At the intersection of old money and digital gold, the world’s leading derivatives marketplace, the Chicago Mercantile Exchange Group (CME), is moving to integrate Bitcoin trading.

The buzz among traders is palpable. They envision a space where regulated finance meets the wild west of crypto.

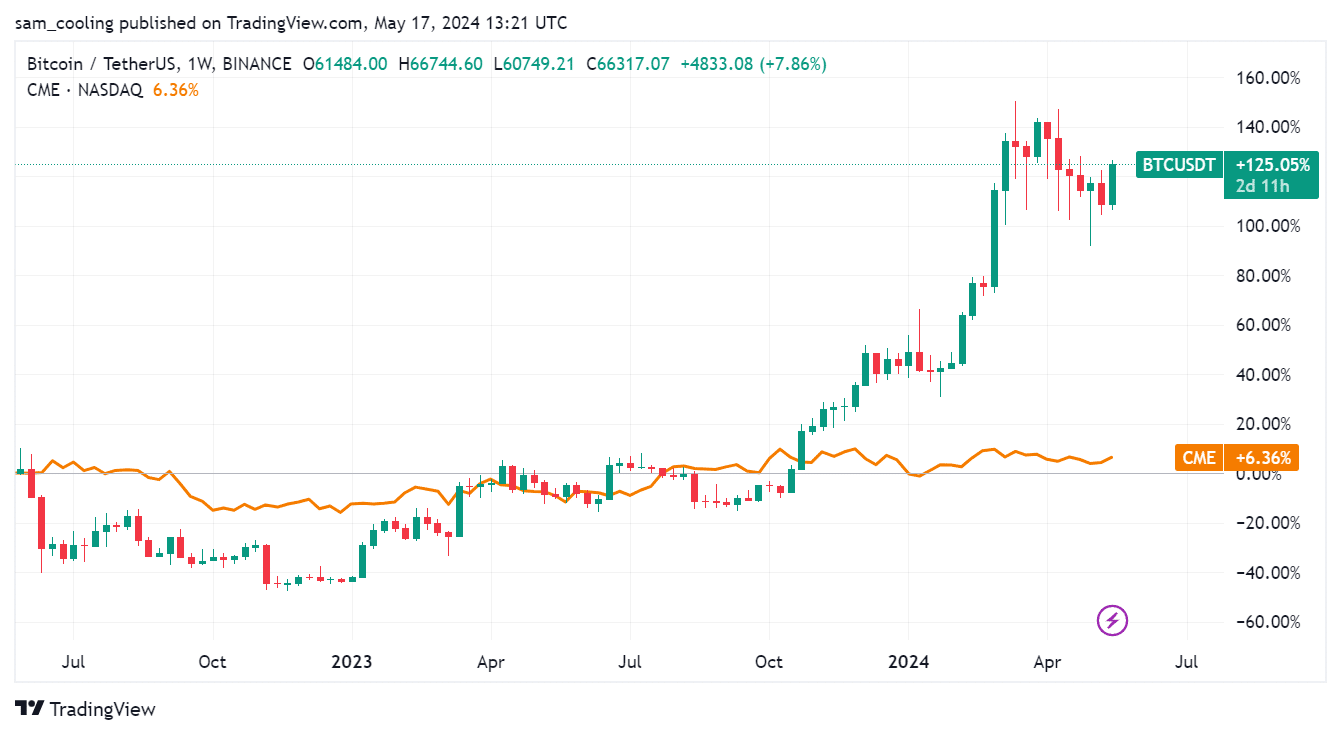

Bitcoin is up +4.9% on the week off of a bullish CPI report and a new crypto senate bill to ease regulations. While a strategy for the Switzerland-based CME is under wraps, the message is clear: they intend to make a mark and butt out crypto exchanges.

“Crypto exchanges might lose some business with the potential debut of a bitcoin spot market on the CME as the present bull run is particularly driven by institutions, who prefer to trade on regulated avenues,” Markus Thielen, founder of 10x Research, said.

DISCOVER: How to Buy Bitcoin ETF in May 2024

CME Group: Bridging Traditional and Digital Finance

Once the black sheep, Bitcoin’s story has flipped on its head.

“Some of the world’s largest financial institutions have turned from bitcoin skeptics into advocates,” reported the Financial Times

Even with its value taking hits, Bitcoin mania, especially via ETFs, is hitting fever pitches, ushering in an era where it’s a bona fide asset class.

CME’s strategic pivot comes when institutional interest in Bitcoin is surging.

Investments from hedge and pension funds in crypto-focused funds managed by BlackRock, Fidelity, and Ark have surpassed $10 billion. Larry Fink’s positive stance on Bitcoin and RWAs further validates its role in mainstream portfolios.

UNCOVER: What’s The Best Crypto Casino For Supercharged Gains in Q2 2024?

Moreover, the potential for a new spot Bitcoin trading ETF at CME, possibly through the EBS currency trading venue in Switzerland, introduces yet another avenue for TradFi to adopt digital assets.

The Bottom Line: What’s Next for Bitcoin and CME Group?

(BTCCME)

The Chicago Mercantile Exchange Group’s leap into Bitcoin trading isn’t just a power play—it’s a signal flare for TradFi’s emergence in crypto.

With big finance cozying up with digital assets, CME could be one of the big players leading a financial revolution.

EXPLORE: Is BTC Set for a Quiet Spring After Bitcoin Halving Event? Here’s Why Traders Eye Altcoins in Q2

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital