Hedera Hashgraph exploded last night after fake Blackrock RWA deal ripped through chart – as price crashes find out what’s next for Hedera in HBAR price analysis.

HBAR, the native token of the Hedera blockchain, soared yesterday after social media users wrongly thought BlackRock, one of the world’s largest asset managers, had tokenized its ICS U.S. Treasury Money Market Fund (MMF) on Hedera.

Archax Tokenizes BlackRock Money Market Fund on Hedera

In a tweet, Hedera clarified that Archax, a digital asset trading platform in the U.K., partnered with Ownera–an institutional-grade blockchain for digital assets– to tokenize BlackRock‘s MMF shares.

By tokenizing them, MMF shares can be traded faster and more securely on the Archax platform and connected networks.

With this confirmation, it is clear that Archax, not BlackRock, had chosen to tokenize on Hedera.

Graham Rodford also said they chose to tokenize these shares on Hedera, given their registration by the U.K. FCA.

Even so, it would have been a massive boost if BlackRock had made this decision, it would have suggested that the asset manager found value in Hedera after first launching BUIDL on Ethereum in Q1 2024.

There could be several reasons why Archax decided to choose Hedera over Ethereum. Though Ethereum is popular, Hedera offers better settlement speeds and is more cost-efficient. It is also secure since there are validators from all over the globe.

Nonetheless, BlackRock shares are not the only offerings on HBAR.

Last year, Archax helped abrdn plc, a wealth manager, tokenize its Aberdeen Standard Liquidity Fund (Lux) – Sterling Fund MMF on Hedera.

HBAR Price Analysis: BlackRock News Fuels Surge and Correction

Following this announcement, HBAR prices soared by over +80% on Tuesday before extending gains in the early Asia session on Wednesday, registering new 2024 highs of $0.18.

(HBARUSDT)

However, at press time, the token has since corrected, sinking to $0.12 for a -30% retracement.

Despite the dip, HBAR is still up by over +90% from April lows – highlighting market appetite for the Hedera Hashgraph token.

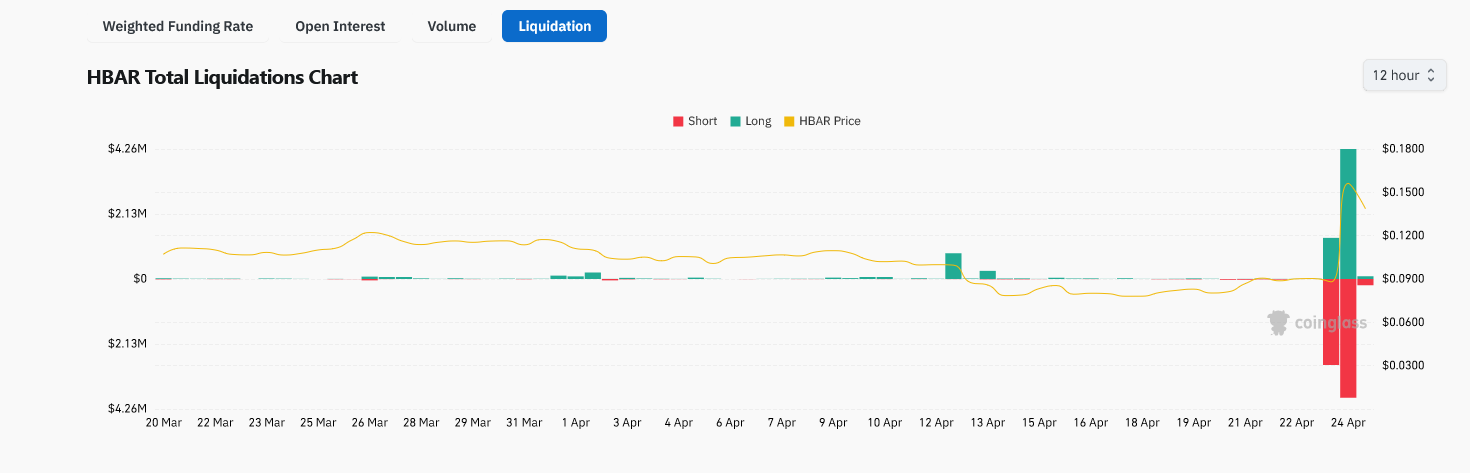

With HBAR prices volatile, CoinGlass data showed that over $3.8 million shorts have been liquidated, and over $4.2 million leveraged longs have been forcefully closed in the last 12 hours.

Explore: Stacks (STX) Unveils Roll-Out of Nakamoto Layer 2 Upgrade

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

1 Comment

1 Comment

FUD. Stop spreading disinformation!