Bitcoin prices might rise after the upcoming Halving event, however, one analyst believes if global liquidity increases, the BTC rally will be stronger than ever anticipated – fuelling outlandish gains.

With the Bitcoin halving event hours away, excitement is building, with most experts expecting the coin to soar in the coming weeks after an initial dip period.

This outlook is well-buttressed by history. In the past months after halving, prices have tended to rip higher, even breaking all-time highs, as seen in post-2016 and 2020 events.

Halving will reduce daily BTC issuance, automatically tightening supply and potentially pushing prices upwards.

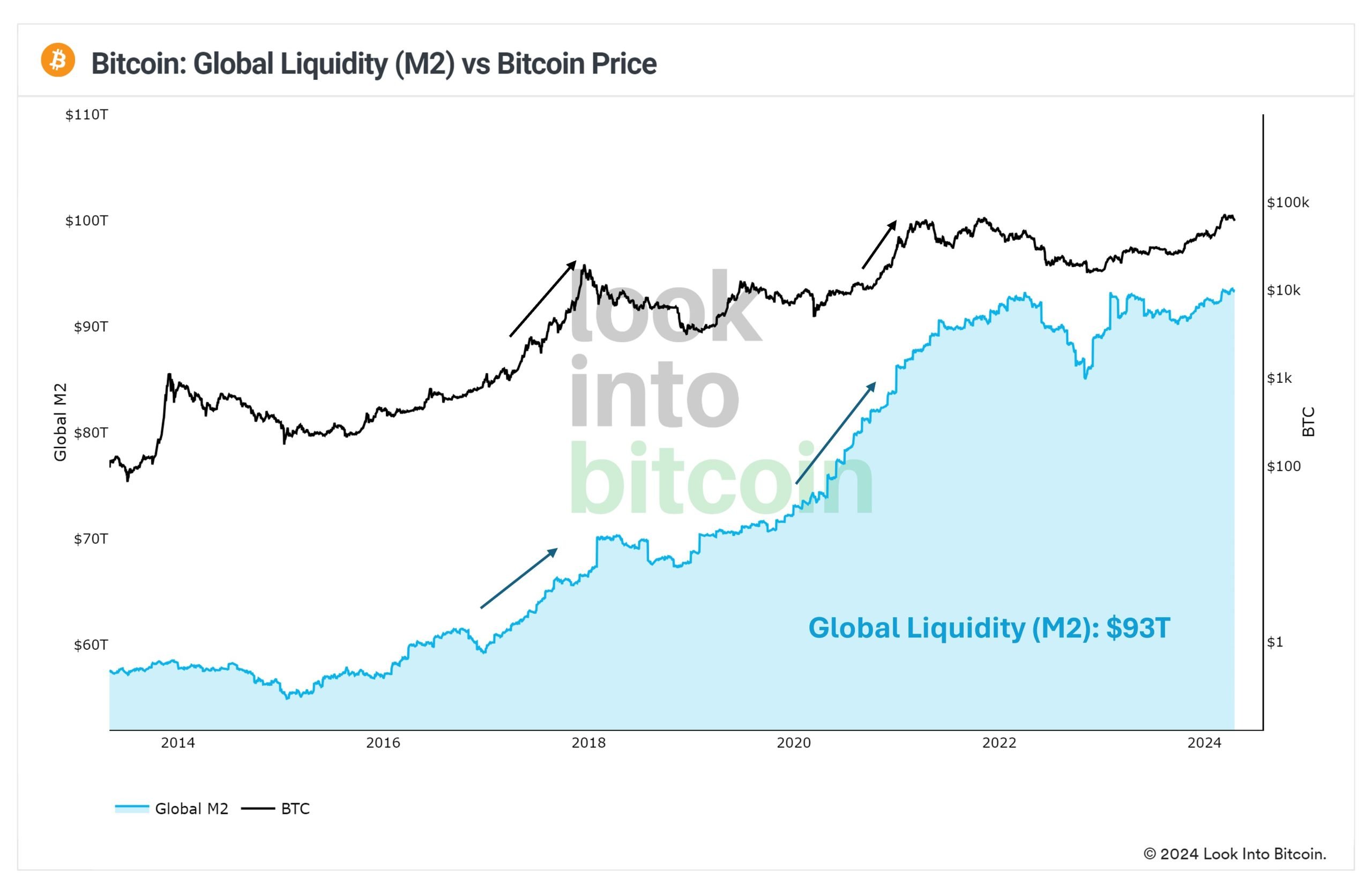

However, while all eyes are on this four-year event, one analyst on X believes Global Liquidity, or M2 money supply in the United States, will be an even bigger driver for the expected bull cycle in 2024.

One Analyst’s Focus on Global Liquidity in Bitcoin Halving

As Bitcoin finds acceptance on Wall Street, its prices will continue to be shaped by market factors, including actions taken by the Federal Reserve.

Through its monetary policies, the central bank shapes the money supply, among other parameters. Global Liquidity is the total amount of money circulating in the economy.

In the post on X, the analyst said if Global Liquidity continues to rise, it could have a more significant bullish impact on Bitcoin even than the halving itself.

Historically, when the M2 supply has risen, Bitcoin prices have tended to explode. This was seen from 2019 through 2020 before the Federal Reserve began hiking interest rates. Then prices rose from less than $9,000 post-2018 to as high as $70,000.

Whenever Global Liquidity rises, investors, flush with cash, may seek alternative assets like Bitcoin to hedge against inflation or simply for diversification.

As the analyst expects, a significant rise in M2 could potentially lead to a larger pool of capital flowing into crypto.

The Bottom Line: Bitcoin Halving Still a Catalyst

Even so, though Global Liquidity might impact prices, the immediate catalyst that shouldn’t be ignored is the impact of Halving event – which reduces the supply of fresh Bitcoin by half.

(BTCUSDT)

As mentioned, the Halving reduces the daily emission of BTC. If the current level of demand continues and institutions double down via spot Bitcoin ETFs, there will likely be a repricing higher.

Still, how fast BTC breaks all-time highs or breaches $100,000 remains to be seen.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

No Comments

No Comments