Bitcoin soared to $69,200 in March, then the market tanked by 15%. Fast forward to June and it’s another crash, and a similar story.

Could it all have been avoided? Absolutely—with the RSI heatmap.

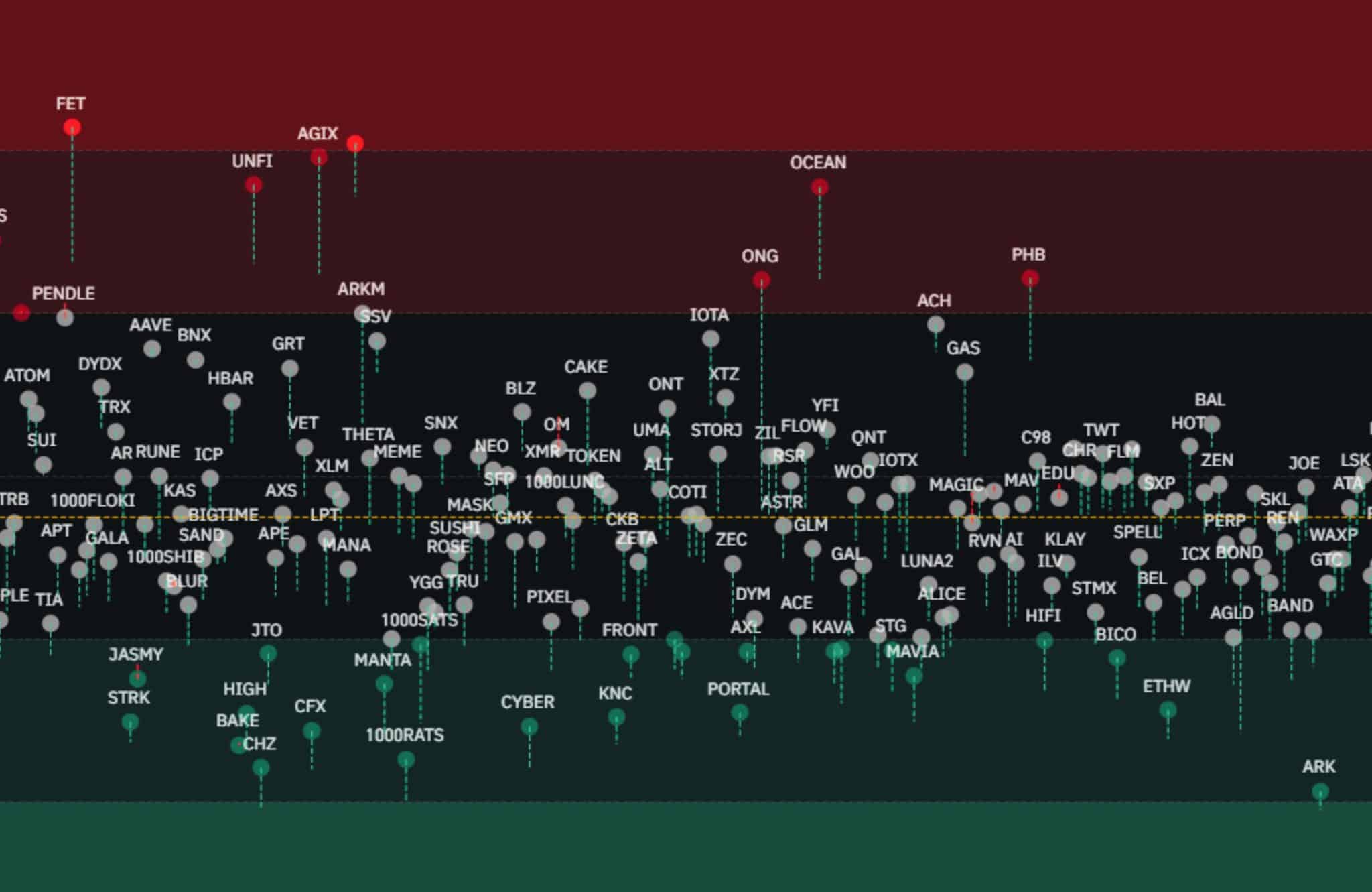

This tool, a staple in crypto futures trading, tracks momentum and price changes.

RSI readings above 70 (or in the red) will tell you when an asset is “overbought,” while below 30 signals (or in the green) are “oversold.”

Before the crash, the warnings were clear.

Let’s break down the red flags and that essential tool.

Warning Signs Before the Drop From the RSI Heatmap

Just like the crypto fear and greed index, traders use the RSI Heatmap alongside other indicators like moving averages to spot and confirm market trends. This helps in making smarter decisions and cutting potential losses.

Before today’s market plunge, meme coins were on a wild ride. Take Pepe (PEPE) – the frog-themed coin shot up 700% in the month before the crash.

Meme coins like Pepe are pure speculation, offering zero utility and a ton of risk. Their wild surges often scream “overheated market.”

We here at 99Bitcoins like Pepe as much as any other meme investor. But Had you paid attention to the RSI heatmap, you might’ve bailed before the crash.

Other Big Warning Signs That The RSI Heatmap and These Indicators Help With

Here are some other warning signs that the RSI heatmap can help you indicate:

- Greed: Warren Buffett’s wisdom, “be fearful when others are greedy,” applies here. The Crypto Fear and Greed Index matches the RSI heatmap, warning when greed skyrockets.

- Wild Volatility: Buy during calm, sell in chaos. High volatility hints at a looming drop. You can use Bollinger Bands to indicate this, or also RSI to help as well.

- Sky-High Crypto Futures Funding Rates: Perpetual futures, or “perps,” have revolutionized crypto. These contracts allow traders to make leveraged bets without an expiry date. However, the catch is high funding rates mean traders are paying a premium to hold positions. That’s a sign of a boiling market, ripe for a crash

Market Recovery and Future Outlook

The RSI heatmap is essential to know when to buy or sell.

And with institutional interest is rising, Bitcoin ETFs taking off, and the April 2024 halving squeezing supply, timing your next crypto move is everything.

EXPLORE: What Is The Best CEX To Use To Buy Crypto in 2024?

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.