With the Bitcoin Halving clock reading just 2 days until supply-side reduction, market hysteria is front-running the US presidential election. But with crypto prices down, retail investors are panicking – so here are 3 reasons to hold your BTC.

Take a deep breath. Don’t sell your Bitcoin. Not until you’ve read this article.

I got into Bitcoin in 2019, and when the 2020 Halving happened, I didn’t really know what to expect: Was my BTC going up, sideways, or down?

Well, I’m glad I held – Bitcoin crabbed post-halving, gaining a meager +6% despite the major event, but my holding behavior was rewarded when the price later exploded by 548% to new all-time highs.

Looking at the market today, especially on crypto X, much FUD (fear, uncertainty, doubt) is going around – that’s by design.

With the Bitcoin Halving clock only two days away, 99Bitcoins wants to give you the ABCs of making money after the Bitcoin Halving clock hits zero. Here are three reasons why the Bitcoin price will explode if you hold.

Reason 1: Jim Kramer Hasn’t Bought Yet

Starting with a light-hearted jab, the “Kramer curse” suggests a contrarian approach: if Jim Kramer endorses a buy, it’s time to sell.

What this really comes down to, however, is that Bitcoin isn’t trending online in the mainstream yet.

Stepping outside the echo chamber means you’re still early. Even if BTC plummets post-Halving, it’ll be because whales are selling, not because we’re experiencing a bubble popping.

A surge in mainstream media coverage and skyrocketing Google searches for Bitcoin is often a precursor to market tops.

BlockBeats reports that from February 18th to 24th, 2024, Google Trends shows ‘bitcoin’ searches scored a low 22, a stark drop from its May 2021 peak of 100.

Celebrity crypto endorsements have historically marked peak hype from Matt Damon to Kim Kardashian. Their return could signal caution (but we’re not there yet).

Reason 2: BTC Has Built-In Mechanics for New Highs (Post Bitcoin Halving Clock)

What the Bitcoin Halving does is implement a reduction in the block reward given to Bitcoin miners.

The 2024 mining will reduce mining rewards from 6.25 BTC to 3.125 newly minted bitcoins.

The idea here is simple: the cost of mining and competition means that miners are pushed to sell at a profit around the halving event.

This process gradually raises Bitcoin’s price floor over time – with a 50% reduction in fresh supply – which can grip price action for up to 14 months.

Reason 3: These Bitcoin Analysts Have Your Back in US Presidential Election Year

In a conversation with macro investor Raoul Pal, Crypto King of the internet and former CEO of BitMEX Arthur Hayes says people don’t have enough imagination for the price of Bitcoin and altcoins in 2024:

“I think this cycle is going to be insane, and people don’t have enough imagination to know how crazy things can get,” claimed Arthur Hayes.

Bitcoin consulting expert Erik Muro is eyeing a cool $200,000 baseline for Bitcoin within four years, scoffing at anything shy of $500,000 as a disappointment.

His confidence is rooted in the stock-to-flow model, betting on Bitcoin’s scarcity to drive its price skyward.

The Bottom Line: When The Bitcoin Halving Clock Hits Zero Do This

When everyone from taxi drivers to grandparents starts inquiring about BTC, it might be time to question the market’s direction – this could come in the months ahead.

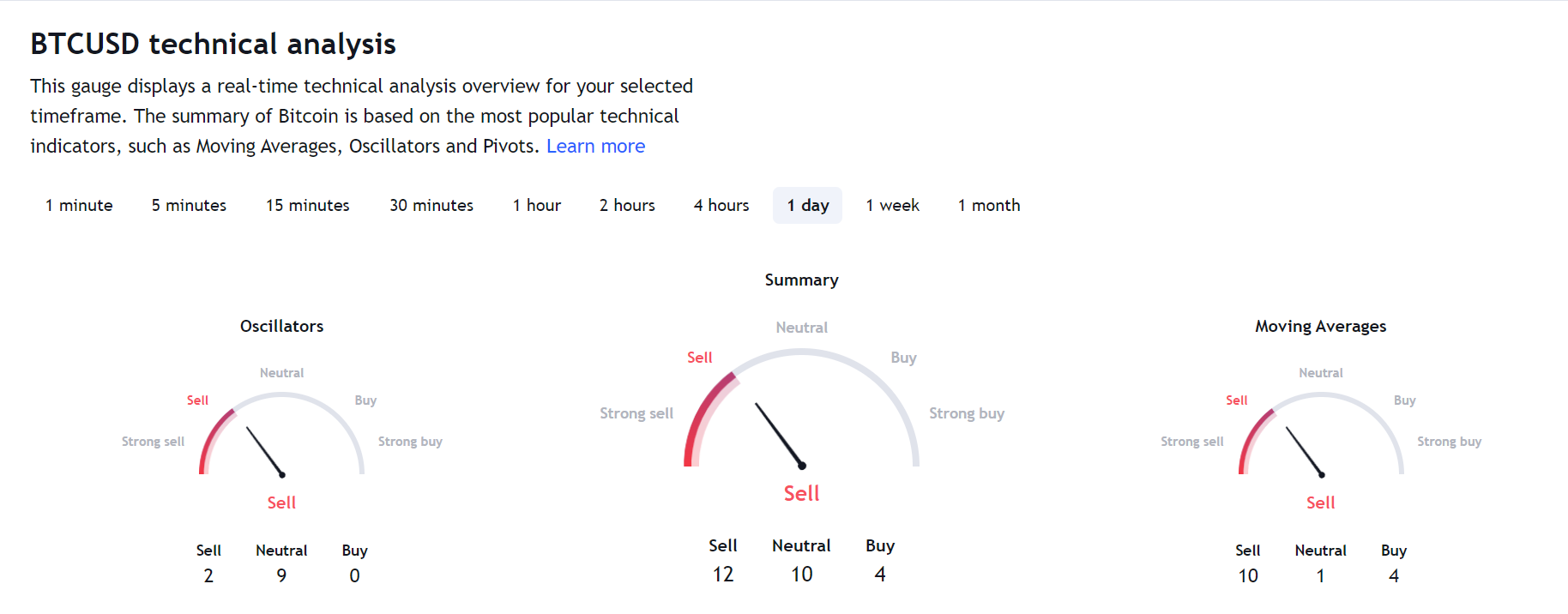

For now, many technical indicators, like the long-term moving average and BTC Fear & Greed Index, indicate bearish momentum post-halving—a normal pattern.

However, like my experience in the 2020 Bitcoin Halving, it seems probable that Bitcoin will skyrocket sometime in 2024 amid intense supply-demand dynamics fuelled by ETFs.

This is buoyed further by a US Presidential Election, which typically triggers bullish market performance.

To put it simply, amid the fervor of 2024 – you just have to hold on.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

No Comments

No Comments