Bitcoin prices are under pressure, but volatility will remain low despite the United States government selling BTC via Coinbase CEX.

Though MicroStrategy might be one of the largest public companies holding Bitcoin, governments are also some of the biggest HODLers.

Some countries have been reportedly mining the coin for years and could possess BTC, running into hundreds of thousands.

However, amid all this, the United States government and its power to seize coins from criminals qualify them for the “whale” status. And whenever they decide to sell, all hell often breaks loose in crypto.

Their choice exchange is often Coinbase, a ramp that the United States Securities and Exchange Commission (SEC) is suing.

As of June 27, Bitcoin is under immense selling pressure, dropping closer to the psychological $60,000 level.

(BTCUSTD)

There could be more losses in the coming sessions, worsened by fundamental events.

The United States Government Selling Bitcoin on Coinbase?

News of Mt. Gox fast-tracking their compensation, pushing distribution from October to July, has also negatively impacted sentiment.

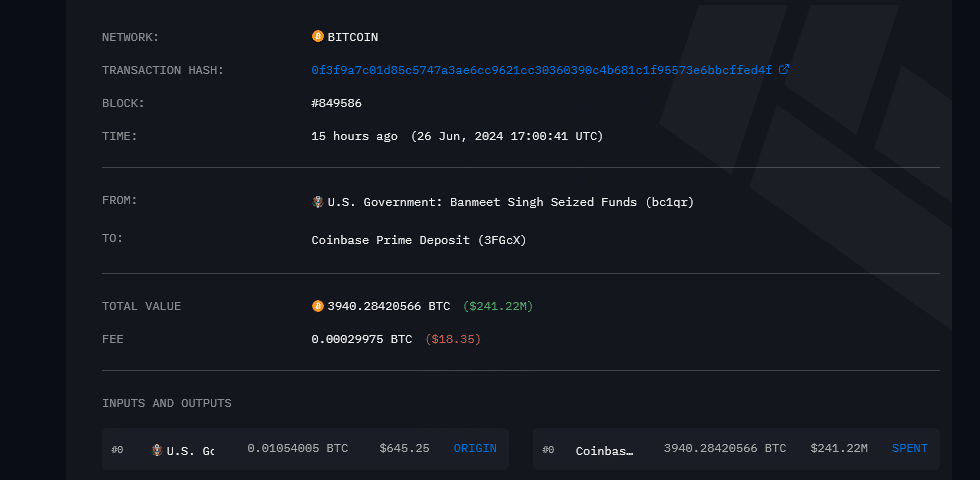

Following Germany’s lead early this week, the United States government sent roughly 4,000 BTC to Coinbase yesterday.

(Arkham)

Whenever they send coins to any exchange, their intention is clear: They are not planning on HODLing but rather sell at the best prices.

Hours following this news, BTC prices fell and are now inching closer to $60,000.

