BlackRock has led a Securitize funding round, which successfully raised $47m to accelerate asset tokenization. This comes as BlackRock’s BUIDL becomes the World’s largest tokenized Treasury.

It is exciting to hear that BlackRock, one of the world’s largest asset managers with over $12 trillion worth of assets under management, is making more moves into any industry.

Last year, when BlackRock submitted its application to the United States Securities and Exchange Commission (SEC), expressing interest in issuing spot Bitcoin ETFs, BTC prices quickly rose.

This was timely and a huge sentiment boost. Confidence was high, but crypto was frustrated.

Whenever BlackRock gets involved, it doesn’t matter who they are up against. Most times, they win.

They surely got to issue spot Bitcoin ETFs from January, when the strict commission said yes to their application and eight others, including Fidelity and ProShares. Now, another trend is emerging: Asset Tokenization.

Larry Fink, the CEO of BlackRock, thinks the industry will be worth trillions in the future, and most assets will be tokenized, mostly on Ethereum.

BlackRock Invests In Securitize: Stunning Funding Round Rated Bullish

Therefore, BlackRock leading a funding round that saw Securitize, a leading tokenization player, raise $47 million per a press release on May 1 indicates that things are just getting started for the blockchain industry,

Other venture capitals were involved, such as Hamilton Lane, ParaFi Capital, and Tradeweb Markets. All are keen on being at the forefront of this transformative technology.

As part of the deal, Joseph Chalom, BlackRock’s Global Head of Strategic Ecosystem Partnerships, is now on Securitize’s Board of Directors.

Chalom said tokenization, of which Securitize is now building infrastructure to fast-track onboarding, has the “potential to drive a significant transformation in capital markets infrastructure.”

DISCOVER: How to Buy Bitcoin ETFs in the USA

He also reiterated Fink’s earlier assessment that their involvement is just but “another step in their evolving digital assets strategy.”

With this new capital injection, Securitize will accelerate product development, expand its global reach, and solidify its partnerships.

BUIDL Becomes The World’s Largest Tokenized Treasury

BlackRock is investing in Securitize, which is also strategic.

Earlier this year, the asset manager launched the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) on Ethereum using Securitize technology.

The fund is unique because it offers a stable value per token worth $1 and daily dividends. Since it is launched on Ethereum, transfers can be made at any time of the day.

BUIDL is a tokenized fund backed by, among others, United States Treasuries, cash, and repo agreements.

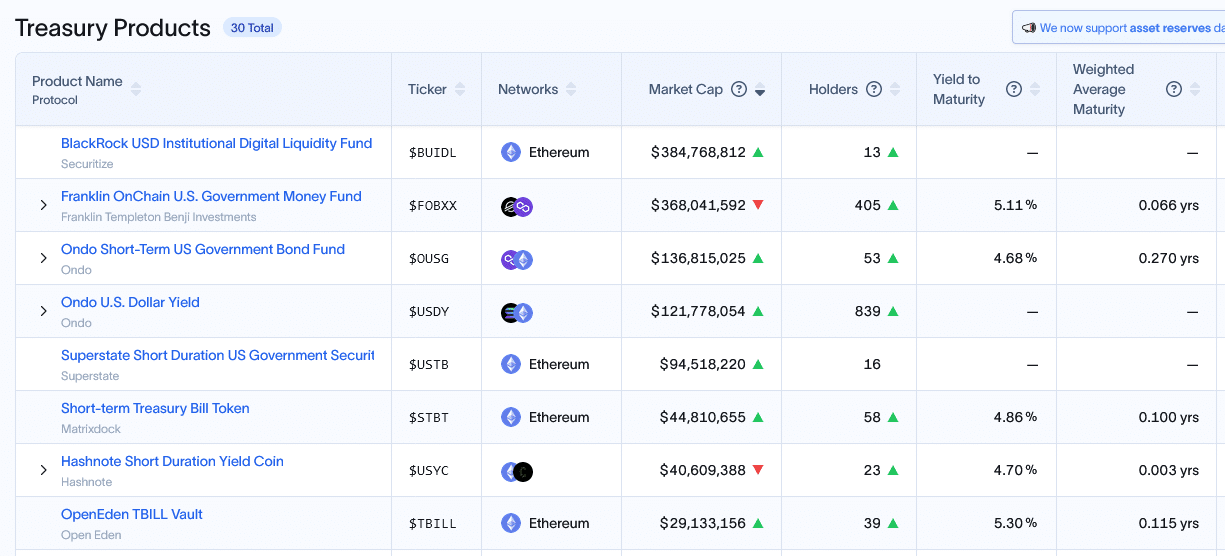

According to rwa.xyz, it is now the largest of its kind, surpassing Franklin Templeton’s offering, receiving over $384 million in deposits. Interestingly, only 13 unique addresses were holders of BUIDL, a sharp contrast with Franklin Templeton’s 405 unique wallets.

