In a post on GitHub, Vitalik Buterin proposed a new Ethereum Improvement Protocol (EIP), EIP-7706, and a new gas fees model for Ether call data.

Just when analysts have been picking a slow but steady decline in Ethereum, which has seen ETH price going to the incinerator, Vitalik Buterin, the co-founder of Ethereum, is coming up with a new gas model proposal.

Pretty much everything around Ethereum and all public ledgers revolves around the cost of securing the platform. The gas fee incentivizes validators, who are motivated to tie up even more coins, making it nearly impossible for third parties to take control.

Without fees, there is no security; thus, Ethereum would cease to exist.

(Source)

Vitalik Buterin Introduces EIP-7706: A New Gas Fee Model For Call Data

In a post on GitHub, Buterin proposed a new Ethereum Improvement Protocol (EIP), EIP-7706.

The proposal seeks to implement a more “refined” gas model and a separate (third) structure for transaction call data.

To better understand how Ethereum works, one must know how to pay for services rendered.

Two gas fee types will be incurred if you want to transact or deploy a smart contract.

First, you must cover the computational power needed to execute your transaction, known as the “execution fee.”

Second, there is a storage fee, which you must pay to store data associated with your transaction in “blobs.”

The co-founder is now introducing a third fee type associated with the transaction call data.

But what exactly is the call data in Ethereum?

You can describe call data as that bit of your transaction that carries important details.

Since all transactions are executed on-chain, critical details are needed, including the function that instructs the smart contract on what to do.

There are also numbers (data) involved for this function to operate flawlessly.

What’s In For Users? Impact on Ethereum Ultrasound Money Narrative

Implementing the proposals of EIP-7706 and the network charging for call data separately might lead to reduced costs for data-heavy transactions.

This is because this proposal will sieve out and reduce costs when processing transactions that require large amounts of data but with low computational demands.

At the same time, the network will automatically set call data costs separately from the other two fees, resulting in more targeted pricing.

Under this model, Buterin is convinced that separating call data fees could significantly reduce the theoretical maximum call data size within a block.

Moreover, using this fee model, call data will become considerably cheaper than it currently is.

DISCOVER: How to Buy Ethereum in May 2024

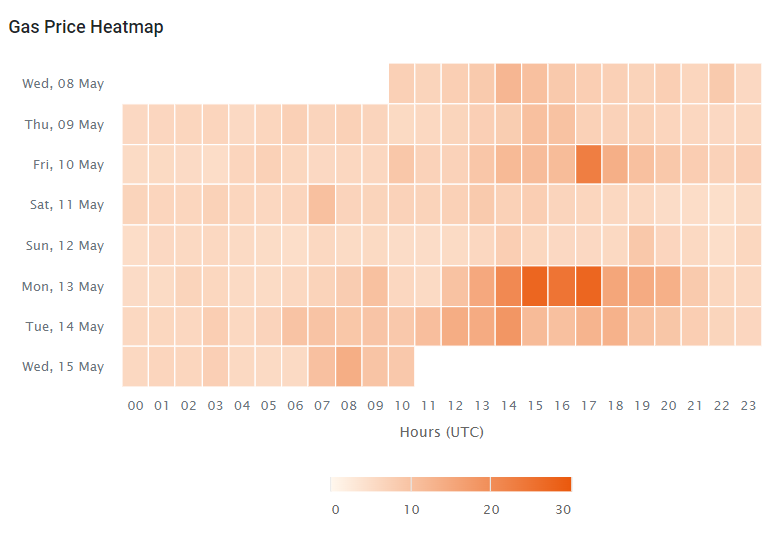

Whether Ethereum will eventually address the relatively high gas fees remains to be seen. The high fee is why users have been deploying on alternative networks like Solana and Avalanche.

The rise and adoption of layer-2s have helped, but gas on the mainnet remains high due to the absence of on-chain scaling. Sharding might help, but the exact implementation could be years from now.

It also looks like the success of Dencun on layer-2 platforms influences Buterin and EIP-7706.

The proposal, like the “blobs” fee marked integrated in Dencun, will introduce a separate call data fee market, complete with its own base fee and gas limit.

In this way, Ethereum will remain efficient and secure since the maximum call data size will be limited.

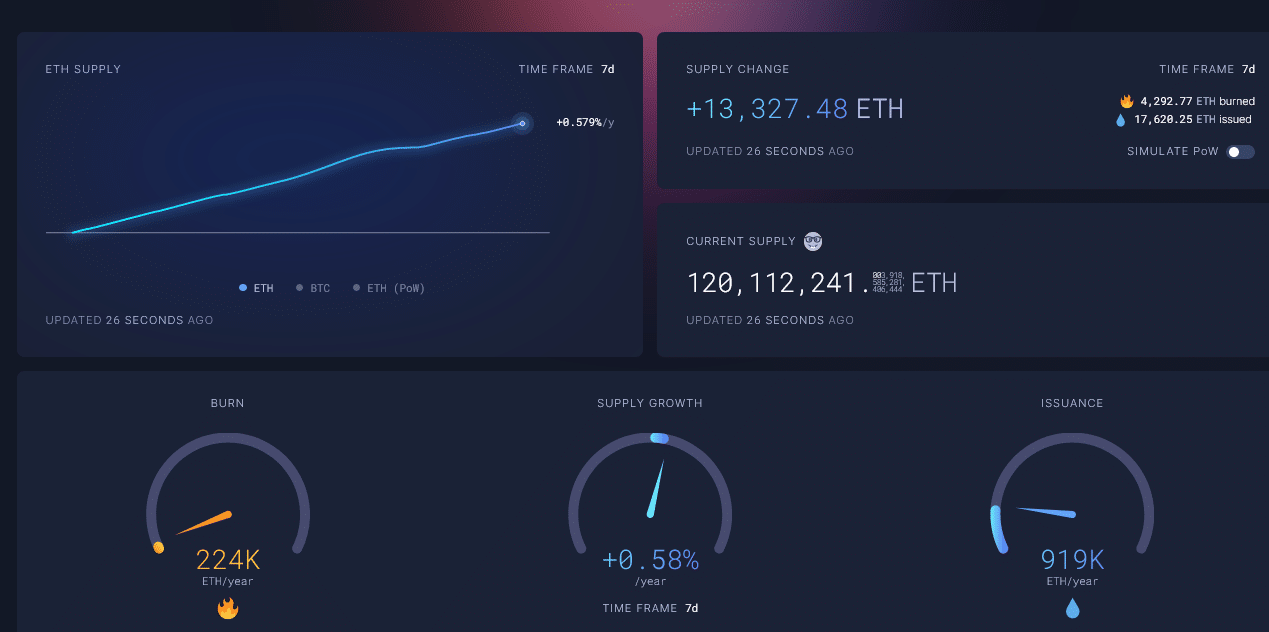

The question remains: If this EIP be implemented, will ETH become more inflationary?

Following the success of ETH Dencun and the drop of layer-2 fees by over 10X, fewer coins are being burned, destroying the “ultrasound money” narrative.

EXPLORE: Bounce Bit Price Analysis – Can This New BTC DeFi Token 10x After a 90% Skyrocket?

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital