Bitcoin has been on a wild ride in the past five years, defying skeptics and cementing its position as the king of cryptocurrencies. However, as we look to the future, the question on everyone’s mind is: how high can Bitcoin really go?

From the halving event to increasing institutional adoption, countless factors are poised to shape Bitcoin’s price movements. In this article, we dive into our Bitcoin price prediction for 2024, 2025, and 2030 and explore whether now is the right time to invest.

Bitcoin Price Prediction for 2024-2030

- The current price of Bitcoin is $67,130, up 136% in the past year.

- The Crypto Fear & Greed Index is at a value of 79, signaling Greed, but down from 83 one month ago.

- Bitcoin briefly fell below $40,000 in late January after spot BTC ETFs were approved in the U.S. However, the coin has rallied since then, reaching a new all-time high of $73,750 on March 14.

- Based on our projections, Bitcoin could reach as high as $100,000 by the end of 2024.

- By the end of 2025, we expect Bitcoin to have posted another record value of around $120,000, with a potential low of $47,000 acting as key support.

| Year | Minimum Price | Average Price | Maximum Price |

| 2024 | $38,540 | $61,000 | $100,000 |

| 2025 | $47,000 | $70,000 | $120,000 |

| 2026 | $30,000 | $42,000 | $90,000 |

| 2030 | $102,000 | $160,000 | $250,000 |

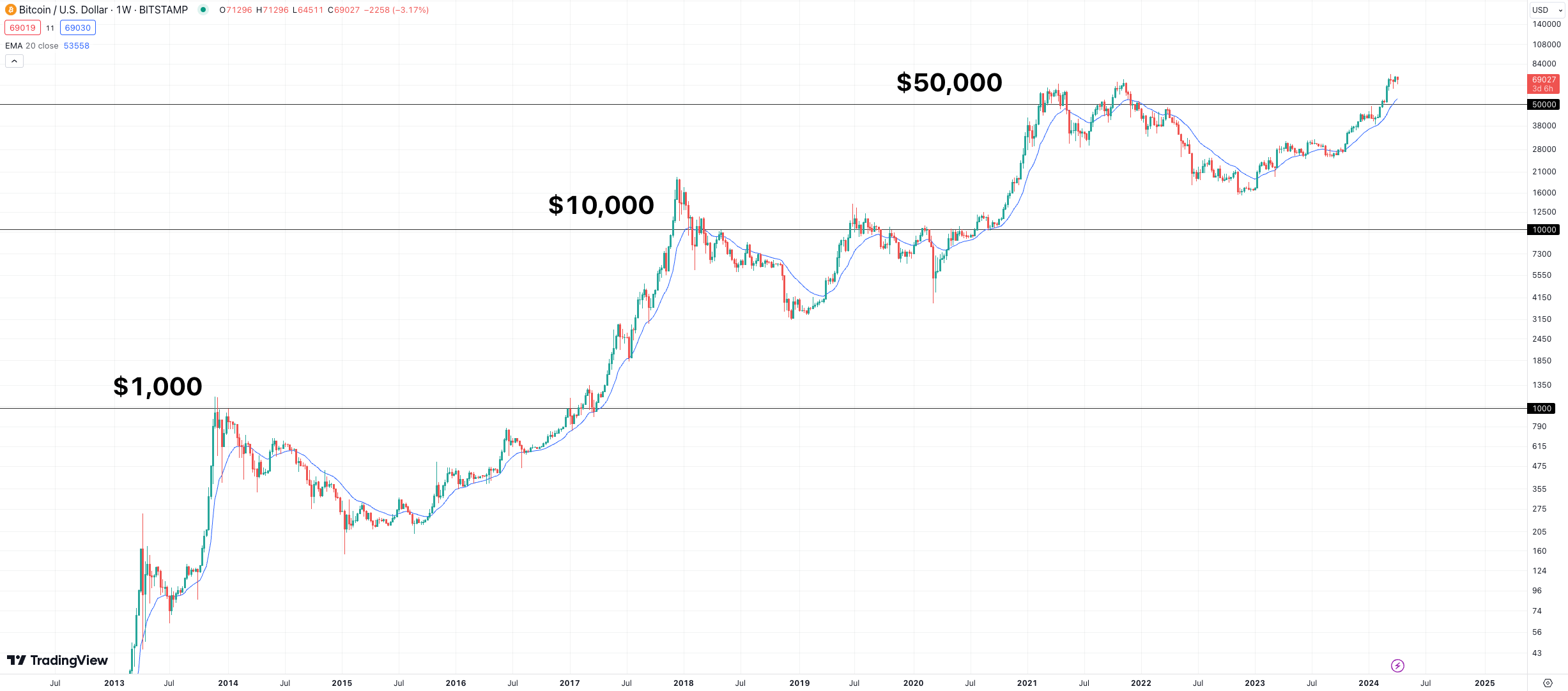

Bitcoin Price History

Bitcoin, the OG of the crypto market, has been on a remarkable journey since it first appeared on the scene in 2009. Created by the anonymous Satoshi Nakamoto, this revolutionary digital asset has evolved from an experiment into a globally recognized (and widely adopted) asset class.

