Bitcoin price closed above $66,000 on May 15, leading to over $47 million in BTC liquidation. CPI Inflation slowed down in April 2024, boosting market confidence for risk-on assets like cryptocurrencies.

Not everyone expected Bitcoin to rip higher yesterday. Some took bets, predicting a washout, forcing the coin to the $50,000 level.

Well, prices surprisingly shot higher on May 15, much to the relief of HODLers who, since March peaks, have had to endure drawdown. To quantify, BTC is down roughly 13% from all-time highs, even with gains yesterday.

$BTC market structure has officially shifted

We have bullish market structure on the daily for the first time in over a month

Higher pic.twitter.com/iSw25951df

— TraderKoz (@TraderKoz) May 16, 2024

When BTC was wallowing at around $56,500, it had shrunk a worrying 20% from all-time highs.

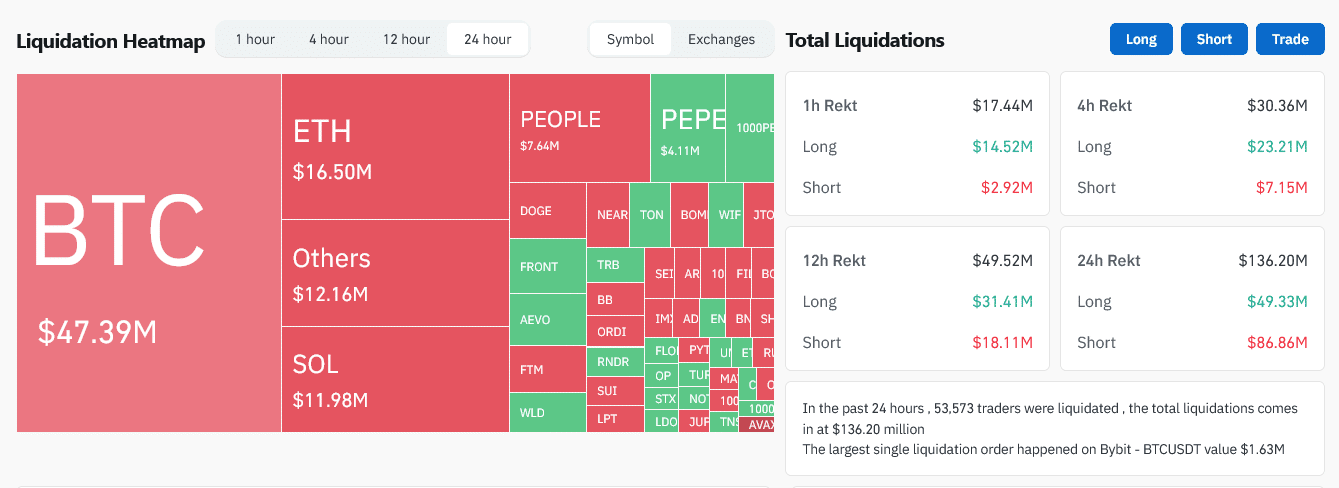

Over 53,690 Traders Liquidated, Most Were Betting Against A Bitcoin Rally

Since the trend appears to be changing, favoring bulls who established the current leg up in Q1 2024, Coinglass data shows that 53,690 leverage traders were liquidated.

This means that the exchange had no choice but to forcefully close their positions, selling their margins on spot rates as a safety measure.

Most of the over 53,000 traders who had to lick their wounds were Bitcoin traders. Specifically, over $47 million worth of BTC positions were unwound.

Coinglass data shows that the largest was $1.6 million, opened on Bybit. However, whether this position was betting for or against a price surge is unclear.

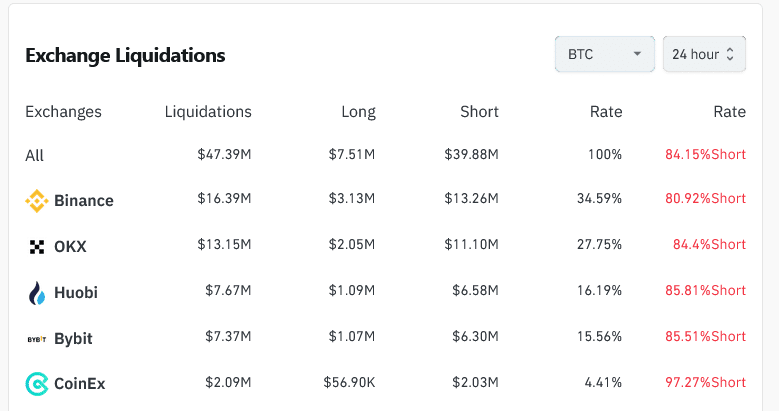

We know that $39.88 million of BTC shorts were liquidated–comprising over 84% of all closed positions. Meanwhile, just $7.51 million of longs were forcefully closed.

