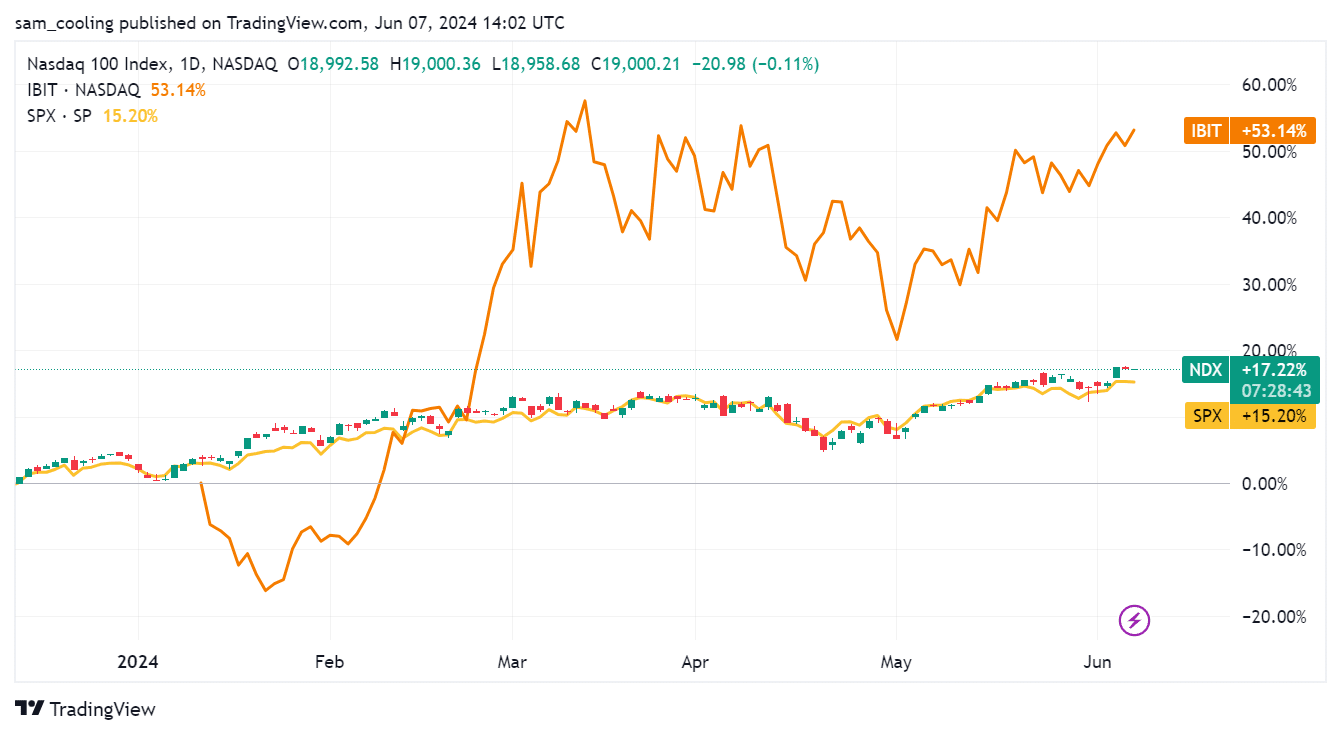

Spot Bitcoin ETFs are set to be the biggest performer as TradFi markets eat up BTC in Q2; BlackRock IBIT fuels the biggest day for Bitcoin Spot ETFs.

Since the launch of BlackRock’s Bitcoin ETF, this has gained +50% in value over the past five months.

(IBITUSD)

BlackRock IBIT Fuels Major Day for Bitcoin ETFs

IBIT, known as iShares Bitcoin Trust, represented an important step for crypto investments. BlackRock’s IBIT (approved by the U.S. Securities and Exchange Commission, SEC, on January 11, 2024) is a Bitcoin spot ETF that allows users to gain exposure to Bitcoin’s price movements without owning the cryptocurrency itself.

IBIT reached a milestone by surpassing $1 billion in assets under management in its first week of trading. This result suggests strong demand and growing interest among investors in a more regulated exposure to Bitcoin.

BlackRock iShares Bitcoin Trust accumulated more than $20 billion in total assets, making it the largest BTC ETF, surpassing GBTC (Grayscale Bitcoin Trust), and the quickest ETF ever to reach $20 billion in funds under management.