Bitcoin was largely dismissed as a joke in its early years, trading at just a few cents per coin. However, as the idea of blockchain technology gained traction and its potential as a peer-to-peer currency became evident, Bitcoin’s value began to soar.

The first significant price surge took place in November 2013, when Bitcoin breached the $1,000 mark for the first time. This led to widespread interest in the coin, yet most serious investors still viewed it as a curiosity.

Subsequent years witnessed continued volatility and price swings, mainly due to security concerns and the emergence of new cryptocurrencies vying for market share – called “altcoins.” Despite these challenges, Bitcoin continued its rise, passing $15,000 in January 2017.

The years 2019 and 2021 further cemented Bitcoin as a force to be reckoned with. In the latter, Bitcoin’s price soared to a staggering $68,789, representing a 9,100% increase from the start of 2017.

However, after hitting that peak, the “crypto winter” took hold and served as a stark reminder of the crypto market’s volatility. During this period, Bitcoin plunged as low as $15,700 in November 2022. At that point, most mainstream sentiment turned pessimistic.

What is a crypto winter?

A crypto winter is an extended period of declining prices and reduced trading volumes. This is often triggered by adverse events or broader economic conditions. For example, in 2022, the FTX exchange collapsed, and inflation levels soared, leading to a “risk-off” sentiment in the crypto market.

Fortunately for crypto investors, 2023 marked a turning point. Bitcoin staged an impressive recovery, breaking through the $30,000 mark by April. The latter half of 2023 was particularly bullish, with the coin ending the year around $42,000.

And then came 2024 – a year that has already been etched into the history books. In January, the U.S. SEC approved 11 spot Bitcoin exchange-traded fund (ETF) applications, paving the way for increased mainstream accessibility. Despite dipping below $40,000 immediately after these ETFs were given the green light, Bitcoin soon embarked on a massive rally.

By early March, Bitcoin had not only returned to 2021’s all-time high but had surged past the $70,000 mark into uncharted territory. On March 14, the coin posted a new all-time high of $73,750, which gave it a market cap of over $1.4 trillion.

At the time of writing, Bitcoin has pulled back from that peak, currently trading around $67,000. However, as we’ll show in our Bitcoin price forecasts, many analysts and investors believe this is just a temporary consolidation before the next upward leg.

Bitcoin Price History – Key Milestones:

- Bitcoin was created in 2009 by the anonymous Satoshi Nakamoto.

- In November 2013, Bitcoin reached $1,000 for the first time.

- In January 2017, Bitcoin passed $15,000.

- Bitcoin went on to reach a high of $68,789 in November 2021.

- The crypto winter of 2022 took hold and saw Bitcoin’s price plummet below $16,000.

- In January 2024, the SEC approved spot Bitcoin ETFs in the U.S., leading to BTC hitting a new all-time high of $73,750 just two months later.

Bitcoin Price Prediction for 2024

This year has already proven pivotal for Bitcoin. As mentioned in the section above, multiple spot BTC ETFs were approved in the U.S., paving the way for increased institutional adoption.

In the aftermath of these ETF approvals, the crypto market has witnessed a massive influx of capital – with estimates suggesting that up to $100 billion in new investment could flow into Bitcoin alone. This surge in demand and Bitcoin’s scarcity could set the stage for a price rally in the coming months.

