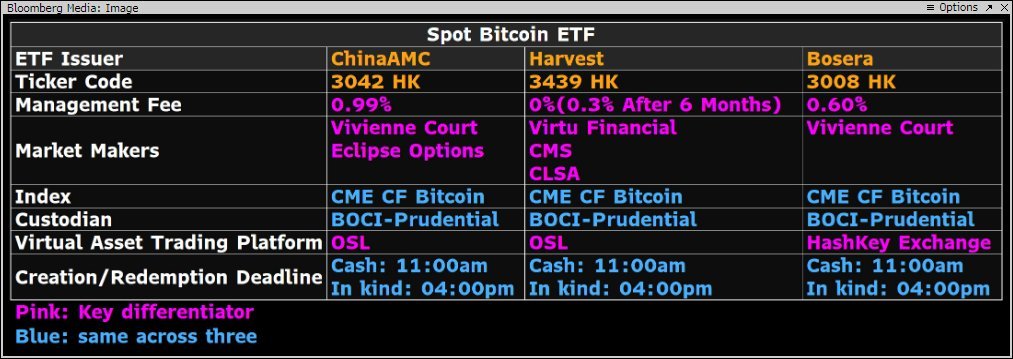

Among approved ETFs are the Bosera Hashkey Bitcoin ETF, Bosera Hashkey Ether ETF, China AMC Bitcoin ETF, China AMC Ether ETF, Harvest Bitcoin Spot ETF, and Harvest Ether Spot ETF. It’s a digital smorgasbord within the comforting confines of regulation.

Can Bitcoin Reach $200k in 2024? Ethereum to $10,000?

Crypto is awash with news to be bullish about in 2024.

Investors like Arthur Hayes say we don’t have “imagination” for what’s coming. Here are a few recent updates:

- Bitcoin Halving typically launches prices 60 days after the event

- Ethereum to get spot ETF consideration in June

- Risk assets are turning a corner, starting with Tesla

- Several new narratives have hit the space including AI, RWAs,

- Solana’s Firedancer update (1 million tps) will launch on mainnet soon

As our analysts at 99Bitcoins have told you, the rest of 2024 will be “macro summer.”

With ETFs slowing pouring in liquidity, both Ethereum and Bitcoin have the catalysts for new all-time highs.

EXPLORE: 3 No-Brainer DePIN Crypto Projects to Watch Out For

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

No Comments

No Comments