Spot Bitcoin ETFs continue to gain traction, and now, BlackRock IBIT is the largest such product after surpassing Grayscale’s GBTC.

Launching spot Bitcoin ETFs in the United States was a landmark milestone for crypto.

Finally, regulators legitimized the emerging asset class for the first time in roughly 15 years, endorsing BTC as a commodity.

But it wasn’t always smooth sailing. The United States SEC rejected the product for over ten years. Among the multiple concerns they had with this product was the risk of manipulation.

These concerns were addressed, but only when Grayscale sued the agency (successfully) after their request to fold their Bitcoin Trust (GBTC) and convert it to an ETF was rejected.

A court directive forced the United States SEC to approve this request, allowing all nine spot Bitcoin ETFs to be launched in January.

While the excitement was high, Bitcoin prices crashed days after the product went live primarily because GBTC began unloading thousands of coins.

BlackRock IBIT Flips GBTC To Become The Largest Spot Bitcoin ETF In The World

Though there have been inflows, especially in April and May, GBTC has been bleeding.

The latest on-chain metrics show that BlackRock’s IBIT is now the world’s largest spot Bitcoin ETF, overtaking GBTC.

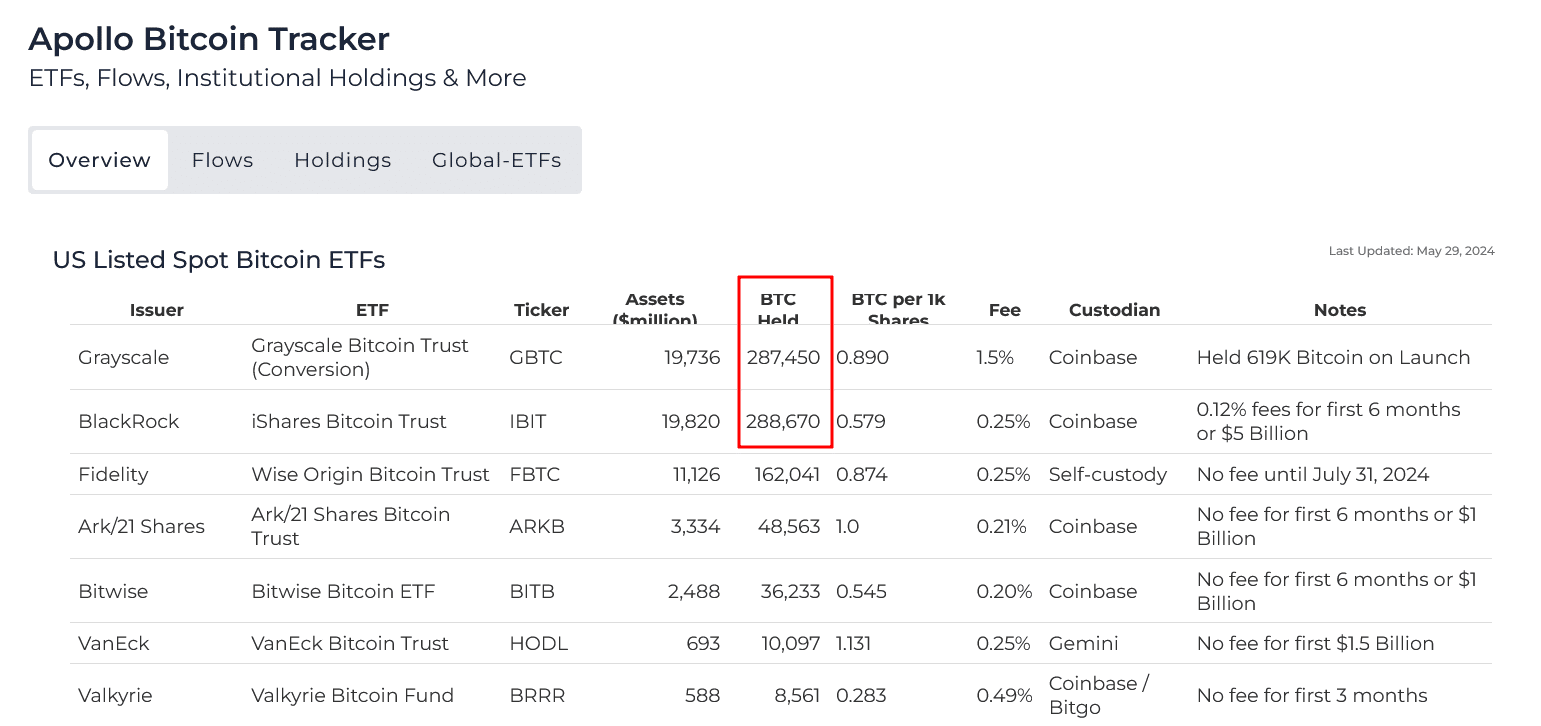

According to trackers, IBIT now holds 288,670 BTC versus GBTC’s 287,450 BTC, making it the world’s largest spot Bitcoin ETF.

Soaring interest in IBIT could be because of its relatively low fee of just 0.25%.

GBTC charges a 1.5% fee, the highest among all spot Bitcoin ETF issuers in the United States.

With BlackRock IBIT now the largest, observers think BTC will find support, considering outflows from GBTC will be neutralized by the rising inflows to IBIT and others, including Fidelity and 21Shares.

Whenever inflow exceeds outflow, BTC prices tend to soar, like in the last bull run, which saw the coin print new all-time highs. The same was observed when prices strongly broke above $66,000 on May 20.

DISCOVER: How to Buy Spot Bitcoin ETF in June 2024

Bulls Optimistic But BTC Price Still Capped Below $70,000 Resistance

Even with BlackRock IBIT surpassing GBTC, there have been no sharp changes in Bitcoin prices. If anything, the coin is under pressure, retracing further from the psychological $70,000 line.

Though the uptrend remains, how prices react to the immediate support at $66,000 and local resistance at $72,000 will shape the short- to medium-term trajectory.

(BTCUSDT)

A breakout to the upside will likely see more institutions pour into the coin, anticipating more price gains in the coming months.

Fundamental drivers will also be in play. Economists are banking on the United States Federal Reserve to slash rates this year. This preview is amid falling inflation.

Extra data from the derivatives market is bullish. For instance, Deribit shows that more Bitcoin options traders are increasingly placing bets. Most expect prices to break $80,000 and $90,000 eventually.

EXPLORE: APU Price Analysis: Apu Apustaja Hits 11.6k Holders – But This Other Coin Could Be Better

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.