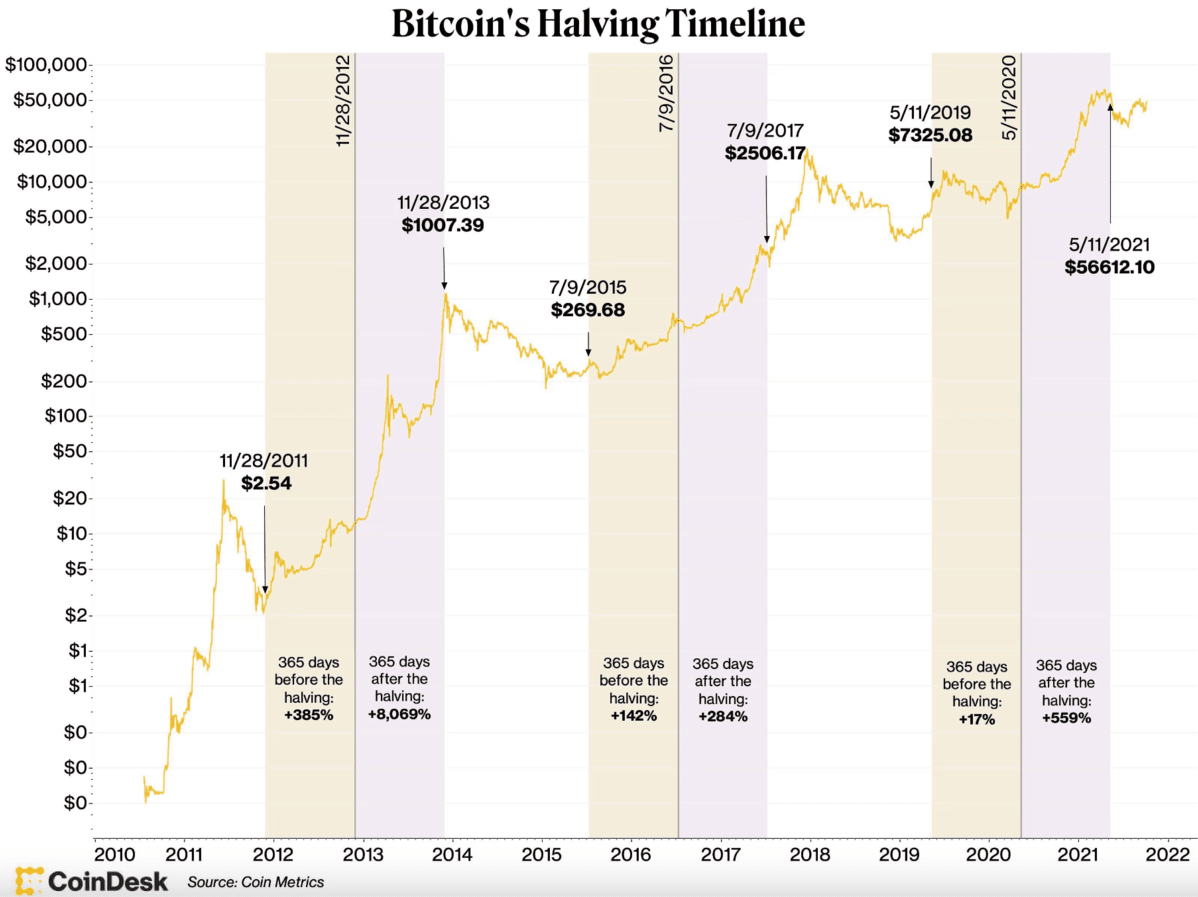

However, the key catalyst to consider during our Bitcoin price prediction for 2024 is the highly anticipated halving event. This event, which occurs every four years, will cut the reward for mining new Bitcoin blocks by half, reducing the supply of new BTC entering circulation.

Historically, halving events have been followed by bull runs as the decreased supply meets growing demand for Bitcoin. For example, after the last halving in May 2020, Bitcoin reached an all-time high above $64,000 within one year. This represented a gain of over 630% from its pre-halving price.

Adding to the bullish sentiment, our Bitcoin price prediction also considers the potential for a decrease in interest rates this year. While high interest rates are usually seen as a headwind, this hasn’t stopped Bitcoin from rallying in recent months.

Therefore, if interest rates were to be cut, Bitcoin may look even more appealing to investors. According to the CME FedWatch tool, there’s now a 58% chance that interest rates will be cut during June’s FOMC meeting, which could be great news for the crypto market in general.

Taking all these factors into account, our BTC price prediction for 2024 remains optimistic. We anticipate that the combination of growing institutional adoption, the halving event, and potential interest rate cuts could push Bitcoin to a new all-time high, potentially around $100,000 by the end of the year.

However, given the volatility in the crypto market, there’s always the potential for “black swan” events to alter Bitcoin’s trajectory. Should one of these events occur, a potential low for Bitcoin could be the $38,000 level, which was tapped in late January.

Here’s a table summarizing our Bitcoin price predictions for each of the coming months:

| Month | Price Prediction |

| July | $81,500 |

| August | $70,000 |

| September | $61,000 |

| October | $65,000 |

| November | $93,000 |

| December | $100,000 |

Bitcoin Price Prediction 2025

Our Bitcoin price prediction for 2025 continues where our 2024 forecast left off. With 2024 laying the groundwork through the approval of spot BTC ETFs and the halving event, the stage is set for even more growth in 2025.

The potential for further interest rate cuts by central banks could be a significant tailwind for Bitcoin. Lower interest rates typically diminish the appeal of traditional fixed-income investments, like bonds, prompting investors to seek other assets with high growth potential. Bitcoin could benefit from this shift.

Moreover, those looking to buy Ethereum in a regulated manner may get their wish in 2025 if a spot ETH ETF is approved in the U.S. As the second-largest crypto in the world, Ethereum’s acceptance as a viable investment option could pave the way for increased institutional involvement across the entire crypto ecosystem. Again, this could be great news for Bitcoin.

Regulatory developments will also likely play a role in shaping Bitcoin’s price trajectory in 2025. With governments now recognizing the need for clear regulatory frameworks for cryptocurrencies, we could witness more favorable policies being implemented to protect investors’ interests.

Such developments would enhance market confidence and facilitate greater investor participation. If regulations are deemed clear and fair, everyday investors, especially those who view the crypto market with trepidation, might be convinced to finally invest in Bitcoin.

To illustrate our Bitcoin price prediction, consider a scenario where interest rates are cut to below 3% and a spot Ethereum ETF is approved by the SEC. Coupled with a push for crypto-friendly regulations, we might see Bitcoin pass the $120,000 mark by the end of 2025.

However, we also expect a high degree of choppiness throughout the year, as is often the case with Bitcoin. Due to this, we predict an average price per BTC of around $70,000 across 2025.

