Paycoin: Decentralized Central Banking

I have started to write this article multiple times, as I slowly walked myself through Paycoin’s potential dangers, including where the idea likely originated, and what it could become. Unfortunately, I cannot state everything that I think about Paycoin, Paybase, GAW, GAW’s owners, and the potential goal of the currency as I do not have the proof needed to back it all up. However, what I can do is explain the problems with the stated with the currency, why the community should not expect it to just “fail”, and provide some extra information that I have gathered that suggest a potential source of the Paycoin plan.

Paycoin’s POS Rates, Prime Controller Bidding, and Orion Controllers

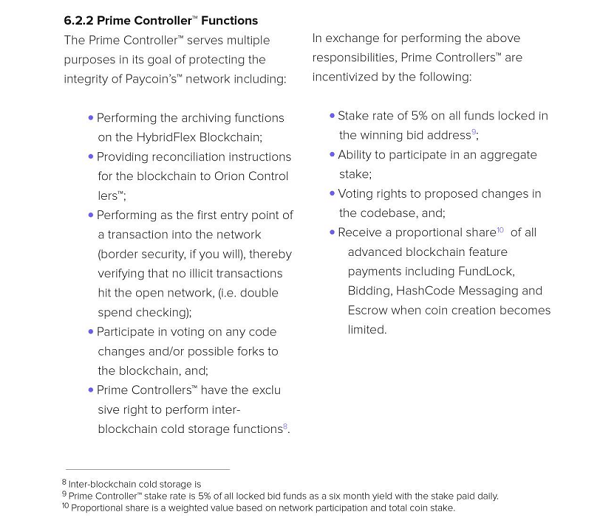

The three biggest problems presented by Paycoin are, truly, just different sides of one large issue. Orion Controllers, as well as the “promoted” version, known as “Prime Controllers” are meant to be similar to Darkcoin‘s “Master Nodes” and are meant handle Paycoin’s transactions and blockchain. Also, both Orion and Prime Controllers, according to the Paycoin whitepaper, will “receive a proportional share of payments and fees sent for advanced blockchain features, such as Escrow, Wallet Locking, and Hashcode Messaging.”

That is fine, as it is perfectly legitimate for a node that is devoting the resources required to handle more resource intense transactions to also receive fees for said transactions. Unfortunately, it does not stop there. The three big issue lie with the “bidding” system, which can transform an Orion Controller into a Prime Controller, the increased POS rate that Prime Controllers receive, and Prime Controller “voting”.

Prime Controller Bidding

Prime Controller bidding is stated in the white paper to require at least half of of all Paycoins in existence divided by total number of Prime Controllers required by the network (1% of all coins if 50 Prime Controllers are needed), with a minimum bidding fee of 50 XPY. Bidding for the first round of Prime Controllers certainly reached a very high number. According to Holy Nerdvana, the winning bids for the first 50 (or 52?) Prime Controllers were 125,000 – 146,429 XPY.

This bidding system then distributes all of the bid fees proportionally to all Orion Controllers (including the newly promoted Prime Controllers). The proportional share is stated to be based on “network participation and total coin stake”. Unfortunately, what this will do is creates a loop of coins that are cycled through the richest Orion Controllers (or Prime Controllers), as the ones bidding on the Prime Controllers must, according to the bidding rules, have a significant portion of the total number of coins. If one group bids, and wins, a Prime Controller, their fees are then split between the other Orion controllers, with the majority going to other groups that are also in the position to bid on Prime Controllers. When other individuals bid on Prime Controllers, the first group is going to receive a significant portion of the bidding transaction fees from that. In the end, the bidding fees should almost be completely regenerated for those who are in the position to run Orion Controllers and bid on Prime Controllers.

A more fair system would split the bids proportionally between all wallet addresses. This would help to slow the growth of the inevitable gap between those with large XPY holdings and those with smaller holdings. However, regardless of how the bidding fees are split, the bigger issue is the staking rate of Prime Controllers.

