Fiat Defectors

People Who All of a Sudden Think Bitcoin is Cool

Submit a new Fiat Defector!

Donald Trump – Former US President

Before: “Bitcoin, it just seems like a scam…” (June 2021, source)

Before: “Bitcoin, it just seems like a scam…” (June 2021, source)

After: Launches NFT collection with images of himself (December 2022, source) AND Holds $2.8 million in ETH in a cryptocurrency wallet (August 2023, source)

Bill Gates – Co-founder of Microsoft

Before: “I agree I would short it if there was an easy way to do it” (May 2018, source)

Before: “I agree I would short it if there was an easy way to do it” (May 2018, source)

After: “I’m not short Bitcoin…I’ve taken a neutral view” (February 2021, source)

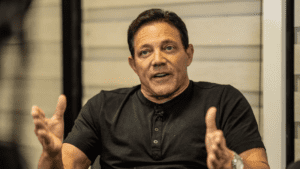

Jordan Belfort – The Wolf of Wall Street

Before: On Bitcoin: “Get out if you don’t want to lose all of your money…” (July 2018, source)

Before: On Bitcoin: “Get out if you don’t want to lose all of your money…” (July 2018, source)

After: Becomes a self-proclaimed crypto-guru (April 2022, source)

Kevin O’Leary – Shark Tank star and investor

Before: Calls Bitcoin ‘garbage’ and ‘useless’ (May 2019, source)

Before: Calls Bitcoin ‘garbage’ and ‘useless’ (May 2019, source)

After: Becomes brand ambassador and spokesperson for FTX crypto exchange (August 2021, source)

Janet Yellen – US Secretary of the Treasury

Before: Warns about the uses and implications of Bitcoin (February 2021, source)

Before: Warns about the uses and implications of Bitcoin (February 2021, source)

After: “…a CBDC (Central Bank Digital Currency) could become a form of trusted money comparable to physical cash but potentially offering some of the projected benefits of digital assets. (April 2022, source)

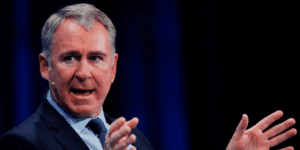

Ken Griffin – Billionaire CEO of Citadel hedge fund

Before: Calls cryptocurrencies “a jihadist call” against the dollar (October 2021, source)

After: Later admits: “…I haven’t been right on this call.” (March 2022, source)

Larry Fink – CEO of BlackRock

Before: Calls Bitcoin an “index of money laundering” (October 2017, source)

After: “We do believe that if we can create more tokenization of assets and securities – and that’s what Bitcoin is – it can revolutionize, again, finance.” AND: “I do believe the role of crypto is digitizing gold, in many ways.” (July 2023, source)

Jamie Dimon (CEO) and JPMorgan Chase

Inconsistent words and actions

Before: Dimon says Bitcoin “is a fraud.” (September 2017, source)

Then: JPMorgan launches JPM Coin. (February 2019, source) and then launches Onyx, a bank-led blockchain platform. (October 2020, source)

Then: Onyx partners with Avalanche (AVAX) for tokenized funds (November 2023, source)

Now: “I’ve always been deeply opposed to crypto, bitcoin, etc.” AND: “If I was the government, I’d close it down.” (December 2023, source)

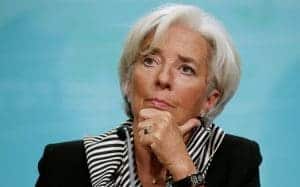

Christine Lagarde – Former Managing Director of the IMF

Before: “I think the banking industry has quite a few good days ahead of it” (November 2015, source)

After: “I think that we are about to see massive disruptions” (October 2017, source)

Bruno Le Maire – French Minister of the Economy and Finance

Before: “We want a stable economy: we reject the risks of speculation and the possible financial diversions linked to bitcoin…” (January 2018, source)

After: “This landmark regulation will put an end to the crypto wild west and confirms the EU’s role as a standard-setter for digital topics.” (June 2022, source)

George Soros – Billionaire hedge fund manager

Before: “Cryptocurrency is a misnomer and is a typical bubble, which is always based on some kind of misunderstanding…” (January 2018, source)

After: Soros Fund Management purchases convertible debentures for cryptocurrency miner Marathon Digital Holdings (MARA) (February 2023, source)