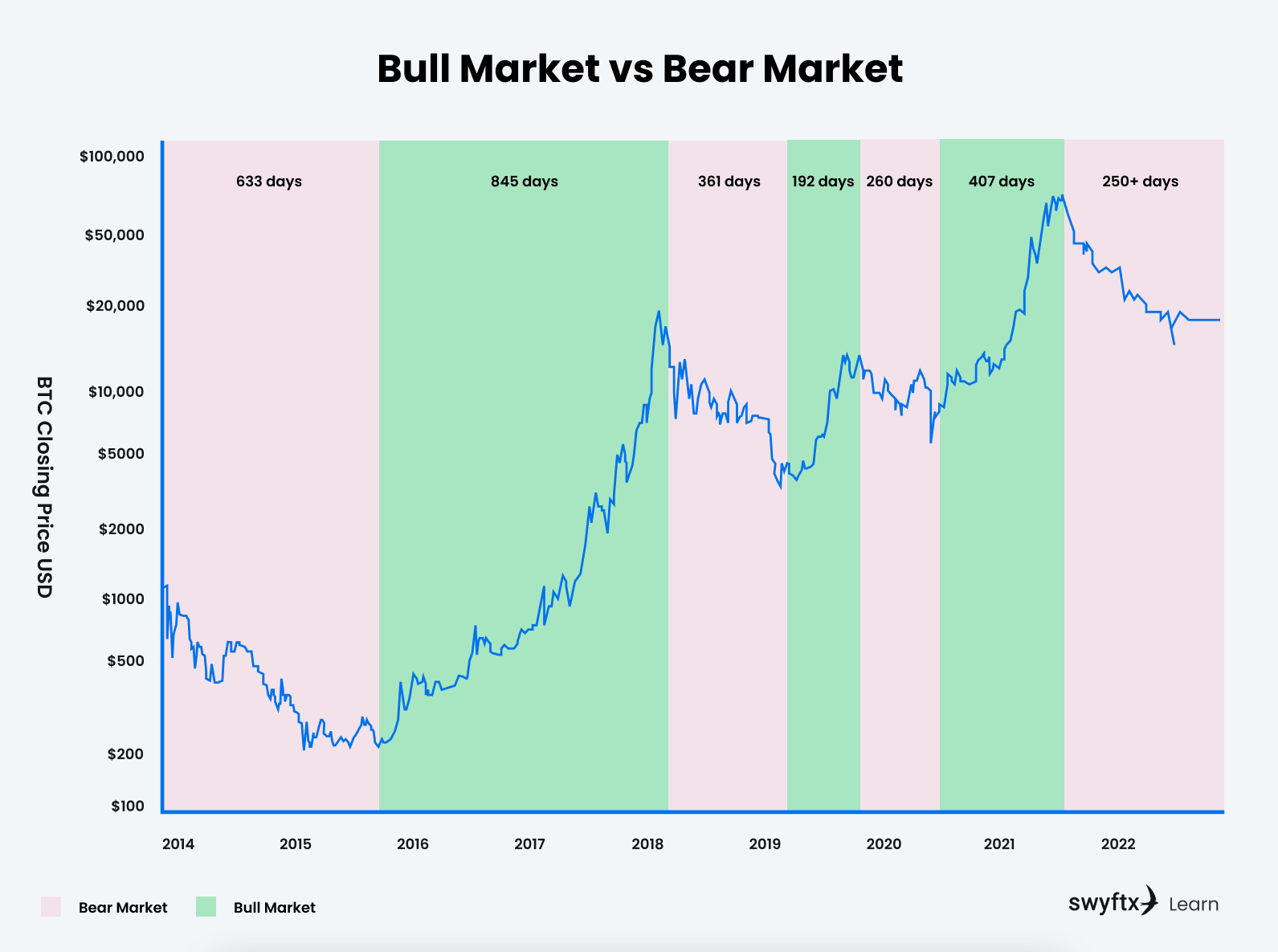

Bitcoin Price Prediction for 2026

Giving a Bitcoin price prediction for 2026 is challenging due to how unpredictable the coin’s movements can be. However, if Bitcoin does experience a rally in 2024 and 2025, as we expect, then the cycle could reverse course in 2026.

History has shown that periods of price appreciation in the crypto space are often followed by consolidation or correction periods. This pattern is not unique to Bitcoin: it is usually seen across other asset classes, like stocks and commodities.

Inflated valuations often give way to profit-taking and a more rational assessment of risk. When this happens, investors usually describe it as a “bear market” or the previously mentioned “crypto winter.”

So, if Bitcoin does reach $120,000 in 2025, it could face a sell-off in 2026. Investors who have benefited from the coin’s previous gains may choose to cash out, leading to increased selling pressure and a downturn in price.

It’s worth noting that Bitcoin’s first-mover advantage could provide some insulation against a complete collapse, even in a bearish scenario. However, investors should be prepared for the possibility of an extended pullback or consolidation phase.

As such, our BTC price forecast for 2026 estimates that the coin could drop as low as $30,000 – with an average price throughout the year of $42,000.