Why BTC Price Will Remain Firm And Not Drop

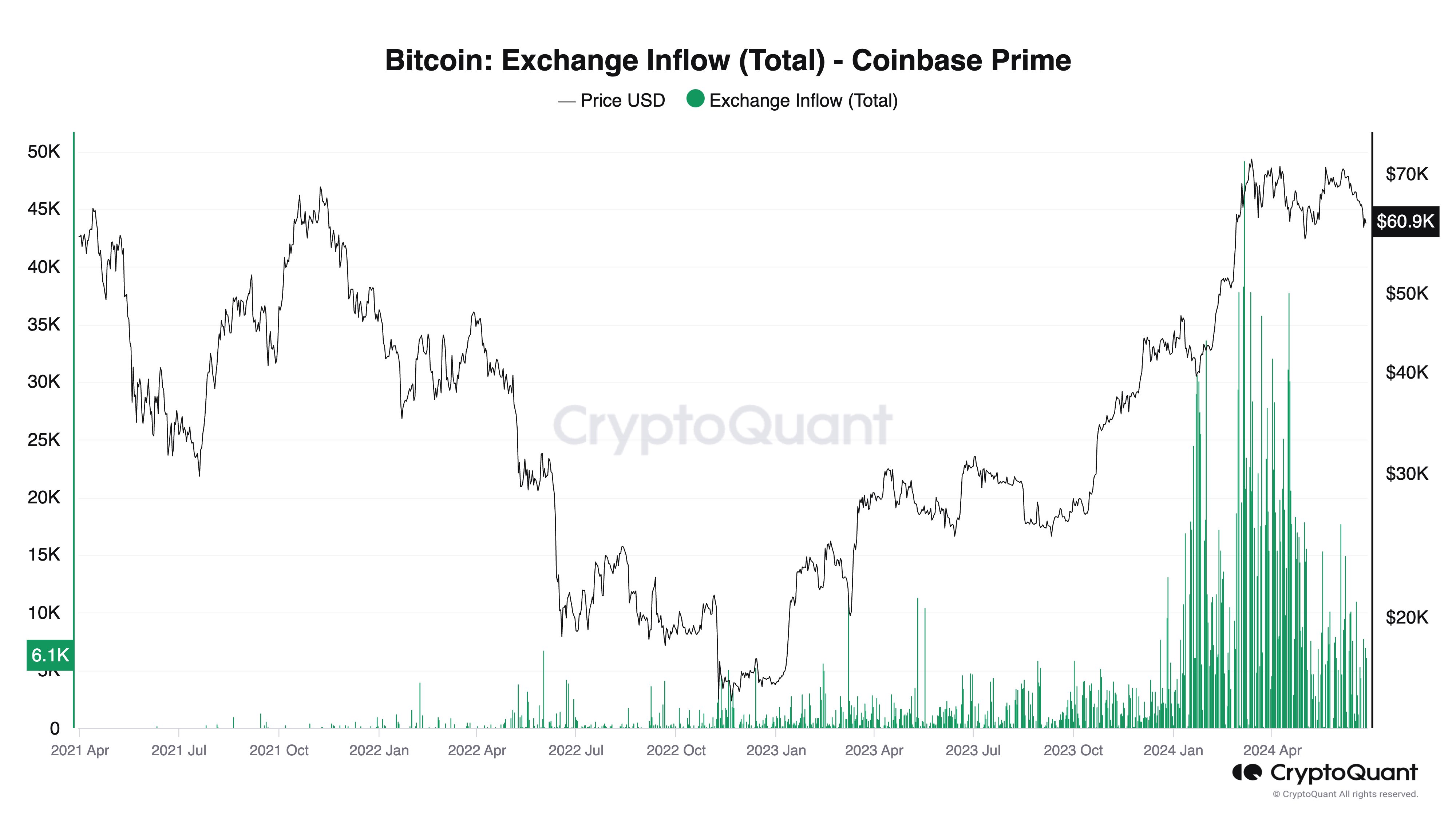

Even amid this market uncertainty, Ki Young Ju, the founder of CryptoQuant, thinks the decision to liquidate will be smaller than anticipated.

To support this outlook, Ju said Coinbase Prime typically handles a daily sell-side liquidity volume of 20,000-49,000 BTC during periods of high spot ETF inflows.

Therefore, with the United States government dumping a mere 4,000 BTC, it is easy to see why the market would easily absorb such sales without triggering huge price swings.

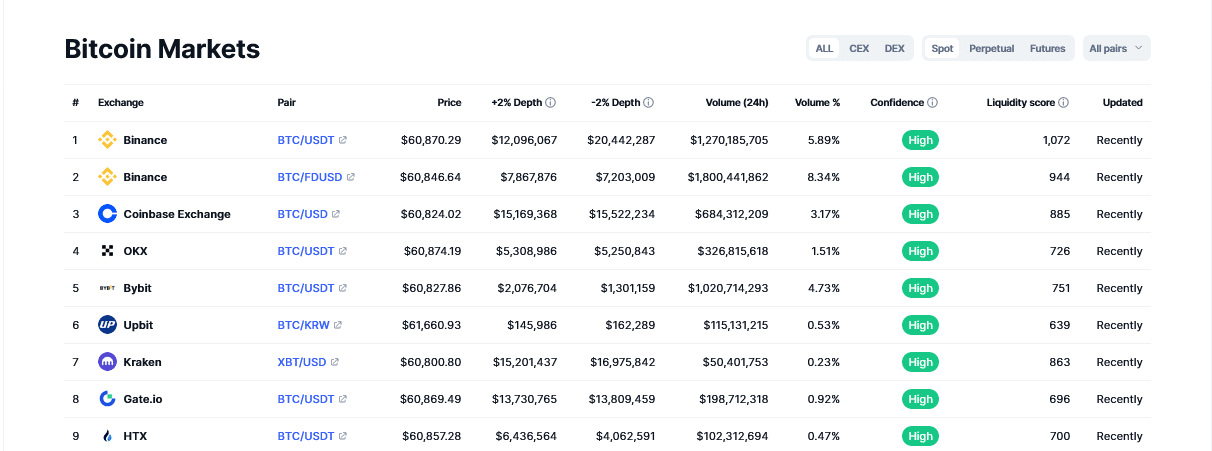

Over the years, Bitcoin’s liquidity has improved. Leading centralized exchanges like Binance and Coinbase process transactions worth billions every day.

According to CoinMarketCap data on June 27, all crypto exchanges generated over $21.8 billion in trading volume in the past 24 hours.

Binance generated over $3 billion in trading volume from their BTCUSDT and BTCFUSD pairs alone.

