Rapidly developing Saudi China CBDC will send shockwaves through the USD. In this article, find out what is MBridge. And discover the world’s first Multi CBDC.

Last week, the Bank for International Settlements blindsided everyone: MBridge, China’s multi-CBDC project, has smashed into its minimum viable product phase.

After the announcement, Saudi Arabia joined the project, signaling that the U.S. dollar’s grip on oil markets is in serious danger.

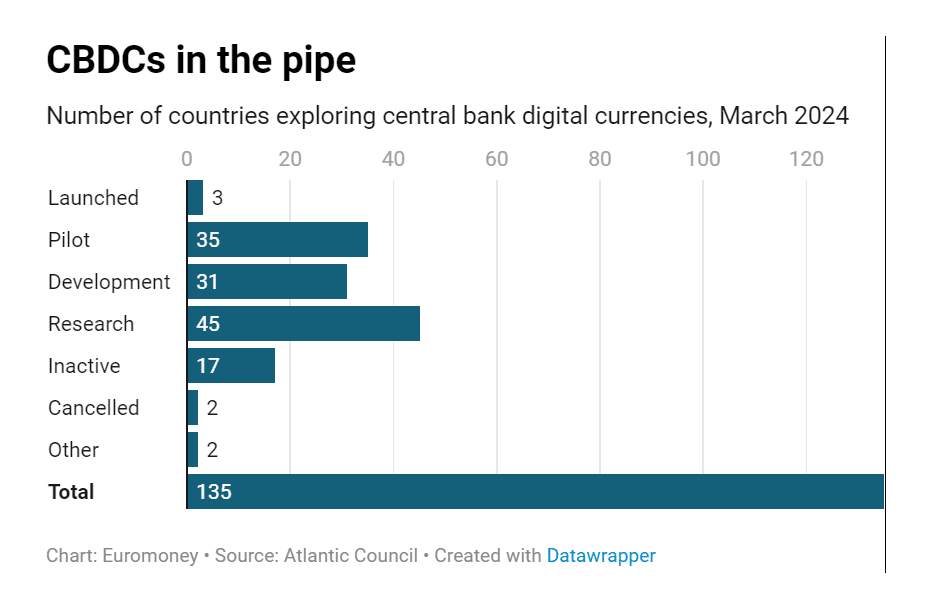

“Since Russia’s invasion of Ukraine and the resulting financial sanctions, we have seen cross-border wholesale CBDCs, such as Project mBridge, multiply and evolve,” the Atlantic Council noted.

Despite its increased popularity, China’s CBDC, the e-CNY, only makes up 0.16% of the country’s cash flow. WeChat Pay and Alipay control 95% of the market, dwarfing the e-CNY.

But even that is expected to change.

With US sanctions tightening their grip, China’s CBDC is emerging as the preferred underground route for global money transfers.

Saudi Arabia’s Crown Prince Mohammed Bin Salman told associates last year that “[we] are no longer interested in pleasing the United States.”

MBridge: A Game-Changer for Cross-Border Transactions

Dominating the CBDC space since launching e-CNY in 2019, China saw massive gains with 950 million transactions of $1.8 trillion renminbi ($253 billion; China’s other currency besides the Yuan) by mid-2023 following its app rollout in 2022.

The rapid development of MBridge can be attributed to geopolitical tensions, such as those stemming from Russia’s actions in Ukraine.

China’s strategy now boosts the renminbi’s role in trade invoicing and cross-border transactions rather than chasing reserve currency status. The People’s Bank of China reported a 24.2% yearly boost in yuan cross-border transactions, reaching Rmb52.3 trillion in 2023.

It also might be the reason China has been defiant in adopting Bitcoin. They have this, their CBDC.

Yuan settlements in China’s cross-border trade rose from 18% in 2022 to 25% in 2023, nearing 30% by early 2024. International trade using yuan hit a peak of 4.7% in March 2024, up from 1.91% in January 2023, Swift reports.