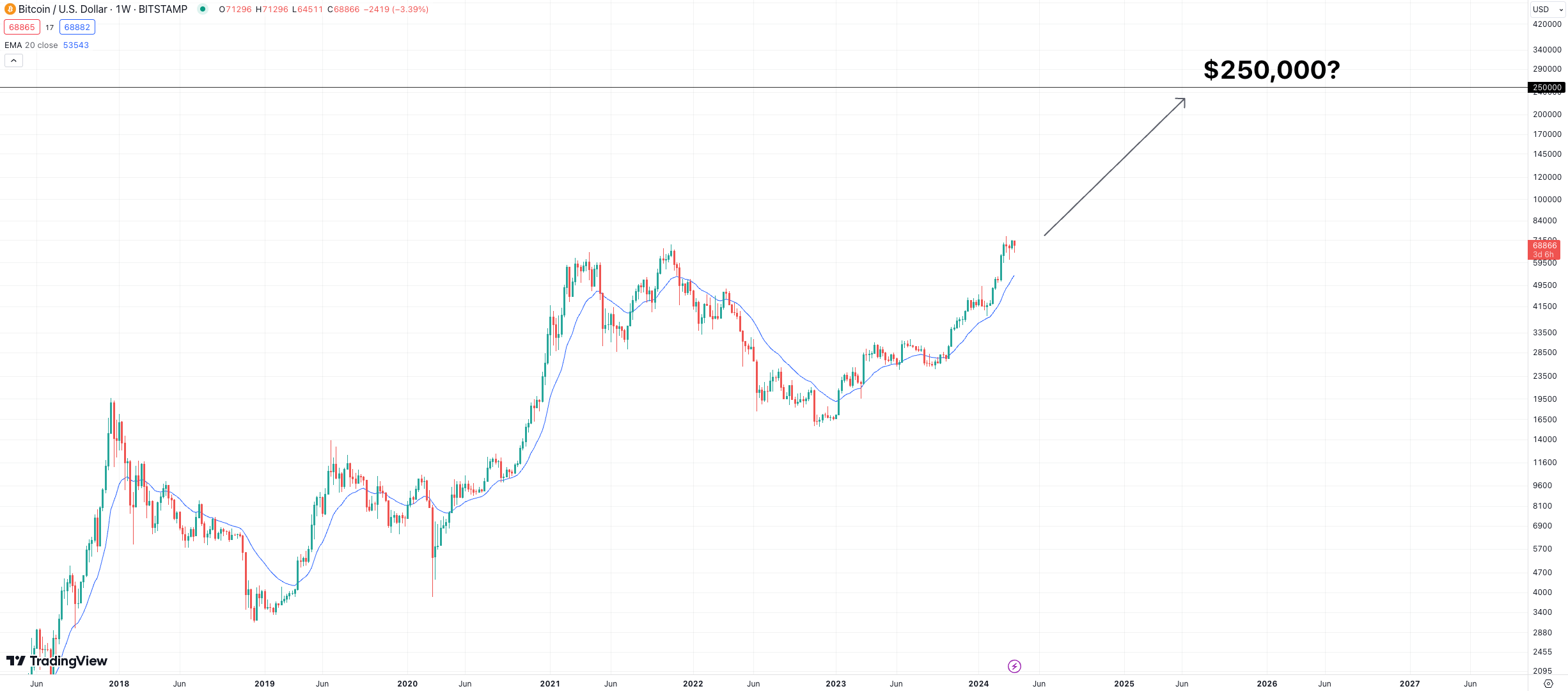

Bitcoin Price Prediction for 2030

Our Bitcoin price prediction for 2030 is underpinned by several factors that could once again push the coin to new heights. The first is the anticipated growth of Bitcoin as a payment option. As more merchants embrace digital currencies, the demand for BTC could surge – translating to higher prices.

Additionally, the development of scalable layer-2 solutions, like the Lightning Network, would fast-track global adoption. Bitcoin’s integration into traditional financial systems could also make it easier for merchants to accept it as a payment option.

Another event that could impact Bitcoin in the run-up to 2030 is the next Bitcoin halving after this one, scheduled to occur in 2028. Like the 2024 halving, this one will reduce the new BTC entering circulation even more and could increase price pressure.

Moreover, increasing interest from institutional investors and sovereign wealth funds may provide a wave of capital into the crypto market. As these deep-pocketed players recognize the potential of Bitcoin as a store of value, their involvement could also boost the coin’s price.

Considering all of these factors, our Bitcoin price prediction for 2030 is bold. We anticipate that by the end of the decade, Bitcoin could hit $250,000. Should it reach this level, it would represent a 263% increase from today’s price.

Long-Term Bitcoin Price Forecast for 2040

Predicting the price of Bitcoin a decade and a half into the future is a shot in the dark, as unforeseen events and technological advancements could easily reshape the crypto landscape. However, here are some potential factors that our Bitcoin price prediction for 2040 takes into consideration:

- Environmental Concerns: Bitcoin’s energy-intensive mining process has long been a subject of criticism. A major environmental event or heightened global awareness of the climate crisis could lead to scrutiny of Bitcoin’s carbon footprint – and hinder adoption.