In less than 5mos, iShares Bitcoin ETF now holds 300,000+ bitcoin…

Or nearly 1.5% of total bitcoin supply.

Less than 5mos.

IBIT has taken in nearly $800mil just this *week*.

Not a view on price, but I believe advisors & inst’l investors are only just beginning to show up.

— Nate Geraci (@NateGeraci) June 7, 2024

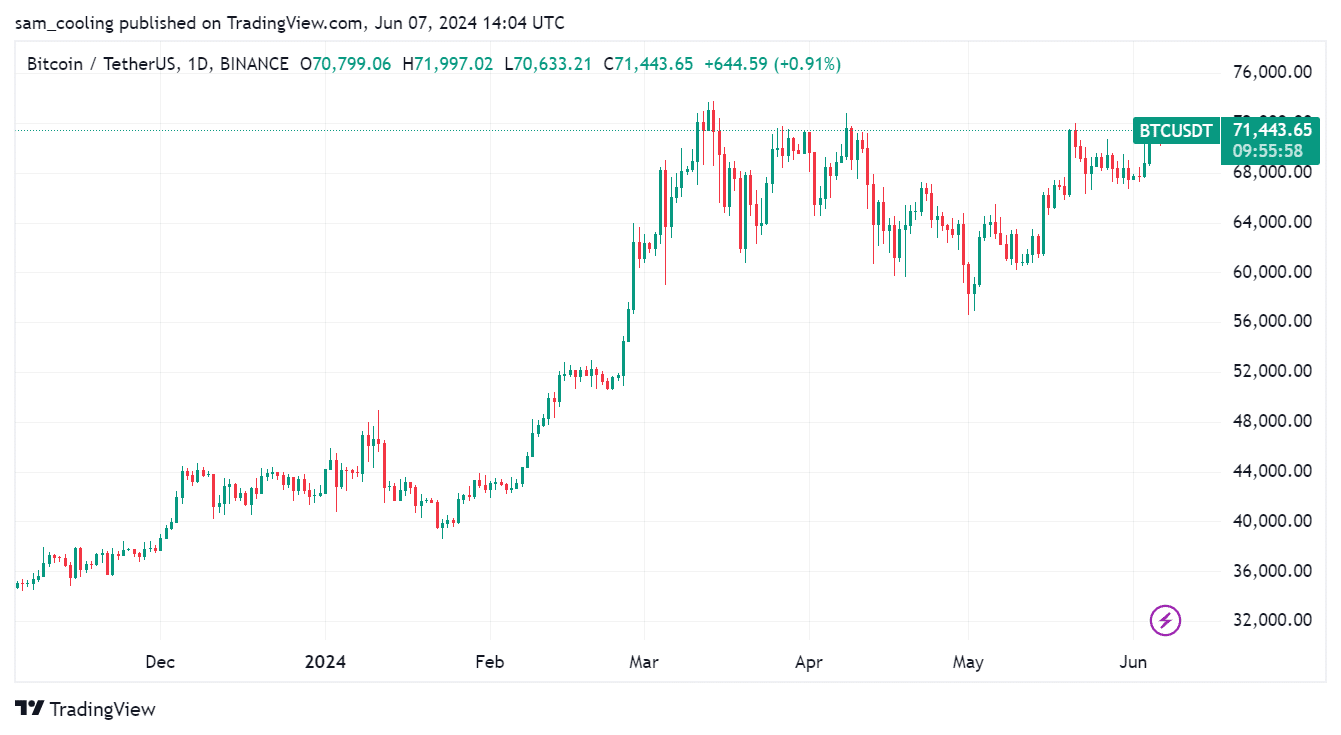

The Bottom Line: Bitcoin ETF Are Bullish for BTC Prices in 2024

(BTCUSDT)

In the last 24 hours, Bitcoin has reached the price of $71,400, an overall increase of 5% in the last 5 days.

The rise in Bitcoin’s price can be attributed to both the accumulation of these institutions, like BlackRock, which are increasing their positions, and the possible early cut in interest rates in September by the Fed, a decision that both the European and Canadian central banks have already taken.

It’s safe to say that institutions seem to love Bitcoin and will continue to accumulate it, making the future of crypto exciting.

EXPLORE: What are Bitcoin ETFs? How to Buy Bitcoin Spot ETF

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.