Prime Contoller Staking Rate and Voting

In the white paper, the Prime Controller stake rate was stated to be 5% 6 month yield of all locked funds, paid daily, which is twice the rate of a basic wallet or an Orion Controller. If one were to keep a Prime Controller for two cycles, and reinvest the interest from the first 6 months in the bidding for the second 6 months, the yearly return should work out to slightly more than 10%.

When the average user is using a standard wallet, and staking at a rate that will generate around 5% in interest per year, they may feel like they are gaining. However, in reality, these users will be losing overall. With Prime Controllers having a doubled staking rate, inflation will fall somewhere between the 5% that average users earn, and the 10% that Prime Controllers earn, and cause the groups that have Prime Controllers to slowly capture a higher and higher % of the total coins.

This effect is similar to what can be witnessed in current banking systems. Paycoin itself is filling the role of the Federal Reserve, and can even increase the number of Prime Controllers (thus increasing the inflation rate), as needed. The Prime Controllers are filling the role that large banking institutions do. By having a large supply of funds, the groups that bid for Prime Controller will enjoy an interest rate that gives them a significant advantage in the market, and force other users to either store their Paycoins with the company that controls the Prime Controller (likely in exchange for a slightly higher than 5% interest rate, while the company keeps the additional income), or experience constant loss.

This 10% to 5% difference is bad enough, but it gets worse. As some people have noticed, a large group of Prime Controllers are currently staking at an incredible rate. These increased rates were also noticed in the Primecoin code. The highest rate currently seems to be ~350% APY, or slightly less than 1% per day. Some have calculated that this will result in an APY much higher than 350%, but this increased staking rate is supposedly only applicable to the pre-stake balance, not the added coins that were received from staking. Regardless of whether this interest is compounding during the 6-month period a Prime Controller is held or not, the incredibly high staking rate here is causing the coin’s total supply to inflate at incredible speeds.

When speaking to Josh Garza on Friday, he explained this as being the result of combining multiple Prime Controllers together. In the whitepaper, there is a mention of Prime Controllers having the ability to participate in an “aggregate stake”, and it seems the Prime Controllers that GAW is managing are all tied together to achieve this rate.

On top of that, instead of a truly decentralized, consensus-based voting system, like Bitcoin and other cryptocurrencies have, Paycoin is almost completely controlled by the Prime Controllers. They have the ability to decide what changes to the core code should be made, or not, with no one else having much say in the matter.

On top of that, instead of a truly decentralized, consensus-based voting system, like Bitcoin and other cryptocurrencies have, Paycoin is almost completely controlled by the Prime Controllers. They have the ability to decide what changes to the core code should be made, or not, with no one else having much say in the matter.

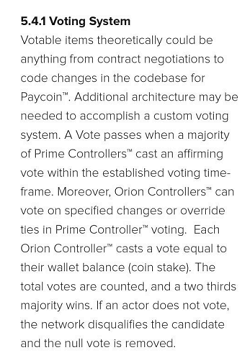

According to the whitepaper, Orion Controllers also have the ability to vote, with their total vote being equal to their wallet balance, but it does not explain what, exactly, an Orion Controller can vote on beyond “specific changes”, or to “override ties in Prime Controller voting”. Votes in general, however, are mentioned to pass “when a majority of Prime Controllers cast an affirming vote within the established voting time-frame.”

To quote my friend, and writer at Coin Brief, Evan Faggart,

Prime Controller eligibility requirements create a barrier to entry for people wanting to become a Prime Controller. This, combined with the majority rule voting system, will likely centralize control over the Paycoin network. Since Prime Controller status is issued to the highest bidders, people who are privileged by the current government-controlled economic system would be the most capable of controlling the Paycoin network.

Paycoin is a Coin for Those Who Already Have Power

If Paycoin were to succeed, and become a major cryptocurrency, it would be very dangerous. Banks are hesitant to adopt Bitcoin, or any other cryptocurrency that currently exists, because it largely replaces them. Of course, there will always be some need for financial companies, or institutions, but that need could be reduced.. The thing that likely scares banks is that in a world that primarily used a decentralized cryptocurrency, they would lose their control on the currency supply, a huge portion of the fees that they charge for payment processing, and it would become much harder to engage in fractional reserve banking.