- Technological Disruption: While Bitcoin was the OG cryptocurrency, its underlying technology might be considered old-fashioned by 2040. The emergence of new, more efficient blockchain platforms or consensus mechanisms could render Bitcoin obsolete.

- Geopolitical Events: Extreme global political events, such as wars or the collapse of fiat currencies, could drive people to seek refuge in decentralized assets like Bitcoin. This flight to safety could boost demand – and price.

Considering these factors, our Bitcoin price forecast for 2040 is relatively conservative. We anticipate that Bitcoin could maintain its position as a widely recognized store of value, trading within a range of $250,000 to $500,000 per coin by the end of the decade.

BTC Price Potential Highs & Lows

As outlined in the sections above, our Bitcoin price forecast for the years ahead is overwhelmingly bullish. To keep track of our predictions, here’s a table summarizing the key price targets to keep an eye on:

| Year | Minimum Price | Average Price | Maximum Price |

| 2024 | $38,540 | $61,000 | $100,000 |

| 2025 | $47,000 | $70,000 | $120,000 |

| 2026 | $30,000 | $42,000 | $90,000 |

| 2030 | $102,000 | $160,000 | $250,000 |

Popular Analysts’ Bitcoin Forecasts

Our Bitcoin price prediction is just one opinion – countless other perspectives are out there. With that in mind, here are five alternative predictions from crypto market experts:

JMP Securities

JMP Securities analysts believe Bitcoin’s price could reach $280,000 within three years. They cite anticipated Bitcoin ETF inflows, estimating around $220 billion of incremental flows over this period – leading to a potential 25x multiplier effect on Bitcoin’s price.

Standard Chartered

Standard Chartered has upped its Bitcoin price prediction for the end of 2024 to $150,000, driven by strong inflows into the spot BTC ETFs launched in January. The bank believes these “sticky” inflows will continue pushing Bitcoin’s price higher – and could see the coin trade at $250,000 in 2025.

FXTM

Lukman Otunaga, a senior market analyst at FXTM, stated that the average price prediction across their sources is $123,056 for Bitcoin. He believes the psychological level of $80,000 could act as resistance, but once breached, Bitcoin could rally from current levels to tap the average predicted price.

Robert Kiyosaki

Robert Kiyosaki, the author of “Rich Dad Poor Dad,” predicts that Bitcoin’s price could hit $300,000 by the end of 2024. He views Bitcoin as a solution for the worsening financial situation and banking crisis in the U.S., recommending everyone to buy Bitcoin, gold, and silver as a hedge.

Tom Lee

Tom Lee, co-founder of Fundstrat Global Advisors, also has a bullish outlook. He predicts Bitcoin could reach $150,000 within the next 12 months and potentially hit $500,000 within five years. His prediction is based on increasing demand, the upcoming halving event, and the potential easing of monetary policy.

What Is Bitcoin and What Is It Used For?

Bitcoin is a decentralized digital currency (a cryptocurrency) that operates on a technology called “the blockchain.” It can be thought of as a form of electronic cash that allows for secure peer-to-peer transactions without the need for a centralized intermediary, such as a bank or government.

What Is Blockchain Technology?

Blockchain technology is like a digital ledger that records transactions securely and transparently. It’s essentially a chain of blocks, each containing data about multiple transactions.

Once a block is added to the chain, it can’t be changed or removed. This allows people to trust the data recorded on the blockchain without needing a middleman.

Importantly, unlike traditional fiat currencies, Bitcoin is not issued or controlled by any single entity. Instead, it is created through a process called “mining,” where powerful computers solve complex mathematical problems to validate transactions.

While Bitcoin was initially created as a medium of exchange for electronic transactions, its use cases have expanded massively over the years. Here are some of Bitcoin’s primary applications:

- Digital Payments: Bitcoin can be used to purchase goods and services online or at physical locations that accept it as a form of payment. According to the latest data, over 10,000 locations worldwide now accept BTC.

- Investing: Due to its limited supply, many investors view Bitcoin as a potential store of value, similar to gold. This makes it a popular hedge against inflation and economic uncertainty.

- Remittances: Bitcoin’s low transaction fees make it attractive for people sending money back to their home countries. This is especially true for people who live in regions with underdeveloped banking systems.

- Ordinals: Ordinals allow for the creation of unique digital assets directly on the Bitcoin blockchain from the smallest unit of Bitcoin (called satoshis). These inscribed satoshis, often carrying images, introduce NFT-like capabilities. Since the start of 2024, there has been over $3 billion in Ordinals sales volume.

As Bitcoin adoption continues to grow, its use cases are likely to expand even further. This has the potential to revolutionize various industries and even challenge legacy financial systems.

What Influences the Price of Bitcoin?

As those who buy Bitcoin regularly will know, the coin’s price is influenced by many factors, both internal and external to the cryptocurrency market. These include:

Crypto Market Sentiment

It’s easy to see from the Bitcoin price chart that the coin’s price is heavily influenced by the overall sentiment within the crypto market. When the market is bullish, investors are optimistic, and money flows into Bitcoin. In turn, this often drives up its price.