Binance, OKX, and Huobi are platforms that liquidated the most positions.

Though the liquidation was noteworthy, it was not the same magnitude as those closed on February 28.

When prices ripped higher that day, over $198 million of shorts were closed. After this flashback, BTC soared to over $73,000 in March 2024.

The primary reason BTC prices rose on Wednesday had nothing to do with the candlestick arrangement.

DISCOVER: 13 Best Altcoins to Invest in May 2024

Inflation Falls In April: Will The Fed Slash Rates?

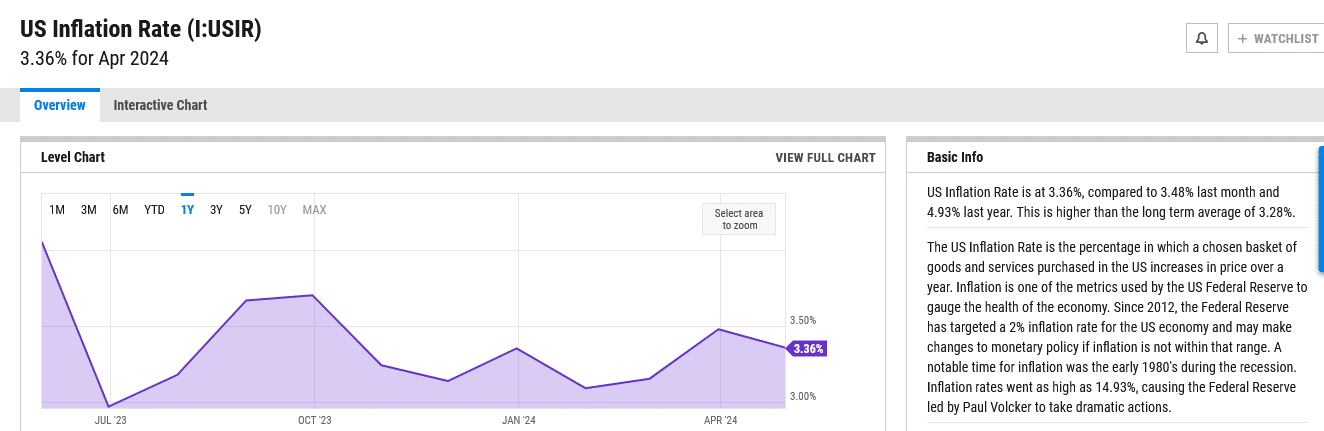

News that the United States inflation reading is cooling off fanned huge demand for risk-off assets like Bitcoin and gold.

According to the latest CPI data, inflation rose at a slower pace than anticipated in April, increasing by 3.36%, down from 3.5% in March.

Falling inflation could signal to the financial markets that the Fed has successfully curbed inflation without triggering a recession – pushing closer to the 2% target.

This news ignited optimism that the Federal Reserve (Fed) will slash interest rates as early as September.

If the United States Fed turns “dovish,” accepting a more accommodative monetary policy environment, it will provide huge tailwinds for Bitcoin, as it did in 2021.

A wave of rate cuts to mitigate the effects of the COVID-19 pandemic helped pump prices to over $69,500 by November 2021.

Should the Fed slash the rate as inflation falls, Bitcoin, reading from past events, could rise, even posting fresh all-time highs above $74,000.

(BTCUSDT)

Thus far, confidence is high because BTC recently slashed its miner rewards to 3.125 BTC, reducing its daily emissions rate.

At this pace, Bitcoin is increasingly becoming more deflationary than gold. It could explain the rising interest among investors keen on shielding their wealth.

EXPLORE: Bitcoin Hits $66.2K High Amid Surprising US CPI Data Revealing Lowest Core Inflation in 3 Years

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.