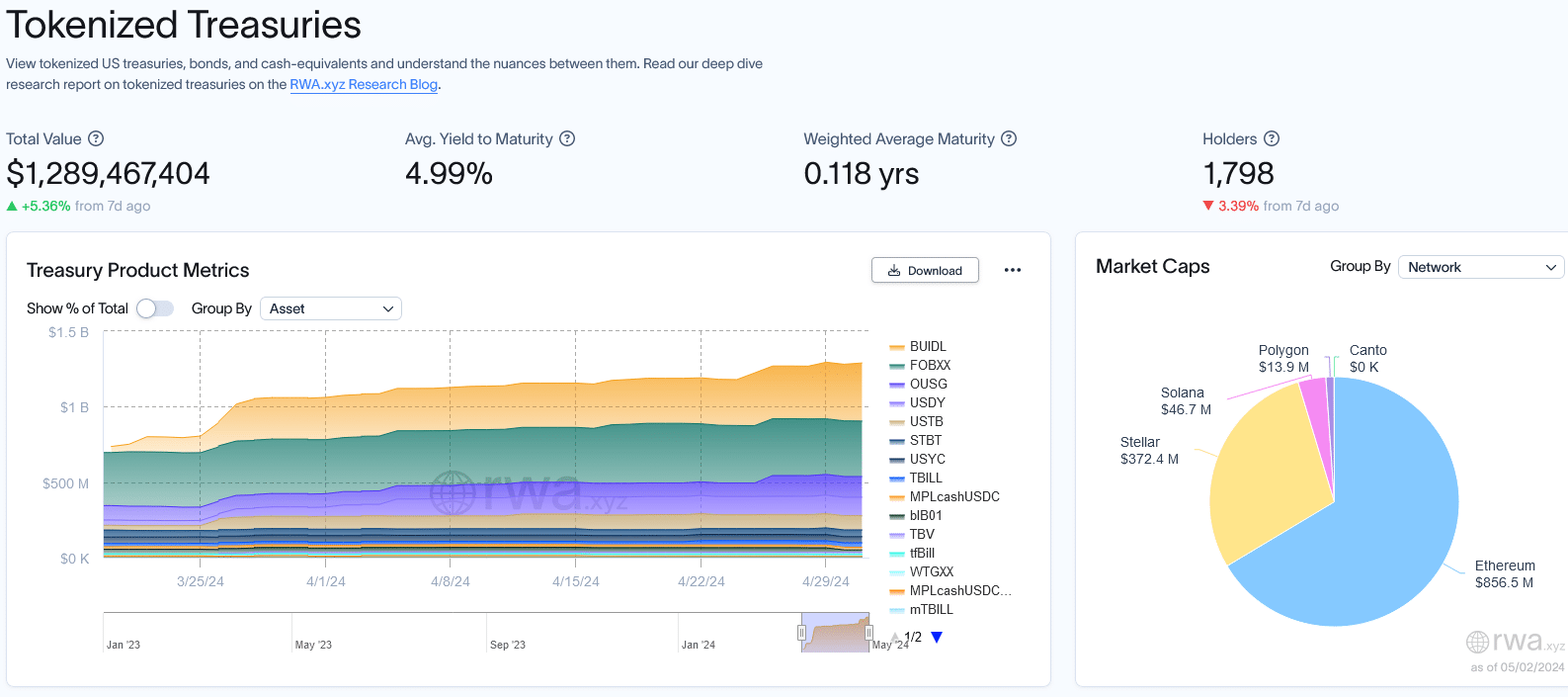

By May 2, rwa.xyz data shows that over $1.2 billion worth of United States Treasuries had been tokenized.

Most of them are tokenized on Ethereum and Stellar – suggesting an institutional vote of confidence in the future of these platforms – alongside Solana and Polygon.

EXPLORE: What is Binius – Vitalik Buterin’s New Cryptographic Scaling Technique

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.