However, investors may seek “safer” assets during bearish periods or market downturns. This can lead to decreased demand for Bitcoin and a corresponding drop in its value.

Supply & Demand

Like any other financial asset, the price of Bitcoin is governed by the fundamental principles of supply and demand. Since Bitcoin has a finite supply (21 million coins), its price is heavily influenced by increasing demand.

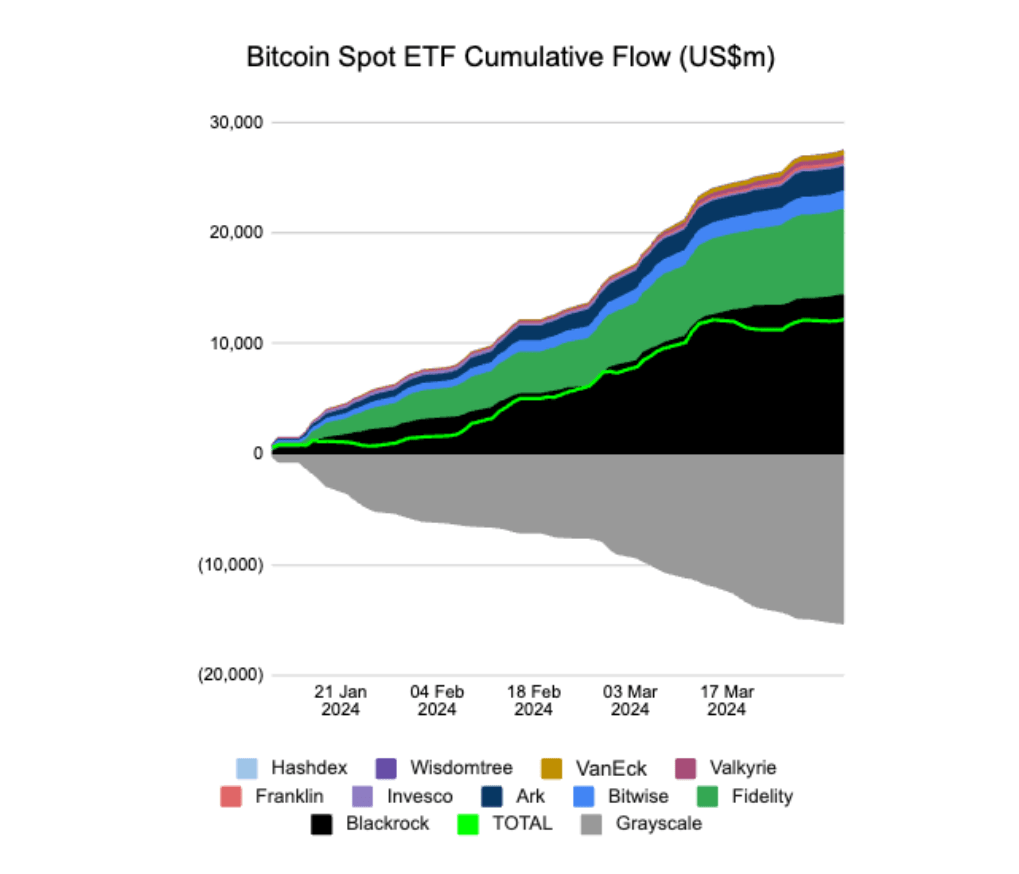

A prime example is the recently launched spot Bitcoin ETFs in the U.S. These ETFs have led to a massive uptick in institutional demand as they provide conventional investment vehicles that funds, pensions, and other large players can use to gain exposure to BTC.

This increased demand from institutional money has helped drive Bitcoin’s price higher in recent months – and was a key catalyst for hitting a new all-time high in mid-March.

Adoption & Use Cases

Bitcoin’s price is heavily influenced by growing adoption and expanding use cases. As more businesses and individuals embrace Bitcoin for transactions, payments, and investment purposes, the demand for the coin is likely to increase.

There are even new use cases for Bitcoin that previously seemed impossible. For example, digital assets can be inscribed directly onto the Bitcoin blockchain through a technology called Ordinals. As more people become aware of these use cases, it could drive further interest in Bitcoin.

Regulatory Environment

The regulatory landscape surrounding cryptocurrencies is another critical factor influencing Bitcoin’s price movements. Favorable regulations, such as the approval of spot Bitcoin ETFs back in January, can boost investor confidence and drive adoption.

Conversely, strict regulations or outright bans can dampen market sentiment and hinder adoption. A famous example is when China banned Bitcoin mining and crypto exchanges within its borders, triggering a sharp price decline for BTC.

Macroeconomic Factors

Lastly, Bitcoin’s price isn’t immune to broader macroeconomic conditions affecting traditional financial markets. Factors such as inflation rates, interest rate policies, geopolitical events, and overall economic performance can (and do) impact investor sentiment and the perceived value of Bitcoin.

These factors play off each other in complex ways and shape Bitcoin’s price movements. Understanding and monitoring them is crucial for investors since they can provide valuable insight into potential price trends.