DISCOVER: How to Buy Bitcoin Anonymously With No KYC / No ID – June 2024 Guide

The Bottom Line: De-Dollarization and the Future of Global Finance

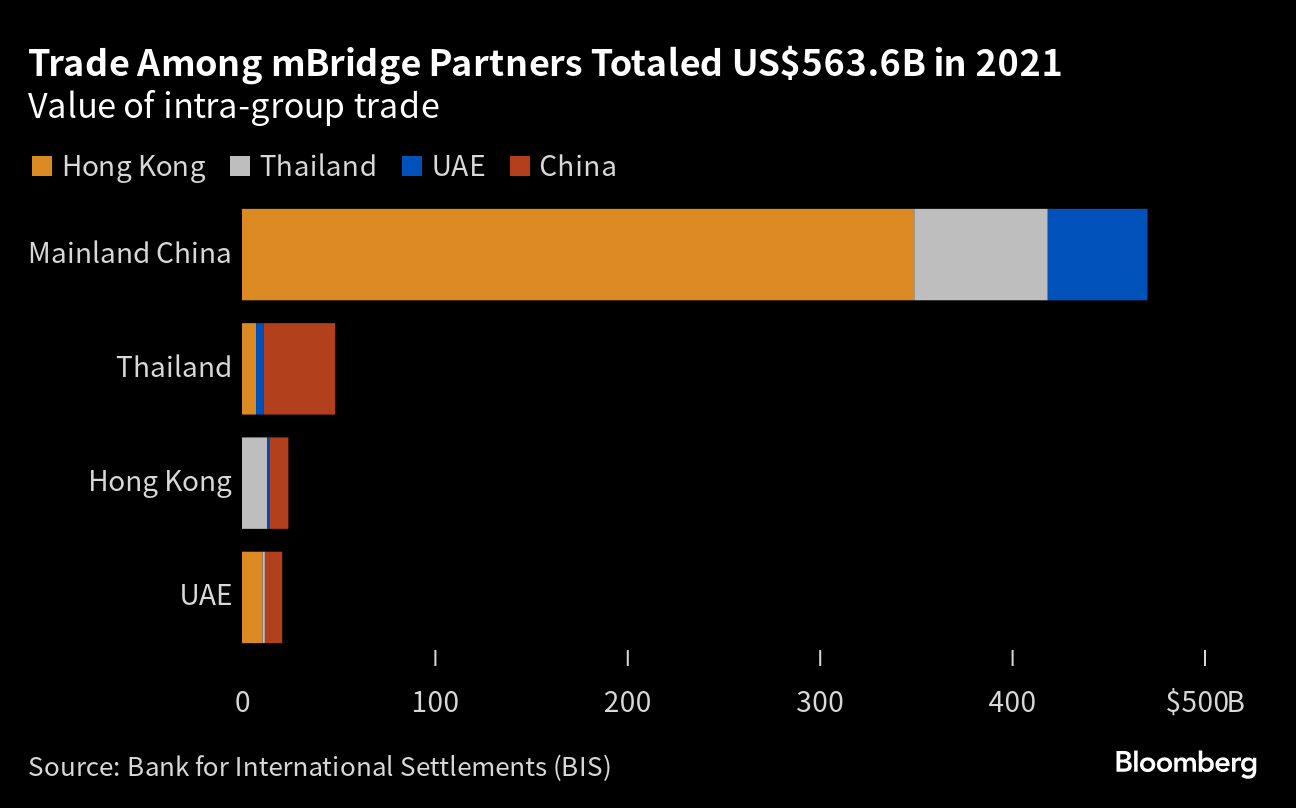

So far, twenty banks have processed over Rmb150 million through 164 cross-border transactions, with digital yuan making up 46.6%. Big names like HSBC and Standard Chartered are in, and the list is expected to grow.

By cutting out intermediary banks and the dollar, MBridge speeds up de-dollarization.

As more central banks adopt CBDCs, the renminbi might just topple the dollar’s supremacy, pushing for a balanced global monetary system and challenging the old guard.

RELATED: 99BTC Presale Launches – Here’s Why Big Money Investors Are All In On This Learn-To-Earn Token

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.