Mark Cuban – Billionaire entrepreneur and Shark Tank star

Before: On Bitcoin: “I think it’s got no shot as a long-term digital currency.” (September 2014, source)

After: “I want Bitcoin to go down a lot further so I can buy some more.” (January 2023, source)

Thomas Peterffy – Interactive Brokers chairman

Before: On Bitcoin: “It has no rhyme or reason for having the price that it has.” (December 2017, source)

After: “…I think that there’s a small chance that this will be a dominant currency, so you have to play the odds.” July 2021, source)

Bryan Durkin – Former CME President

Before: “I really don’t see us going forward with a futures contract in the very near future.” (September 2017, source)

After: CME plans to launch Bitcoin futures by the end of 2017 (October 2017, source)

Peter Schiff – CEO at Euro Pacific Capital

Before: “Here’s the problem: people are advocating the use of Bitcoins as if it’s a form of money, but it can’t be. Because bitcoins do not represent a store of value. You don’t know what bitcoins are going to be worth next week, next year, in five years….” (May 2014, source)

After: “We don’t have to ignore blockchain technology, we can use it to improve the divisibility and the portability of gold and make it an even better monetary instrument, than it was in the past…” (June 2023, source)

Jay Clayton – Former SEC Chairman

Before: Issues a warning to cryptocurrency investors (December 2017, source)

After: “I am a huge believer in this technology…The efficiency benefits in the financial system and otherwise from tokenization are immense. (December 2021, source)

Joe Weisenthal – Former executive editor of Business Insider

Before: “But make no mistake, Bitcoin is not the currency of the future. It has no intrinsic value.” (November 2013, source)

After: “…there is no denying the power of blockchain technology to lower costs, improve transparency and inclusion while unlocking new business models.” (December 2023, source)

Agustín Carstens – GM of Bank for International Settlements (BIS)

Before: Sees ‘no value’ in issuing digital currency (March 2019, source)

After: “It might be that it is sooner than we think that there is a market, and we need to be able to provide central bank digital currencies.” (June 2019, source)

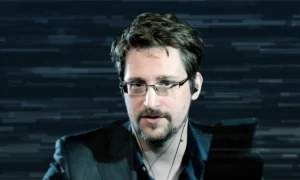

Edward Snowden – Former NSA security consultant, whistle-blower

Before: “…One day, capital-B Bitcoin will be gone, but as long as there are people out there who want to be able to move money without banks, cryptocurrencies are likely to be valued.” (November 2018, source)

After: “I use bitcoin to use it. In 2013, bitcoin is what I used to pay for the servers pseudonymously…” (June 2022, source)

Tyler Cowen – Bloomberg Opinion columnist, economist, and professor

Before: “Imagine you hold a currency which, over the next period, will either double or halve in value. […] What a good deal that is!” (April 2013, source)

After: “Crypto has become underrated by most intelligent, honest observers…” (January 2023, source)

Ray Blanco – Editor, Agora Financial

Before: “Bitcoin itself, it’s doomed. The end is near. As soon as Congress has a reason, they figure out how to shut it down. You mark my words. Too many banks have too much to lose. And if we know one thing, it’s that big banks and Congress are part of the same beast” (May 2017, source)

After: “Blockchain and cryptocurrency tech is here to stay. The changes we’ve seen so far are just the start. My position’s evolved. Yours should too if it hasn’t already.” (October 2017, source)

Mark T. Williams – Finance professor at Boston University

Before: “I predict that Bitcoin will trade for under $10 a share by the first half of 2014, single digit pricing reflecting its option value as a pure commodity play. Miners/speculators will be best served to acknowledge the meltdown has begun…” (December 2013, source)

After: “I’m really interested in how blockchain could replace financial institutions in a trustless environment.” (October 2022, source)

Timothy Sykes – Penny stock trader and entrepreneur

Before: “Bitcoin is nothing more than a virtual casino and perhaps the market dynamics of this fast-growing casino are saying that you should buy and hold Bitcoin, as the chart and price action suggests, but it is also the single most volatile and dangerous casino you’ll ever visit as any day the entire thing could collapse under regulations or hackers.” (November 2013, source)

After: Writes a post in which he promotes a guide on how to trade in Bitcoin. (May 2016, source)

Did we forget anyone? Submit a new defector here: