Will Bitcoin go higher? Read on to find out in 99Bitcoin’s latest Bitcoin price analysis and discover what’s in stock for BTC in the month ahead.

Bitcoin and crypto prices are cyclical, which means sharp price expansions are inevitably followed by dumps.

We saw this in the first crypto euphoria of 2017 when Bitcoin soared to over $20,000 before dumping in 2018. The same cycle was repeated in 2021 before the crash of 2022.

Though market experts say Bitcoin is trending higher, it remains to be seen whether it will clear $74,000 and extend gains from the second half of last year.

(BTCUSDT)

The price charts show that Bitcoin is cooling off, retracing about 10% from market peaks.

Is Bitcoin Price Preparing To Rip Higher?

Though cracks are emerging, one analyst thinks the Bitcoin uptrend remains, and the recent dump is just a temporary setback.

In his post on X, he believed bulls are preparing to push prices higher, and this preview is purely based on price action.

Presently, the chartist said there is an “inverse head and shoulders” formation on the daily chart.

(X)

If bulls push on, the analyst said prices will rip higher, breaking above the psychological $70,000 level.

Whether this will print out depends on time and the existing sentiment.

Historically, the inverse head and shoulders pattern is bullish and often prints out cycle bottoms.

Therefore, if there is a close above the neckline, in this case, $70,000, and ideally $72,000, BTC could fly.

There are several market factors that could accelerate the leg up.

DISCOVER: How to Buy Bitcoin Anonymously Without an ID – No KYC – June 2024 Guide

United States Federal Reserve Liquidity Rising

One analyst said the United States Federal Reserve liquidity is rapidly increasing. There is a solid historical correlation between rising liquidity and price expansions.

(X)

When the former increases, the economy is lush with cash. Some of it flows to BTC, lifting prices higher.

Even so, the open interest (OI)–a gauge for measuring trading interest among leveraged traders– across various Bitcoin futures platforms like OKX and Binance is falling.

While a falling OI can indicate a weakening market, it’s important to note that Bitcoin’s OI remains significantly higher than at the beginning of the year. This suggests that despite the recent dip, overall market interest in Bitcoin remains strong.

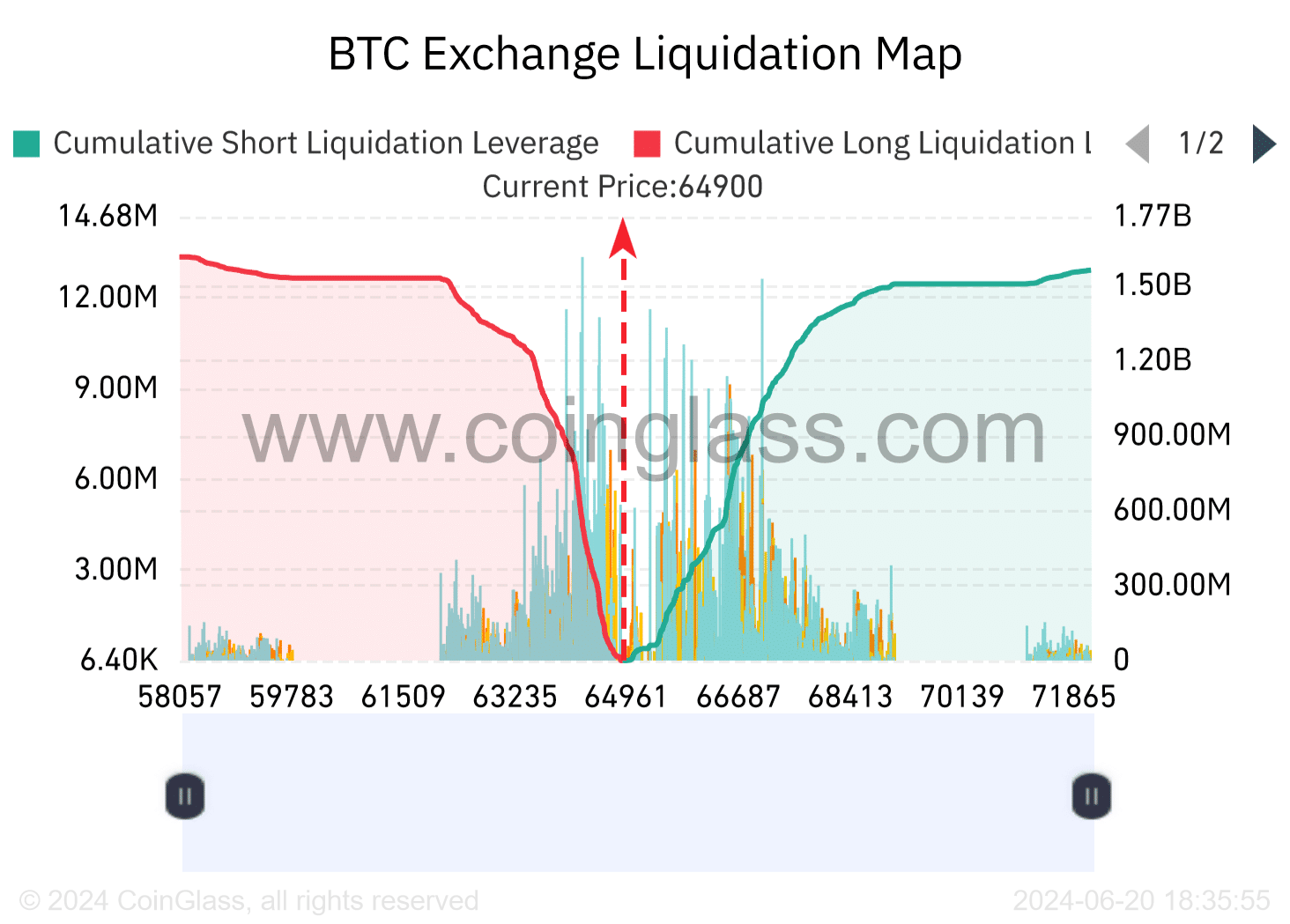

At the same time, analysts note that if BTC climbs above $70,000, it could trigger a big short squeeze.

In that event, short sellers will be forced to buy back BTC at a higher price to cover their short positions–further driving prices higher.

Coinglass data shows that a staggering $1.5 billion worth of short positions could be liquidated if buyers have the upper hand.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.