In the latest CVX price analysis, learn about the rapid price surge of Convex Finance’s CVX token driven by Curve – and find out if CVX is set for a moonshot in 2024.

Convex Finance’s CVX token just went ballistic with a +90.85% surge in 24 hours. Starting at $2.14 on June 16, it hit $4.50 the next day before cooling off to $3.80.

"Bear market? DeFi winter?

You must have hit your head anon…$CVX is up another 96% today…

Its time to scour Tetranode and DegenSpartan's tweets for alfa and then tend to your yield farms…" pic.twitter.com/FmCHHiaXDu

— rektdiomedes (@rektdiomedes) June 17, 2024

All around, the crypto scene is electrified for this coin. The question is there a 10x moonshot left for CVX in 2024? Here’s what we think.

Key Catalysts Behind the Surge for CVX Price

Founded by an anonymous team in April 2021, Convex helps users maximize their yield while maintaining liquidity.

CVX originally optimized yield for Curve (CRV), but Convex Finance has since expanded to other protocols.

Moreover, regarding this recent pump, Curve is driving CVX’s price surge. Curve’s founder, Michael Egorov, faced a $27 million liquidation crisis last week, sending CRV plummeting to $0.21 and pivoting investor interest to CVX.

Can anyone name a Solana meme/celebcoin that has distributed $141m in hard cash to its holders directly sourced from fees? 🦖🤦♂️🙃

Anybody who🔒 $CRV in past years has made a significant chunk of their investment back off fees + veCRV bribes, not to mention airdrops like $CVX https://t.co/RNgP63YW05 pic.twitter.com/NaFB2MjFyF

— DefiMoon 🦇🔊 (@DefiMoon) June 16, 2024

Despite the hit, Egorov cleared $10 million of his debt. This move left a pile of CRV collateral and paved the way for CVX’s impressive surge.

“Convex has captured Curve, Frax, f(x)n, Prisma, and others will come. They get a big piece of all their fees and established significant incentive markets for them,” explained analyst Jason Hitchcock.

“Stablecoins and pegged assets have found a home on Curve, and those markets are taking off as expected.”

CVX Price Analysis: Unprecedented Trading Volume For CVX

The recent rally wasn’t just about price—it came with a massive spike in trading volume. Santiment reports a staggering +2,677% increase in the last 24 hours, pushing the total to $161.61 million.

Binance saw spot volume for the token nearly touch $32 million, a new record for Convex.

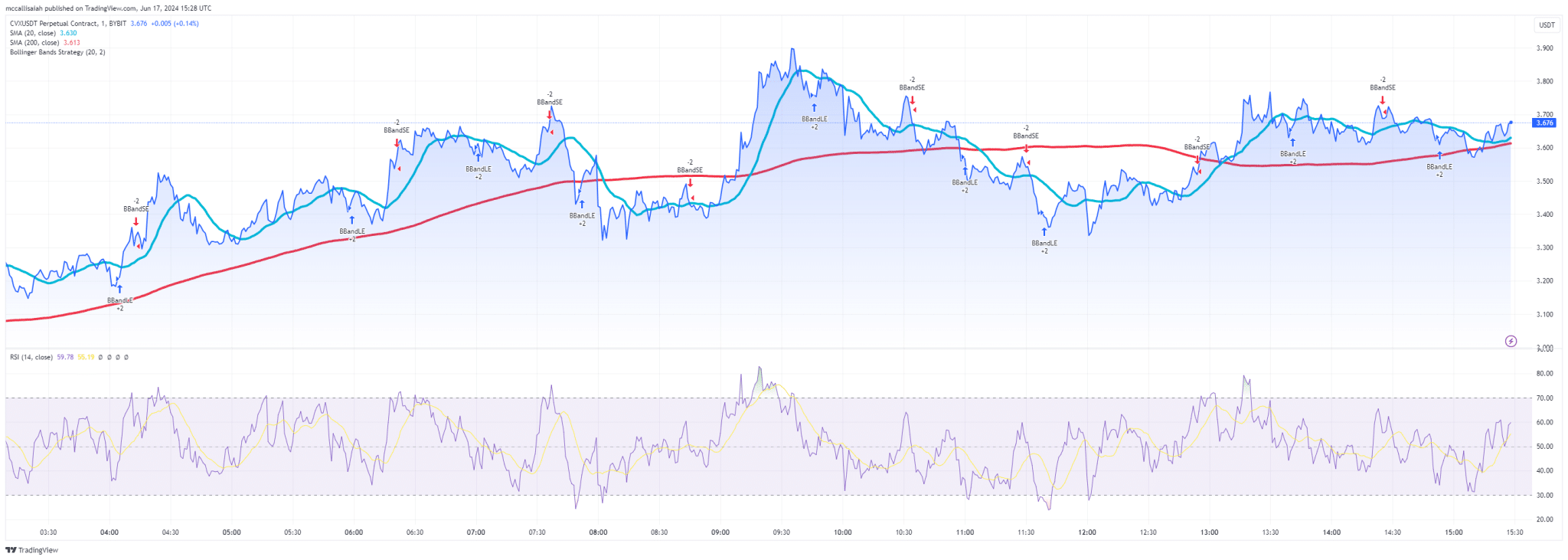

Despite this surge, predicting CVX’s future means looking at market sentiment and key metrics. 99Bitcoins analyzed the moving averages and RSI to provide some insights.

(CVXUSDT)

CVX’s RSI dropped to 59.78 post-selloff, signaling the potential for another bull phase.

The token’s price above the 20-day and 200-day SMAs points to a positive trend.

If buying pressure persists, Convex could target $5 soon. Investors are glued to Convex Finance’s moves, watching key indicators to navigate the market’s volatility.

DISCOVER: 18 New Upcoming Cryptocurrency Launches in Summer 2024

A Final Thought: $5 First or Under $3?

CVX is on a mission to dominate Curve Finance, and this surge is another leap forward.

With boosted rewards for liquidity providers and governance by a decentralized community of holders, it’s more enticing than other DeFi protocols.

Think of it as the Polygon of Curve. Expect it to break $5 before it dips under $3.

EXPLORE: The Best Altcoins To Buy For Huge Growth Potential in Q2 2024

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.