Paycoin changes all of that. Prime Controllers, and Orion Controllers, will collect all of the transaction, and “advanced blockchain feature”, fees. The inflated interest rate of Prime Controllers returns the ability to manipulate the currency supply to a point, and Paycoin itself will manipulate the currency supply automatically by changing the number of Prime Controllers.

When I asked Josh Garza to explain why Prime Controllers have the ability to reach such high staking rates, the response confirmed that it was, indeed, to incentivize individuals, or groups, with large amounts of capital to bid on multiple controllers.

There is no incentive for a company to bid on more than one Prime Controller if it is a flat 5% per 6 month. So, we have the ability for Prime Controllers to bond together, and get the interest compounded.

He went on to claim that the ~35 Prime Controllers that GAW controls were obtained by pooling their funds together with the funds of customers that purchased Hashstakers, and that the current aim is to create 500,000 XPY per day.

The reason for that amount is that the customers came together. We want 500,000 new coins to be created per day. We pooled our resources together, and the majority of the stake from these Prime Controllers will to customers with Hashstakers. When we said we won’t premine, or mine for our own coins, we meant that none of the initial 12,000,000 coins went to GAW. They went to customers, people or companies who put up resources to get it going, including Paybase, and a nonprofit organization.

A successful Paycoin could very well attract large financial institutions. Then, with the leverage that they already have, it could be pushed into the mainstream by sheer force. With the ability to bond Prime Controllers together, groups of financial institutions, or powerful corporations, could effectively control the rate of currency creation. If they want to slow the creation of coins, they would just keep their Prime Controllers unbonded, or only bond them in small groups. If they want to increase the rate of coin creation, they only need to bond more Prime Controllers together, and compound the staking rate.

Still, I see a few issues with this that could arise over time, and Evan pointed a few out to me as well. However, I would rather not mention these problems, as I do not want to be responsible for making Paycoin even more attractive for financial institutions to seize.

Paycoin’s Origination and GAW’s Investors

The idea for Paycoin seems like it almost certainly is modeled to be attractive to large financial institutions. When speaking to Josh Garza and Dan Kelley, I asked a question that I had asked Josh in the past via email, but had not received a clear response. I basically wanted to know if Paycoin is basically “Bankcoin”, or a coin made so that banks will be willing to jump onboard. The response I receive did not specifically answer this, but it did hint at it’s intentions:

We can confirm that there is an interest from large financial institutions (in cryptocurrency). So we are showing that it is possible, and here is how it is done.

Investment Bankers and GAW Labs

Of course, it is not surprising that Mr. Garza would create a cryptocurrency to appeal to financial institutions. He has been involved with many businesses over the years, and has been involved with one specific investment banker, along with this banker’s son, since 2003.

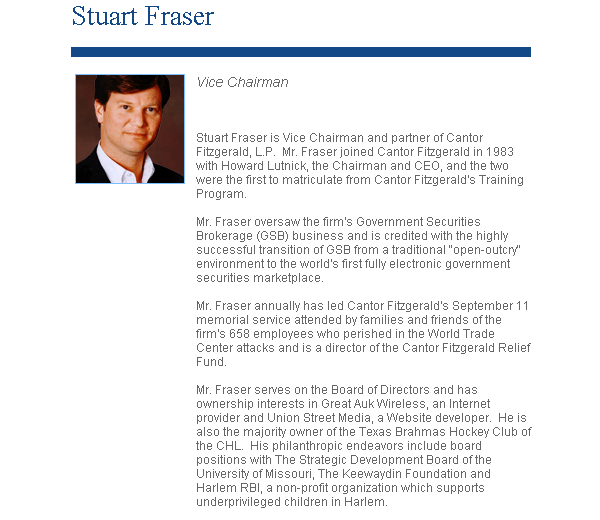

Stuart Fraser is a partner, and Vice Chairman at Cantor Fitzgerald. Stuart is the nephew of Iris Cantor, who also held the title of Vice Chairman at one time, and was the wife of Cantor Fitzgerald’s founder Bernard Cantor. His true level of involvement at GAW is unknown, and some members of the cryptocurrency community have claimed that he is not actually involved with GAW at all. However, from what I have found, that is unlikely to be true. Josh Garza has confirmed that he is a partner at GAW, which will mean very little to many people…but Mr. Fraser’s “about” page on Cantor Fitzgerald’s website mentions his ownership interests in Great Auk Wireless (the first GAW, which was an Internet Service Provider).

