Bitcoin price might be stable at spot rates, but analysts remain bullish looking ahead to Q2, with many expecting a BTC breakout above all-time highs – fuelled by Bitcoin whales in accumulation.

Bitcoin has been under immense selling pressure in the past trading month. If anything, the coin fell from all-time highs, dipping by -15% before expanding to spot rates.

Overall, the path of least resistance is southwards, and sellers have the upper hand. The coin is trading inside the bear bar of April 13 and struggling to extend gains of April 22.

Bitcoin Whales Accumulating, Signaling Bullish Outlook For BTC

Even so, Bitcoin bulls have reason to cheer as crucial data points suggest a potential spike in the coming days.

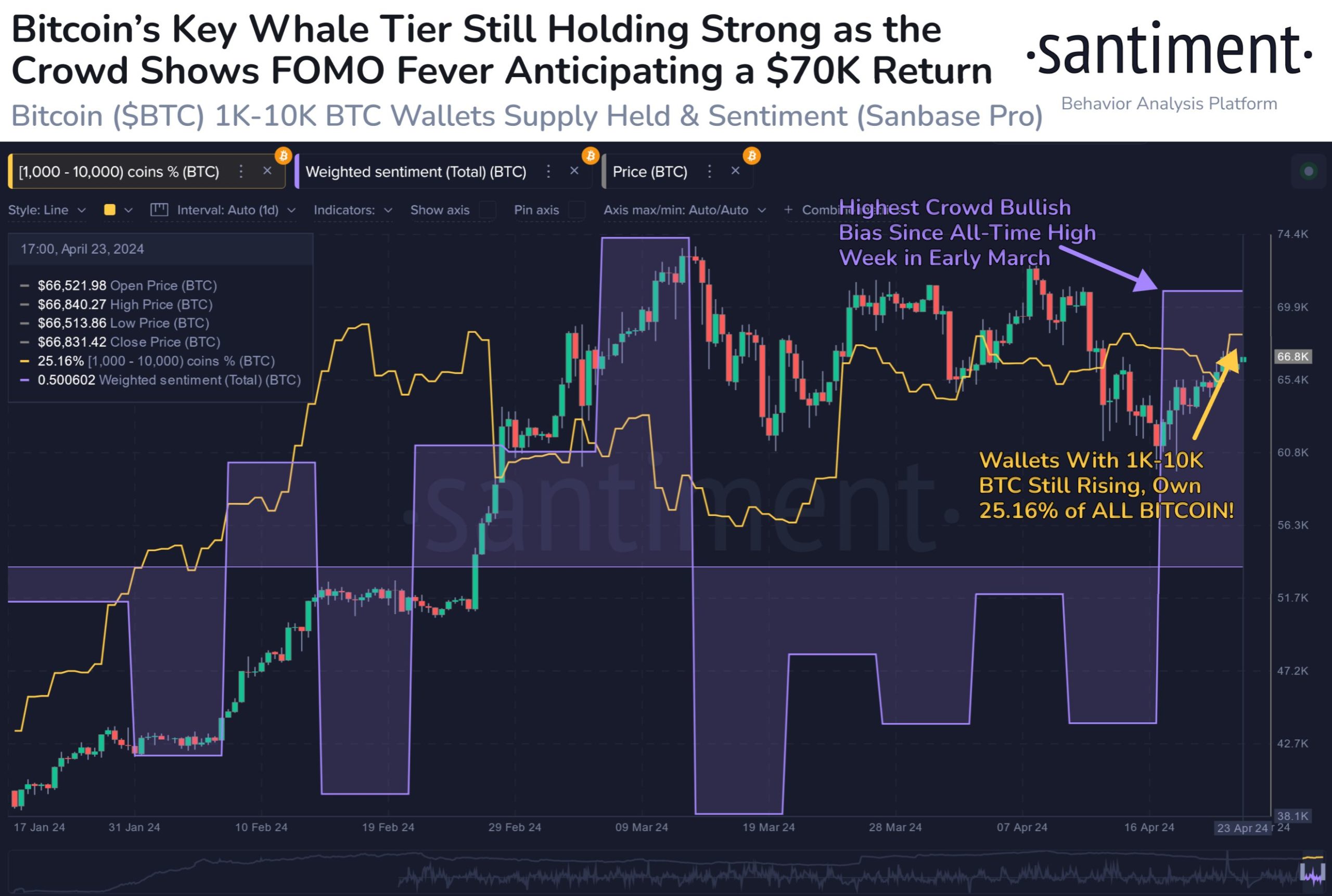

According to Santiment, a crypto market intelligence platform, whales holding between 1,000 and 10,000 BTC appear to be supporting the current rally.

On-chain, data shows that since the beginning of 2024, these whales have scooped up an additional 266,000 BTC, representing 1.24% of the total supply.

Notably, this cohort controls over 25% of all circulating BTC, a massive endorsement for bulls and a potential for a breakout above $74,000 in the days ahead.

The Key Question: When Will Bulls Take Over?