2024 Bitcoin Halving

As referenced earlier in our Bitcoin halving price prediction, this event is crucial for maintaining the coin’s scarcity and value. In simple terms, the halving is when the reward for mining new Bitcoin blocks is reduced by 50%.

Here are the key points to remember regarding the 2024 Bitcoin halving:

- The halving occurs roughly every 210,000 blocks, or approximately every four years, to control the supply of new Bitcoins entering circulation.

- By reducing the supply of new Bitcoins, while demand remains constant (or increases), the halving event could drive up prices due to the law of supply and demand.

- Currently, miners receive 6.25 Bitcoins for every new block they add to the blockchain.

- With the halving event scheduled for April 20, 2024, this reward will be cut to 3.125 Bitcoins per block.

Significant price rallies for Bitcoin have followed previous halving events. For example:

- In the 12 months following the 2012 halving, Bitcoin’s price rallied over 8,300%.

- In the 12 months following the 2016 halving, Bitcoin experienced a gain of over 288%.

- In the 12 months following the 2020 halving, Bitcoin surged over 650%.

While past performance doesn’t guarantee future results, the 2024 halving has the potential to generate considerable excitement in the crypto community. In fact, based on Elliott Wave charting, analysts at BitQuant believe that Bitcoin could reach as high as $250,000 post-halving.

Is Bitcoin a Buy Right Now?

So, is Bitcoin a good investment? Or is it better to wait on the sidelines? On one hand, the crypto market is currently buzzing with bullish sentiment surrounding the halving event. As highlighted in this guide, these halvings often act as a positive catalyst.

Adding fuel to the fire is the growing adoption of Bitcoin by institutions. According to BitMEX Research, the 11 SEC-approved spot Bitcoin ETFs saw over $12 billion in total inflows during Q1 2024. BlackRock’s offering has been the biggest winner, while the Grayscale Bitcoin Trust is a key outlier, having seen billions in outflows due to high fees.

Moreover, the potential for interest rate cuts later in the year could make Bitcoin a more attractive investment proposition. With traditional assets like bonds offering lower yields, investors may flock to Bitcoin to generate higher returns.

However, it’s essential to approach any investment with a healthy dose of caution. The crypto market remains highly volatile, and unexpected regulatory hurdles or shifts in market sentiment could quickly derail Bitcoin’s uptrend. For example, if a major exchange like Coinbase or Binance was hacked or collapsed.

Ultimately, investing in Bitcoin should be based on one’s own risk tolerance and investment objectives. Although our Bitcoin price prediction estimates that BTC could top $100,000 by the end of 2024, this is just our opinion and shouldn’t be considered investment advice.

Bitcoin Price Prediction – Conclusion

In summary, our Bitcoin price prediction sees a promising future for the world’s largest cryptocurrency. With the halving event on the horizon and growing institutional interest, there’s a high chance Bitcoin could reach new heights – and perhaps even breach $100,000 by 2025.

While Bitcoin’s long-term prospects appear bullish, those seeking diversification (and higher returns potential) may wish to read our comprehensive guide on the best cryptocurrencies to buy in 2024 and beyond.

Check Out Our Best Cryptos to Buy Guide

FAQs

How much will Bitcoin be worth in 2025?

Our Bitcoin price prediction forecasts that BTC will reach a high of around $120,000 in 2025 and an average price of $70,000 throughout the year.

How much will Bitcoin be worth in 2030?

While long-term predictions are challenging, our analysis indicates that Bitcoin could trade as high as $250,000 in 2030.

How much will Bitcoin be worth in 2040?

Given the numerous factors that could influence its value, making accurate Bitcoin price predictions for 2040 is challenging. However, if scarcity does drive continued price appreciation, BTC could reach $500,000 by 2040.

Is now a good time to buy Bitcoin?

Given Bitcoin’s recent breakout to new all-time highs and the positive market sentiment surrounding the halving event, the current market conditions could present an opportune time to add Bitcoin to one’s portfolio.

References

- Bitcoin ETF Flow Data for Q1 2024 (BitMEX Research Twitter Account)

- Bitcoin Merchant Data (BTCMap)

- @cbspears on Twitter “We quietly crossed over $3 billion in Ordinals marketplace trading volume” (Twitter)

- Bitcoin Price Predictions Post-Halving (Cointelegraph)

- Bitcoin Price Stats (CoinMarketCap)

- CME FedWatch Tool (cmegroup.com)

- Crypto Fear & Greed Index (Alternative.me)

- FXTM Bitcoin Price Prediction (The Independent)

- JMP Securities Bitcoin Price Prediction (investing.com)

- Law of Supply & Demand (Investopedia)

- SEC Approves Spot BTC ETFs in the U.S. (Reuters)

- Spot BTC ETFs May Bring $50-100 Billion in Inflows (TheBlock)

- Standard Chartered Bitcoin Price Prediction (BitcoinMagazine.com)

- Tom Lee Bitcoin Price Prediction (CNBC)

- What Are Bitcoin Ordinals? (Decrypt)

- Who Is Satoshi Nakamoto? (Investopedia)