DISCOVER: The Best RWA Asset Tokens to Buy in July 2024

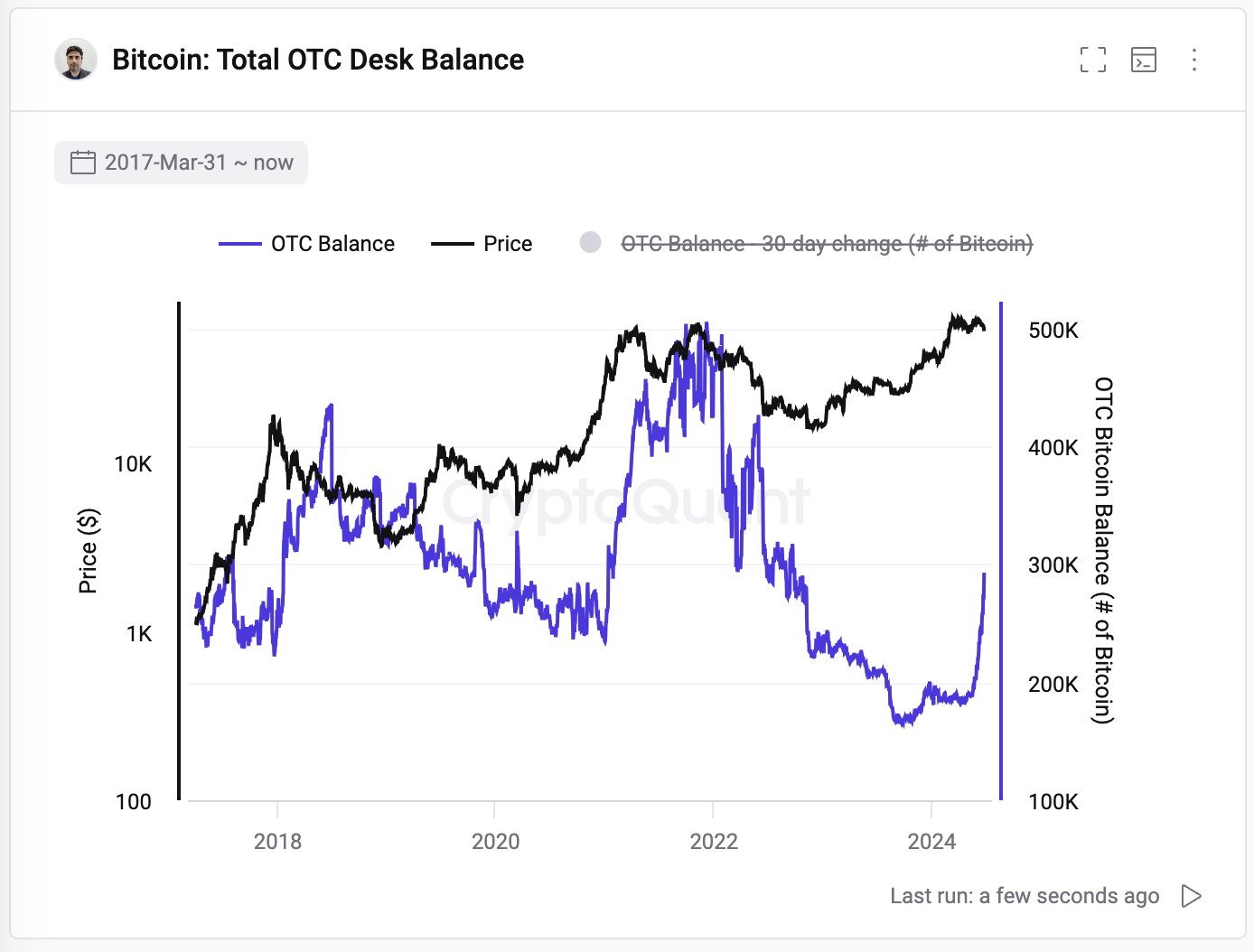

OTC BTC Balances Rising: No Buyers?

Besides the United States government, it appears that institutions and hedge funds have been pilling more BTC via over-the-counter (OTC) desks.

Ju notes that OTC desks have accumulated roughly 103,000 BTC over the past six weeks.

However, the rising balance coupled with the falling market price suggests these institutions, who might include miners, are struggling to find buyers.

Though these transactions are executed away from exchanges, if it emerges that the big boys are actively selling, it may heap more pressure on prices, accelerating the sell-off.

Even so, the Bitcoin Liquidation Map shows clusters of buy orders at $60,800 and $62,400.

If bulls maintain prices at current levels, absorbing the bear pressure, prices might recover.

EXPLORE: Stacks Price Explodes as Dwindling Bitcoin Dominance Fuels Viral Interest in Bitcoin Beta Plays

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.