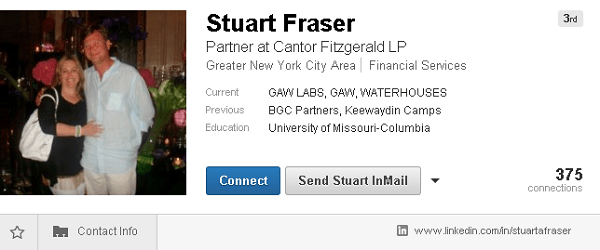

Beyond that, Mr. Cantor’s LinkedIn profile mentions that he is a partner at GAW Labs. Of course, a LinkedIn profile can be faked, but the number of connections the profile has to Cantor employees, as well as the level of depth in the profile, and the lack of another profile for Mr. Cantor, seem to suggest that it is authentic.

When speaking to Mr. Garza recently, I inquired about Mr. Fraser’s involvement, and was told that,”Stuart Fraser is a minority partner, and hasn’t been involved in decision making process, or the launch of Paycoin.” However minor the level of involvement Mr. Fraser has with Paycoin, it is largely irrelevant. It was made clear to me that Josh Garza is quite close to Stuart Fraser, that the two of them have been involved in multiple business ventures together, and that Stuart is not your typical investment banker. Josh described him as,”thinking outside the box” and mentioned that he enjoys trying to start new businesses. This close relationship, if it exists as Josh Garza claims, would certainly have an influence on Mr. Garza.

Whether Mr. Fraser is a “traditional investment banker” or not, I am sure that Josh has learned quite a bit about how banking functions, as well as what would interest banks. Not only that, being the Vice Chairman of Cantor Fitzgerald, one of the “22 primary dealers authorized to trade U.S. government securities with The Federal Reserve Bank of New York”, along with being a member of the Cantor family, means that Mr. Fraser is in a very powerful position, and likely has connections to high ranking individuals in companies throughout the financial sector.

To add to this, Stuart Fraser’s son, Thomas Fraser, seems to be the founder of Zenminer, the company that GAW “acquired” when preparing their cloud mining service. I was unable to determine if, or how, he is involved with GAW today. However, Zenminer was the key to launching the cloud mining services that GAW sold as “hashlets”, as well as the core of the mining software that was included with their physical scrypt ASICs beforehand.

At this point, I am not sure what else I can say about the danger of Paycoin itself. I highly suggest that anyone that is currency involved with it, or supports the currency, reads through the white paper very carefully, and considers the scenario I have outlined above. As it stands, cryptocurrency as a whole is mostly decentralized. Bitcoin, and the majority of other major cryptocurrencies are not easily corruptible or controllable. However, while Mr. Garza seems to believe that the number of Paycoins, and their total value, will make gaining control of the currency too expensive for a malicious actor to manipulate the system, I believe that is underestimating some of the most powerful organizations on the planet.

Continuing on, I will go over some of the recent criticism of GAW, along with both evidence and data presented by individuals, as well as explanations from GAW. In these cases, I am going to present the information I have without making a judgement for or against GAW, as it would not be appropriate for me to do so. However, I will give my final thoughts on GAW and Paycoin…

2 Comments

2 Comments

Perhaps crypto enthusiasts may initially dislike paycoin because of what it may become (as the article suggests) — but on the other hand, perhaps they should actually love paycoin precisely because it has the potential to become mainstream as it will naturally evolve to become an enabler for the masses to transition to more ideological cryptos such as Bitcoin.

I agree, but #paycoin is symptom/response to collective failure of community in running a decentralized system. #Selfish #profit