Based on the BTCUSDT price action in the daily chart, it is clear that the coin is moving inside a range. Of note, price action is clean and market relatively stable post-Halving.

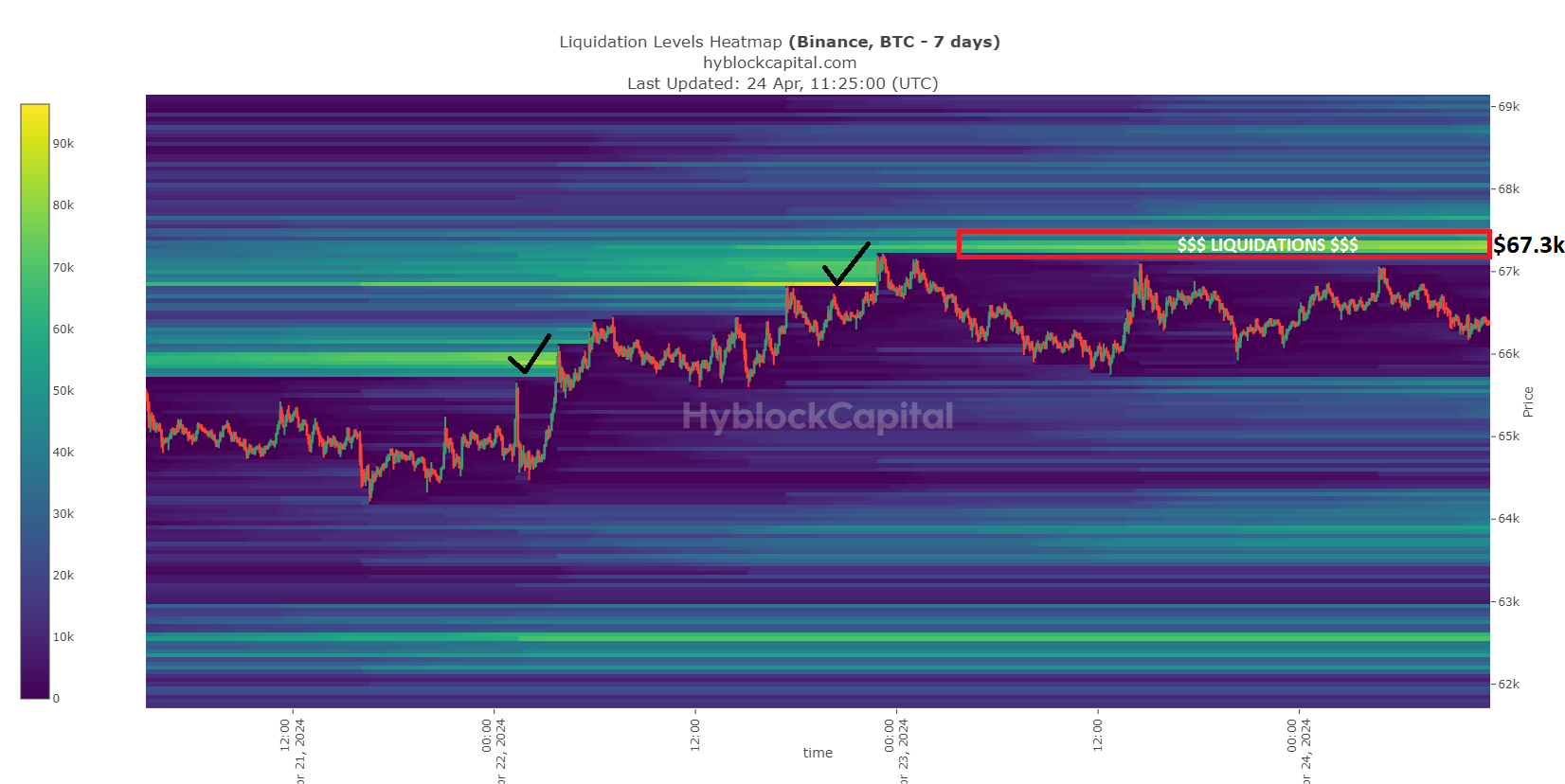

Still, one analyst expects Bitcoin to rip higher as sellers are liquidated, pumping prices to all-time highs. Taking to X, one analyst said sellers are building stop losses at around $67,300.

If this level is conquered, it will act like a catapult. Usually, when a stop-loss sell order is hit, it automatically creates a buy order. If there are billions worth of stop losses liquidated at once, the deluge of buy orders often pushes prices to new highs.

Beyond price action, analysts note a marked decrease in daily outflows from the Grayscale Bitcoin Trust (GBTC). On April 23, Lookonchain data shows that GBTC unloaded 750 BTC while the other spot Bitcoin ETF issuers added 1,513 BTC.

While the pace of inflows into spot Bitcoin ETFs has slowed, there is still a consistent inflow of new capital.

This suggests that institutions are interested. Therefore, as GBTC outflows decrease, it will alleviate selling pressure, possibly lifting prices.

Explore: Bitbot: Revolutionary Crypto Telegram Bot Passes $2.5M Mark in Presale

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

No Comments

No Comments (

(